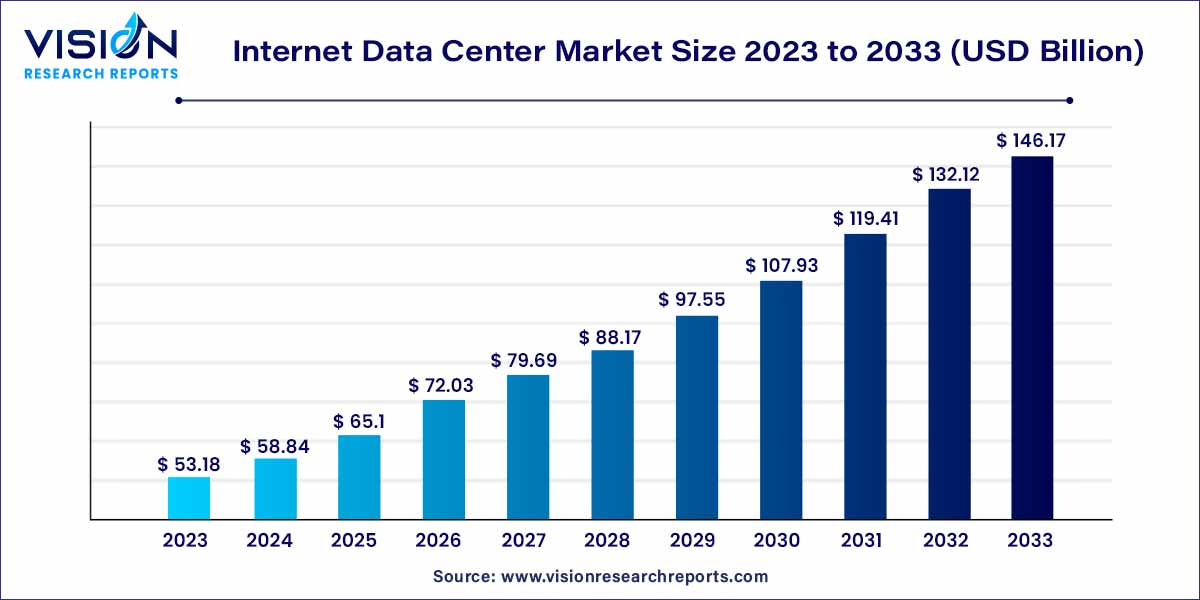

The global internet data center market size was surpassed at USD 53.18 billion in 2023 and is expected to hit around USD 146.17 billion by 2033, growing at a CAGR of 10.64% from 2024 to 2033.

The internet data center (IDC) market, a cornerstone of the digital revolution, is witnessing unprecedented growth and innovation. As businesses and individuals increasingly rely on digital services, the demand for secure, scalable, and efficient data centers has surged.

The internet data center (IDC) market is experiencing robust growth due to several key factors. First and foremost, the exponential rise in digitalization across various industries is fueling the demand for data storage and processing capabilities. Businesses are increasingly relying on cloud-based services, big data analytics, and IoT applications, necessitating advanced IDC solutions. Additionally, the rapid adoption of 5G technology is driving the need for low-latency, high-bandwidth connections, further boosting the IDC market. Furthermore, the global shift towards remote work and online services, accelerated by the COVID-19 pandemic, has highlighted the importance of reliable and scalable data centers.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.63% |

| Market Revenue by 2032 | USD 146.17 billion |

| Revenue Share of North America in 2023 | 40% |

| CAGR of Asia Pacific from 2024 to 2033 | 12.07% |

| Base Year | 2023 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The colocation segment held the largest revenue share of 46% in 2023. Colocation services offer businesses the opportunity to house their servers and computing hardware in a third-party data center. This arrangement provides numerous advantages, including cost savings on infrastructure and maintenance, access to high-speed internet and power resources, and enhanced security measures. Colocation services cater to businesses of all sizes, allowing them to focus on their core activities while relying on the expertise of IDC providers for secure and efficient data storage.

The CDN segment is expected to grow at the fastest CAGR of 14.05% over the forecast period. Content delivery network (CDN) services have become integral for businesses aiming to deliver digital content swiftly and seamlessly to their users across the globe. CDN providers strategically position servers in multiple locations worldwide, reducing latency and ensuring rapid content delivery. By caching and distributing content geographically, CDNs optimize the loading times of websites, streaming services, and applications. This not only enhances user experience but also contributes significantly to improved website performance, higher conversion rates, and increased customer satisfaction.

The public segment contributed the largest market share of 53% in 2023. Public cloud deployment stands as a beacon of accessibility and flexibility in the IDC landscape. Businesses opting for public cloud solutions leverage the infrastructure and services provided by third-party providers. This model offers a streamlined approach, eliminating the need for on-site hardware maintenance and management. The pay-as-you-go model allows businesses to scale resources on-demand, ensuring agility and cost efficiency. Public cloud deployments are particularly beneficial for startups and small to medium-sized enterprises (SMEs) seeking to minimize initial investment and swiftly adapt to changing market demands.

The hybrid segment is expected to grow at the fastest CAGR of 13.04% during the forecast period. Hybrid cloud deployment, a harmonious blend of public and private cloud solutions, caters to enterprises with diverse needs. In this model, businesses retain sensitive data and critical applications within a private cloud environment, ensuring unparalleled security and compliance adherence. Simultaneously, non-sensitive data and applications find a home in the public cloud, capitalizing on its scalability and flexibility. Hybrid clouds provide businesses with the best of both worlds – the security of a private cloud for sensitive operations and the scalability of a public cloud for variable workloads

The large enterprises segment held a largest revenue share of 84% in 2023. For large enterprises, the scale of operations and data processing needs are substantial. These organizations require robust IDC solutions that can handle vast volumes of data, support complex applications, and ensure high availability. Large enterprises often opt for private or hybrid cloud deployments, allowing them to maintain control over their data while leveraging the scalability of cloud resources. These enterprises demand dedicated resources, advanced security protocols, and custom configurations to meet their unique IT demands.

The SME segment is expected to expand at the fastest CAGR of 12.04% over the forecast period. SMEs operate within different constraints, often having limited budgets and resources. Consequently, their IDC requirements focus on cost-effectiveness, scalability, and ease of management. Cloud-based solutions, particularly public cloud deployments, are popular among SMEs due to their pay-as-you-go model and minimal upfront costs. Public cloud IDCs offer SMEs the flexibility to scale resources based on their immediate needs, enabling them to efficiently manage fluctuating workloads without overburdening their budgets..

The CSP segment held the highest revenue share of around 36% in 2023. CSPs, the backbone of cloud computing services, rely heavily on IDCs to host their platforms, applications, and data. These providers demand scalable, high-performance IDC infrastructure capable of handling massive workloads and ensuring uninterrupted services for their clients. CSPs often seek colocation services, leveraging third-party IDC facilities to house their servers and networking equipment. By doing so, they benefit from shared resources, cost-efficiency, and enhanced redundancy, ensuring the reliability and availability of their cloud services. Additionally, CSPs prioritize data security, redundancy, and low-latency connectivity, enabling them to deliver seamless cloud solutions to businesses and consumers across the globe. The IDC market serves as the cornerstone of CSP operations, enabling them to offer innovative and reliable cloud services to a diverse client base.

The e-commerce & retail segment is expected to register the fastest CAGR of more than 13.04% over the forecast period. The E-commerce & Retail industry has undergone a paradigm shift, with a significant portion of transactions occurring online. IDCs play a pivotal role in supporting the digital storefronts and transactional platforms of e-commerce giants and retail chains. These businesses require IDC solutions that guarantee high availability, ultra-fast response times, and robust security protocols. IDCs enable e-commerce platforms to manage large product databases, process transactions in real-time, and deliver engaging multimedia content to online shoppers.

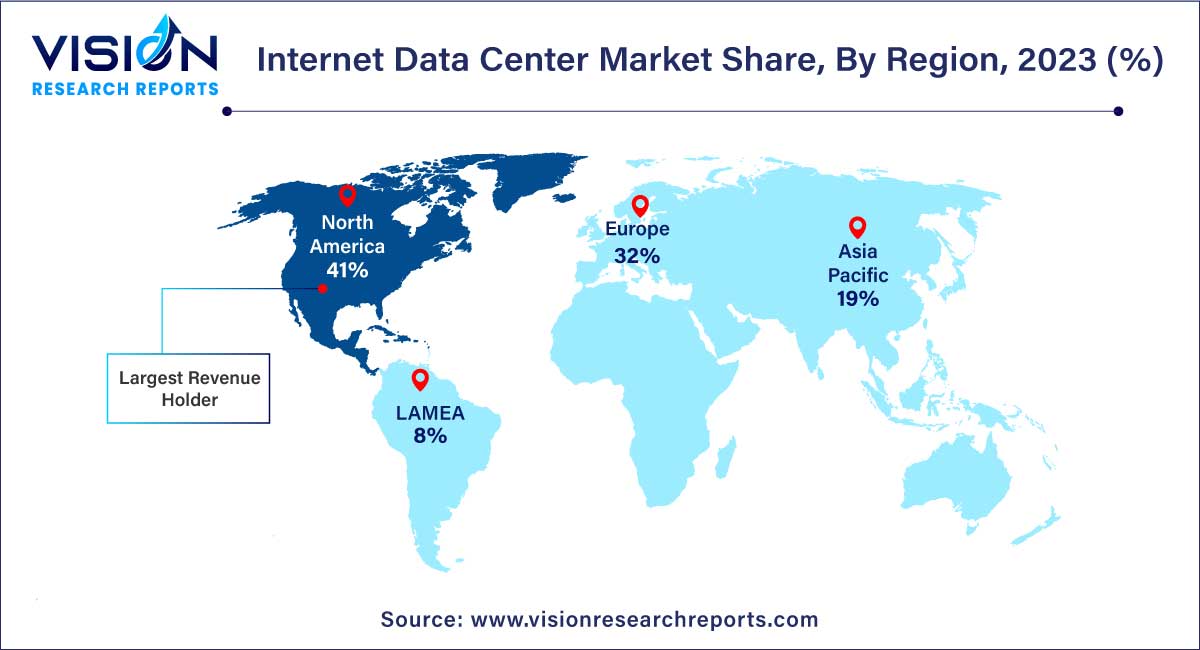

North America region dominated the market with the largest market share of 41% in 2023. North America, often regarded as a technology hub, stands at the forefront of IDC advancements. The region boasts a robust digital infrastructure, driven by tech giants and enterprises demanding cutting-edge data storage and processing solutions. With a focus on cloud computing, artificial intelligence, and IoT applications, North America's IDC market continues to flourish, catering to diverse industry needs and fostering technological innovation.

Asia Pacific is expected to register the fastest CAGR of 12.07% during the forecast period. Asia-Pacific, marked by its economic dynamism and rapid digital transformation, represents a burgeoning market for IDC services. Countries such as China, India, Japan, and Singapore are witnessing a surge in data-intensive applications, necessitating state-of-the-art IDC infrastructure. The region's IDC market is driven not only by established enterprises but also by the booming startup ecosystem, making it a vibrant hub for IDC investments and innovations.

By Services

By Deployment

By Enterprise Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Internet Data Center Market

5.1. COVID-19 Landscape: Internet Data Center Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Internet Data Center Market, By Services

8.1. Internet Data Center Market, by Services, 2024-2033

8.1.1. Hosting

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Colocation

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. CDN

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Internet Data Center Market, By Deployment

9.1. Internet Data Center Market, by Deployment, 2024-2033

9.1.1. Public

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Private

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hybrid

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Internet Data Center Market, By Enterprise Size

10.1. Internet Data Center Market, by Enterprise Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. SMEs

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Internet Data Center Market, By End-use

11.1. Internet Data Center Market, by End-use, 2024-2033

11.1.1. CSP

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Telecom

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Government/Public Sector

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. BFSI

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Media & Entertainment

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. E-commerce & Retail

11.1.6.1. Market Revenue and Forecast (2021-2033)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Internet Data Center Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Services (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Services (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Services (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Services (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Services (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Services (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Alibaba Cloud

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Amazon Web Services, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. AT&T

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Lumen Technologies (CenturyLink)

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. China Telecom Americas, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. CoreSite

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. CyrusOne

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Digital Realty Equinix, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Google Cloud IBM Microsoft NTT Communications Corp. Oracle Tencent Cloud

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others