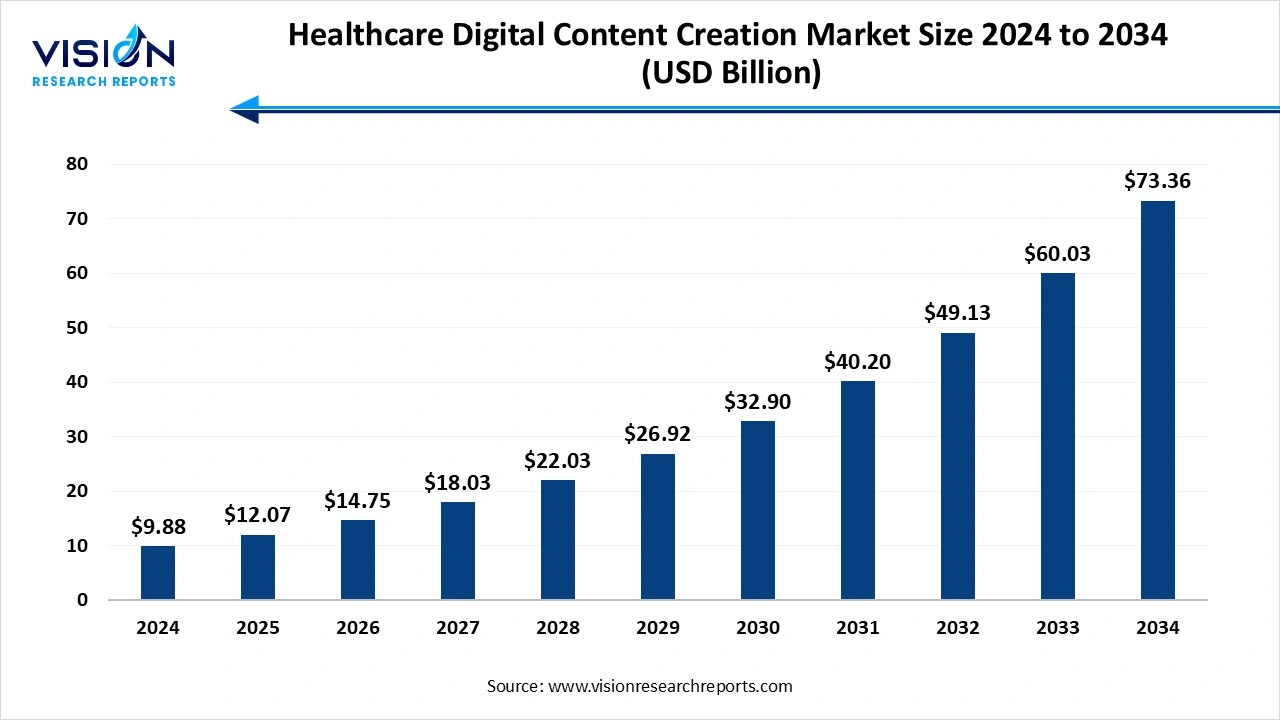

The global healthcare digital content creation market size was valued at USD 9.88 billion in 2024 and is expected to grow from USD 12.07 billion in 2025 to around USD 73.36 billion by 2034, expanding at a CAGR of 22.2% during the forecast period. The market growth is driven by the rapid digitalization of healthcare, rising patient demand for reliable online health information, and the adoption of AI and data analytics for personalized, scalable content creation. Increasing use of telemedicine, mobile apps, and wearables further fuels the need for engaging, compliant, and accessible digital healthcare content.

The healthcare digital content creation market is experiencing significant growth, driven by the rising demand for accurate, accessible and engaging health information across digital platforms. With the global shift toward telemedicine, personalized healthcare, and health literacy, medical providers, pharmaceutical companies, and health tech firms are increasingly investing in digital content strategies. This includes educational blogs, video content, social media campaigns, interactive tools, and patient engagement platforms. Advancements in AI, data analytics, and content automation are further propelling the market, enabling scalable and personalized content solutions. As consumer expectations evolve and regulatory landscapes adapt, high-quality, compliant digital content has become a crucial differentiator in the competitive healthcare ecosystem.

One of the primary growth drivers in the healthcare digital content creation market is the increasing digitalization of healthcare services. As patients become more tech-savvy and proactive about their health, there is a growing demand for reliable, engaging, and easily digestible health content online. Healthcare organizations are leveraging blogs, videos, infographics, podcasts, and social media content to educate and connect with patients. This trend is further supported by the widespread adoption of smartphones, wearable health devices, and internet access, making digital content a vital tool for enhancing patient experience and engagement.

Another significant factor fueling market growth is the integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics. These tools enable personalized content creation at scale, tailored to individual patient needs, preferences, and health conditions.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.88 billion |

| Revenue Forecast by 2034 | USD 73.36 billion |

| Growth rate from 2025 to 2034 | CAGR of 22.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | WebMD Health Corp., Healthline Media, Medscape, Johnson & Johnson, Philips Healthcare, McKesson Corporation, Allscripts Healthcare Solutions, Cerner Corporation, Elsevier Health, Everyday Health, Sharecare, IQVIA Holdings, Merck & Co., Abbott Laboratories, and Medtronic. |

Increased Demand for Digital Content

The rising global demand for digital and multimedia content is a key driver, propelling the growth of the market. As internet use increases worldwide, consumers are spending more time online, seeking information, entertainment and connection through various digital platforms, especially social media. This creates a constant need for fresh, engaging and diverse content across all formats like articles, images, audio and even video. Businesses all over the world are recognizing the power of content creation and are heavily investing in digital content in order to attract customers, build brand awareness and drive engagement. Moreover, the shift from traditional media consumption to digital channels further surges this demand, creating a content cycle where creators and platforms are pushed to deliver new and compelling content to a global audience.

High Cost of Tools and Infrastructure

One of the primary restraints on the digital content creation market is the high cost that is associated with high quality tools, advanced technology and robust infrastructure. Professional grade software for activities like video editing, graphic design, 3D modeling, and audio production generally have high licensing fees. High performance hardware such as powerful computers, cameras, microphones and specialized peripherals, also create significant upfront investments. Furthermore, maintaining the necessary infrastructure, including cloud storage, high bandwidth internet, and cybersecurity measures, adds to ongoing operational expenses. This can be quite discouraging for aspiring creators or small scale businesses who are aiming for high quality production, thus limiting access and slowing down market penetration.

Advancements in Technology

Technological advancements, particularly in Artificial Intelligence, Machine Learning (ML), Automation, Augmented Reality as well as Virtual Reality are revolutionizing the digital content creation market. AI and ML tools are now enabling creators to generate content more efficiently, from automated video editing, personalized content recommendations all the way to AI driven copywriting and image generation. This helps to significantly reduce the time and resources that are required for creation, increasing access to professional grade tools. AR and VR technologies are also opening up new avenues of immersive content experiences, ranging from interactive marketing campaigns to virtual events and even educational simulations. These innovations not only help to streamline existing workflows but also helps expand the possibilities for content creators.

The widespread global penetration of mobile devices and continuous improvements in internet connectivity is also another such opportunity boosting market potential. Smartphones have now become a necessity. They are now considered as powerful tools for both content consumption and creation. High speed internet, including 4G and 5G networks, allow for seamless streaming, faster uploads and more collaborative content production from almost anywhere. This environment empowers creators to capture, edit, and publish content on the go, leading to growth, innovation and development.

North America led the healthcare digital content creation market, accounting for 38% of the total revenue share in 2024. The United States, in particular, is a leader in creating and distributing healthcare content across digital channels, driven by both private sector innovation and public health initiatives. The presence of key technology firms and healthcare providers investing heavily in digital strategies further strengthens the region’s market position.

Europe is expected to have the fastest growth rate throughout the forecast period, characterized by its focus on data privacy and ethical content creation. Regulations like GDPR influence market dynamics, pushing for greater transparency and responsible use of consumer data. The region is also driven by a strong demand for multilingual and culturally relevant content, as creators must cater to a diverse range of languages and national identities. While video content is a key growth driver, the audio segment, especially healthcare podcasts are also gaining traction. The European Union also actively takes initiatives to foster a digital single market, creating a favorable environment for cross border content distribution and innovation, contributing to the market's growth.

Which content type dominated the market in 2024?

The video content segment led the market, capturing the largest revenue share of 39% in 2024. From patient testimonials and doctor interviews to animated explainers and virtual facility tours, video allows healthcare organizations to humanize their services and simplify complex topics. Its engaging nature helps boost retention and comprehension, making it particularly effective for in-patient education, treatment instructions and health awareness campaigns. As video consumption continues to grow across platforms like YouTube, TikTok and other healthcare portals, the demand for high-quality, compliant medical video content is expected to rise even more.

The infographics and visuals segment is expected to experience the fastest growth during the forecast period, driven by increasing demand for easily understandable health information. By combining graphics, icons and concise text, infographics can convert statistical data, treatment processes or wellness tips into visually engaging narratives. These aspects are especially useful in public health messaging and social media campaigns, where clarity and quick comprehension are key.

Which end user held the largest market share this year?

The healthcare providers segment led the market, accounting for 47% of the total revenue share in 2024. Hospitals, clinics, and private practices are actively investing in diverse digital formats such as educational blogs, explainer videos, email newsletters and mobile app content in order to inform patients about medical procedures, preventive care and wellness strategies. This type of content supports clinical care by preparing patients before visits, guiding post-treatment recovery and improving medication adherence as well as awareness.

The patient segment is seen to have the fastest growth rate, driven by an increasing demand for personalized health education. With the growing availability of smartphones and health apps, patients are increasingly turning towards online platforms for instant, credible information that empowers self-care and chronic disease management. This shift has given rise to a more informed, proactive patient population that values clarity, visual learning and convenience in accessing health knowledge.

By Content Type

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Digital Content Creation Market

5.1. COVID-19 Landscape: Healthcare Digital Content Creation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Healthcare Digital Content Creation Market, By Content Type

8.1. Healthcare Digital Content Creation Market, by Content Type

8.1.1. Video Content

8.1.1.1. Market Revenue and Forecast

8.1.2. Written Content

8.1.2.1. Market Revenue and Forecast

8.1.3. Infographics & Visuals

8.1.3.1. Market Revenue and Forecast

8.1.4. Audio Content

8.1.4.1. Market Revenue and Forecast

Chapter 9. Healthcare Digital Content Creation Market, By End Use

9.1. Healthcare Digital Content Creation Market, by End Use

9.1.1. Healthcare Providers

9.1.1.1. Market Revenue and Forecast

9.1.2. Patients

9.1.2.1. Market Revenue and Forecast

9.1.3. Others

9.1.3.1. Market Revenue and Forecast

Chapter 10. Healthcare Digital Content Creation Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Content Type

10.1.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. WebMD Health Corp.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Healthline Media

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Medscape (a division of WebMD)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Johnson & Johnson (Digital Health Division)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Philips Healthcare

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. McKesson Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Allscripts Healthcare Solutions

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Cerner Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Elsevier Health

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Everyday Health, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others