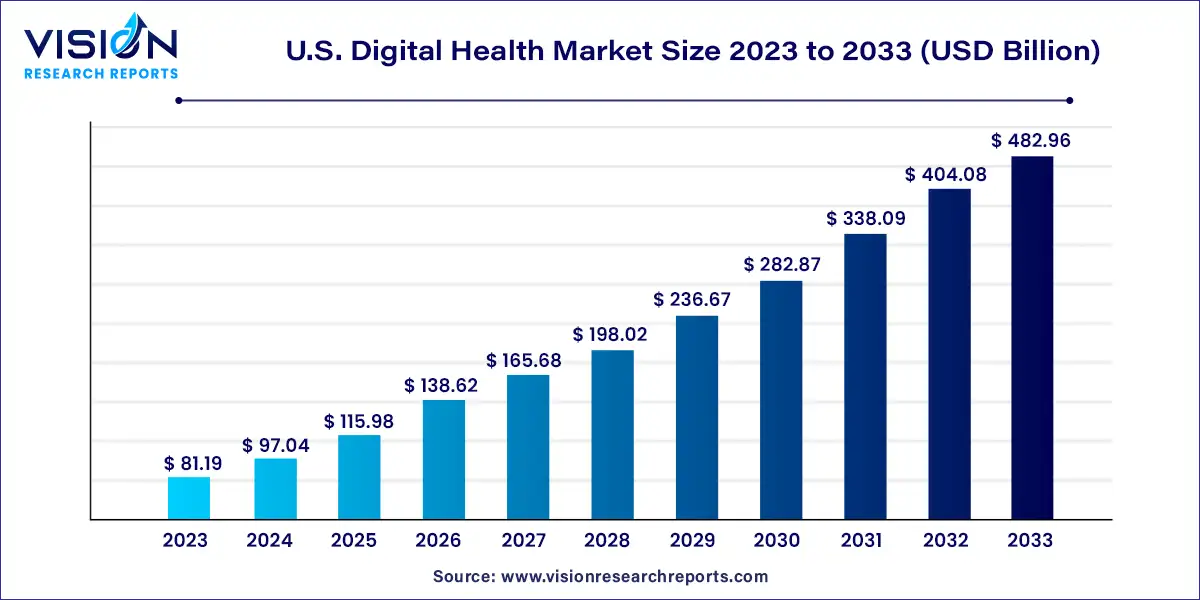

The U.S. digital health market size was estimated at around USD 81.19 billion in 2023 and it is projected to hit around USD 482.96 billion by 2033, growing at a CAGR of 19.52% from 2024 to 2033.

The growth of the U.S. digital health market is propelled an advancement in technology, including the widespread adoption of smartphones, wearable devices, and telemedicine platforms, have expanded the reach and accessibility of digital health solutions. Additionally, the COVID-19 pandemic has accelerated the acceptance of telehealth services, driving a surge in virtual care delivery and remote patient monitoring. Moreover, the integration of artificial intelligence (AI) and data analytics in healthcare has unlocked opportunities for personalized treatment, enhanced clinical decision-making, and improved patient outcomes. Furthermore, the rising prevalence of chronic diseases and the growing focus on preventive healthcare have fueled demand for digital therapeutics and health monitoring tools.

The telehealthcare segment dominated the market, commanding the highest revenue share of 44% in 2023. This growth is fueled by increased investments in telehealthcare platforms following the COVID-19 pandemic. Companies are embracing digital healthcare platforms to deliver remote care to individuals, particularly those with chronic diseases like diabetes. For instance, in January 2023, the National Institutes of Health (NIH) launched the Home Test to Treat program, a COVID-19 telehealth initiative. This program provides free COVID-19 health assistance, including telehealth sessions, rapid home testing, and at-home remedies.

The mHealth segment follows as the second largest segment, driven by the widespread use of smartphones, the growing adoption of mobile health applications, and the utilization of smartwatches and fitness trackers. Smartwatches are frequently paired with smartphones, enabling users to perform various tasks such as making calls, receiving notifications, controlling music, sending messages, and monitoring fitness directly from their wrist. This integration enhances convenience, further propelling segment growth. In October 2023, b.well Connected Health, a patient-centric health management platform, announced its integration with the Samsung Health app. This initiative aims to provide Galaxy smartphone users with a unified platform to access health data, receive insights and recommendations, and virtually connect with care providers.

In 2023, the services segment emerged as the market leader, capturing the highest revenue share of more than 38%. This was primarily due to the increasing demand for software upgrades and a preference for advancements in both hardware and software. Furthermore, the development of digital platforms focusing on monitoring, diagnosis, prevention, and wellness is expected to bolster segment growth. For example, in January 2024, Eli Lilly and Company introduced LillyDirect, a digital healthcare experience tailored for U.S.-based patients. This initiative includes LillyDirect Pharmacy Solutions, a digital pharmacy offering medications facilitated by third-party online pharmacy fulfillment services.

The software segment is projected to achieve the fastest CAGR during the forecast period. This growth can be attributed to the escalating software development endeavors undertaken by service providers and developers to enhance digital healthcare services. Moreover, the increasing adoption of healthcare software by consumers and service providers, integrated into platforms to improve patient care quality, is anticipated to propel segment growth. For instance, in December 2023, Tandem Diabetes Care, Inc. launched an updated version of its insulin pump software, t:slim X2, featuring integration with Dexcom G7 Continuous Glucose Monitoring (CGM) systems in the U.S.

The diabetes segment commanded the largest revenue share, exceeding 25% in 2023, and is projected to exhibit the swiftest CAGR from 2024 to 2033. The segment's growth is driven by the escalating prevalence of diabetes and its associated complications. According to the Centers for Disease Control and Prevention (CDC), the U.S. witnessed 38.4 million diabetes cases in 2021, with 38.1 million individuals aged 18 and above affected. To address the evolving needs of diabetes patients, companies are innovating digital health technologies. For example, in February 2023, DexCom, Inc. launched the Dexcom G7 continuous glucose monitoring (CGM) System in the U.S., accompanied by a Super Bowl commercial featuring Nick Jonas, a diabetes advocate. The commercial aimed to reach over 4.8 million diabetic Americans, including 3.3 million non-CGM users and 2.3 million individuals with CGM coverage.

Obesity represents the second-largest application segment, driven by its high prevalence and the increasing demand for effective weight management solutions. A significant portion of the U.S. population grapples with obesity, with approximately 58% projected to be affected, according to the World Obesity Atlas 2023. This widespread issue underscores the need for impactful interventions to address obesity-related health challenges. Technological advancements have facilitated the creation of innovative digital health tools and platforms tailored for obesity management. For instance, in December 2023, Fauna Bio collaborated with Eli Lilly and Company to integrate Fauna's Convergence AI into preclinical drug discovery efforts targeting obesity.

The patient segment secured the largest share, accounting for 35% in 2023, and is projected to experience the most rapid CAGR from 2024 to 2030. This growth is attributed to heightened awareness of health management and the shift towards patient-centered care. Digital health technologies have revolutionized healthcare, equipping patients with remote monitoring tools, self-management capabilities, and easily accessible health information. For instance, in February 2024, Samsung Electronics received De Novo approval from the U.S. FDA for the sleep apnea feature of its Samsung Health Monitor app, which detects sleep apnea using the Samsung Galaxy Watch and phone.

The providers segment holds a substantial share of the U.S. digital health industry and is expected to maintain its market dominance throughout the forecast period. The widespread adoption of advanced technologies such as digital therapeutics and telemedicine is propelling market growth. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies beyond traditional care settings. Integrating digital tools enables providers to deliver more convenient and tailored care, ultimately improving patient outcomes.

By Technology

By Component

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others