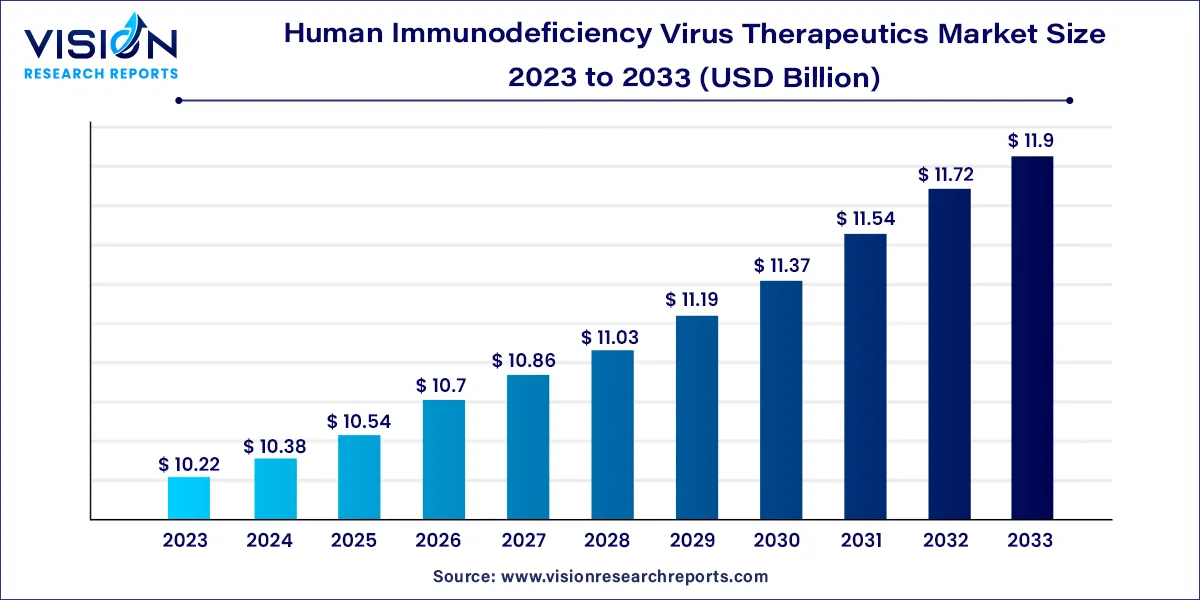

The global human immunodeficiency virus therapeutics market size was estimated at around USD 10.22 billion in 2023 and it is projected to hit around USD 11.9 billion by 2033, growing at a CAGR of 1.53% from 2024 to 2033.

The human immunodeficiency virus (HIV) therapeutics market is a vital segment of the pharmaceutical industry, dedicated to developing treatments for HIV/AIDS. HIV, a global health concern, attacks the immune system, making affected individuals susceptible to infections and diseases. The market for HIV therapeutics has witnessed significant advancements, transforming the landscape of HIV/AIDS treatment over the years.

The human immunodeficiency virus (HIV) therapeutics market is poised for substantial growth, driven by several key factors. Advances in medical research and technology have led to the development of innovative therapies and drugs, enhancing the efficacy of HIV treatments. Additionally, increased awareness about HIV prevention and early diagnosis has led to higher demand for therapeutics. Collaborative efforts between governments, non-profit organizations, and pharmaceutical companies have facilitated improved accessibility to HIV medications, especially in low-income regions. Furthermore, ongoing research and development activities focused on novel drug formulations and combination therapies continue to fuel market expansion. The rising global healthcare expenditure and initiatives promoting affordable HIV treatments also contribute significantly to the market's growth trajectory. These factors, combined with a growing emphasis on addressing healthcare disparities, are expected to propel the HIV Therapeutics Market forward in the coming years.

| Report Coverage | Details |

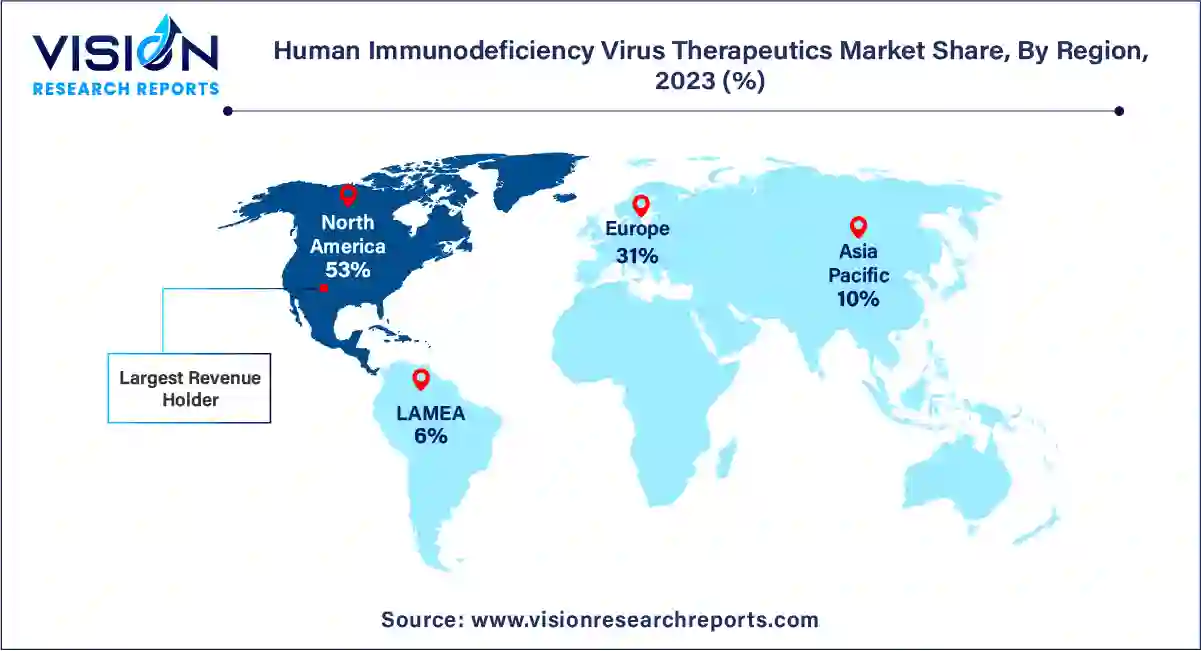

| Revenue Share of North America in 2024 | 53% |

| CAGR of Asia Pacific from 2024 to 2033 | 4.85% |

| Revenue Forecast by 2033 | USD 11.9 billion |

| Growth Rate from 2024 to 2033 | CAGR of 1.55% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The branded drugs segment led the market in 2023. Branded drugs, often developed and marketed by pharmaceutical giants, undergo rigorous research, clinical trials, and regulatory processes before reaching the market. These drugs are patented and come with a brand name. Branded HIV medications are known for their efficacy, as they are specifically formulated to target the virus and enhance the immune system. Pharmaceutical companies invest significantly in the development of these drugs, ensuring they meet stringent quality standards and are backed by extensive scientific research.

The generic drugs segment is predicated to grow at the CAGR over the forecast period. Generic drugs play a crucial role in the HIV therapeutics market. These drugs are bioequivalent to branded medications, meaning they contain the same active ingredients and demonstrate similar efficacy and safety profiles. Generic drugs are typically more affordable because they enter the market after the patent expiration of branded drugs. Generic HIV medications provide accessible treatment options, especially in regions where affordability is a significant concern. They allow a broader population to access life-saving HIV treatments without the financial burden associated with branded drugs.

The nucleoside-analog reverse transcriptase inhibitors segment contributed the largest market share of 45% in 2023. Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs) stand out as a critical category. NRTIs are antiretroviral drugs that interfere with the reverse transcription process of HIV, hindering the virus's ability to replicate. By mimicking the structure of natural nucleosides, these drugs integrate into the viral DNA chain, causing premature termination during replication. This disruption halts the progression of the virus, effectively controlling HIV infections. Commonly prescribed NRTIs include zidovudine, tenofovir, and abacavir, among others. NRTIs are often combined with other classes of antiretroviral drugs to form highly effective combination therapies, commonly known as Highly Active Antiretroviral Therapy (HAART) or antiretroviral cocktails.

The non-nucleoside reverse transcriptase inhibitors segment is anticipated to grow at the CAGR of 3.66% during the forecast period. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) play a pivotal role in HIV therapeutics. Unlike NRTIs, NNRTIs inhibit reverse transcriptase by binding to a specific enzyme pocket, disrupting its function and preventing the conversion of RNA to DNA. This distinct mechanism of action makes NNRTIs valuable components of combination therapies. Efavirenz, nevirapine, and rilpivirine are examples of NNRTIs that have demonstrated efficacy in managing HIV infections. NNRTIs are particularly advantageous due to their oral administration, enhancing patient adherence to treatment regimens.

North America led the market with the highest revenue share of 53% in 2023. North America, with its advanced healthcare infrastructure and substantial investments in research and development, stands as a prominent hub for HIV therapeutics. The region benefits from a high prevalence of pharmaceutical companies, leading to a continuous stream of innovative drugs and therapies. Moreover, extensive awareness programs and stringent regulatory frameworks ensure widespread access to state-of-the-art treatments for HIV-positive individuals. North America’s emphasis on research, coupled with a robust healthcare system, contributes significantly to advancements in HIV therapeutics.

Asia Pacific is expected to expand at the fastest CAGR of 4.85% over the forecast period. Asia Pacific, on the other hand, presents a diverse scenario within the HIV therapeutics market. While some economically developed countries in the region mirror the advanced approaches of North America and Europe, several developing nations face challenges related to healthcare infrastructure and affordability. In these countries, government initiatives, supported by non-governmental organizations, play a vital role in improving access to HIV medications. Additionally, collaborations with international entities and the adoption of generic drugs contribute significantly to making HIV treatments more accessible to a broader population.

By Drug Type

By Drug Class

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others