Downstream Processing Market Size, Report 2025-2034

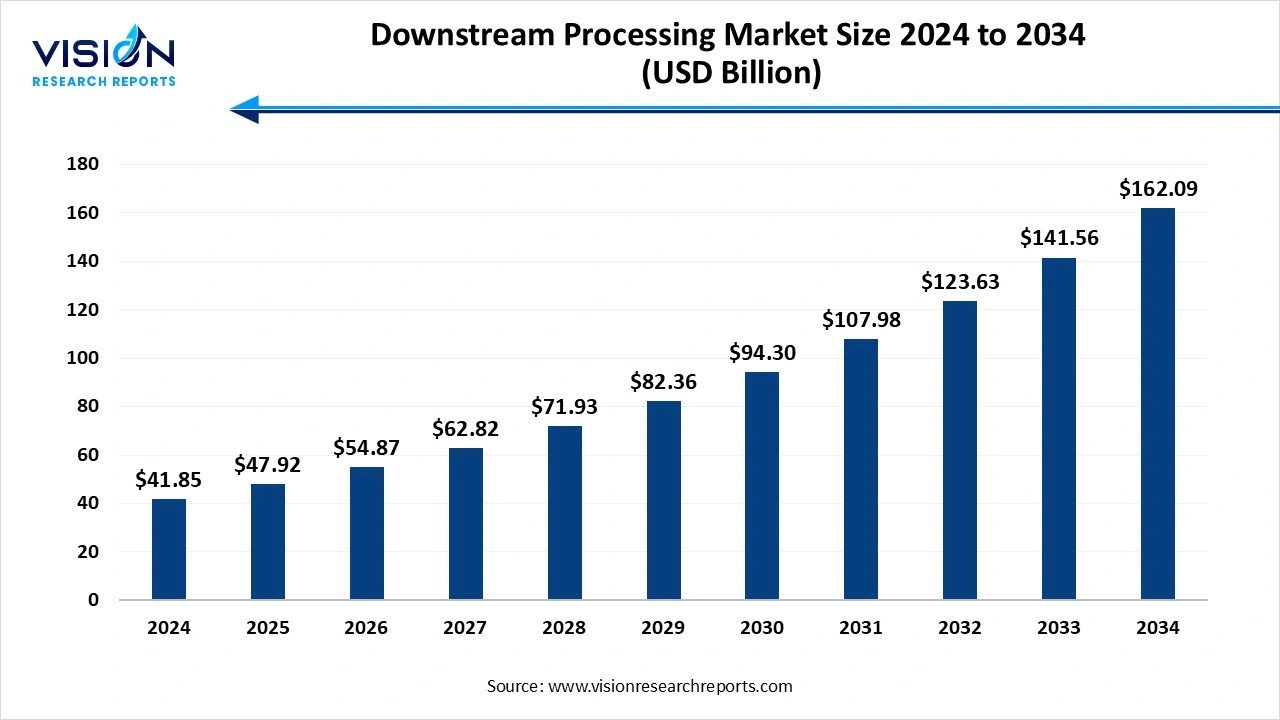

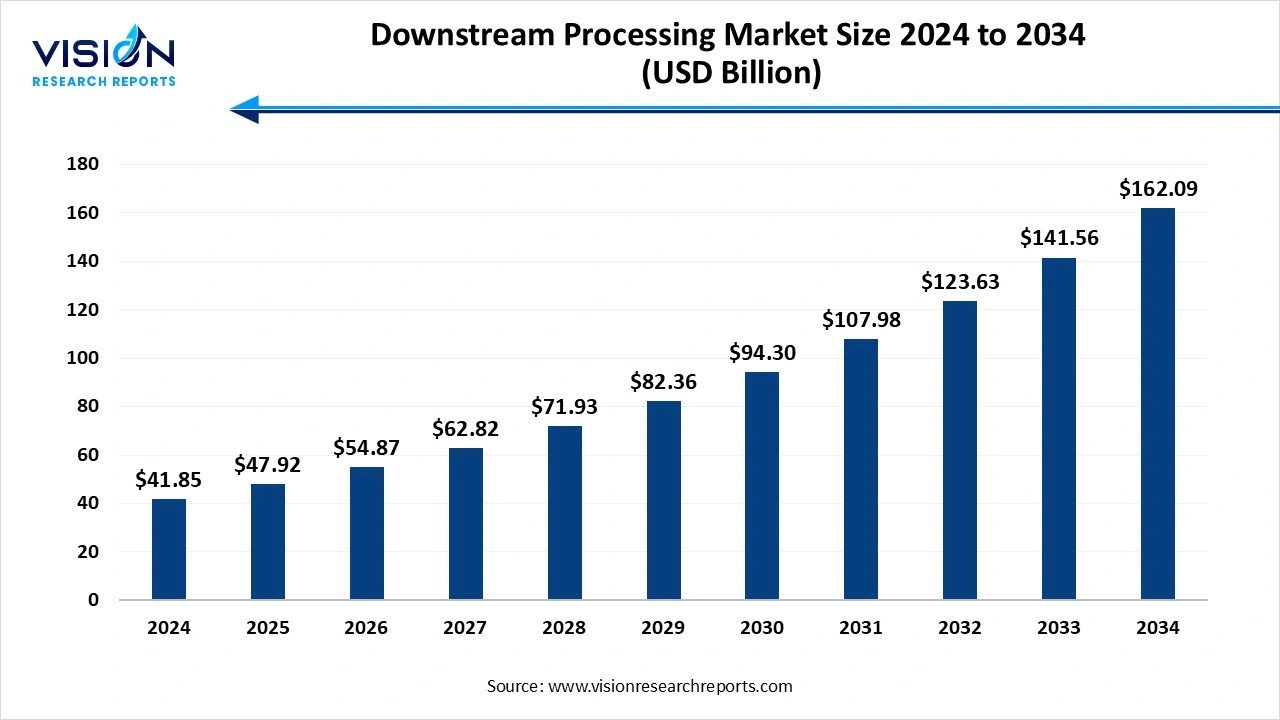

The global downstream processing market size stood at USD 41.85 billion in 2024 and is estimated to reach USD 47.92 billion in 2025. It is projected to surge past USD 162.09 billion by 2034, registering a robust CAGR of 14.5% from 2025 to 2034. The rising biopharmaceutical demands, innovations in research and development, and expansion of the biopharmaceutical sector drive the market growth.

Key Pointers

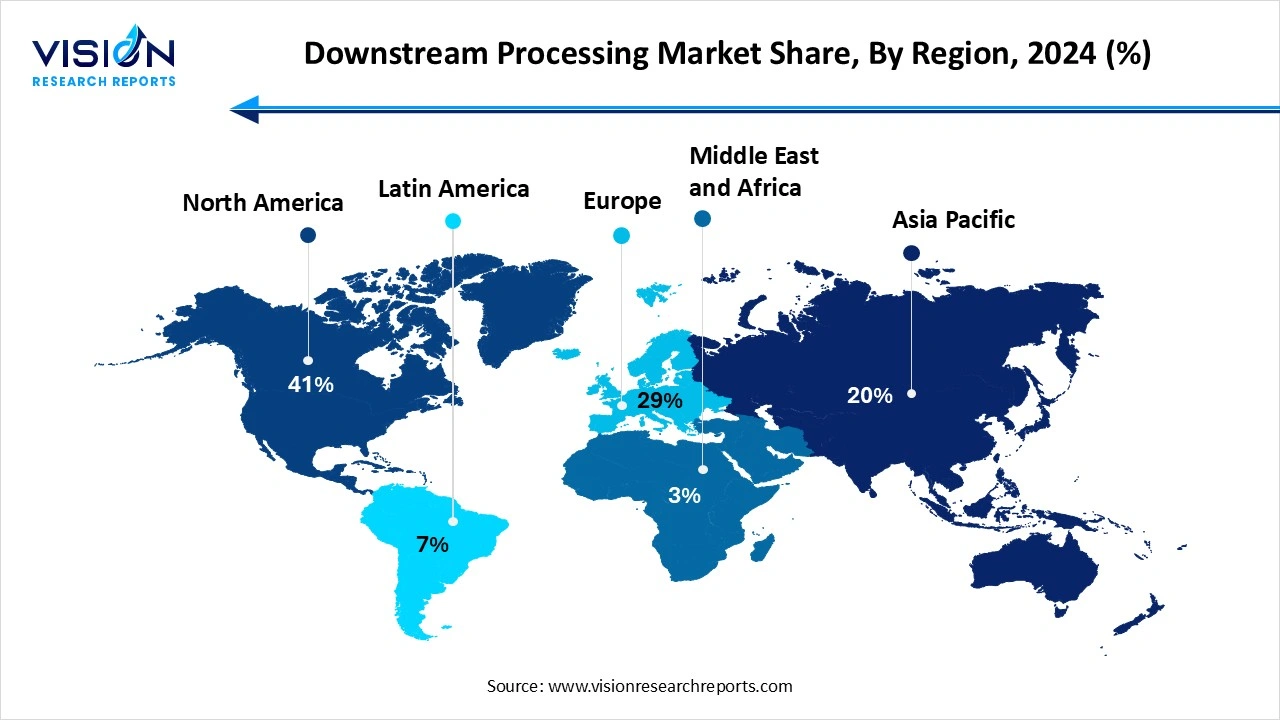

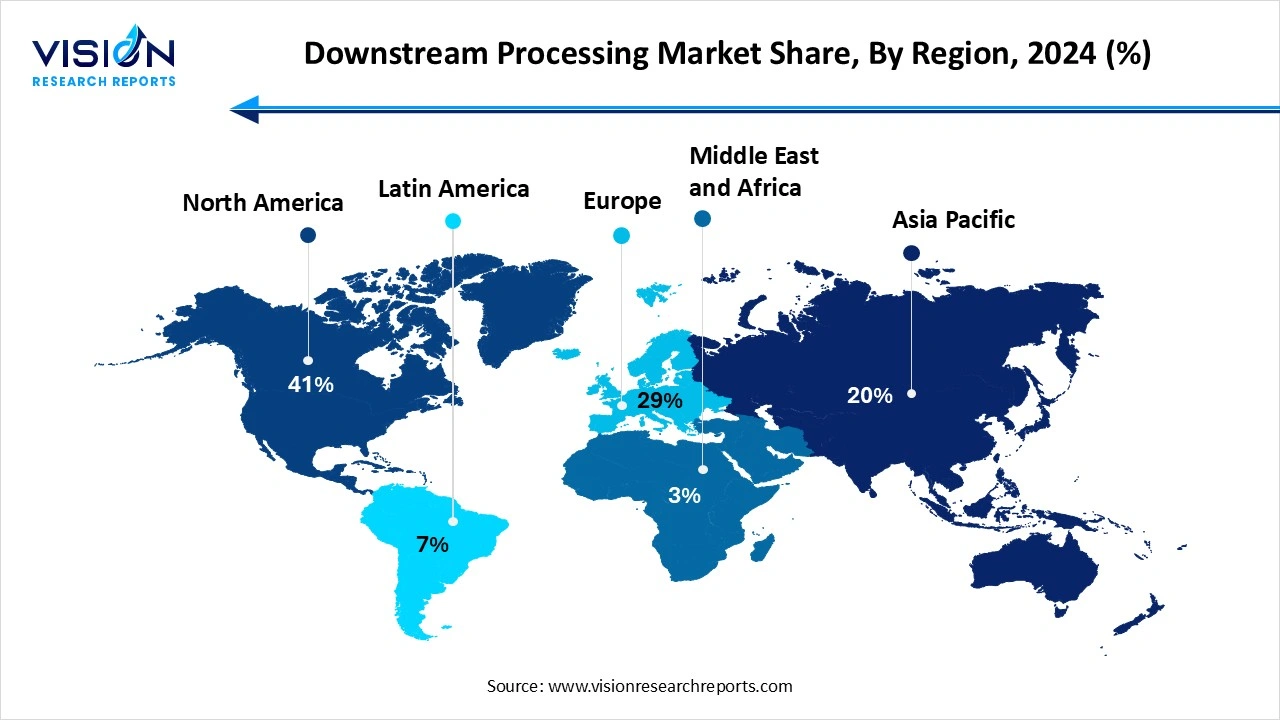

- By region, North America dominated the global market with highest share of 41% in 2024.

- By product, the chromatography systems segment contributed the largest market share of 42% in 2024.

- By product, the filters segment is expected to expand at the highest CAGR from 2025 to 2034.

- By technique, the purification by chromatography segment is generated the maximum market share of 42% in 2024.

- By technique, the solid-liquid separation segment is expected to grow at the notable CAGR during the forecast period.

- By application, the antibiotic production segment registered the maximum market share of 30% in 2024.

Downstream Processing Market Overview

A downstream process is defined as the recovery, purification, and packaging of a biosynthetic product, such as a pharmaceutical drug, from its natural source, like a fermentation broth. These processes are crucial for separating the target product from a complex mixture of contaminants, including cells, cell debris, and other impurities. The market growth is driven by the need for purifying and isolating complex biological products, such as monoclonal antibodies and vaccine, driving the need for these technologies as the biopharmaceutical industry expands. Innovation in biotechnology, the rapid adoption of single-use and disposable technologies, and increased investments in biopharmaceutical research and development, including efforts to modernize bioprocess technologies, are fueling demand for improved downstream processing solutions.

Advancements in Purification Processing Market Growth

The development of advanced resins and columns has improved the speed and capacity of chromatography, the standard purification method for most biologics. There is a market shift toward integrated and continuous DSP systems, which combine multiple purification steps into a more streamlined process. This approach reduces operational costs and time while improving overall process efficiency. Novel membrane filtration technologies have been developed to increase the efficiency of clarification and viral inactivation.

Report Scope of the Downstream Processing Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 17.73 billion |

| Revenue Forecast by 2034 |

USD 27.80 billion |

| Growth rate from 2025 to 2034 |

CAGR of 4.6% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

|

Downstream Processing Market Trends

- Technology Advancement: Continuous advancement of automation in processes such as chromatography, filtration, and drying reduces human error and improves consistency, while the application of AI and machine learning increases efficacy and product yield. The increasing single-use system adoption offers benefits, such as flexibility, reduced cleaning, and lower capital investment, especially for small-batch manufacturing. Shift towards a continuous manufacturing process, which improves productivity and offers significant advantages in large-scale biopharmaceutical production.

Downstream Processing Market Opportunity

Expansion in the Biopharmaceutical Sectors for the Downstream Processing Market

The demand for biopharmaceuticals, especially mAbs, has been on a steady rise to treat conditions like cancer and autoimmune diseases. As upstream processes have become more productive, resulting in higher concentrations of the desired product, the downstream purification process has become a bottleneck. This has driven the need for more advanced and high-throughput DSP solutions. Downstream processing is essential for purifying and isolating complex biological products, like monoclonal antibodies and vaccines, driving the need for these technologies as the biopharmaceutical industry expands.

Downstream Processing Market Challenge

High Cost in the Downstream Processing Market

The downstream processing requires specialized instruments and consumables, such as chromatography systems, filters, and resins, which come at a high price. Setting up downstream processing facilities requires considerable initial capital investment.

Regional Insights

Which Region Dominated the Downstream Processing Market?

North America led the downstream processing industry, accounting for the highest revenue share of 41% in 2024. The region has major biopharmaceutical industries and significant investment in innovative technologies, technological advancement in downstream processing, with a strong emphasis on research and development activities, which fuel the market growth. The increasing demand for biopharmaceuticals, such as biologics, personalized medicine, and biosimilars, creates more demand, well-established biopharmaceutical manufacturing facilities, and well-developed healthcare infrastructure drive the market growth.

United States Downstream Processing Market Trends

The adoption of single-use systems for their flexibility and cost-effectiveness, and a shift towards continuous processing to improve productivity and control. There is also an increase in outsourcing to Contract Manufacturing Organizations (CMOs) for their expertise and infrastructure, and a strong emphasis on regulatory compliance, which drives investment in advanced technologies. Technological advancements in chromatography and filtration are improving efficiency, and there is a focus on process intensification to optimize operations.

Why is the Asia Pacific Significantly Growing in the Downstream Processing Market?

The Asia Pacific unmanned systems industry is projected to register the highest compound annual growth rate (CAGR) of over 14.1% between 2025 and 2034. The rising demand in the region of biopharmaceuticals and vaccines, an increasing aging population, and chronic diseases necessitate efficient purification and separation processes. The growing private and government investment in biotechnology and pharmaceutical research and development is fuelling the market growth. The adoption of process intensification, automation, and single-use technologies in biomanufacturing increases efficiency, reduces the risk of cross-contamination, and lowers operational costs.

Segmental Insights

Products Insights

Why did the Chromatography Segment Dominate the Downstream Processing Market?

The chromatography systems segment led the downstream processing market, capturing the largest revenue share of 42% in 2024. It has high resolution and purification capabilities, which are essential for manufacturing safe and effective biopharmaceuticals. The technique's versatility allows for multi-step purification tailored to specific biomolecules, meeting stringent regulatory standards. Continued innovation in automation, resins, and single-use technologies further cemented its market dominance. As the biopharmaceutical sector grows, chromatography will remain a critical tool for isolating complex biologics with high purity.

The filters segment is the fastest-growing in the downstream processing market during the forecast period. The new development in membrane filtration and depth filtration, including an advanced tangential flow filtration system, improves efficacy and scalability. The rising trends towards single-use filters in biomanufacturing simplify processes, reduce cross-contamination risks, and increase production rate. The increasing demand for biologics, vaccines, and monoclonal antibodies requires advanced filtration solutions for drug development and manufacturing, fueling the market growth.

Technique Insights

How the Purification by Chromatography Segment hold the Largest Share in the Downstream Processing Market?

The purification by chromatography segment held the largest share of the downstream processing market, accounting for 42% of total revenue in 2024. The unmatched precision and reliability for isolating high-value biopharmaceuticals. It is essential for meeting the stringent purity requirements of modern biologics, like monoclonal antibodies and vaccines, driving market growth. With continuous innovation in single-use and automated systems, chromatography remains the most effective and adaptable solution for complex purification challenges. This technological superiority and its critical role in biomanufacturing secure its leading market position.

The solid-liquid separation segment is experiencing the fastest growth in the market during the forecast period. It is crucial for the separation of cells and insoluble components from the culture broth, a primary step in isolating the desired product. This method is more economical than other purification techniques. Solid-liquid separation techniques are well-suited for integration into continuous manufacturing processes, which enhance overall productivity and efficiency.

Application Insights

How the Antibiotic Production Segment hold the Largest Share in the Downstream Processing Market?

The antibiotic production segment led the downstream processing market, accounting for the highest revenue share of 30% in 2024. There is a high demand for antibiotics to combat infectious diseases, including those caused by antibiotic-resistant bacteria. Antibiotics are broadly used in both human medicine for various disorders and in agriculture, further contributing to their high consumption and, consequently, demand for downstream processing. The rising threat of antibiotic-resistant bacteria, which causes hundreds of thousands of deaths annually, drives continuous research and development into novel antibiotics. This fuels the demand for innovative and efficient downstream processing technologies to purify these new drug candidates.

The antibody production segment is experiencing the fastest growth in the market during the forecast period. The high demand for monoclonal antibodies used in targeted therapies. Technological advancements like single-use and continuous processing are addressing purification challenges from increased upstream production yields. Biopharmaceutical companies and contract manufacturers are investing significantly to reduce costs and accelerate time-to-market for complex biologics. This rising demand and technological support for monoclonal antibodies contribute to the segment's dominant growth in downstream processing.

The Downstream Processing Market-Value Chain Analysis

- R&D: The downstream processing market focuses on the recovery, purification, and formulation of biosynthetic products, such as pharmaceuticals and vaccines, from natural sources like fermentation broths or plant/animal tissues.

- Patient Support and Services: The downstream processing market involves the biopharmaceutical industry that deal with entirely separate parts of the product lifecycle.

- Distribution to Hospitals, Pharmacies: The Biopharmaceutical and biotech companies, Contract manufacturing organizations (CMOs), and Hospitals and pharmacies.

Recent Developments

- In January 2025, Bio-Rad Laboratories introduced CHT™ Foresight Pro Columns, developed for process-scale chromatography applications across all stages of biological drug manufacturing. (Source: The Scientist)

- In September 2025, Aptamer Group announced a partnership with Invizius to integrate its Optimer platform with Invizius’ H-Guard technology to develop highly specific binders for the complement system. (Source: aptamer group)

Top Companies in Downstream Processing Market

Market Segmentation

By Product

- Chromatography Systems

- Filters

- Evaporators

- Centrifuges

- Dryers

- Others

By Technique

- Cell Disruption

- Solid-liquid Separation

- Filtration

- Centrifugation

- Concentration

- Evaporation

- Membrane Filtration

- Purification By Chromatography

- Formulation

By Application

- Antibiotic Production

- Hormone Production

- Antibodies Production

- Enzyme Production

- Vaccine Production

By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Australia

- Latin America

- Middle East and Africa (MEA)

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Frequently Asked Questions

The global downstream processing market size was reached at USD 41.85 billion in 2024 and it is projected to hit around USD 162.09 billion by 2034.

The global downstream processing market is growing at a compound annual growth rate (CAGR) of 14.50% from 2025 to 2034.

The North America region has accounted for the largest downstream processing market share in 2024.

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Downstream Processing Market

5.1. COVID-19 Landscape: Downstream Processing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Downstream Processing Market, By Product

8.1. Downstream Processing Market, by Product

8.1.1 Chromatography Systems

8.1.1.1. Market Revenue and Forecast

8.1.2. Filters

8.1.2.1. Market Revenue and Forecast

8.1.3. Evaporators

8.1.3.1. Market Revenue and Forecast

8.1.4. Centrifuges

8.1.4.1. Market Revenue and Forecast

8.1.5. Dryers

8.1.5.1. Market Revenue and Forecast

8.1.6. Others

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global Downstream Processing Market, By Technique

9.1. Downstream Processing Market, by Technique

9.1.1. Cell Disruption

9.1.1.1. Market Revenue and Forecast

9.1.2. Solid-liquid Separation

9.1.2.1. Market Revenue and Forecast

9.1.3. Concentration

9.1.3.1. Market Revenue and Forecast

9.1.4. Purification By Chromatography

9.1.4.1. Market Revenue and Forecast

9.1.5. Formulation

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Downstream Processing Market, By Application

10.1. Downstream Processing Market, by Application

10.1.1. Antibiotic Production

10.1.1.1. Market Revenue and Forecast

10.1.2. Hormone Production

10.1.2.1. Market Revenue and Forecast

10.1.3. Antibodies Production

10.1.3.1. Market Revenue and Forecast

10.1.4. Enzyme Production

10.1.4.1. Market Revenue and Forecast

10.1.5. Vaccine Production

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Downstream Processing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Technique

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Technique

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Technique

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Technique

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Technique

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Technique

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Technique

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Technique

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Technique

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Technique

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Technique

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Technique

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Technique

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Technique

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Technique

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Technique

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Technique

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Technique

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Technique

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Technique

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Technique

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Sartorius AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Danaher Corporation (including Cytiva and Pall Corporation).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Thermo Fisher Scientific Inc..

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Merck KGaA (Millipore Sigma in the U.S. and Canada).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Repligen Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. 3M Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Eppendorf AG.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. GE Healthcare (part of Cytiva, now under Danaher)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Waters Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lonza Group AG

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments