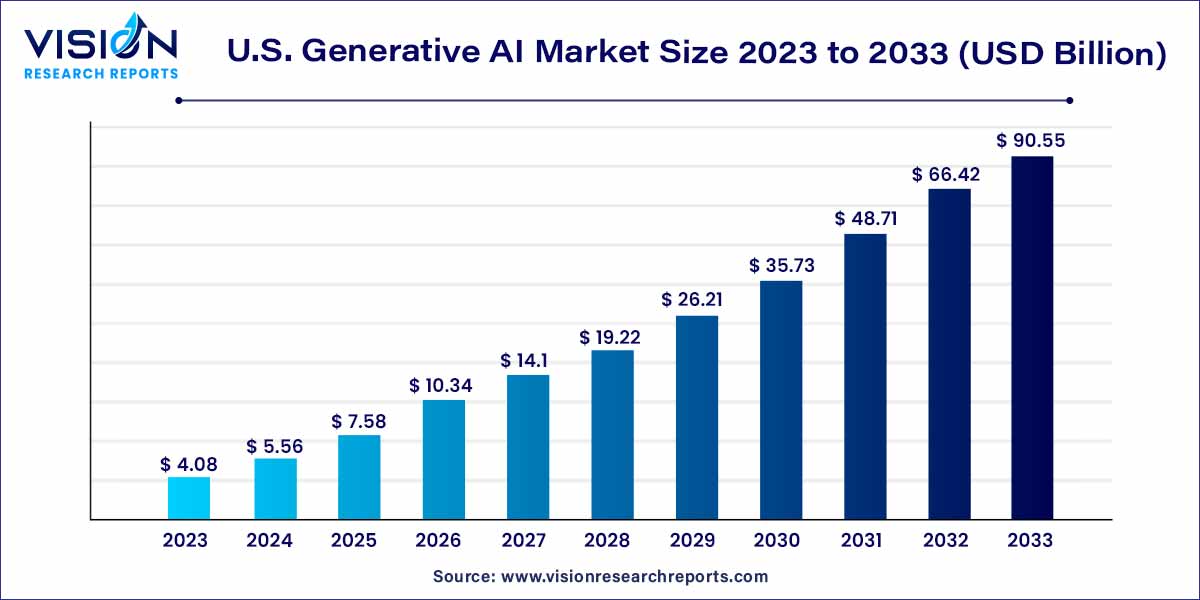

The U.S. generative AI market size was estimated at USD 4.08 billion in 2023 and it is expected to surpass around USD 90.55 billion by 2033, poised to grow at a CAGR of 36.34% from 2024 to 2033. The U.S. generative AI market is driven by the escalating demand for automation across industries, increased investment, technological advancements, and businesses are leveraging generative ai to deliver personalized experiences to customers.

The U.S. generative AI market is witnessing rapid growth and innovation, driven by advancements in artificial intelligence technology and increasing demand across various industries. Generative AI, a subset of AI, involves systems that can autonomously produce content, images, or other data based on input or patterns learned from data. This overview explores the current landscape of the U.S. generative AI market, including key trends, drivers, challenges, and opportunities.

The growth of the U.S. generative AI market is propelled by several key factors. Firstly, rapid advancements in artificial intelligence technology, particularly in machine learning algorithms and deep learning architectures, are driving the development of more sophisticated generative AI models. These models can autonomously produce high-quality content, images, and data, catering to diverse industry needs. Additionally, the increasing demand for personalized experiences across various sectors, including healthcare, finance, marketing, and entertainment, is fueling the adoption of generative AI solutions. Businesses are leveraging these technologies to automate tasks, enhance creativity, and deliver tailored experiences to customers. Furthermore, the potential cost and time savings offered by generative AI, through automation of repetitive tasks and acceleration of product development cycles, are driving adoption among enterprises seeking efficiency gains. Overall, these growth factors signify a promising outlook for the U.S. generative AI market, with opportunities for innovation and transformative outcomes across industries.

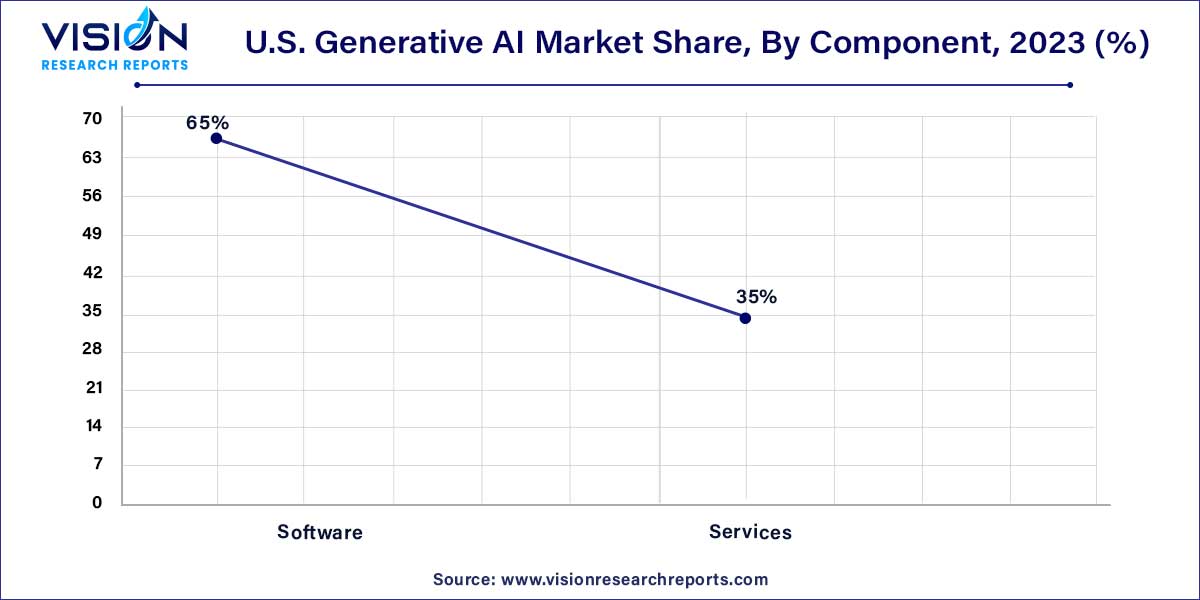

Segmented by components, the market further breaks down into services and software. In 2023, the software segment claimed the largest revenue share, amounting to 65%, and is projected to maintain its dominance throughout the forecast period. The expansion of the software sector can be attributed to several factors, including the adoption of advanced technologies, increased investment in artificial intelligence, rising demand for automation, and favorable regulatory conditions. Moreover, the emergence of generative AI software is expected to significantly impact various sectors and industries such as manufacturing, gaming, and design.

Conversely, the service segment is poised to witness the fastest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is fueled by escalating concerns over fraud detection, risk factor modeling, data protection, and trading prediction. Cloud-based generative AI services are anticipated to gain traction due to their scalability, flexibility, and cost-effectiveness, thereby propelling the segment's growth. For instance, in February 2024, S&P Global launched a generative AI search feature on the S&P Global Marketplace. This Global Solution for Marketplace Generative AI Search aims to streamline and enhance the exploration of S&P Global's offerings worldwide. By interpreting users' natural language queries and providing comprehensive responses, the platform improves the search experience. Furthermore, it takes proactive measures by suggesting additional relevant data sets and services, thereby broadening users' insights and options.

The market is categorized by technology into transformers, Generative Adversarial Networks (GANs), diffusion networks, and variational auto-encoders. The transformers segment held the largest revenue share in 2023, mainly due to the increasing adoption of transformer applications such as text-to-image AI, which converts text into images. Numerous companies are integrating text-to-image AI tools into their platforms to revolutionize the creation of visuals for projects, campaigns, and brands. For example, in January 2023, Shutterstock, Inc. launched its AI image generation platform, available in multiple languages, enabling prompt conversion into licensable visuals for its customers.

Additionally, the diffusion networks segment is projected to experience the fastest growth during the forecast period. Image synthesis has become vital across various industries including healthcare, automotive & transportation, defense, media & entertainment, BFSI, among others. This technology has empowered these industries to meet the increasing demands for image generation and deliver high-value services to businesses, government entities, and the general public.

The market is divided by end-use into media & entertainment, BFSI, IT & telecommunications, healthcare, automotive & transportation, and others. The "others" sub-segment includes security, aerospace & defense. In 2023, the media & entertainment segment held the largest market share and is anticipated to grow at a significant Compound Annual Growth Rate (CAGR) during the forecast period. The increasing adoption of generative AI for enhancing advertisement and campaign journalism is expected to drive demand for this technology in the media & entertainment industry. For example, in October 2023, Amazon Ads introduced a generative AI solution for image generation aimed at assisting advertisers in creating more engaging content and enhancing their ad campaigns.

On the other hand, the BFSI segment is projected to witness the fastest growth rate during the forecast period. This growth is attributed to simplifying complex data analysis, improving customer experiences, and enhancing risk management within the banking sector. Moreover, the BFSI industry has found generative AI valuable in generating marketing visuals and text, as well as enhancing the efficiency and accuracy of machine learning applications through data generation.

The Natural Language Processing (NLP) segment emerged as the market leader in 2023 and is forecasted to maintain significant growth momentum throughout the forecast period. Generative AI plays a pivotal role in advancing NLP processing by providing intricate prompts akin to human feedback. Furthermore, generative AI within NLP introduces advanced models and ethical considerations, fostering opportunities for applications in content summarization, sentiment analysis, and personalized user experiences.

Conversely, the computer vision segment is poised to experience the most rapid Compound Annual Growth Rate (CAGR) during the forecast period, driven by the escalating adoption of computer vision systems within the automotive and transportation sectors. Additionally, generative AI techniques empower computers to comprehend and manipulate visual data in unprecedented ways, including image inpainting, style transfer, and image-to-image translation, thereby unlocking novel applications in digital content creation, medical imaging, autonomous vehicles, and surveillance systems.

The large language model segment asserted its dominance in the market during 2023 and is forecasted to sustain substantial growth at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period. Breakthroughs in neural network architectures, particularly transformer-based models like GPT, have facilitated the creation of large language models with millions, and even billions, of parameters. This advancement has notably enhanced their capacity to comprehend and generate text resembling human language across diverse contexts and domains. Such technological progressions have sparked heightened interest and investment in generative AI, propelling its rapid expansion and adoption across various applications.

Conversely, the multimodal generative model is poised to witness the fastest growth during the forecast period. Its capability to augment accuracy and resilience by amalgamating data from different modalities is a significant driver for its growth. This model type can achieve heightened performance by integrating information from multiple sources, thereby fueling its proliferation within the industry. Moreover, the segment of image and video models is anticipated to undergo substantial growth owing to its proficiency in swiftly producing high-quality and realistic images and videos. These outputs, often challenging or unattainable through conventional methods, are propelling the widespread adoption and advancement of this model type.

By Component

By Technology

By End-use

By Application

By Model

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Generative AI Market

5.1. COVID-19 Landscape: U.S. Generative AI Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Generative AI Market, By Component

8.1. U.S. Generative AI Market, by Component, 2024-2033

8.1.1. Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Generative AI Market, By Technology

9.1. U.S. Generative AI Market, by Technology, 2024-2033

9.1.1. Generative Adversarial Networks (GANs)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Transformers

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Variational auto-encoders

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Diffusion Networks

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Generative AI Market, By End-use

10.1. U.S. Generative AI Market, by End-use, 2024-2033

10.1.1. Media & Entertainment

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. BFSI

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. IT & Telecommunication

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Healthcare

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Automotive & Transportation

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Gaming

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Generative AI Market, By Application

11.1. U.S. Generative AI Market, by Application, 2024-2033

11.1.1. Computer Vision

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. NLP

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Robotics and Automation

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Content Generation

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Chatbots and Intelligent Virtual Assistants

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Predictive Analytics

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Generative AI Market, By Model

12.1. U.S. Generative AI Market, by Model, 2024-2033

12.1.1. Large Language models

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Image & Video generative models

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Multi-modal generative models

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Generative AI Market, Regional Estimates and Trend Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Technology (2021-2033)

13.1.3. Market Revenue and Forecast, by End-use (2021-2033)

13.1.4. Market Revenue and Forecast, by Application (2021-2033)

13.1.5. Market Revenue and Forecast, by Model (2021-2033)

Chapter 14. Company Profiles

14.1. Google LLC

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Amazon Web Services, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. IBM

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Microsoft

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Hugging Face

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Cohere

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Tome.App

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. AssemblyAI

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Midjourney

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Klaviyo

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others