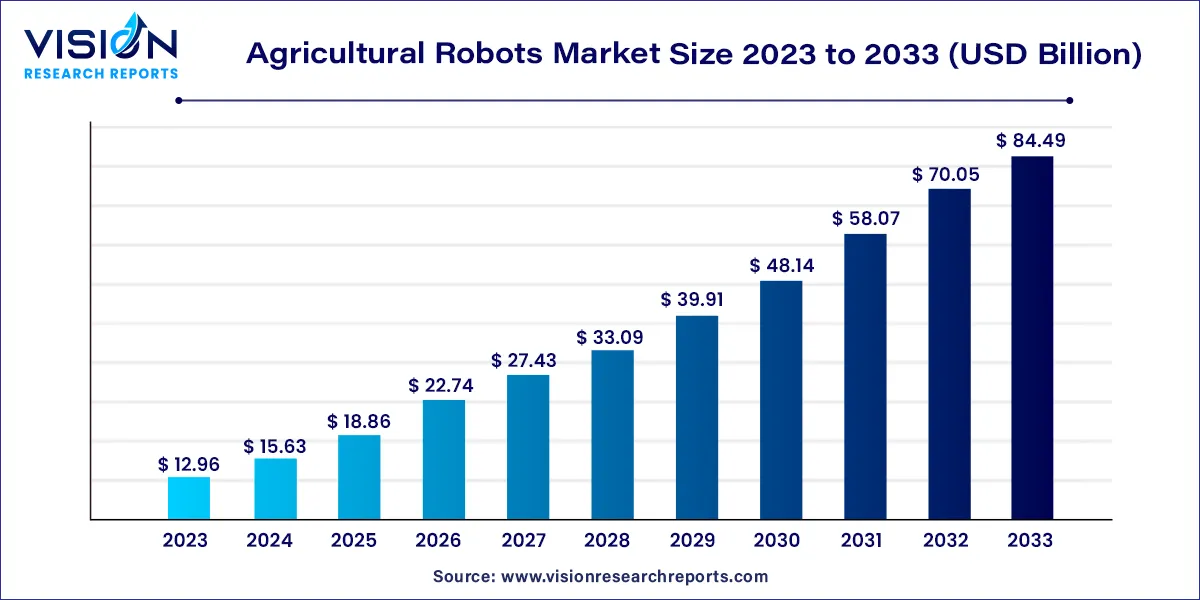

The global agricultural robots market size was valued at USD 12.96 billion in 2023 and it is predicted to surpass around USD 84.49 billion by 2033 with a CAGR of 20.62% from 2024 to 2033.

The agricultural sector is undergoing a profound transformation with the integration of advanced technologies, and at the forefront of this revolution is the agricultural robots market. These intelligent machines, equipped with artificial intelligence, machine learning, and automation capabilities, are reshaping traditional farming methods and ushering in a new era of smart agriculture.

The agricultural robots market is experiencing robust growth driven by several key factors. Firstly, the escalating global population coupled with the need for enhanced food production is pressuring the agricultural sector to adopt advanced technologies. Agricultural robots, equipped with artificial intelligence and automation, optimize farming processes, thereby increasing overall yield. Secondly, the rising awareness about sustainable farming practices is propelling the demand for agricultural robots. These machines promote precision agriculture by minimizing chemical usage and optimizing resource allocation, aligning with eco-friendly farming methods. Additionally, labor shortages in many regions are compelling farmers to automate tasks that were traditionally labor-intensive. By deploying agricultural robots, farmers can streamline operations, reduce dependency on human labor, and maintain consistent productivity.

| Report Coverage | Details |

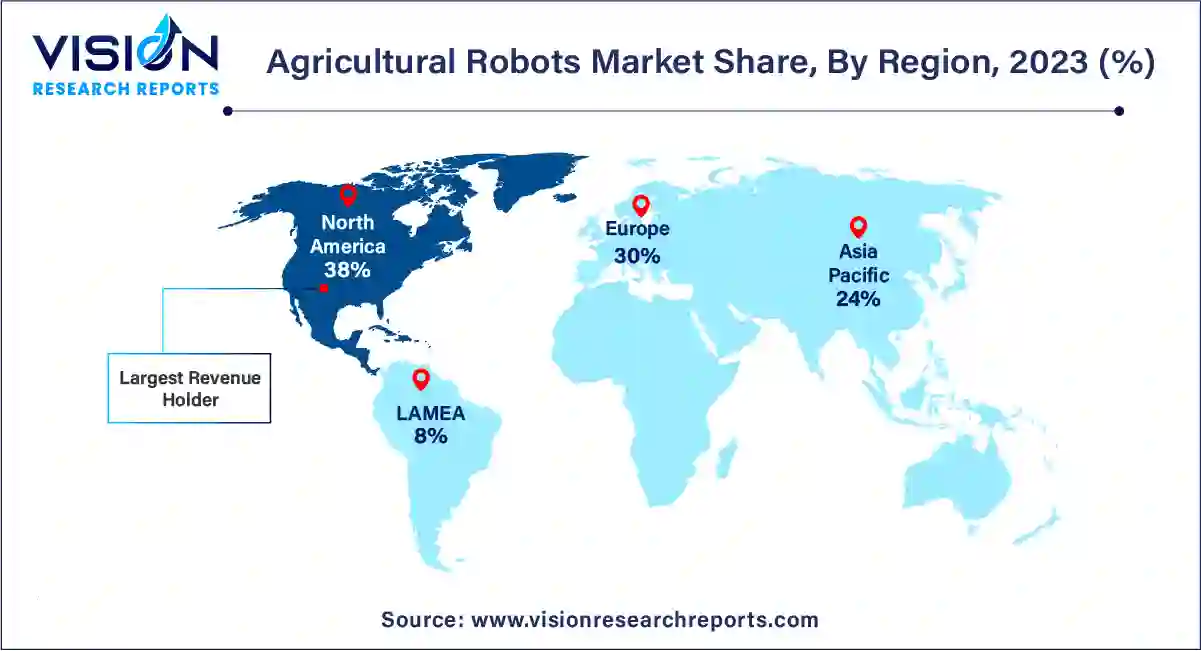

| Revenue Share of North America in 2023 | 37% |

| CAGR of Asia Pacific from 2024 to 2033 | 21.28% |

| Revenue Forecast by 2033 | USD 84.49 billion |

| Growth Rate from 2024 to 2033 | CAGR of 20.62% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The milking application segment led the market with a revenue share of 32% in 2023. The milking, agricultural robots have revolutionized dairy farming. Automated milking systems, equipped with robotic arms and sensors, have transformed the milking process. These robots can identify individual cows, clean their udders, attach milking cups, and monitor milk quality, all without human intervention. This not only reduces the manual labor involved but also ensures a consistent and efficient milking routine. Farmers benefit from increased productivity and healthier cows, while consumers receive a steady supply of high-quality milk products.

The planting and seeding management application segment expected to grow at the fastest CAGR of 23.66% over the forecast period. In the domain of planting and seeding management, agricultural robots have introduced precision and efficiency. Autonomous planting and seeding robots are equipped with advanced sensors and GPS technology, allowing precise placement of seeds in the soil. These robots can adapt to different soil conditions and planting patterns, optimizing seed placement for maximum yield. Moreover, they can operate round the clock, regardless of weather conditions, ensuring timely planting and minimizing dependency on human labor. By promoting precision agriculture, these robots enhance crop uniformity, improve resource utilization, and contribute to higher agricultural productivity.

The dairy robots segment contributed more than 40% of revenue share in 2023. Dairy robots, a prominent category within this market, have reshaped the dairy farming industry. These robots, equipped with advanced sensors and robotic arms, have automated the labor-intensive process of milking cows. Through sophisticated technology, dairy robots can identify individual cows, sanitize their udders, attach milking cups, and monitor milk quality all autonomously. This innovation not only reduces the physical strain on farmers but also ensures a consistent and efficient milking routine, leading to increased productivity and healthier herds.

The UAVs segment is predicted to grow at the remarkable CAGR of 22.07% during the forecast period. On the other front, UAVs, commonly known as drones, have soared into the agricultural sector, offering unparalleled perspectives from above. Equipped with cameras and sensors, agricultural UAVs provide farmers with valuable aerial insights. These drones can survey vast agricultural fields swiftly and with precision, capturing high-resolution images and collecting vital data about crop health, soil conditions, and irrigation needs. Farmers leverage this data to make informed decisions, optimizing irrigation, detecting crop diseases early, and enhancing overall yield.

The hardware registered the maximum market share of 56% in 2023. At the heart of agricultural robotics are the tangible components, collectively known as hardware. This category encompasses the physical robots themselves, equipped with a myriad of sophisticated sensors, actuators, and mechanical parts. These robots are meticulously engineered to perform specific tasks autonomously, ranging from planting and harvesting to milking and precision spraying. The hardware offerings also extend to the supporting infrastructure, such as charging stations, communication devices, and robotic arms. The continuous innovation in hardware technology ensures that agricultural robots are not only efficient but also durable, capable of withstanding the rigors of agricultural environments. Farmers rely on these robust hardware solutions to mechanize labor-intensive tasks, reduce operational costs, and enhance overall productivity.

The software segment is expected to grow at the fastest CAGR of 26.59% from 2024 to 2033. The software facet of agricultural robotics is equally indispensable, representing the brains behind the machines. Agricultural robot software includes sophisticated algorithms, artificial intelligence, and data analytics tools. These software solutions interpret the data gathered by sensors, enabling the robots to make real-time decisions and execute tasks with precision. Moreover, agricultural robot software plays a vital role in data management and analysis. It processes vast amounts of information related to soil quality, crop health, weather patterns, and more. Through data-driven insights, farmers can optimize irrigation, monitor pest infestations, and implement precision farming techniques.

North America region dominated the market with the largest market share of 38% in 2023. In North America, particularly in the United States and Canada, the agricultural robots market has witnessed significant growth. Technological advancements, supportive government policies, and a high level of mechanization in agriculture have spurred the adoption of agricultural robots. Farmers in this region are increasingly investing in advanced technologies, including autonomous tractors, drones, and robotic harvesters, to optimize their operations and cope with labor shortages. Precision agriculture and the use of robots for various tasks such as planting, monitoring, and harvesting are driving the market forward.

The Asia Pacific region is anticipated to grow at the noteworthy CAGR of 21.28% during the forecast period. The Asia-Pacific region, encompassing countries like China, Japan, and Australia, is experiencing rapid growth in the agricultural robots market. In countries like Japan, where an aging population and labor shortages are prevalent, agricultural robots are becoming essential for maintaining agricultural productivity. China, with its large agricultural sector, is investing in robotic technologies to improve efficiency and reduce dependency on manual labor.

By Application

By Type

By Offering

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Agricultural Robots Market

5.1. COVID-19 Landscape: Agricultural Robots Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Agricultural Robots Market, By Application

8.1. Agricultural Robots Market, by Application, 2024-2033

8.1.1 Planting & Seeding Management

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Spraying Management

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Milking

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Monitoring & Surveillance

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Harvest Management

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Livestock Monitoring

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Agricultural Robots Market, By Type

9.1. Agricultural Robots Market, by Type, 2024-2033

9.1.1. Driverless Tractors

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. UAVs

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Dairy Robots

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Material Management

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Agricultural Robots Market, By Offering

10.1. Agricultural Robots Market, by Offering, 2024-2033

10.1.1. Hardware

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Software

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Service

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Agricultural Robots Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Offering (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Offering (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Offering (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Offering (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Offering (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Offering (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Offering (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Offering (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Offering (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Offering (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Offering (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Offering (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Offering (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Offering (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Offering (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Offering (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Offering (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Offering (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Offering (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Offering (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Offering (2021-2033)

Chapter 12. Company Profiles

12.1. AGCO Corporation.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Autonomous Solutions, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. BouMatic.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. CNH Industrial N.V.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. CLAAS KGaA mbH.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. GEA Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Harvest Automation, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Trimble, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Agrobot.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lely

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others