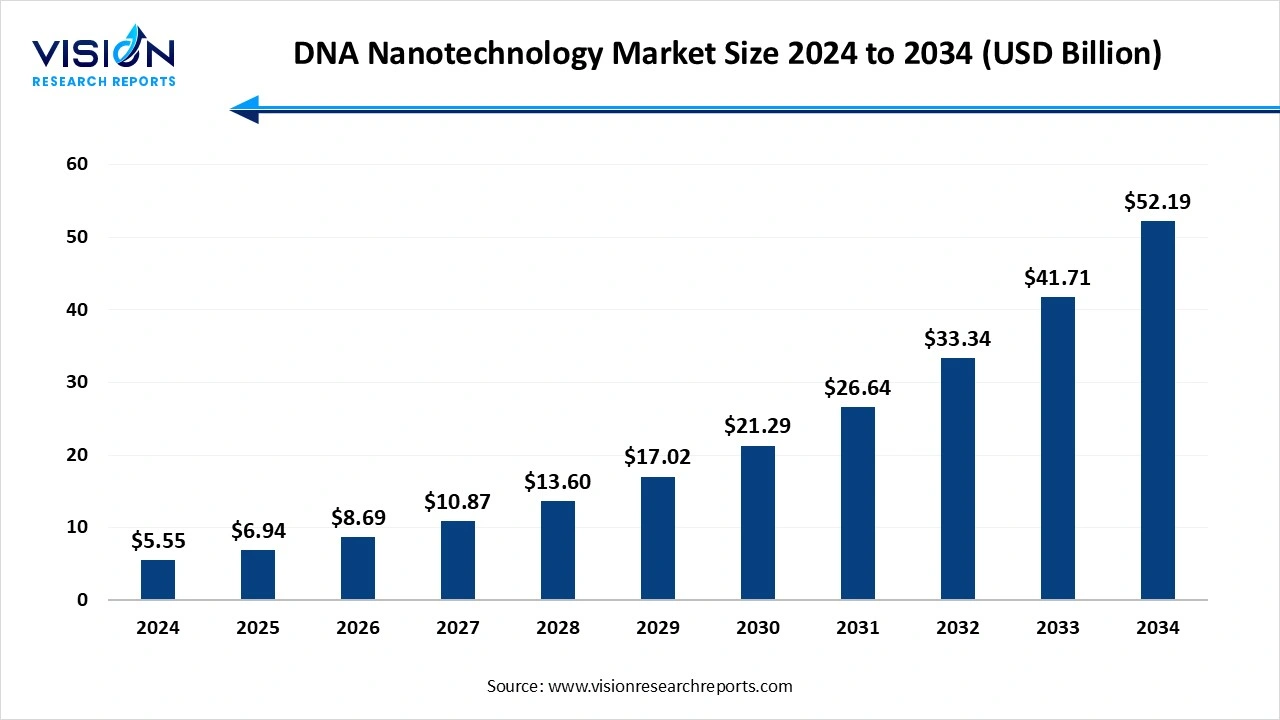

The global DNA nanotechnology market size stood at USD 5.55 billion in 2024 and is estimated to reach USD 6.94 billion in 2025. It is projected to hit USD 52.19 billion by 2034, registering a robust CAGR of 25.12% from 2025 to 2034. Market growth is driven by the expanding use of DNA-based nanostructures in drug delivery and diagnostics, offering precise, targeted, and programmable solutions for diseases such as cancer. Rising investments in R&D, growing focus on personalized medicine, and integration of AI for nanostructure design are accelerating innovation and commercialization.

DNA nanotechnology is a field that utilizes DNA molecules as building blocks to create nanoscale structures and devices, enabling innovative applications in various scientific domains. The significance of DNA nanotechnology lies in its ability to harness the unique properties of DNA, such as its programmability and stability and to create novel materials and devices at the nanoscale. This field is rapidly evolving, with ongoing research aimed at expanding its applications in medicine, materials science and beyond.

The DNA nanotechnology market is experiencing rapid growth, driven by advancements in molecular engineering, biotechnology and nanomedicine. The increasing demand for targeted therapeutics coupled with the rising focus on personalized medicine has accelerated the adoption of DNA nanotechnology in healthcare.

The DNA nanotechnology market is primarily driven by the expanding applications of DNA-based nanostructures in the healthcare and biotechnology sectors. With the rising prevalence of chronic diseases such as cancer, there is an increasing demand for advanced diagnostics and targeted drug delivery systems. DNA nanotechnology offers precision at the molecular level, enabling the development of highly specific diagnostic tools and nanocarriers for drug delivery.

Another critical growth factor is the increasing investment in research and development by both public and private sectors. Governments worldwide are funding nanotechnology research, while leading biotech companies are collaborating with academic institutions to explore innovative applications of DNA nanotechnology.The growing interest in personalized medicine, where treatments are tailored to individual genetic profiles, has also boosted demand for DNA-based diagnostic and therapeutic solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.55 billion |

| Revenue Forecast by 2034 | USD 52.19 billion |

| Growth rate from 2025 to 2034 | CAGR of 25.12% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | TGen (Translational Genomics Research Institute), IBM Research, Oxford Nanopore Technologies, BioNano Genomics, Abcam plc, Aptamer Group, Nanopore Diagnostics, and Sandia National Laboratories. |

Rising Demand for Personalized Medicine

One of the key drivers propelling the DNA nanotechnology market forward is the rising demand for personalized medicine and targeted drug delivery systems. Traditional drug delivery methods often face limitations related to specificity and efficiency, while in comparison, DNA nanostructures offer highly targeted and controlled drug release, thus reducing side effects and enhancing therapeutic effectiveness. Moreover, the increasing prevalence of chronic diseases globally and the need for more precise medical treatments is boosting the demand for DNA-based technologies even more. According to the WHO and multiple health journals, the global burden of chronic diseases, including heart disease, cancer and diabetes is increasing, pushing the need for innovations in drug delivery and diagnostic techniques.

The rise of personalized medicine is also another such key market driver as it focuses on tailoring medical treatment to individual characteristics, particularly genetic profiles. The ability to design DNA-based materials that is able to interact specifically with biological targets further enhances the effectiveness of treatments. Such innovations highlight the growing importance of personalized approaches in medicine, boosting market potential.

High Production Costs

Despite multiple growth prospects, the market does have its fair share of challenges. One such restraint are the high costs associated with DNA nanotechnology development. DNA-based nanostructures often need sophisticated fabrication methods together with expert reagents and precise chemical design, which drives up overall prices of production. Small scale and medium scale enterprises lack the adequate funding to support large-scale manufacturing, which thus slows down both innovation efforts and market opportunities. Moreover, the lack of inexpensive, scalable methods to produce DNA nanostructures hinders market adoption even more, especially within developing nations.

Rise of DNA Technology

The DNA nanotechnology market presents numerous opportunities, particularly in the field of molecular diagnostics. The ability to create highly sensitive and specific biosensors using DNA nanostructures has shown significant potential for early disease detection, particularly for cancers and genetic disorders. The integration of DNA nanotechnology in diagnostic tools could also potentially revolutionize the healthcare industry by enabling faster, more accurate, and cost-effective detection methods.

Furthermore, there is also a growing interest in applying DNA nanotechnology to environmental monitoring and sensing applications. DNA-based sensors have shown potential in detecting pollutants, toxins and pathogens, all of which is crucial for ensuring environmental safety. Governments worldwide are increasing investments in environmental protection, creating an opportunity for DNA nanotechnology to play a role in addressing global environmental challenges as well.

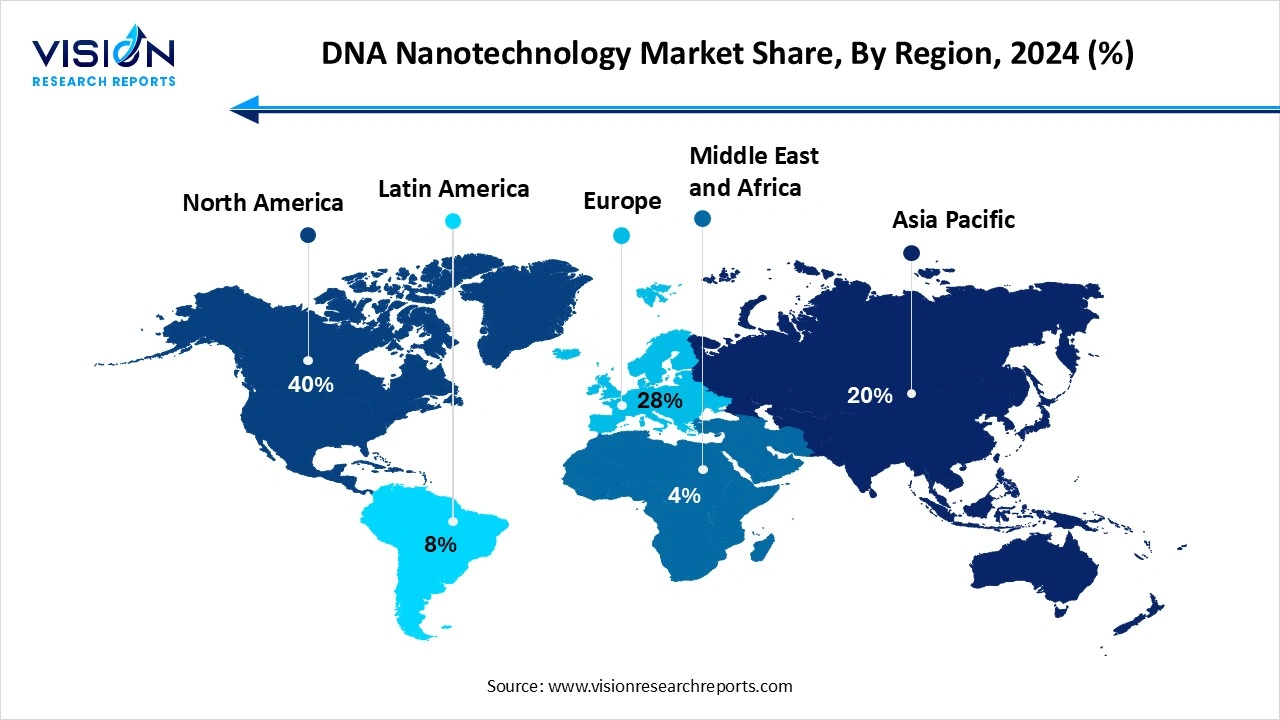

North America led the global DNA nanotechnology industry, accounting for 40% of total share in 2024. The region stands at the forefront of innovation with the help of leading academic institutions and research centers. They make substantial contributions to the development of DNA-based applications in drug delivery, diagnostics and molecular computing. The growing demand for personalized medicine coupled with the high incidence of chronic diseases such as cancer and cardiovascular disorders further fuels the adoption of DNA nanotechnology-based therapeutic solutions and positions the region as a global leader and competitor.

Asia-Pacific is seen to be the fastest growing region, fueled by the region's growing emphasis on biotechnology and nanotechnology research. Countries like China, Japan and South Korea are investing heavily in DNA nanotechnology as part of their broader initiatives to enhance healthcare and pharmaceutical sectors. The region benefits also from a large and expanding population with increasing healthcare needs, which further supports the demand for innovative solutions in areas such as early disease detection, targeted treatments and personalized medicine.

Which technology dominated the market in 2024?

The structural DNA nanotechnology segment dominated the market in 2024. These structures are meticulously engineered using techniques such as DNA origami, where long single-stranded DNA is folded into predefined shapes using complementary short DNA strands. Such structures can be programmed to form two-dimensional and three-dimensional shapes, including tiles, tubes and polyhedra, which serve as platforms for a variety of applications. In the healthcare sector, structural DNA nanotechnology can be used to create nanoscale drug carriers, diagnostic devices and biosensors.

The dynamic DNA nanotechnology segment is expected to grow at the fastest rate. This is because it explores the creation of DNA-based structures that are not only programmable but also capable of controlled motion and reconfiguration in response to external stimuli. This technology utilizes the principles of molecular self-assembly and strand displacement, enabling the design of responsive devices that are able to perform logical operations and switch between different configurations.

Which application led the market as of this year?

The drug delivery systems segment led the market, accounting for the market share in 2024. DNA nanostructures can be designed to encapsulate therapeutic molecules, protecting them from degradation and ensuring targeted delivery to specific tissues or cells. The programmability of DNA allows for the incorporation of molecular triggers that release drugs only under certain conditions, such as changes in pH, temperature or the presence of specific enzymes, making them ideal for personalized medicine.

The diagnostics and biosensing development sector is expected to experience the fastest growth rate. DNA-based biosensors leverage the unique ability of DNA molecules to undergo precise base-pairing interactions, allowing them to recognize target molecules with exceptional accuracy. These biosensors can be engineered to detect nucleic acids, proteins, or small molecules, making them highly versatile.

Which end user held the largest market share in 2024?

The academic and research institutions segment led the market, accounting for the market share in 2024. Researchers in these institutions use DNA nanotechnology in order to explore the principles of molecular self-assembly, develop sophisticated nanostructures and investigate their potential applications across various scientific fields. These institutions experiment with novel design techniques such as DNA origami, dynamic DNA nanomachines and DNA-based computational systems, driving innovation and market potential.

The biotechnology and pharmaceuticals sector is expected to experience the fastest growth rate during the forecast period. These companies are primarily focused on harnessing DNA nanotechnology for the development of advanced therapeutics, diagnostics and personalized medicine solutions. In the drug development domain, they utilize DNA nanocarriers for targeted drug delivery, which enhances therapeutic efficacy while minimizing side effects. It also enables the creation of smart drug delivery systems that respond to specific biological triggers, providing controlled and precise treatment options for diseases such as cancer, autoimmune disorders and genetic conditions.

BY type

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technology Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on DNA Nanotechnology Market

5.1. COVID-19 Landscape: DNA Nanotechnology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global DNA Nanotechnology Market, By Type

8.1. DNA Nanotechnology Market, by Type

8.1.1 Dynamic DNA Nanotechnology

8.1.1.1. Market Revenue and Forecast

8.1.2. Structural DNA Nanotechnology

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global DNA Nanotechnology Market, By Application

9.1. DNA Nanotechnology Market, by Application

9.1.1. Drug Delivery Systems

9.1.1.1. Market Revenue and Forecast

9.1.2. Diagnostics and Biosensing Development

9.1.2.1. Market Revenue and Forecast

9.1.3. Material Science and Nanoassembly

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global DNA Nanotechnology Market, By End Use

10.1. DNA Nanotechnology Market, by End Use

10.1.1. Academic & Research Institutions

10.1.1.1. Market Revenue and Forecast

10.1.2. Biotechnology and Pharmaceuticals

10.1.2.1. Market Revenue and Forecast

10.1.3. Others

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global DNA Nanotechnology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. TGen (Translational Genomics Research Institute).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. IBM Research.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Oxford Nanopore Technologies.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. BioNano Genomics.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Abcam plc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Aptamer Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Nanopore Diagnostics.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sandia National Laboratories

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others