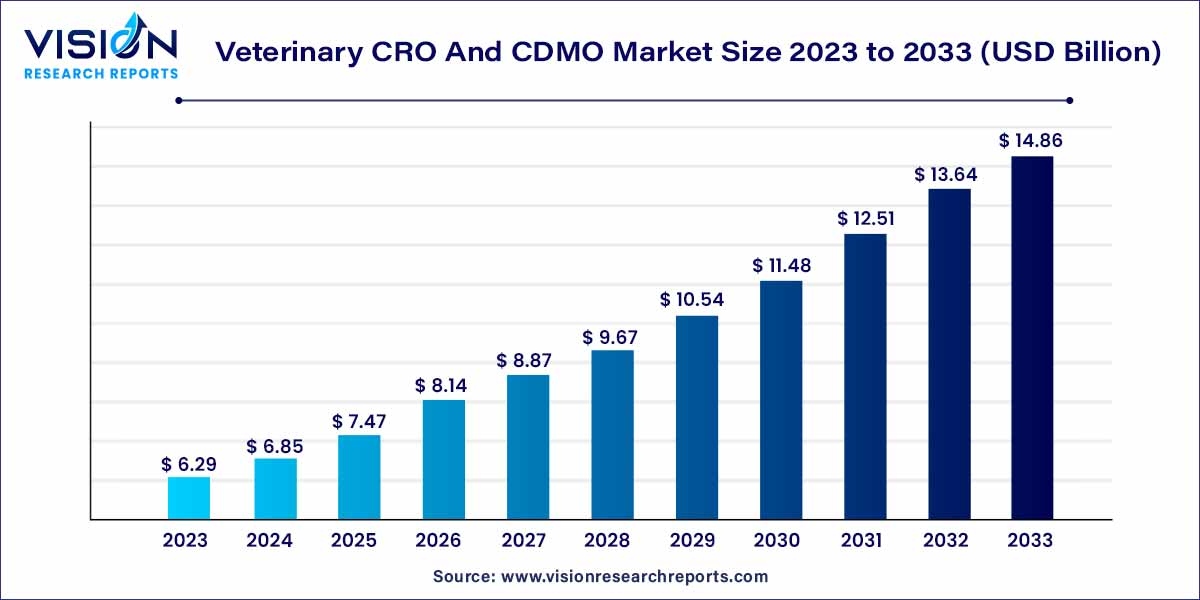

The global veterinary CRO and CDMO market size was estimated at USD 6.29 billion in 2023 and it is expected to surpass around USD 14.86 billion by 2033, poised to grow at a CAGR of 8.98% from 2024 to 2033. The Veterinary contract research organization (CRO) and contract development and manufacturing organization (CDMO) market is a dynamic sector within the pharmaceutical industry, specifically tailored to the field of veterinary medicine. These organizations provide essential services to pharmaceutical companies and biotechnology firms dedicated to the development, research, and manufacturing of veterinary drugs and treatments.

The growth of the veterinary contract research organization (CRO) and contract development and manufacturing organization (CDMO) market can be attributed to several key factors. Firstly, the increasing prevalence of animal diseases has led to a heightened demand for specialized veterinary drugs and treatments. This rising need for effective pharmaceutical solutions propels the demand for research and development services offered by Veterinary CROs and CDMOs. Secondly, advancements in veterinary medicine and biotechnology have created opportunities for innovative drug discovery and manufacturing techniques. CROs and CDMOs, equipped with state-of-the-art technologies, are well-positioned to capitalize on these opportunities, driving market growth. Additionally, stringent regulatory standards governing the production of veterinary pharmaceuticals necessitate the expertise of CROs and CDMOs to ensure compliance, further boosting their significance in the industry. Furthermore, the growing pet population worldwide and the increasing awareness about animal health have amplified the demand for high-quality veterinary products. As a result, pharmaceutical companies are increasingly relying on CROs and CDMOs to enhance their research capabilities and deliver safe, efficacious, and innovative veterinary drugs, fostering the expansion of the Veterinary CRO and CDMO market.

| Report Coverage | Details |

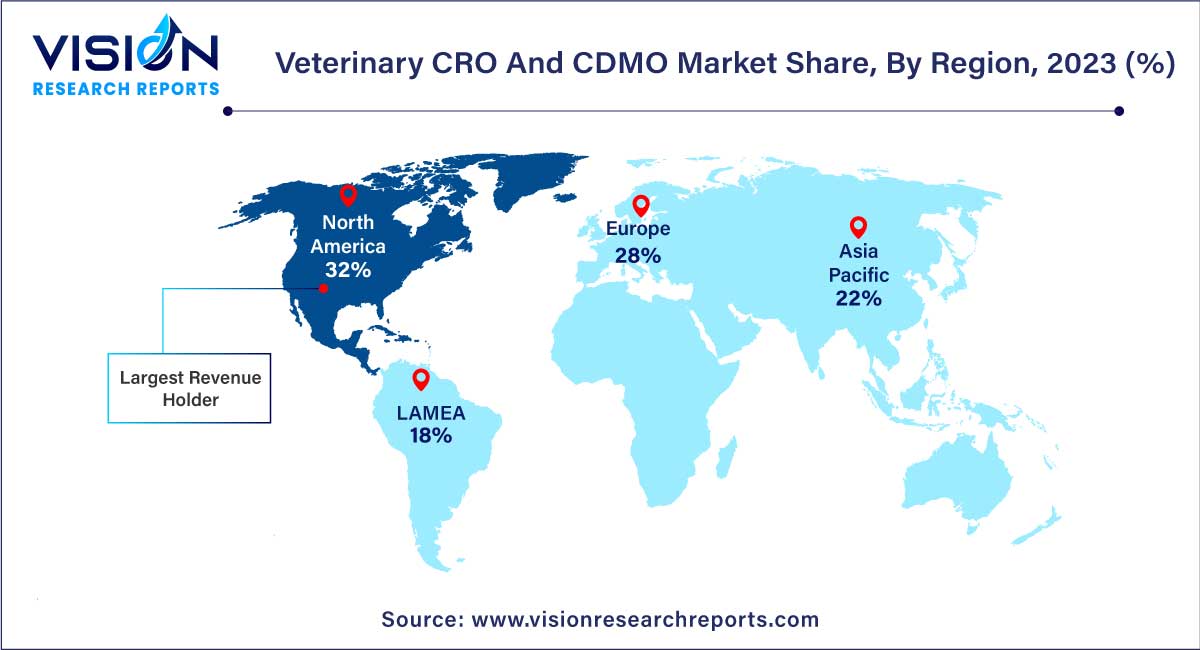

| Revenue Share of North America in 2023 | 32% |

| Revenue Forecast by 2033 | USD 14.86 billion |

| Growth Rate from 2024 to 2033 | CAGR of 16.75% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The livestock animal segment captured the maximum market share of 42% in 2023. The livestock animal segment plays a vital role in the global economy, encompassing animals such as cattle, poultry, swine, and aquaculture species. Livestock animals are a source of meat, milk, eggs, and other essential products. Ensuring the health and well-being of livestock is crucial for food safety and security. Veterinary CROs and CDMOs collaborate with agricultural and animal husbandry industries to develop vaccines, antibiotics, and other pharmaceuticals to prevent and treat diseases in livestock. Additionally, these organizations focus on improving the efficiency of animal production, enhancing the quality of animal-derived products, and promoting sustainable farming practices.

The companion animal segment is expected to grow at the fastest CAGR during the projected period. Companion animals, including pets like dogs, cats, birds, and small mammals, represent a substantial portion of the veterinary pharmaceutical market. As pet ownership continues to rise worldwide, there is an increasing demand for specialized veterinary drugs and therapies for these animals. This trend has led to significant investments in research and development activities focused on companion animals, with pharmaceutical companies partnering with CROs and CDMOs to formulate innovative and effective treatments.

The development segment generated the largest revenue share of 32% in 2023. Development services offered by Veterinary CROs are multifaceted and play a pivotal role in the early stages of pharmaceutical innovation. CROs engage in comprehensive pre-clinical research, involving laboratory testing and animal studies, to evaluate the efficacy and safety of potential drug candidates. Through meticulous clinical trials, these organizations assess the performance of new compounds, ensuring they meet regulatory standards and are suitable for animal use. CROs also provide invaluable support in regulatory affairs, navigating the complex landscape of approvals and compliance. Additionally, their expertise extends to formulation development, optimizing the delivery mechanisms of drugs for maximum effectiveness.

Veterinary CDMOs specialize in the manufacturing phase, translating research findings into tangible pharmaceutical products. These organizations are equipped with cutting-edge facilities for large-scale production, adhering to stringent quality control measures throughout the manufacturing process. From formulation scaling and analytical testing to packaging and distribution, CDMOs ensure that the drugs are manufactured efficiently, meeting the highest industry standards. By integrating advanced technologies and adhering to Good Manufacturing Practices (GMP), CDMOs guarantee the production of safe, reliable, and consistent veterinary pharmaceuticals.

The medicine segment registered the highest market share of 64% in 2023. When it comes to medicines, Veterinary CROs and CDMOs are at the forefront of pharmaceutical innovation, focusing on the development and production of a wide array of veterinary drugs. These drugs are designed to address various health concerns in animals, ranging from common infections to chronic diseases. Through meticulous research and clinical trials, CROs explore new compounds and formulations, ensuring their efficacy, safety, and suitability for different animal species. Veterinary CDMOs, on the other hand, transform these research findings into tangible medicines through advanced manufacturing processes.

In addition to medicines, the Veterinary CRO and CDMO market also delves into the realm of medical devices for animal healthcare. These devices are designed to enhance diagnostics, improve treatment outcomes, and provide overall better care for animals. Veterinary CROs engage in research and development to create innovative medical devices, such as diagnostic tools, monitoring equipment, and specialized surgical instruments. Through collaborations with veterinary professionals, they refine these devices to meet the specific needs of diverse animal species.

North American region dominated the animal health CRO & CDMO market with the largest revenue share of more than 32% in 2023. In North America, the market is driven by a robust pet industry, a high prevalence of pet ownership, and stringent regulatory standards. The United States and Canada, in particular, are major contributors to the market growth, owing to the significant investments in research and development activities. Additionally, the region witnesses a constant influx of innovative technologies, fostering collaborations between pharmaceutical companies, CROs, and CDMOs to create cutting-edge veterinary drugs and services.

The Asia Pacific region predicted to grow at the fastest CAGR during the forecast period. Asia-Pacific is emerging as a key market for Veterinary CRO and CDMO services. Rapid urbanization, a growing middle class, and increased pet ownership are fueling the demand for specialized animal healthcare products. Countries like China, Japan, and India are witnessing a surge in investments in research and development, with a focus on innovative drug formulations and medical devices. Additionally, the region's strong manufacturing capabilities make it a strategic hub for CDMOs, catering not only to local demands but also to global pharmaceutical companies outsourcing their production.

By Animal Type

By Service Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Animal Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Veterinary CRO And CDMO Market

5.1. COVID-19 Landscape: Veterinary CRO And CDMO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Veterinary CRO And CDMO Market, By Animal Type

8.1. Veterinary CRO And CDMO Market, by Animal Type, 2024-2033

8.1.1 Companion Animals

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Livestock Animals

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Veterinary CRO And CDMO Market, By Service Type

9.1. Veterinary CRO And CDMO Market, by Service Type, 2024-2033

9.1.1. Discovery

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Development

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Manufacturing

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Packaging & Labeling

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Market Approval & Post-marketing

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Veterinary CRO And CDMO Market, By Application

10.1. Veterinary CRO And CDMO Market, by Application, 2024-2033

10.1.1. Medicines

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Medical Devices

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Veterinary CRO And CDMO Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Animal Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Labcorp Drug Development.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Charles River Laboratories.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Clinvet.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. KLIFOVET GmbH (Argenta Group).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. OCR – Oncovet Clinical Research

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Knoell – Triveritas

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Veterinary Research Management.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. VETSPIN

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Inotiv.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. IDEXX Laboratories

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others