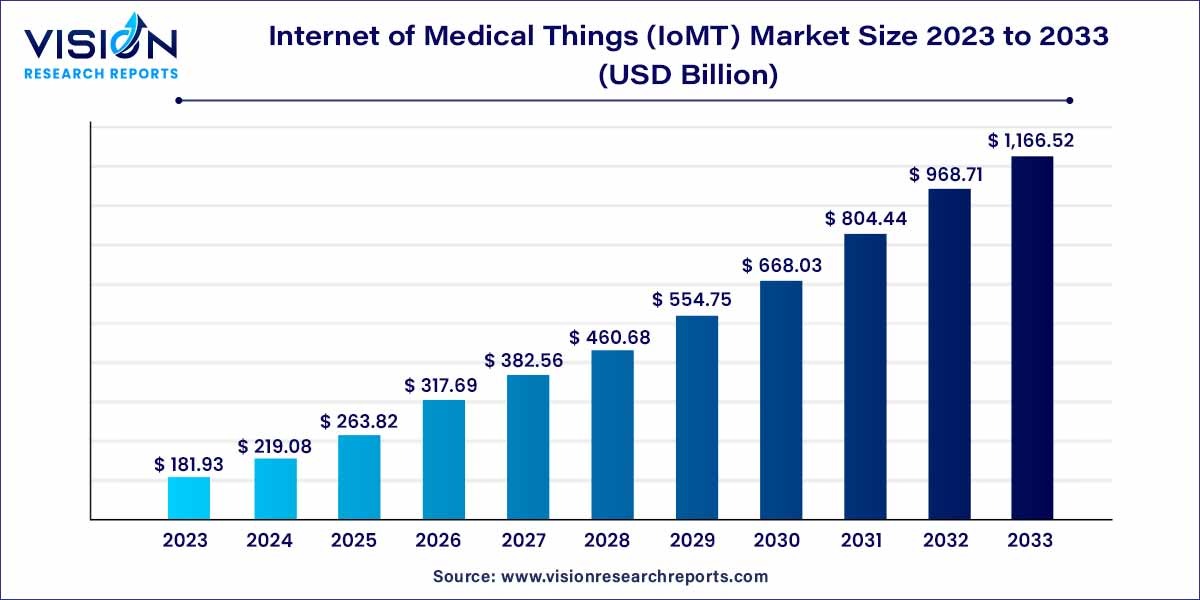

The global internet of medical things (IoMT) market size was estimated at around USD 181.93 billion in 2023 and it is projected to hit around USD 1,166.52 billion by 2033, growing at a CAGR of 20.42% from 2024 to 2033.

The internet of medical things (IoMT) is a transformative paradigm in the healthcare industry, ushering in a new era of interconnected medical devices and applications. Unlike traditional medical devices, IoMT devices are equipped with sensors, software, and network connectivity, enabling them to collect, transmit, and exchange vital patient data in real-time. This convergence of healthcare and technology holds immense promise, revolutionizing patient care, optimizing clinical workflows, and enhancing overall healthcare outcomes.

The internet of medical things (IoMT) market is experiencing rapid growth due to several key factors. One of the primary drivers is the escalating demand for remote patient monitoring solutions. IoMT devices enable healthcare providers to remotely track patients' vital signs, ensuring timely interventions and reducing hospital readmissions. Additionally, the increasing prevalence of chronic diseases has propelled the adoption of IoMT technologies, offering continuous monitoring and personalized healthcare approaches. Furthermore, advancements in data analytics and artificial intelligence have enhanced the IoMT's capabilities, enabling healthcare professionals to derive valuable insights from the vast amount of patient data collected.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 20.42% |

| Revenue Forecast by 2033 | USD 1,166.52 billion |

| Revenue Share of North America in 2023 | 38% |

| CAGR of Asia Pacific from 2024 to 2033 | 23.68% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The hardware component segment accounted for the highest market share of 49% in 2023. Hardware components play a pivotal role in capturing, transmitting, and processing medical data. These components encompass a wide array of devices, including wearable sensors, medical monitoring equipment, implantable devices, and medical robots. Wearable sensors, such as smartwatches and fitness trackers, are becoming increasingly sophisticated, capable of monitoring vital signs, physical activity, and even detecting irregularities in health parameters. Medical monitoring equipment, ranging from glucose monitors to blood pressure devices, provides real-time data, enabling healthcare professionals to remotely monitor patients' health conditions.

The software component segment is anticipated to grow at the noteworthy CAGR of 23.56% over the forecast period. The software component of the internet of medical things (IoMT) market forms the backbone of innovative healthcare solutions. IoMT software encompasses a spectrum of applications designed to process, analyze, and interpret the vast amounts of data generated by medical devices. These applications include data analytics platforms, artificial intelligence algorithms, electronic health record (EHR) systems, and telemedicine software. Data analytics platforms utilize machine learning and predictive analytics to identify patterns, trends, and anomalies within the extensive datasets collected by IoMT devices. Artificial intelligence algorithms enhance IoMT capabilities by enabling predictive modeling, personalized treatment plans, and early detection of diseases

The telemedicine segment captured the maximum market share of 33% in 2023. Telemedicine, a prominent application within the internet of medical things (IoMT) landscape, has revolutionized healthcare delivery by leveraging advanced technologies. Through IoMT, telemedicine services have become more sophisticated, allowing patients to consult healthcare professionals remotely. IoMT-enabled devices, such as wearable sensors and mobile health apps, enable patients to monitor vital signs, chronic conditions, and overall wellness from the comfort of their homes.

The inpatient monitoring segment is predicted to grow at the fastest CAGR of 22.17% over the forecast period. Inpatient monitoring stands as a cornerstone of IoMT applications, transforming the way healthcare professionals observe and respond to patients within medical facilities. IoMT devices deployed in hospitals collect a wealth of patient data, including vital signs, medication adherence, and recovery progress. These devices continuously transmit this information to centralized systems, allowing healthcare providers to monitor multiple patients simultaneously.

The hospitals segment generated the maximum market share of 33% in 2023. Hospitals serve as critical end-users in the expansive landscape of the Internet of Medical Things (IoMT) market. IoMT technologies have transformed hospital operations and patient care significantly. Within hospital settings, IoMT devices are employed for various applications. These devices continuously monitor patients' vital signs, allowing healthcare providers to track their health status in real-time. IoMT-enabled equipment, such as smart infusion pumps and connected patient monitors, enhance accuracy and automate data collection, reducing the margin for error in medical procedures.

The homecare segment is expected to grow at a significant CAGR of 20.94% over the forecast period. The integration of internet of medical things (IoMT) devices in homecare settings has ushered in a new era of personalized and convenient healthcare services. IoMT-enabled devices, such as wearable health trackers, smart pill dispensers, and remote monitoring equipment, have empowered patients to actively participate in their healthcare management. These devices enable continuous monitoring of vital signs and chronic conditions from the comfort of patients’ homes.

The on-premise segment accounted for the largest market share of 57% in 2023. On-premise deployment in the Internet of Medical Things (IoMT) market involves the installation and management of IoMT devices and infrastructure within the physical premises of healthcare facilities. This deployment method offers healthcare providers a high degree of control and customization over their IoMT systems. With on-premise deployment, healthcare organizations have direct access to and full ownership of their data, ensuring data security and compliance with regulatory standards. On-premise IoMT solutions are particularly favored by institutions with specific security and compliance requirements, allowing them to implement robust data protection measures tailored to their needs.

The cloud-based deployment segment is expected to register the fastest growth rate of 21.13% over the forecast period. Cloud-based deployment in the Internet of Medical Things (IoMT) market leverages cloud computing technology to store, process, and manage medical data collected from IoMT devices. Cloud-based IoMT solutions offer scalability, flexibility, and accessibility to healthcare providers. By utilizing cloud services, healthcare organizations can easily scale their IoMT infrastructure based on demand, accommodating growing data volumes and device connectivity. Cloud deployment eliminates the need for substantial on-site hardware investments, making it a cost-effective solution for healthcare facilities, especially smaller clinics and organizations with limited IT budgets. Additionally, cloud-based IoMT systems enable remote access to medical data, allowing healthcare professionals to monitor patients' health status from any location.

The North America regional market captured the largest revenue share of 38% in 2023. North America stands at the forefront of the internet of medical things (IoMT) market, driven by advanced technological infrastructure, robust healthcare systems, and substantial investments in research and development. The region witnesses significant adoption of IoMT technologies in both healthcare facilities and home settings.

-market-share-by-region.jpg)

The Asia Pacific region is expected to grow at the considerable CAGR of 23.68% over the forecast period. Asia-Pacific showcases immense potential in the internet of medical things (IoMT) market, driven by rapid technological advancements and increasing healthcare digitization. Countries like China, Japan, and South Korea are at the forefront of IoMT adoption, with a growing focus on smart healthcare solutions. The region witnesses a surge in the development and deployment of IoMT devices, catering to the diverse healthcare needs of a vast population.

By Component

By Application

By End-use

By Deployment

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Internet of Medical Things (IoMT) Market

5.1. COVID-19 Landscape: Internet of Medical Things (IoMT) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Internet of Medical Things (IoMT) Market, By Component

8.1. Internet of Medical Things (IoMT) Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Internet of Medical Things (IoMT) Market, By Application

9.1. Internet of Medical Things (IoMT) Market, by Application, 2024-2033

9.1.1. Telemedicine

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Clinical Operations & Workflow Management

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Connected Imaging

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Medication Management

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Inpatient Monitoring

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Internet of Medical Things (IoMT) Market, By End-use

10.1. Internet of Medical Things (IoMT) Market, by End-use, 2024-2033

10.1.1. Homecare

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Hospitals

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Research Institutes & Academics

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Internet of Medical Things (IoMT) Market, By Deployment

11.1. Internet of Medical Things (IoMT) Market, by Deployment, 2024-2033

11.1.1. On-premise

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Cloud

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Internet of Medical Things (IoMT) Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by End-use (2021-2033)

12.1.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.3. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.3. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.3. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.5.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5.4. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.3. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6.4. Market Revenue and Forecast, by Deployment (2021-2033)

Chapter 13. Company Profiles

13.1. Apple, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Boston Scientific Corp.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Biotronik SE & Co. KG

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cisco Systems, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. General Electric Company

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Honeywell International Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. IBM Corp.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Koninklijke Philips N.V.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Lenovo Group Ltd.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Medtronic plc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others