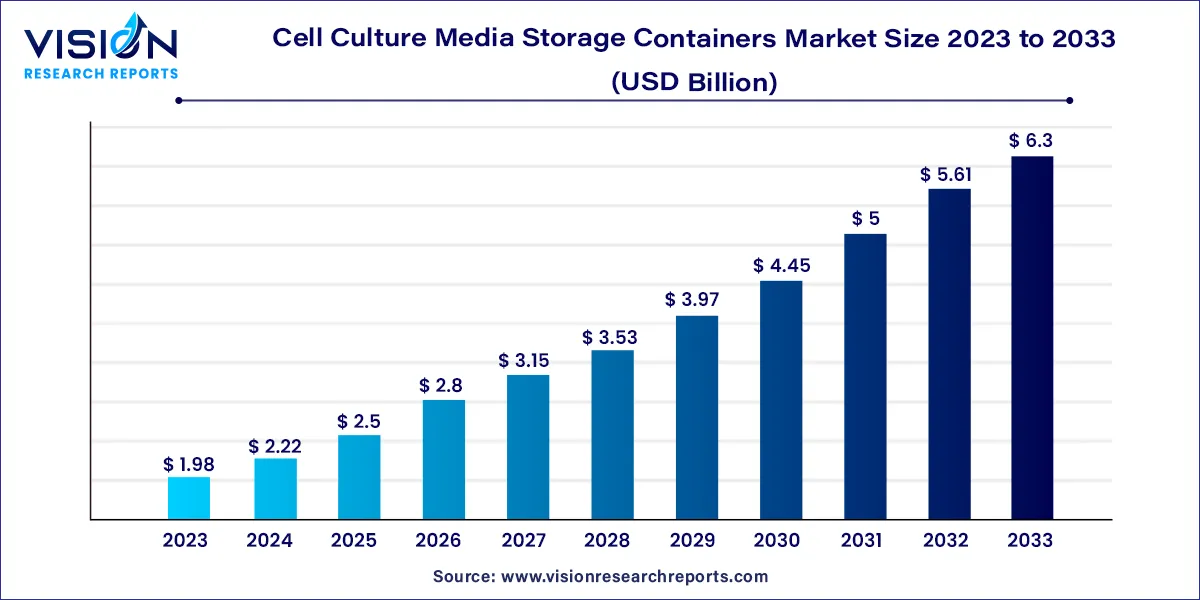

The global cell culture media storage containers market size was estimated at around USD 1.98 billion in 2023 and it is projected to hit around USD 6.3 billion by 2033, growing at a CAGR of 12.27% from 2024 to 2033.

The cell culture media storage containers market plays a pivotal role in the biotechnology and scientific research. These containers are essential for preserving cell culture media, ensuring the viability and integrity of cells, tissues, and biological samples. As the biopharmaceutical and life sciences sectors continue to expand, the demand for advanced storage solutions has surged, propelling the growth of the cell culture media storage containers market.

The growth of the cell culture media storage containers market is driven by several key factors. Firstly, the increasing prevalence of chronic diseases and the subsequent rise in cell-based research activities have heightened the demand for efficient storage solutions. Researchers and biotechnologists rely on these containers to maintain the integrity of cell cultures, driving market expansion. Secondly, advancements in biopharmaceuticals and regenerative medicine have created a need for specialized storage containers, essential for preserving the therapeutic potential of cells. Additionally, the pharmaceutical industry's focus on bioprocessing and biomanufacturing has further boosted the market. The demand for contamination-free storage systems in large-scale production processes has fueled the market's growth trajectory. Furthermore, continuous technological innovations, including the use of advanced materials and smart storage solutions, have enhanced the efficiency and reliability of these containers, catering to the evolving needs of the scientific community. These factors combined contribute significantly to the market's growth and development.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 42% |

| CAGR of Asia Pacific from 2024 to 2033 | 13.20% |

| Revenue Forecast by 2033 | USD 6.3 billion |

| Growth Rate from 2024 to 2033 | CAGR of 12.27% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The storage bags segment held the maximum market share of 43% in 2023 and it is also predicted to grow at the CAGR during the forecast period. Storage Bags provide flexibility and ease of use, allowing researchers to store varying quantities of cell culture media securely. These bags are often designed with advanced materials that ensure compatibility with different media formulations, maintaining the integrity of stored samples. Storage Bags find extensive applications in laboratories and research facilities where space optimization and efficient storage management are crucial.

Storage Bottles offer a more traditional yet highly reliable option for preserving cell culture media. These bottles are available in different sizes and materials, including glass and various types of plastics, to accommodate diverse storage requirements. Glass bottles are preferred for their inert nature, ensuring that the stored media remains uncontaminated and unaltered. Plastic bottles, made from specialized polymers, provide a lightweight and durable alternative, offering excellent chemical resistance to maintain the purity of the stored samples.

The biopharmaceutical production segment dominated the global market with the largest market share of 53% in 2023. Biopharmaceutical Production, a cornerstone of the pharmaceutical industry, relies heavily on precisely controlled cell cultures. These cultures serve as the foundation for producing biopharmaceutical drugs, vaccines, and therapeutic proteins. Cell culture media storage containers in this context ensure the stability and purity of the cell cultures, critical factors in the production of high-quality pharmaceuticals. The containers used in biopharmaceutical production are designed to maintain sterile conditions, prevent contamination, and offer controlled environments, ensuring the consistency and reliability of the produced drugs.

The tissue engineering and regenerative medicine segment is anticipated to grow at the noteworthy CAGR of 13.09% during the forecast period. Tissue Engineering and Regenerative Medicine, researchers and scientists focus on creating functional tissues and organs for transplantation and regenerative therapies. Achieving this goal requires meticulous handling and preservation of cells and tissues in a controlled environment. Cell culture media storage containers in this application serve as incubators for cultivating and storing cells for tissue engineering purposes. These containers facilitate the growth of cells into tissues or organs by providing the necessary nutrients and maintaining optimal conditions, ensuring the viability and functionality of the engineered tissues.

The pharmaceutical & biotechnology companies segment held the largest market share of 46% in 2023. Pharmaceutical & Biotechnology Companies are the cornerstone of the healthcare industry, constantly engaged in groundbreaking research, drug discovery, and biotechnological innovations. In these companies, cell culture media storage containers are essential tools. They provide the necessary environment to preserve and nurture cell cultures, ensuring the integrity and stability of biological samples. These containers are critical in drug development, enabling researchers to conduct experiments, screen potential drug candidates, and manufacture biopharmaceuticals on a large scale.

The contract research organizations segment is expected to grow at the fastest CAGR of 13.05% from 2024 to 2033. Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) are outsourced service providers that offer a wide range of research and manufacturing services to pharmaceutical and biotechnology companies. CROs specialize in conducting research studies and clinical trials, requiring secure storage solutions to maintain the viability of biological samples throughout the testing processes. CMOs, on the other hand, focus on manufacturing pharmaceuticals and biotechnological products on behalf of pharmaceutical companies. They rely on Cell Culture Media Storage Containers to store large quantities of cell cultures efficiently, ensuring the consistency and quality of the products being manufactured. These organizations rely on the precision and reliability of these containers to deliver accurate research results and high-quality products to their clients.

North America dominated the market with the largest market share of 42% in 2023. In North America, particularly in the United States and Canada, the market is driven by robust investments in research and development activities. The presence of numerous pharmaceutical and biotechnology companies, along with cutting-edge research institutions, fuels the demand for advanced Cell Culture Media Storage Containers. Additionally, the region's strong focus on drug discovery and biotechnology innovations further propels market growth.

Asia Pacific is anticipated to register the fastest CAGR of 13.20% during the forecast period. Asia-Pacific, with prominent players in Japan, China, and India, is witnessing significant market expansion. The region's thriving biopharmaceutical sector, coupled with increasing investments in life sciences research, amplifies the demand for storage solutions.

By Product

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cell Culture Media Storage Containers Market

5.1. COVID-19 Landscape: Cell Culture Media Storage Containers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cell Culture Media Storage Containers Market, By Product

8.1. Cell Culture Media Storage Containers Market, by Product, 2024-2033

8.1.1 Storage Bags

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Storage Bottles

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Storage Bins & Drums

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Other Storage Assemblies

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cell Culture Media Storage Containers Market, By Application

9.1. Cell Culture Media Storage Containers Market, by Application, 2024-2033

9.1.1. Biopharmaceutical Production

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Tissue Engineering and Regenerative Medicine

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Diagnostics

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cell Culture Media Storage Containers Market, By End-use

10.1. Cell Culture Media Storage Containers Market, by End-use, 2024-2033

10.1.1. Pharmaceutical & Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. CROs & CMOs

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Academic & Research Institutes

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Cell Culture Media Storage Containers Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Merck KGaA.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danaher.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Sartorius AG.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Greiner Bio-One International GmbH.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Corning Incorporated

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. VWR International, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Saint Gobain

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Diagnocine.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. HiMedia Laboratories

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others