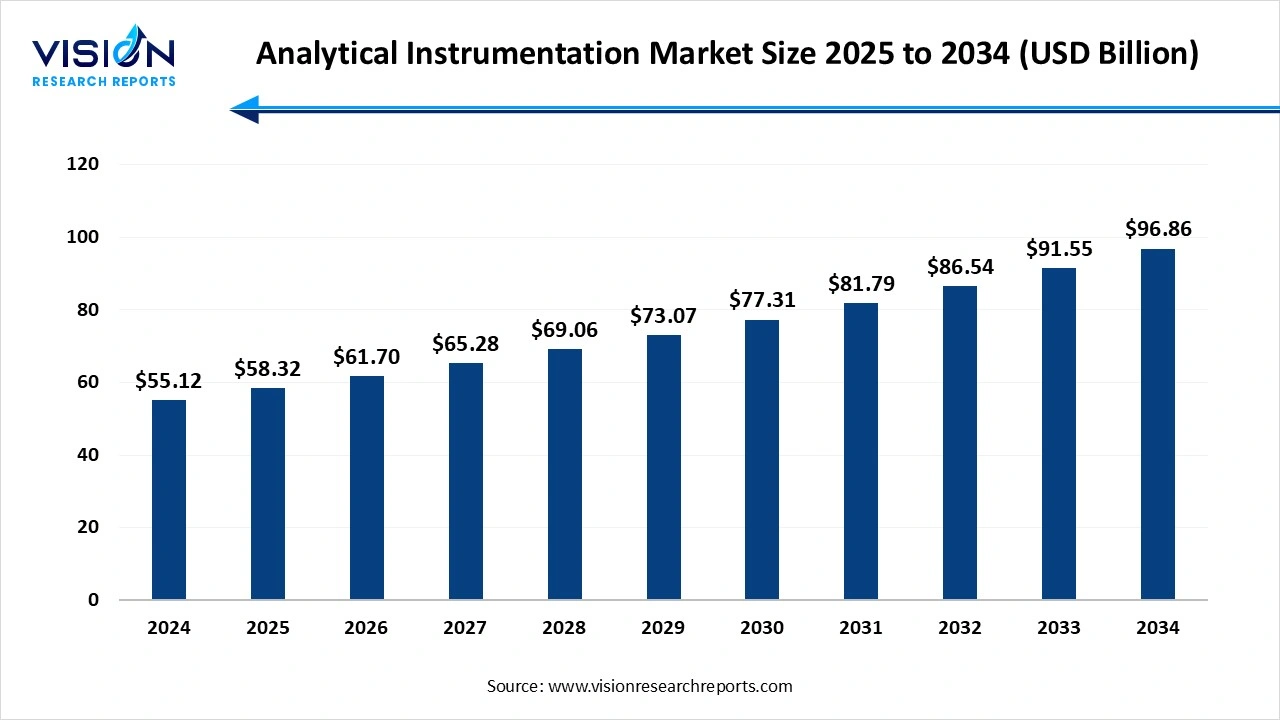

The global analytical instrumentation market size was reached at around USD 55.12 billion in 2024 and it is projected to hit around USD 96.86 billion by 2034, growing at a CAGR of 5.80% from 2025 to 2034. The market growth is driven by the rising demand for advanced analytical technologies in pharmaceutical research, environmental monitoring, and food safety testing, the analytical instrumentation market is experiencing robust growth.

The analytical instrumentation market plays a crucial role across various industries by enabling precise measurement, identification, and quantification of chemical, physical, and biological properties of materials. This market is driven by the growing need for advanced testing solutions in sectors such as pharmaceuticals, biotechnology, food and beverage, environmental monitoring, and petrochemicals. With increasing regulatory pressure and the demand for accurate and reliable data, companies are investing in high-performance instruments such as chromatography systems, spectrometers, and molecular analyzers. Technological advancements, including automation, miniaturization, and integration with AI and IoT, are further accelerating market growth.

The growth of the analytical instrumentation market is primarily driven by the increasing demand for precise and reliable analytical tools across critical industries such as pharmaceuticals, life sciences, food and beverages, environmental testing, and chemical manufacturing. The pharmaceutical and biotechnology sectors, in particular, are witnessing heightened demand due to rising drug development activities, stringent quality control regulations, and the expansion of personalized medicine.

Another key growth factor is the rapid advancement in technology, including automation, digitalization, miniaturization, and integration of AI and machine learning in analytical systems. These innovations enhance efficiency, improve accuracy, and reduce operational time, making them highly desirable in laboratory and field applications. Furthermore, the surge in R&D activities and the increasing adoption of analytical tools in academic and research institutions are also fueling market expansion.

One of the primary challenges faced by the analytical instrumentation market is the high cost of advanced instruments and related maintenance. Sophisticated technologies such as mass spectrometry, nuclear magnetic resonance (NMR), and high-performance liquid chromatography (HPLC) require substantial capital investment, making them less accessible to small and mid-sized laboratories, particularly in developing regions. Additionally, operational complexity and the need for skilled personnel to handle and interpret data from these instruments further raise the barrier to entry.

Another significant challenge is the regulatory and compliance landscape, which varies across countries and industries. Analytical instruments used in pharmaceuticals, environmental testing, or food safety must meet stringent accuracy and validation standards. Navigating these evolving regulatory requirements can delay product launches and complicate market expansion. Furthermore, data integrity, reproducibility, and traceability are critical concerns, especially with the increasing shift toward digital systems.

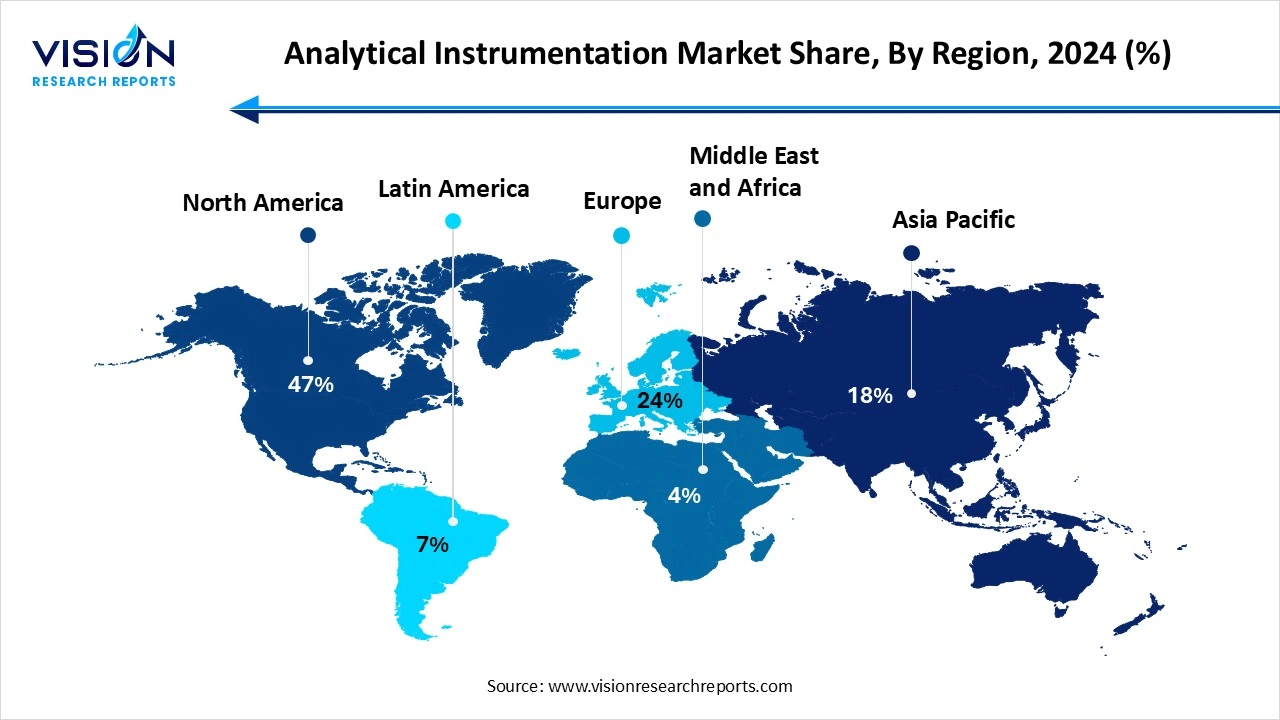

North America accounted for the largest share of the analytical instrumentation market, contributing 47% of the total revenue in 2024. North America holds a leading position in the market, primarily driven by the strong presence of key industry players, robust healthcare and pharmaceutical sectors, and significant investments in R&D activities. The United States, in particular, is a major contributor due to its advanced laboratory infrastructure, early adoption of cutting-edge technologies, and support from government and private entities for scientific innovation. Additionally, the region benefits from a high concentration of academic institutions and biotechnology companies that rely heavily on analytical instruments for both fundamental and applied research.

The Asia-Pacific analytical instrumentation market is projected to experience the fastest compound annual growth rate of 7.24% between 2025 and 2034. ountries like China, India, Japan, and South Korea are witnessing increased demand for advanced instrumentation to support diagnostics, quality assurance, and academic research. Favorable government initiatives, rising awareness about analytical technologies, and the presence of cost-effective manufacturing hubs make the region a strategic market for global players.

The Asia-Pacific analytical instrumentation market is projected to experience the fastest compound annual growth rate of 7.24% between 2025 and 2034. ountries like China, India, Japan, and South Korea are witnessing increased demand for advanced instrumentation to support diagnostics, quality assurance, and academic research. Favorable government initiatives, rising awareness about analytical technologies, and the presence of cost-effective manufacturing hubs make the region a strategic market for global players.

The instruments segment accounted for the largest portion of overall revenue, capturing a 64% share in 2024. Instruments hold a dominant share in the market due to their fundamental role in performing various analytical processes across industries such as pharmaceuticals, biotechnology, environmental testing, food and beverage, and chemical manufacturing. These instruments include chromatography systems, spectrometers, particle analyzers, electrophoresis devices, and microscopes, among others.

The software segment is expected to experience the highest compound annual growth rate of 7.96% over the forecast period. Analytical software is essential for instrument control, data acquisition, analysis, and interpretation. With the rising complexity of data generated by modern analytical tools, there is a growing need for sophisticated software solutions that ensure data accuracy, security, and regulatory compliance. Cloud-based platforms, AI-powered analytics, and machine learning algorithms are increasingly being embedded into software solutions, enabling real-time insights and remote access to laboratory operations.

The polymerase chain reaction (PCR) segment accounted for the largest revenue share of 25% in 2024. Polymerase chain reaction technology plays a pivotal role in molecular biology by amplifying small DNA or RNA samples, making it a cornerstone in genetic analysis, diagnostics, forensic science, and life science research. The demand for PCR-based instruments has surged in recent years due to their critical application in disease detection, including infectious diseases such as COVID-19.

The sequencing segment is expected to register the fastest CAGR of 8.88% throughout the forecast period. It is widely used in fields such as personalized medicine, genetic diagnostics, drug development, and agricultural biotechnology. The growing focus on precision medicine and the rising incidence of genetic disorders have significantly fueled the adoption of sequencing instruments and solutions. Additionally, the continuous improvements in sequencing speed, accuracy, and data analysis tools have made the technology more accessible to research institutions and clinical laboratories.

The life sciences research & development segment accounted for the highest share of the total revenue at 47% in 2024. In this field, analytical instruments are essential for exploring biological systems, identifying molecular mechanisms, and developing new therapeutic solutions. Instruments such as mass spectrometers, chromatography systems, and high-resolution microscopes enable researchers to conduct detailed molecular and cellular analyses, which are critical in drug discovery, genomics, proteomics, and metabolomics.

The clinical and diagnostics analysis segment is projected to witness the highest CAGR of 6.95% over the forecast period. Clinical laboratories and diagnostic centers use a wide range of instruments, including polymerase chain reaction systems, immunoassay analyzers, and spectrophotometers, to perform routine and specialized tests. These instruments provide rapid, accurate, and reproducible results that are essential for timely and informed medical decision-making. The rising global burden of chronic diseases, increasing demand for early and accurate diagnostics, and growing emphasis on point-of-care testing have further expanded the use of analytical technologies in clinical settings.

By Product

By Technology

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Analytical Instrumentation Market

5.1. COVID-19 Landscape: Analytical Instrumentation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Analytical Instrumentation Market, By Product

8.1. Analytical Instrumentation Market, by Product

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

8.1.3. Software

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Analytical Instrumentation Market, By Technology

9.1. Analytical Instrumentation Market, by Technology

9.1.1. Polymerase Chain Reaction

9.1.1.1. Market Revenue and Forecast

9.1.2. Spectroscopy

9.1.2.1. Market Revenue and Forecast

9.1.3. Microscopy

9.1.3.1. Market Revenue and Forecast

9.1.4. Chromatography

9.1.4.1. Market Revenue and Forecast

9.1.5 Flow Cytometry

9.1.5.1. Market Revenue and Forecast

9.1.5. Sequencing

9.1.5.1. Market Revenue and Forecast

9.1.5. Microarray

9.1.5.1. Market Revenue and Forecast

9.1.5. Others

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Analytical Instrumentation Market, By Application

10.1. Analytical Instrumentation Market, by Application

10.1.1. Life Sciences Research & Development

10.1.1.1. Market Revenue and Forecast

10.1.2. Clinical & Diagnostic Analysis

10.1.2.1. Market Revenue and Forecast

10.1.3. Food & Beverage Analysis

10.1.3.1. Market Revenue and Forecast

10.1.4. Forensic Analysis

10.1.4.1. Market Revenue and Forecast

10.1.5. Environmental Testing

10.1.5.1. Market Revenue and Forecast

10.1.6. Others

10.1.6.1. Market Revenue and Forecast

Chapter 11. Global Analytical Instrumentation Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Technology

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Technology

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Technology

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Technology

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Technology

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Technology

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Technology

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Technology

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Technology

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Technology

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Technology

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Technology

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Technology

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Technology

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Technology

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Technology

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Technology

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Technology

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Technology

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Technology

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Technology

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Agilent Technologies, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danaher Corporation

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Shimadzu Corporation

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PerkinElmer, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Waters Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Bruker Corporation

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Bio-Rad Laboratories, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Merck KGaA

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. JEOL Ltd.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Termsv

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others