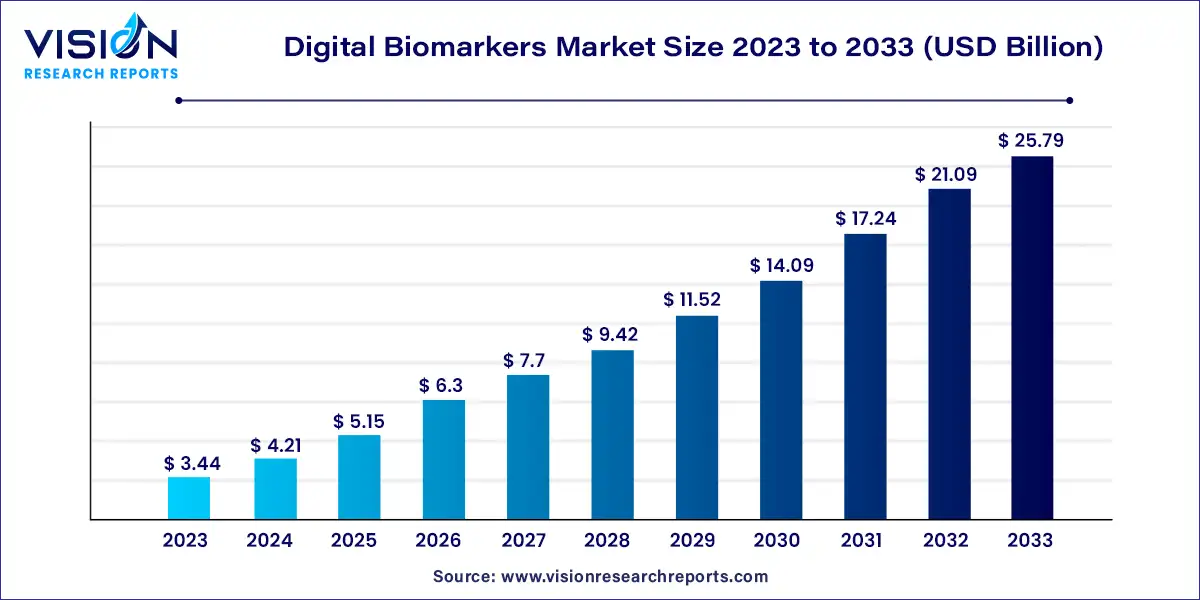

The global digital biomarker market size was estimated at around USD 3.44 billion in 2023 and it is projected to hit around USD 25.79 billion by 2033, growing at a CAGR of 22.32% from 2024 to 2033.

The digital biomarkers market is experiencing significant growth due to advancements in technology and increasing adoption of digital health solutions. Digital biomarkers, which are measurable indicators of health and disease that are collected through digital devices, offer several advantages over traditional biomarkers, including real-time monitoring, remote patient management, and greater accuracy.

The growth of the digital biomarkers market is propelled by the technological advancements have led to the development of sophisticated digital health solutions, enabling more accurate and efficient monitoring of health parameters. Additionally, the increasing prevalence of chronic diseases worldwide has created a growing need for continuous remote monitoring, driving the demand for digital biomarkers. Furthermore, the integration of artificial intelligence and machine learning algorithms for data analysis has enhanced the predictive capabilities of digital biomarkers, further fueling market growth. Moreover, the COVID-19 pandemic has accelerated the adoption of digital health technologies, including digital biomarkers, as healthcare systems prioritize remote monitoring solutions to minimize in-person interactions and improve patient outcomes.

In 2023, wearables dominated the market with a commanding share of 40%. The advancement of remote data collection technologies, a cornerstone of the digital biomarker market, is expected to benefit from continuous improvements in wearable technology throughout the forecast period.

The surge in mobile application usage, a pivotal driver of digital biomarker market growth, is projected to propel mobile-based applications at a robust CAGR of 24.35%. This upward trajectory signifies an anticipated increase in mobile phone adoption, thereby driving market expansion in the foreseeable future. Moreover, the pervasive use of the internet further amplifies growth prospects in this domain. Over the forecast period, sensors are poised to compete vigorously with wearables and mobile applications.

Market participants are solidifying their foothold through strategic initiatives, such as forging alliances with regional players, aimed at expanding their customer base and delivering enhanced solutions at competitive prices. These endeavors are expected to catalyze overall market growth throughout the forecast period. A noteworthy example is the collaboration between Biogen and Apple in February 2021, wherein they joined forces to develop digital biomarkers for assessing cognitive health using the potential of iPhone and Apple Watch, particularly targeting conditions like moderate cognitive impairment (MCI).

In 2023, diagnosis digital biomarkers commanded the largest market share, exceeding 33%. This dominance stems from the escalating utilization of interconnected digital devices and health-oriented mobile applications for diagnosing and monitoring various disease categories, including cardiovascular ailments, mental health conditions, neurological disorders, and diabetes. Consequently, digital biomarkers are poised to emerge as pivotal tools in future diagnostics and treatments across diverse disease domains.

Monitoring digital biomarkers exhibited the swiftest growth trajectory during the forecast period. This surge can be attributed to increased investment in wearable technology and smartwatches, promising easier and more precise access to health-related data. Furthermore, wearables developed by biopharmaceutical companies are streamlining internal processes by leveraging patient biometrics and functionalities, encompassing tracking capabilities, heart rate monitoring, sleep analysis, and disease-specific biometrics like electro-stimulation and sweat analysis. This trend is expected to propel market expansion further.

The cardiovascular diseases category currently holds the largest market share in the global digital biomarker market, driven by the increasing therapeutic applications and the preventable nature of cardiovascular disease, which remains the leading cause of death worldwide. Biofourmis, after securing USD 300 million in series-D funding and nearing the commercialization of its BioVitalsHF digital treatment for heart failure, has achieved unicorn status, poised to capitalize on the market's expansion.

The healthcare companies segment is anticipated to witness significant market growth due to a surge in investments and financing initiatives aimed at accelerating research on digital biomarkers. For example, in May 2020, Hikma Pharmaceuticals PLC invested in Altoida, Inc. following the latter's USD 6.3 million Series A investment in 2019. Altoida's technology integrates digital biomarkers with cutting-edge advancements in artificial intelligence, virtual reality, and algorithms, offering healthcare professionals a novel approach to assess patients' risk of moderate cognitive impairment and drive enhanced clinical outcomes for neurological conditions.

Segmented by end-use, the market comprises healthcare companies, healthcare providers, payers, and others, including patients and caregivers. Healthcare companies held the largest market share of 51% in 2023. This dominance is a result of healthcare companies' endeavors to seamlessly integrate digital metrics throughout clinical care and research, ensuring that interconnected devices offer a holistic perspective of patient health.

The payers segment is poised to witness the swiftest CAGR of 24.53% during the forecast period. This growth is fueled by the increasing adoption of innovative digital biomarkers within insurance firms, empowering payers to meet patient demands more effectively and devise personalized care plans with pre-authorization schedules.

In 2023, North America emerged as the dominant force in the market, capturing a revenue share exceeding 59%. This stronghold can be attributed to the robust presence of leading market players, substantial product launches, heightened investments in research and development, growing acceptance of smart devices, and heightened awareness regarding the efficacy of digital biomarkers within the region.

The digital biomarker market in Europe is projected to experience the most rapid growth. This surge is propelled by a rising population of individuals afflicted with chronic illnesses necessitating real-time monitoring and diagnostic solutions for various diseases. Additionally, the advanced healthcare infrastructure across European nations, coupled with a dedicated focus on research and development initiatives, is catalyzing market expansion throughout the forecast period, thereby fostering overall market growth.

By Type

By Clinical Practice

By Theraeputic Area

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Biomarkers Market

5.1. COVID-19 Landscape: Digital Biomarkers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Biomarkers Market, By Type

8.1. Digital Biomarkers Market, by Type, 2024-2033

8.1.1. Wearable

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mobile based Applications

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Sensors

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Biomarkers Market, By Clinical Practice

9.1. Digital Biomarkers Market, by Clinical Practice, 2024-2033

9.1.1. Diagnostic digital biomarkers

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Monitoring digital biomarkers

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Predictive and Prognostic digital biomarkers

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Other's (Safety, Pharmaco dynamics/ Response, Susceptibility)

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Biomarkers Market, By Therapeutic Area

10.1. Digital Biomarkers Market, by Therapeutic Area, 2024-2033

10.1.1. Cardiovascular and metabolic disorders (CVMD)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Respiratory disorders

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Psychiatric disorders

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Sleep & Movement Disease

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Neurological disorders

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Musculoskeletal disorders

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others (Diabetes, Pain Management)

10.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Digital Biomarkers Market, By End-Use

11.1. Digital Biomarkers Market, by End-Use, 2024-2033

11.1.1. Healthcare companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Healthcare Providers

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Payers

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Others (Patient, caregivers)

11.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Digital Biomarkers Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.1.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.1.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.2.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.3.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.4.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.5.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Clinical Practice (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 13. Company Profiles

13.1. ActiGraph LLC

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AliveCor Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Koneksa

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Altoida Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Amgen Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Biogen Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Empatica Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Vivo Sense

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. IXICO plc

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Adherium Limited

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others