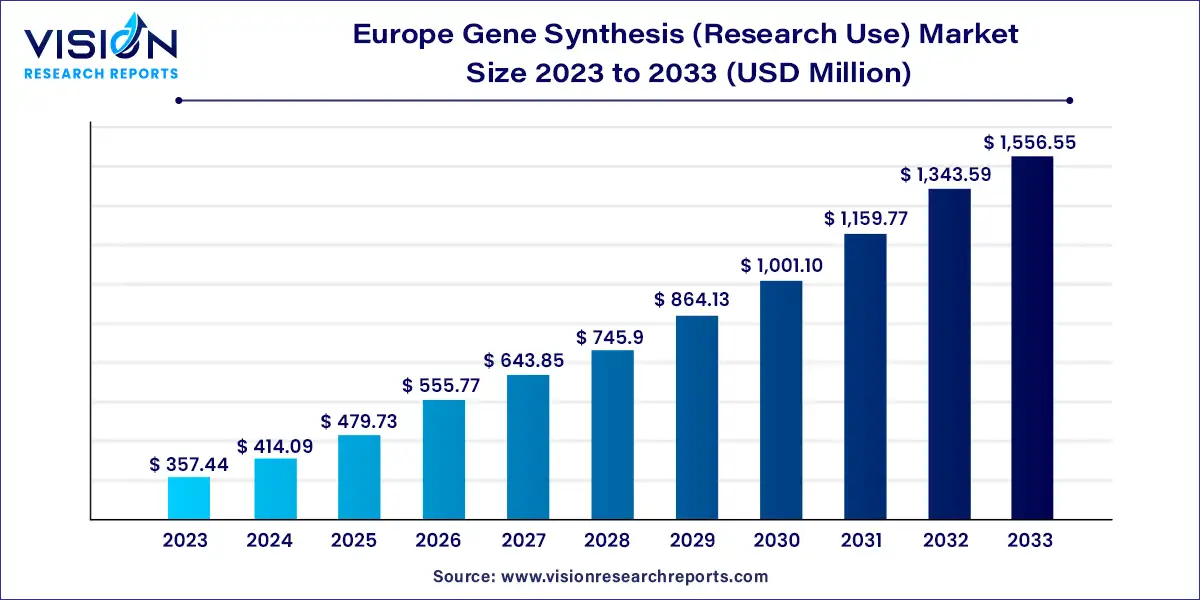

The Europe gene synthesis (research use) market size was valued at USD 357.44 million in 2023 and it is predicted to surpass around USD 1,556.55 million by 2033 with a CAGR of 15.85% from 2024 to 2033.

The gene synthesis market for research use in Europe is experiencing significant growth, driven by advancements in biotechnology, increasing demand for customized genetic materials, and expanding applications in various fields such as pharmaceuticals, agriculture, and academic research.

The growth of the gene synthesis market for research use in Europe is propelled by an advancements in biotechnology have enabled the development of sophisticated gene synthesis techniques, making it easier and more cost-effective for researchers to obtain custom DNA sequences. Secondly, increasing investments in genomics research across Europe are driving the demand for gene synthesis services, particularly in areas such as drug discovery, personalized medicine, and agricultural biotechnology. Additionally, collaborations between academic institutions, biotech companies, and government organizations are fostering innovation and driving the adoption of gene synthesis technologies. Moreover, the expanding applications of synthetic genes in fields such as molecular biology, synthetic biology, and biomedicine are fueling market growth by creating new opportunities for research and product development.

| Report Coverage | Details |

| Market Size in 2023 | USD 357.44 million |

| Revenue Forecast by 2033 | USD 1,556.55 million |

| Growth rate from 2024 to 2033 | CAGR of 15.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on method, the market is segmented into solid-phase, chip-based, and PCR-based enzyme synthesis. Solid-phase synthesis segment dominated the market in 2023 with a share of 40% due to the presence and widespread use of this technique, along with the increasing automation in solid-phase technology, which enhanced the efficiency of DNA synthesis. A rise in the adoption of solid-phase synthesis for biophysical studies also favors segment demand.

The PCR-based enzyme synthesis method is expected to witness the fastest CAGR of 17.94% over the forecast period. The growth of the segment can be attributed to the restraints of the chemical synthesis process, such as producing desired quality DNA for only up to a limited length and the environmental impact of the harsh chemicals used.

In the services segment, the antibody DNA synthesis segment held the largest market share of 63% in 2023, owing to an increase in the adoption of gene synthesis in the production of antibodies used for research and the availability of cutting-edge recombinant technology. Furthermore, the increased importance of personalized antibodies and related research for cancer or genetic disorders drives the segment.

The viral DNA synthesis segment is expected to grow at the fastest CAGR of 18.65% during 2024-2033. Gene synthesis enables the construction of viral DNA in the laboratory without needing an existent virus sample. Moreover, the synthesis of viral genomes also assists in recognizing the gene functions and pathogenicity of the organism, allowing for the development of better treatment or disorder prevention options. These applications of viral DNA synthesis services are anticipated to drive the segment.

Based on application, the gene synthesis market is segmented into gene & cell therapy development, vaccine development, and others. The gene & cell therapy development segment held a revenue share of 56% in 2023, and it is anticipated to showcase the fastest CAGR over the forecast period. The dominance and growth of the segment can be attributed to several factors, including increasing gene & cell therapy approvals and the growing use of gene synthesis methods for cloning synthetic therapeutic genes in viral vectors. Moreover, the growing adoption of gene & cell therapies and increasing government support are anticipated to drive the segment in the coming years.

Based on research phase, the Europe gene synthesis (research use) market is segmented into preclinical and clinical. The clinical segment accounted for the largest regional market share of 74% in 2023. The segment is also projected to display lucrative growth over the forecast period with a CACR of 17.26%. The segment's growth is expected to be driven by the increase in the number of clinical trials for advanced therapy medicinal products. In addition, biomarker discovery and disease modeling are also anticipated to propel segment growth by 2032.

Based on end-use, the gene synthesis market is segmented into academic & government research institutes, biotechnology & pharmaceutical companies, and contract research organizations (CROs). The academic & government research institutions segment dominated the market with a revenue share of 44% in 2023. The segment's dominance is due to expanding research prospects aimed at exploring the use of gene synthesis for studying model organisms. Moreover, enhanced flexibility and automation in gene synthesis facilitated a growing penetration of the technique in research laboratories. Collaborations between industry and academia are expected to boost segment growth over the coming years.

The contract research organization end-use segment is expected to witness the fastest CAGR of 18.25% throughout the forecast period. The growing number of small biotechnology companies and increasing outsourcing trends are anticipated to impact segment growth in the forthcoming years.

By Method

By Service

By Application

By Research Phase

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Gene Synthesis (Research Use) Market

5.1. COVID-19 Landscape: Europe Gene Synthesis (Research Use) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Gene Synthesis (Research Use) Market, By Method

8.1. Europe Gene Synthesis (Research Use) Market, by Method, 2024-2033

8.1.1. Solid-phase Synthesis

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Chip-based Synthesis

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. PCR-based Enzyme Synthesis

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Gene Synthesis (Research Use) Market, By Service

9.1. Europe Gene Synthesis (Research Use) Market, by Service, 2024-2033

9.1.1. Antibody DNA Synthesis

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Viral DNA Synthesis

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Gene Synthesis (Research Use) Market, By Application

10.1. Europe Gene Synthesis (Research Use) Market, by Application, 2024-2033

10.1.1. Gene & Cell Therapy Development

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Vaccine Development

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Europe Gene Synthesis (Research Use) Market, By Research Phase

11.1. Europe Gene Synthesis (Research Use) Market, by Research Phase, 2024-2033

11.1.1. Pre-clinical

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Clinical

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Europe Gene Synthesis (Research Use) Market, By End-use

12.1. Europe Gene Synthesis (Research Use) Market, by End-use, 2024-2033

12.1.1. Biotechnology and Pharmaceutical Companies

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Academic and Government Research Institutes

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Contract Research Organizations

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Europe Gene Synthesis (Research Use) Market, Regional Estimates and Trend Forecast

13.1. Europe

13.1.1. Market Revenue and Forecast, by Method (2021-2033)

13.1.2. Market Revenue and Forecast, by Service (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by Research Phase (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. GenScript

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Azenta, Inc. (GENEWIZ)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Boster Biological Technology

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Twist Bioscience

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. ProteoGenix, Inc

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Biomatik

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. ProMab

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Thermo Fisher Scientific, Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Integrated DNA Technologies, Inc. (Danaher)

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. OriGene Technologies, Inc

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others