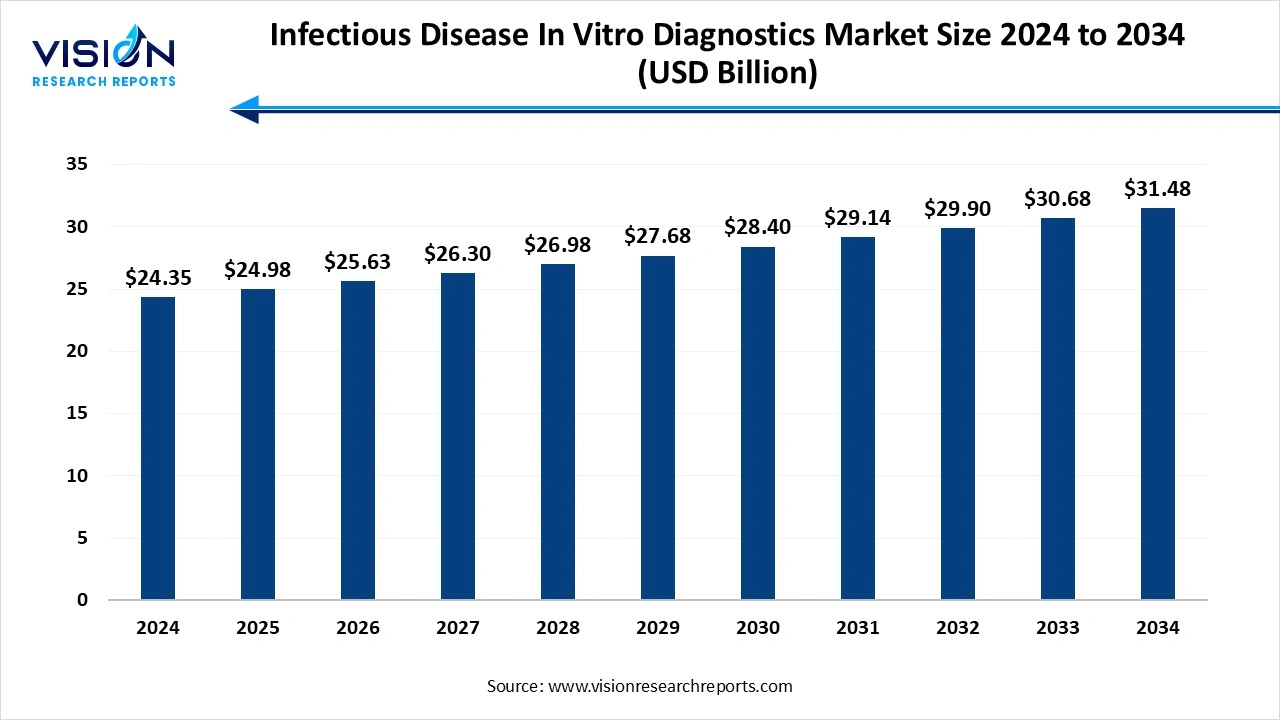

The global infectious disease in vitro diagnostics market size was valued at USD 24.35 billion in 2024 and is expected to grow from USD 24.98 billion in 2025 to around USD 31.48 billion by 2034, expanding at a CAGR of 2.6% during the forecast period. The rising geriatric population is susceptible to infectious diseases, increased awareness and patient care, and rising demand for rapid and accurate diagnostics, and innovation in technology fuel the market growth.

Infectious Disease In Vitro Diagnostics (IVD) are medical devices and reagents used to detect, identify, and monitor infectious pathogens, such as bacteria, viruses, fungi, and parasites, in biological samples like blood, tissue, urine, or saliva. The term in vitro, meaning "in glass," refers to tests performed outside of a living organism, typically in a laboratory or near a patient.

The global in vitro diagnostic market growth is driven by the increasing worldwide prevalence of various infectious diseases, including viral, bacterial, and parasitic infections, necessitating the use of IVD for early detection and control. Healthcare systems are increasingly focused on rapid, precise diagnostic methods to enable timely and targeted treatment decisions, which is fueled by the capabilities of IVD solutions.

The increasing global prevalence of various infectious diseases, including viral, bacterial, and parasitic infections, necessitates the use of IVD for early detection and control. Early detection is crucial for monitoring disease progression, reducing transmission, and improving patient outcomes.

This necessitates a growing demand for efficient diagnostic tools. Government-led health programs and public awareness initiatives encourage diagnostic testing, further driving the demand for IVD solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.35 billion |

| Revenue Forecast by 2034 | USD 31.48 billion |

| Growth rate from 2025 to 2034 | CAGR of 2.6% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, bioMérieux SA, Thermo Fisher Scientific Inc., Hologic, Inc., Qiagen N.V., Becton, Dickinson and Company (BD), Luminex Corporation, and Danaher Corporation. |

Continuous innovations in diagnostic technologies, including molecular diagnostics, point-of-care testing (POCT), and next-generation sequencing (NGS), enhance the speed, specificity, and sensitivity of infectious disease diagnostics. Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into diagnostics to improve accuracy and efficiency. MDx offers high sensitivity and specificity for identifying pathogens and can detect them even before symptoms appear, which is crucial for early intervention and personalized treatment. Technologies like RT-PCR became widely used for diseases like COVID-19 and tuberculosis, leading to a decentralization of such tests from large referral labs to smaller setups.

The inadequate and inconsistent reimbursement policies from payers, whether public or private, limit coverage and rates for advanced diagnostic tests. This financial gap hinders healthcare providers' adoption of innovative IVD technologies and can restrict patient access, particularly in cost-sensitive settings.

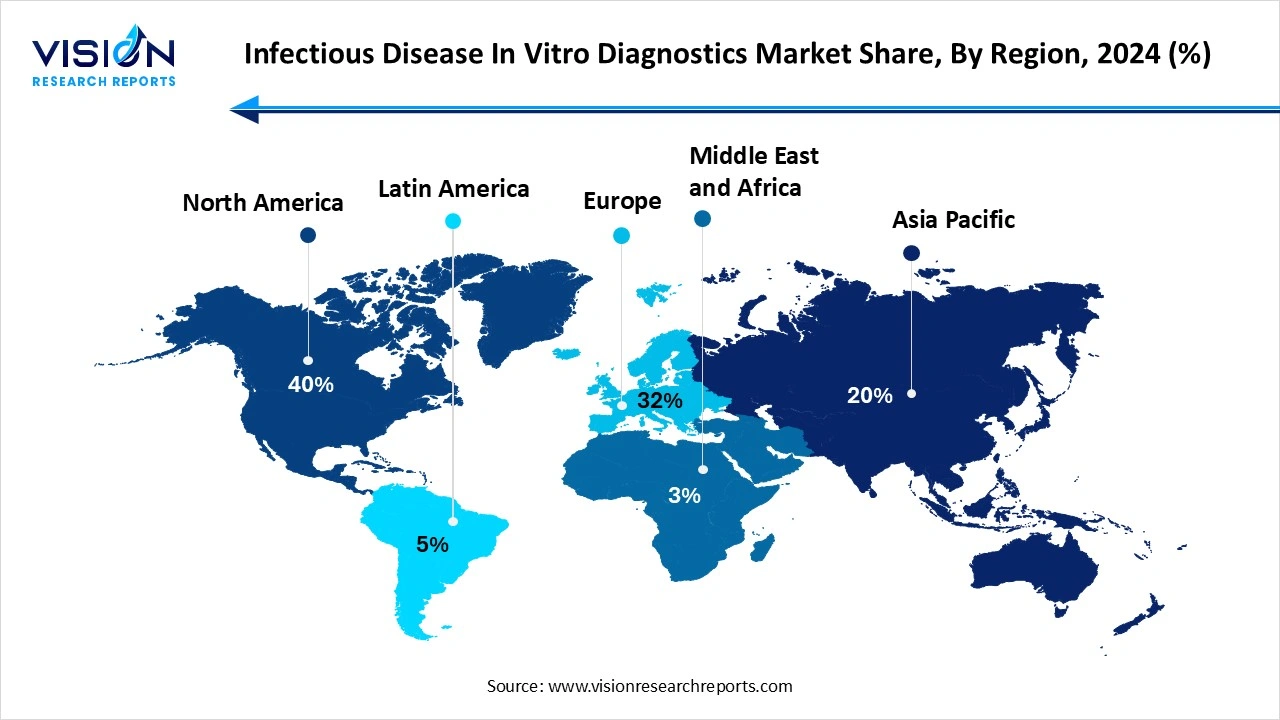

North America dominated the infectious disease in vitro diagnostics market share 40% in 2024, and the region is expected to sustain the position during the forecast period. The region has well-established healthcare systems that support the widespread integration of innovative diagnostic technologies into patient care. The ongoing prevalence of infectious and chronic diseases necessitates the demand for effective IVD solutions for diagnosis and monitoring. Supportive government regulations and reimbursement policies in countries like the US and Canada encourage the adoption and development of IVD devices.

United States Infectious Disease In Vitro Diagnostics Market Trends

The rising disease prevalence, demand for rapid testing, and technological advancements like molecular diagnostics and point-of-care solutions. Key trends include the increasing adoption of molecular testing, expansion of POC testing, and a shift towards home-based diagnostics. However, challenges such as the high cost of instruments, stringent regulations, and a shortage of skilled professionals could impact market progression.

Asia Pacific expects significant growth in the Infectious Disease In Vitro Diagnostics market during the forecast period. The high burden of infectious diseases and increasing awareness for early diagnosis. Technological advancements like molecular diagnostics and point-of-care testing are key growth drivers. Significant healthcare expenditure and an aging population also contribute to market expansion. Despite challenges like unequal access, the region's focus on innovation and healthcare investment points towards continued strong growth.

Why did the Reagents Segment Dominate the Infectious Disease In Vitro Diagnostics Market?

The reagents dominated the market, accounting for 68% of the global revenue share in 2024. They are consumable items that are essential for performing every diagnostic test. Unlike expensive, long-lasting instruments, reagents generate consistent, recurring revenue due to their high-volume usage. This continuous demand is driven by the global prevalence of infectious diseases and increasing adoption of molecular and immunoassay technologies, which are highly dependent on specific reagents for detection. The reagents segment's dominance is further reinforced by frequent product innovations and the expanding applications of personalized medicine.

Rapid innovation continues to play a crucial role in gaining a competitive advantage in the market. A study published in February 2024 by Diagnostic Microbiology and Infectious Disease highlighted how advanced molecular techniques have revolutionized the identification and diagnosis of pathogenic microorganisms and viruses in clinical microbiology laboratories. Next-generation sequencing (NGS), which enables nucleic acid detection and genetic profiling, has notably transformed infectious agent identification.

How the Immunoassay Technology Segment hold the Largest Share in the Infectious Disease In Vitro Diagnostics Market?

The immunoassay technology held the largest share of revenue, accounting for 36% of the total market in 2024. Its high sensitivity, specificity, and rapid results are essential for infectious disease diagnosis. Versatile and adaptable, these tests work across multiple sample types and testing environments, from centralized labs to point-of-care. Ongoing innovations, including automation and multiplexing, further enhance accuracy and efficiency for managing infectious diseases. This combination of speed, accuracy, and broad application meets the pressing global demand for effective infectious disease diagnostics.

The microbiology technology segment is experiencing the fastest growth in the market during the forecast period. Advancements like automated systems and pathogen identification are addressing the global burden of infectious diseases and antimicrobial resistance. Additionally, the rising demand for rapid, accurate diagnostics and increased investments by key players will fuel the microbiology segment's expansion. Thus, its growing innovation and integration with other technologies will secure a rapid growth trajectory.

How the COVID-19 Application Segment hold the Largest Share in the Infectious Disease In Vitro Diagnostics Market?

The COVID-19 application held the largest share of market revenue, accounting for 15% in 2024. The unprecedented demand for testing kits during the pandemic. Government initiatives and rapid product innovation drove mass testing and accelerated regulatory approvals for various diagnostics. This surge eclipsed testing for other infectious diseases but has since declined as the pandemic subsided. The pandemic's long-term legacy includes heightened investment in rapid, point-of-care, and multiplex testing technologies.

The HIV segment is experiencing the fastest growth in the market during the forecast period. The rising global HIV prevalence and heightened awareness of early diagnosis. This is supported by significant technological advancements, particularly rapid, point-of-care, and self-testing kits that improve accessibility and convenience. Additionally, strong government initiatives and international funding programs expand testing availability and reduce social stigma, driving market momentum towards accessible and accurate diagnostic solutions.

How the Central Laboratories Segment hold the Largest Share in the Infectious Disease In Vitro Diagnostics Market?

The central laboratories segment held the largest share in 2024, accounting for 49% of the market. Their sophisticated technologies and automated systems facilitate high-throughput, high-precision testing necessary for the large volumes of samples often required for infectious disease diagnosis. Handling a large volume of tests allows central laboratories to achieve lower per-unit costs, making them cost-effective for high-volume testing. Central laboratories are vital in public health surveillance and outbreak response, contributing to their high testing volumes.

The point of care segment is experiencing the fastest growth in the market during the forecast period. The rising worldwide burden of infectious diseases and emerging viral threats like monkeypox creates a constant demand for rapid and effective diagnostic solutions. The growing trend towards decentralized healthcare models, moving testing closer to patients in clinics, physicians' offices, urgent care centers, and even homes, further fuels the demand for convenient and accessible POC solutions. Growing awareness about the importance of early disease detection and prevention encourages individuals to seek diagnostic testing, including readily available POC options.

By Product

By Technology

By Application

By Test Location

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Infectious Disease In Vitro Diagnostics Market

5.1. COVID-19 Landscape: Infectious Disease In Vitro Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Infectious Disease In Vitro Diagnostics Market, By Product

8.1. Infectious Disease In Vitro Diagnostics Market, by Product

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Reagents

8.1.2.1. Market Revenue and Forecast

8.1.3. Software

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Infectious Disease In Vitro Diagnostics Market, By Technology

9.1. Infectious Disease In Vitro Diagnostics Market, by Technology

9.1.1. Immunoassay

9.1.1.1. Market Revenue and Forecast

9.1.2. Molecular diagnostics

9.1.2.1. Market Revenue and Forecast

9.1.3. Microbiology

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Infectious Disease In Vitro Diagnostics Market, By Application

10.1. Infectious Disease In Vitro Diagnostics Market, by Application

10.1.1. MRSA

10.1.1.1. Market Revenue and Forecast

10.1.2. Streptococcus

10.1.2.1. Market Revenue and Forecast

10.1.3. Clostridium difficile

10.1.3.1. Market Revenue and Forecast

10.1.4. VRE

10.1.4.1. Market Revenue and Forecast

10.1.5. CRE

10.1.5.1. Market Revenue and Forecast

10.1.6. Respiratory Virus

10.1.6.1. Market Revenue and Forecast

10.1.7. Candida

10.1.7.1. Market Revenue and Forecast

10.1.8. TB and drug-resistant TB

10.1.8.1. Market Revenue and Forecast

10.1.9. Gastro-intestinal panel testing

10.1.9.1. Market Revenue and Forecast

10.1.10. Chlamydia

10.1.10.1. Market Revenue and Forecast

10.1.11. Gonorrhea

10.1.11.1. Market Revenue and Forecast

10.1.12. HPV

10.1.12.1. Market Revenue and Forecast

10.1.13. HIV

10.1.13.1. Market Revenue and Forecast

10.1.14. Hepatitis C

10.1.14.1. Market Revenue and Forecast

10.1.15. Hepatitis B

10.1.15.1. Market Revenue and Forecast

10.1.16. COVID-19

10.1.16.1. Market Revenue and Forecast

10.1.17. Other Infectious Diseases

10.1.17.1. Market Revenue and Forecast

Chapter 11. Global Infectious Disease In Vitro Diagnostics Market, By Test Location

11.1. Infectious Disease In Vitro Diagnostics Market, by Test Location

11.1.1. Point of Care

11.1.1.1. Market Revenue and Forecast

11.1.2. Central Laboratories

11.1.2.1. Market Revenue and Forecast

11.1.3. Others

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Infectious Disease In Vitro Diagnostics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by Test Location

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by Test Location

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by Test Location

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by Test Location

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by Test Location

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by Test Location

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by Test Location

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by Test Location

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by Test Location

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by Test Location

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by Test Location

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by Test Location

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by Test Location

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by Test Location

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by Test Location

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by Test Location

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by Test Location

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by Test Location

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by Test Location

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by Test Location

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by Test Location

Chapter 13. Company Profiles

13.1. Roche Diagnostics

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Abbott Laboratories

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Siemens Healthineers

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. bioMérieux SA

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Thermo Fisher Scientific Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Hologic, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Qiagen N.V.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Becton, Dickinson and Company (BD)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Luminex Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Danaher Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others