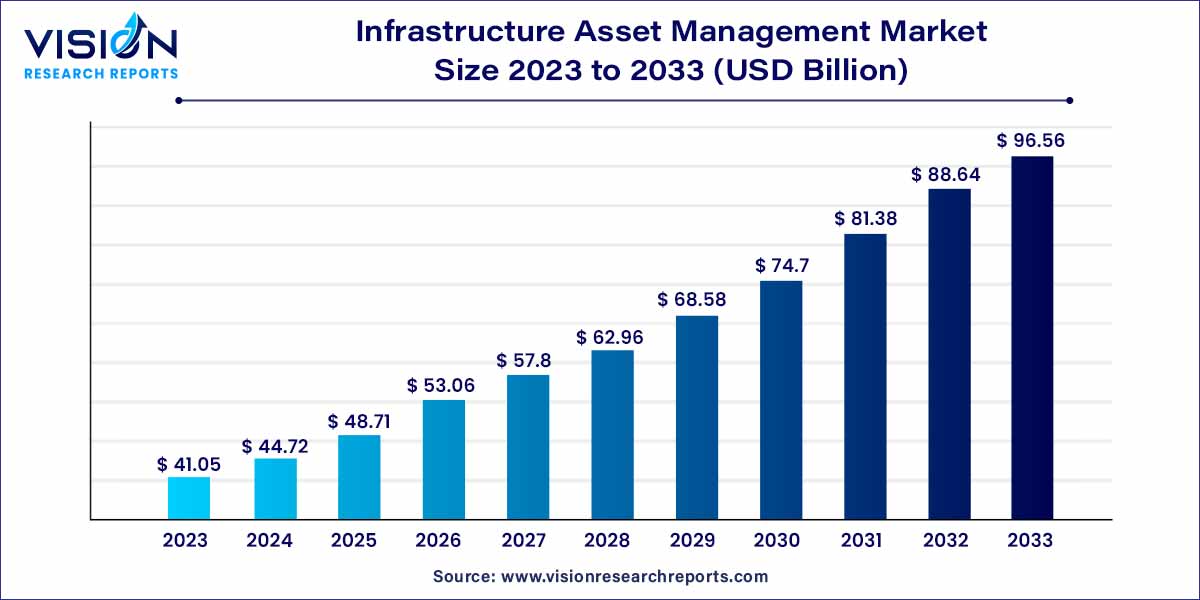

The global infrastructure asset management market size was estimated at around USD 41.05 billion in 2023 and it is projected to hit around USD 96.56 billion by 2033, growing at a CAGR of 8.93% from 2024 to 2033. Infrastructure asset management encompasses a holistic framework that integrates engineering principles, financial expertise, and advanced technology solutions to maximize the value of public and private infrastructure investments. By systematically assessing, planning, and managing infrastructure assets throughout their life cycles, organizations can enhance operational efficiency, reduce costs, and ensure the safety and satisfaction of communities they serve.

The infrastructure asset management (IAM) market is experiencing robust growth driven by several key factors. Rapid urbanization, particularly in emerging economies, has led to an increased demand for efficient infrastructure management solutions. Technological advancements, including the integration of IoT devices and data analytics, have revolutionized asset monitoring and predictive maintenance practices. Moreover, stringent regulations regarding infrastructure safety and environmental standards have propelled organizations to invest in IAM technologies. The need for optimal asset utilization and the desire to enhance operational efficiency amid budget constraints are also significant growth factors in the IAM market. These factors collectively contribute to the market's expansion, fostering innovation and driving the adoption of advanced IAM solutions worldwide.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 96.56 billion |

| Growth Rate from 2024 to 2033 | CAGR of 8.93% |

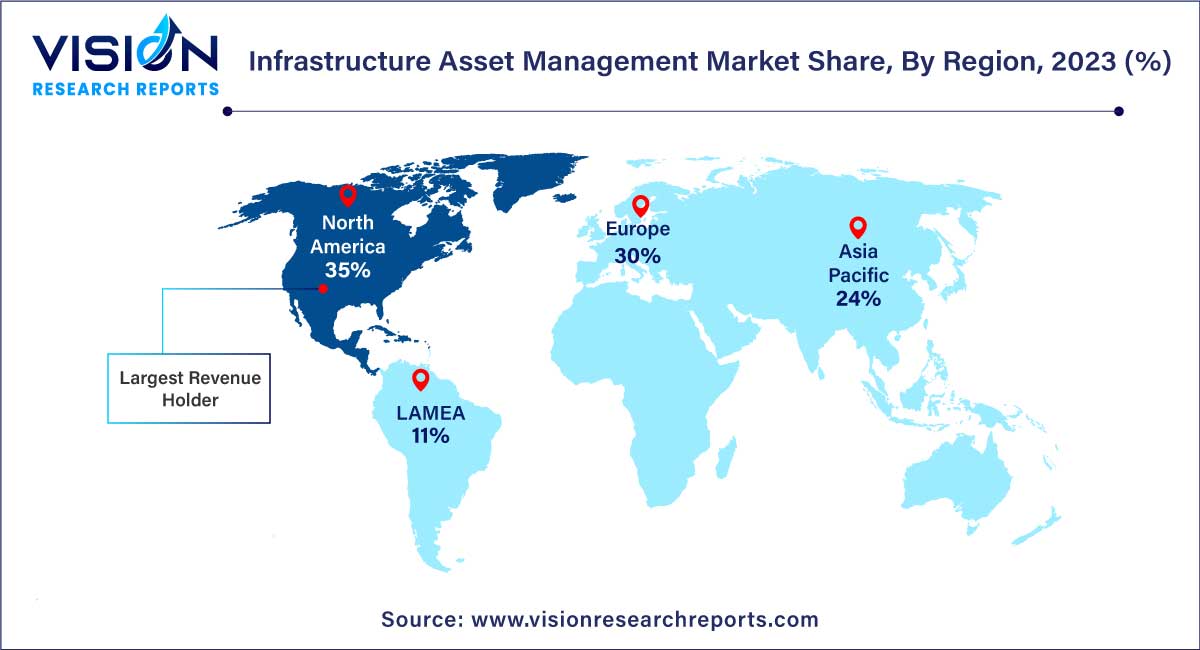

| Revenue Share of North America in 2023 | 34% |

| CAGR of Asia Pacific from 2024 to 2033 | 10.18% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The services segment accounted for the largest revenue share of 67% in 2023 and is expected to expand at the fastest CAGR of 9.25% over the forecast period. Services within this encompass a wide array of offerings, including consulting and advisory services, where expert professionals provide strategic insights and recommendations tailored to specific infrastructural needs. Implementation and integration services play a pivotal role, ensuring the seamless incorporation of advanced technologies like IoT devices and predictive analytics into existing infrastructure.

The solution segment is expected to witness significant growth over the forecast period. Solutions in the Infrastructure Asset Management market are multifaceted and dynamic. Software solutions are at the forefront, offering innovative platforms equipped with data analytics, AI algorithms, and real-time monitoring capabilities. These software solutions enable organizations to gather valuable insights into asset performance, allowing for informed decision-making and predictive maintenance planning. Hardware components, including sensors and monitoring devices, are the physical backbone of these systems, capturing real-time data that fuels the analytical processes. Furthermore, cloud-based solutions have revolutionized data storage and accessibility, providing a secure and scalable environment for storing vast amounts of asset-related information.

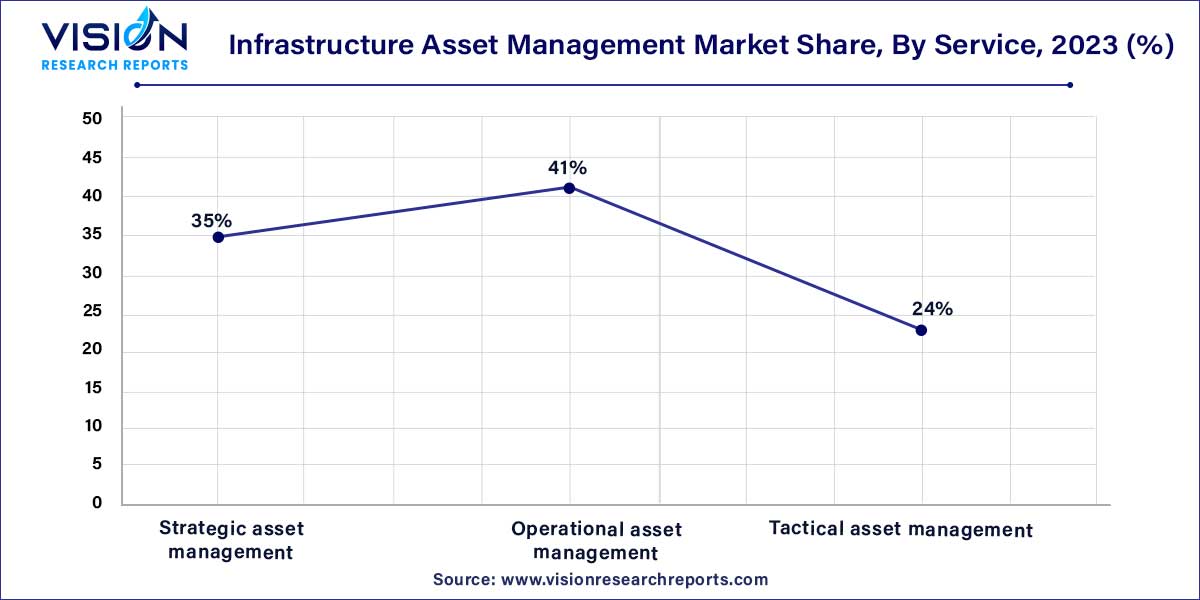

The operational asset management segment contributed the largest market share of 41% in 2023 and is expected to grow at the notable CAGR of 9.72% over the forecast period. Operational asset management focuses on the day-to-day activities, ensuring that existing assets operate at peak efficiency. This service involves routine inspections, maintenance, and repair work, ensuring that the infrastructure functions seamlessly. It also encompasses real-time monitoring and data analysis, enabling organizations to promptly address issues and optimize asset performance. Operational asset management acts as the frontline defense, ensuring the reliability and functionality of essential infrastructure components, thus minimizing downtime and maximizing operational productivity.

The strategic asset management segment is expected to witness a significant growth over the forecast period. Strategic asset management takes a broader perspective, involving long-term planning and decision-making processes. This service delves into the development of comprehensive asset management strategies, aligning them with organizational goals and future requirements. Strategic asset management incorporates predictive modeling, risk assessments, and financial analyses to optimize investment decisions. It considers factors such as asset lifecycle, regulatory compliance, and technological advancements, ensuring that organizations make informed choices regarding asset upgrades, replacements, or expansions.

The transportation segment accounted for the largest revenue share of 33% in 2023. Transportation infrastructure encompasses an extensive network of roads, bridges, railways, and airports, serving as the lifeblood of economies by facilitating the movement of goods and people. Within this context, Infrastructure Asset Management plays a pivotal role by ensuring the optimal functionality and safety of these transportation systems. Through real-time monitoring and predictive maintenance, IAM enhances the efficiency of transportation networks, reducing congestion, minimizing downtime, and enhancing overall connectivity. By addressing the unique challenges posed by diverse transportation modes, IAM enables governments and organizations to make data-driven decisions, enhancing the reliability and sustainability of transportation infrastructure, thus fostering economic growth and regional development.

The energy infrastructure segment is anticipated to grow at the noteworthy CAGR of 11.14% during the forecast period. Energy infrastructure stands as a cornerstone of modern societies, encompassing power plants, electrical grids, and renewable energy facilities. Infrastructure asset management in the energy sector focuses on maximizing the reliability and efficiency of these critical systems. By employing advanced technologies such as IoT sensors and data analytics, IAM facilitates the continuous monitoring of energy assets, ensuring seamless operations and reducing the risk of disruptions. Moreover, in the renewable energy, IAM aids in optimizing the performance of solar farms, wind turbines, and hydroelectric plants, harnessing sustainable energy sources efficiently. Through strategic planning and predictive maintenance, IAM enhances the overall resilience of energy infrastructure, contributing to a stable and sustainable energy supply.

North America dominated the infrastructure asset management market with the largest revenue share of 35% in 2023. North America, as a mature market, places a strong emphasis on technology integration and data analytics. With well-established infrastructure systems, the focus here is on predictive maintenance and real-time monitoring. Investments in upgrading existing assets are substantial, leading to the widespread adoption of sophisticated Infrastructure Asset Management solutions. The region's advanced technological infrastructure allows for seamless integration of IoT devices, AI-driven analytics, and cloud-based platforms, optimizing asset performance and operational efficiency.

Asia Pacific region predicted to grow at the remarkable CAGR of 10.19% during the forecast period. In Asia-Pacific, rapid urbanization and infrastructural growth present unique challenges and opportunities. Emerging economies like China and India focus on building new, technologically advanced assets while concurrently upgrading existing ones. IAM in this region is characterized by scalability, adaptability, and a focus on smart city initiatives.

Coastal Waste & Recycling (Coastal) and Macquarie Asset Management (MAM) declared in June 2023 that Coastal's recapitalization was complete. Consequently, MAM has taken a major ownership stake in Coastal through one of its funds. It is anticipated that MAM's strategic investment in Coastal will accelerate its growth and solidify its standing as one of the leading privately held integrated solid waste and recycling companies in the Southeast.

Siemens Digital Industries Software and IBM announced in April 2023 that their long-standing collaboration would be extended. Their partnership is centered on developing a unified software solution that combines their different systems engineering, asset management, and service lifecycle management products.

By Component

By Service

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Infrastructure Asset Management Market

5.1. COVID-19 Landscape: Infrastructure Asset Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Infrastructure Asset Management Market, By Component

8.1. Infrastructure Asset Management Market, by Component, 2024-2033

8.1.1 Solution

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Infrastructure Asset Management Market, By Service

9.1. Infrastructure Asset Management Market, by Service, 2024-2033

9.1.1. Strategic asset management

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Operational asset management

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Tactical asset management

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Infrastructure Asset Management Market, By Application

10.1. Infrastructure Asset Management Market, by Application, 2024-2033

10.1.1. Transportation infrastructure

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Energy infrastructure

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Water & waste infrastructure

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Critical infrastructure

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Mining

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Infrastructure Asset Management Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Service (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Service (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. WSP.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. RPS Group.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Brookfield Asset Management.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Macquarie Group Limited.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. SIMCO Technologies.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Pitney Bowes Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Atkins.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. AABASOFT TECHNOLOGIES INDIA PRIVATE LIMITED.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. ThomasLloyd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. EverStream Capital Management

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others