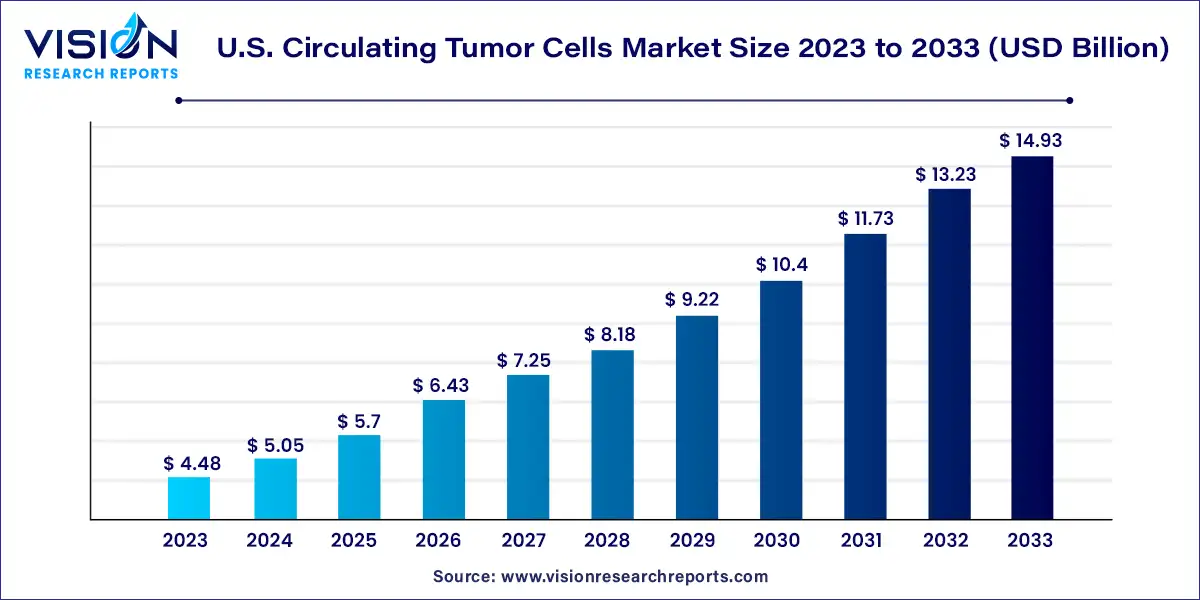

The U.S. circulating tumor cells market size was valued at USD 4.48 billion in 2023 and is anticipated to reach around USD 14.93 billion by 2033, growing at a CAGR of 12.79% from 2024 to 2033.

The U.S. circulating tumor cells (CTCs) market represents a pivotal segment within the broader landscape of cancer diagnostics and monitoring. CTCs, as rare cancer cells shed from primary tumors into the bloodstream, hold significant promise as a non-invasive tool for early cancer detection, prognosis assessment, and treatment response monitoring. This overview delves into the key facets shaping the U.S. CTCs market, including market dynamics, technological advancements, regulatory landscape, competitive scenario, and future prospects.

The growth of the U.S. circulating tumor cells (CTCs) market is propelled by an increasing incidence of cancer and the pressing need for early detection and monitoring drive demand for CTC-based diagnostics. Technological advancements in CTC isolation and detection methods enhance the sensitivity and specificity of assays, making them more reliable for clinical use. Additionally, the shift towards personalized medicine and the rising adoption of liquid biopsy approaches further boost market growth. Regulatory support, including stringent validation requirements by the FDA, ensures the quality and reliability of CTC-based tests, instilling confidence among healthcare providers and patients. Moreover, strategic collaborations and partnerships within the industry foster innovation and market expansion, contributing to the overall growth trajectory of the U.S. CTCs market.

The blood segment dominated the market with a share of 48% in 2023. Detecting circulating tumor cells (CTCs) in blood samples is crucial for predicting prognosis and determining the response to systemic chemotherapy in cancer patients. Therefore, the identification of CTCs in blood samples holds significant importance in cancer research. Moreover, the use of untreated whole blood samples proves beneficial in enriching CTCs. Technological advancements aimed at addressing the challenges associated with detecting CTCs in blood samples are expected to drive further growth in this segment.

The segment focusing on other body fluids is projected to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. Several leading companies offer blood collection tubes containing preservatives for stabilizing blood samples. Additionally, proprietary storage tubes like Cell-Free DNA tubes are available, enabling the stability of CTCs for at least four days at room temperature. EDTA, the most commonly used anticoagulant agent in these tubes, helps stabilize blood samples by preserving cell viability, thus allowing for genetic and proteomic-level studies and facilitating biomarker analysis.

In 2023, the CTC enrichment methods segment dominated the market with a share of 67%. This was largely due to the wide array of available techniques aimed at enriching circulating tumor cells (CTCs) in cancer detection. Various methods include filtration, centrifugal force, magnetic beads-based enrichment, and leveraging physical properties like size, density, deformity, and electric charges for CTC detection. The positive or negative enrichment of CTCs based on biological properties is expected to notably drive market growth during the forecast period. Additionally, successful enrichment processes contribute to sensitivity, selectivity, and yield enhancement, ensuring the positive clinical translation of CTCs.

On the other hand, the CTC analysis segment is forecasted to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. This segment holds promise in helping clinicians identify the underlying reasons for unresponsiveness among patients undergoing targeted therapy. CTC analysis serves as a minimally invasive method for repetitive analysis and is a validated technology for tumor study and clinical decision-making. Furthermore, technological advancements such as next-generation sequencing (NGS) and immunofluorescence are anticipated to significantly enhance CTC analyses, thereby further propelling the growth of this segment.

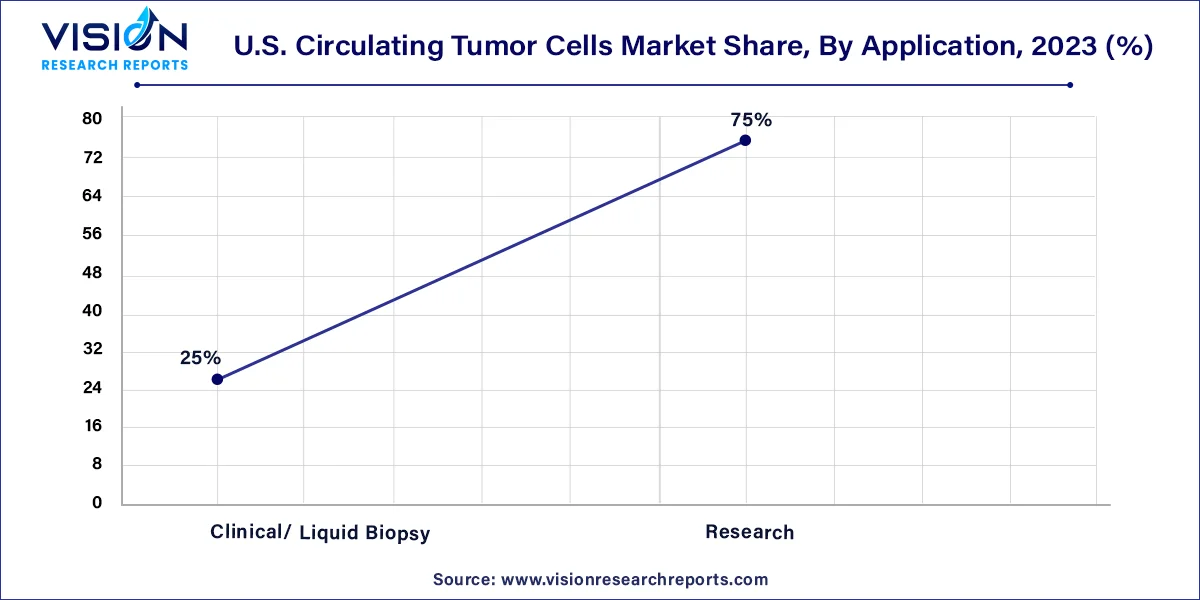

In 2023, the research segment commanded the largest market share at 75% and is projected to demonstrate the fastest compound annual growth rate (CAGR) throughout the forecast period. Circulating tumor cells (CTCs) play a pivotal role in cancer metastasis and serve as valuable material for liquid biopsy. The enumeration of CTCs stands as a reliable predictive and prognostic biomarker, offering enhanced capabilities in monitoring treatment efficacy, detecting early metastasis development, and assessing therapeutic responses more accurately compared to traditional imaging methods.

There's an increasing emphasis on characterizing and isolating CTCs, presenting promising avenues for predictive testing research. Given that repeated tissue biopsies can be costly, invasive, and impractical in some cases, the characterization of CTCs in liquid biopsy emerges as an appealing alternative to minimize invasiveness and expenses. Consequently, the genomic and molecular characterization of CTCs contributes significantly to treatment selection and the development of more personalized treatment approaches.

In 2023, the kits & reagents segment dominated the market with a share of 45%, largely due to the frequent purchases of these products and their widespread usage rates. Notably, the CellSearch Circulating Tumour Cell Kit is extensively utilized in the U.S., making it the most popular CTC kit in the country. Researchers favor this kit for its ease of use, with several cancer cell lines tested using it, resulting in the production of label-free viable cells for downstream analysis. Moreover, the accessibility of a diverse product portfolio, coupled with advancements in microfluidic technology, is anticipated to further drive market growth.

On the other hand, the devices or systems segment is forecasted to experience the highest compound annual growth rate (CAGR) from 2024 to 2033. This growth is attributed to various advances in microfluidics technology and the availability of a wide product portfolio. The introduction of fabricated glass microchips aimed at overcoming challenges and enhancing technical feasibility for mass production is expected to propel the growth of this segment in the coming years.

By Technology

By Application

By Product

By Specimen

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others