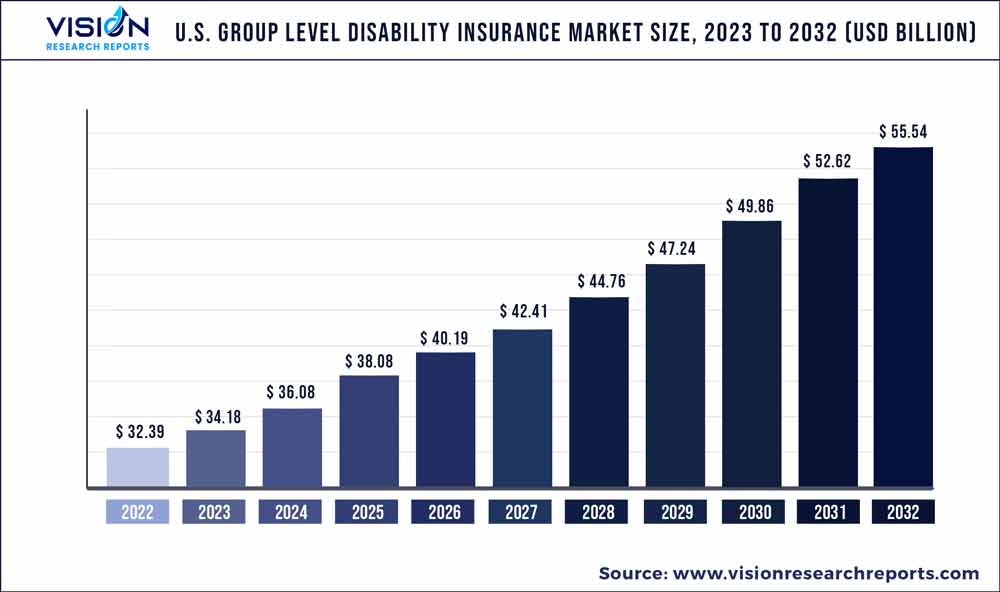

The U.S. group level disability insurance market was estimated at USD 32.39 billion in 2022 and it is expected to surpass around USD 55.54 billion by 2032, poised to grow at a CAGR of 5.54% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Group Level Disability Insurance Market

| Report Coverage | Details |

| Market Size in 2022 | USD 32.39 billion |

| Revenue Forecast by 2032 | USD 55.54 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.54% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | The Hartford; Unum Group; Prudential Financial, Inc.; MetLife; StanCorp Financial Group, Inc.; The Guardian Life Insurance Company of America; Reliance Standard; AFLAC INCORPORATED; Mutual of Omaha Insurance Company; Principal Financial Services, Inc. |

The market's growth can be attributed to the rising cost of healthcare in the U.S., which has led to an increased focus on protecting one's income in the event of a disability. Disability insurance can provide a safety net to help cover the costs of medical care and other expenses.

The companies are increasingly turning to Artificial Intelligence (AI) and Machine Learning (ML) to improve efficiency, accuracy, and customer service. Predictive analytics, underwriting, claims processing, fraud detection, and customer service are some areas where AI and ML are being applied. By analyzing large amounts of data, insurers can predict and set policy premium accurately. Automating the underwriting and claims processing procedures enhances insurers' decision-making abilities and accelerates the benefits delivery process, resulting in improved operational efficiency and customer satisfaction.

Disability insurance providers are offering more customizable policies to meet the specific needs of customers. Customers can choose the coverage level they need, the length of the waiting period, and the benefit period. Additionally, disability insurance providers are integrating their policies with other benefits, such as life insurance and retirement plans. This provides customers with a more comprehensive package of benefits and simplifies the administration of those benefits.

The COVID-19 pandemic had a positive impact on the regional market, and several changes such as changes in the underwriting and claim process, are likely to persist after the end of the pandemic. The COVID-19 pandemic has highlighted the need for more comprehensive coverage for dealing with the negative effects of the pandemic and other health crises. Disability insurance providers are developing policies offering more robust coverage for these occurrences.

Coverage Type Insights

The long term disability insurance segment dominated the market in 2022 and accounted for a revenue share of more than 65.02%. Long term disability insurance covers a portion of the employee's income for a specified period, for instance, 2 years, 5 years, 10 years, up to the age of 65, or for life, depending on the policy. Employers generally offer long term disability insurance as part of their employee benefits package, and it is often a preferred option for employees looking for comprehensive coverage. Additionally, long term disability insurance premiums are typically lower than short-term disability insurance premiums, which makes it a cost effective option for both employers and employees.

The short term disability insurance segment is anticipated to register significant growth in the forecast period. Short term group disability insurance offers weekly financial assistance to employees who are entirely or partially unable to work due to a covered injury, illness, pregnancy, or mental condition. There is an increasing trend among employers to offer disability insurance as part of their employee benefits package. As a result, more companies are looking to provide short-term disability insurance coverage to their employees, driving segment's growth. Additionally, the rise in number of chronic illnesses and medical conditions that can cause short-term disability is fueling the segment's growth.

Insurance Type Insights

The employer supplied disability insurance segment dominated the market in 2022 and accounted for a revenue share of over 58.04%. Most employers offer disability insurance as part of their employee benefits package, and as a result, the employer supplied disability insurance segment has the most extensive customer base. Employers offer disability insurance to attract and retain talent, as it is an essential form of financial protection for employees who may be unable to work due to a disability. By offering disability insurance, employers can demonstrate their commitment to the financial well-being of their employees, making them more attractive to potential hires and helping to retain existing employees.

The high limit disability insurance segment is anticipated to grow significantly over the forecast period. The cost of living continues to rise, many individuals require higher levels of disability insurance coverage to maintain their standard of living in the event of a disability. High limit disability insurance provides greater financial protection, ensuring that they can cover their expenses and maintain their lifestyle in case of unexpected events. Additionally, the increasing awareness of disability insurance and the importance of financial protection has led to greater demand for high limit disability insurance coverage.

Distribution Channel Insights

The tied agents and branches segment dominated the market in 2022 and accounted for a revenue share of over 54.06%. Tied agents and branches have established customer relationships and are often seen as a trusted source of information and advice. This allows them to effectively market and sell disability insurance policies to customers, increasing their market share. Additionally, tied agents and branches have the backing of a large insurance company, which can provide them with resources and support to effectively market and sell disability insurance policies. This helps them to remain competitive in the market and dominate in terms of market share.

The brokers segment is expected to register significant growth in the forecast period. Brokers offer a more comprehensive range of insurance products from multiple disability insurance providers, allowing customers to choose from various options and select the one that best suits their needs. Additionally, brokers often have a deeper understanding of insurance products and can provide more personalized advice to customers. This can help customers make more informed decisions about their insurance coverage, leading to greater customer satisfaction and loyalty.

End-use Insights

The enterprise segment dominated the market in 2022 and accounted for a revenue share of over 64.07%. The enterprise segment typically has more bargaining power when negotiating rates with insurance providers. This allows them to secure more favorable terms and lower premiums, which can make disability insurance more affordable for both the company and its employees. Enterprise has a greater need for disability insurance due to the potentially significant financial impact that an employee's disability could have on the organization.

The government segment is anticipated to register significant growth in the forecast period. Government organizations have a large and diverse workforce often eligible for disability insurance coverage. Many government agencies and departments also have legal requirements to provide disability insurance for their employees. Secondly, there is an increasing focus on the importance of disability insurance and the benefits it provides to individuals and society as a whole.

U.S. Group Level Disability Insurance Market Segmentations:

By Coverage Type

By Insurance Type

By Distribution Channel

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Group Level Disability Insurance Market

5.1. COVID-19 Landscape: U.S. Group Level Disability Insurance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Group Level Disability Insurance Market, By Coverage Type

8.1. U.S. Group Level Disability Insurance Market, by Coverage Type, 2023-2032

8.1.1. Short Term Disability Insurance

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Long Term Disability Insurance

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Group Level Disability Insurance Market, By Employer Supplied Disability Insurance

9.1. U.S. Group Level Disability Insurance Market, by Insurance Type, 2023-2032

9.1.1. Employer Supplied Disability Insurance

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. High Limit Disability Insurance

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Business Overhead Expense Disability Insurance

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Group Level Disability Insurance Market, By Distribution Channel

10.1. U.S. Group Level Disability Insurance Market, by Distribution Channel, 2023-2032

10.1.1. Tied Agents and Branches

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Brokers

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Group Level Disability Insurance Market, By End-use

11.1. U.S. Group Level Disability Insurance Market, by End-use, 2023-2032

11.1.1. Government

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Enterprise

11.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Group Level Disability Insurance Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Coverage Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Insurance Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. The Hartford

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Unum Group

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Prudential Financial, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. MetLife

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. StanCorp Financial Group, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. The Guardian Life Insurance Company of America

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Reliance Standard

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. AFLAC INCORPORATED

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Mutual of Omaha Insurance Company

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Principal Financial Services, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others