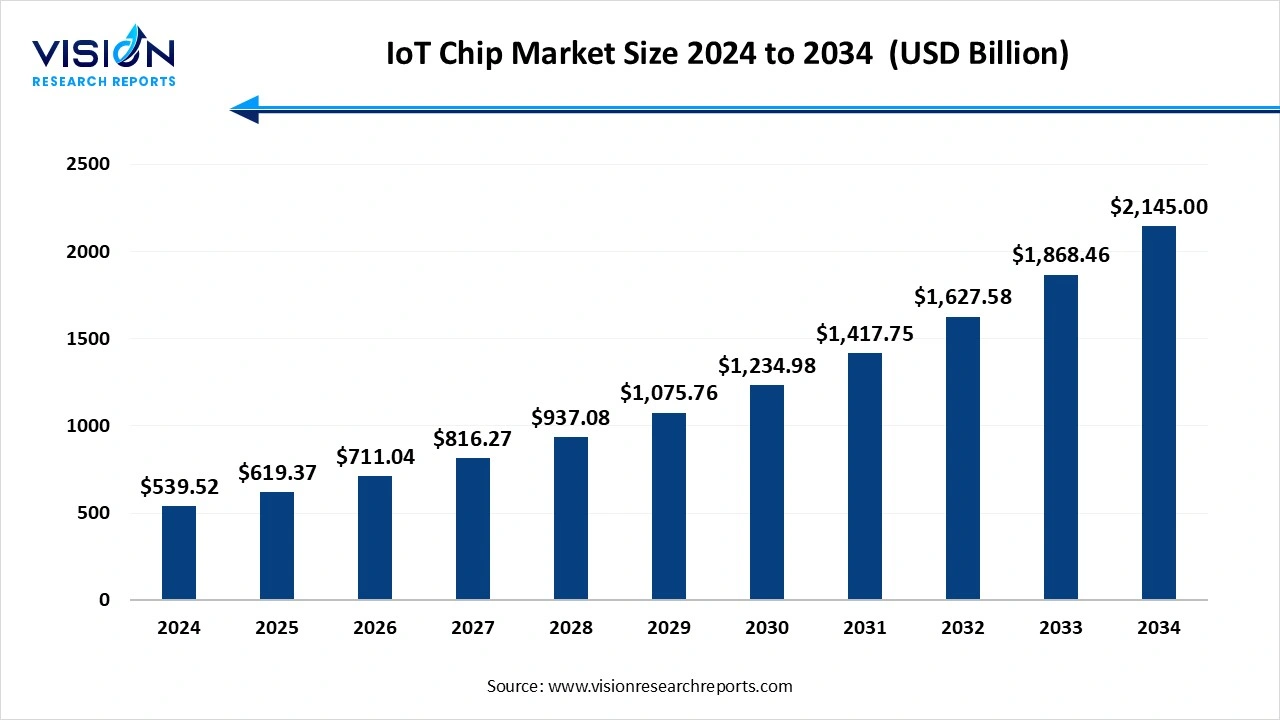

The global IoT chip market size stood at USD 539.52 billion in 2024 and is estimated to reach USD 619.37 billion in 2025. It is projected to hit USD 2,145 billion by 2034, registering a robust CAGR of 14.8% from 2025 to 2034. The Internet of Things (IoT) chip market is experiencing significant growth, driven by the rapid expansion of IoT applications across various industries. These chips, which are integral to IoT devices, enable connectivity, processing, and data management, supporting the seamless integration of devices into the digital ecosystem.

The IoT chip market is experiencing robust growth driven by an escalating adoption of connected devices across various sectors, including consumer electronics, healthcare, and industrial automation, significantly drives demand for advanced IoT chips. Technological advancements in chip design, such as enhanced processing capabilities, energy efficiency, and miniaturization, are further fueling market expansion by enabling more sophisticated and power-efficient IoT solutions. Additionally, substantial investments from both private and public sectors in IoT infrastructure and smart technologies are accelerating market development. The increasing focus on smart cities and the rise of applications requiring real-time data processing and connectivity underscore the growing need for innovative IoT chip solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 539.52 billion |

| Revenue Forecast by 2034 | USD 2,145 billion |

| Growth rate from 2025 to 2034 | CAGR of 14.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Qualcomm Technologies Inc., Intel Corporation, STMicroelectronics N.V., Texas Instruments Incorporated, NXP Semiconductors N.V., Samsung Electronics Co. Ltd., Analog Devices Inc., MediaTek Inc., Microchip Technology Inc., and Infineon Technologies AG. |

Advancements in Edge Computing:

Integration with AI and Machine Learning:

Focus on Energy Efficiency:

Expansion of 5G Connectivity:

Security Vulnerabilities:

Interoperability Issues:

Scalability Concerns:

Power Consumption:

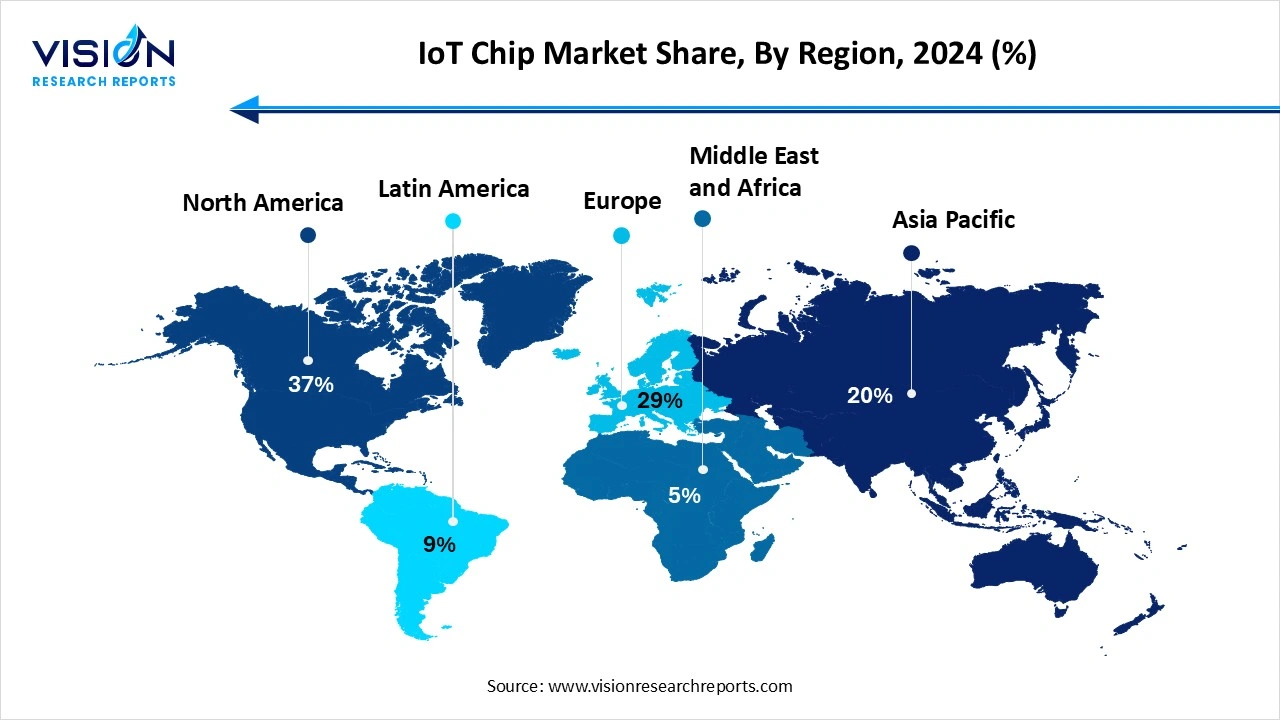

North America led the market with a revenue share of nearly 37% in 2023. This dominance is driven by a strong demand for connected devices in consumer electronics, healthcare, industrial automation, and smart cities. The region's emphasis on innovation and technological advancements further boosts market growth. Companies in North America, including major players like Intel Corporation and Texas Instruments, are leading the development of advanced IoT chip technologies, such as efficient processors, enhanced connectivity solutions, improved sensors, and innovative memory devices.

Europe IoT Chip Market Trends

In Europe, the market is anticipated to grow at a CAGR of over 7.03% from 2024 to 2033. This growth is driven by the rising adoption of IoT technologies across various industries, increased demand for connected devices, and the push towards Industry 4.0 initiatives.

Asia-Pacific IoT Chip Market Trends

Asia-Pacific IoT Chip Market Trends

The Asia-Pacific region is expected to see a CAGR of over 12.04% from 2024 to 2033. The region is experiencing significant advancements in processor technology, with IoT chip manufacturers developing more powerful and energy-efficient processors for IoT applications. This trend is enhancing the performance and capabilities of IoT devices across multiple industries in the region.

In 2023, connectivity integrated circuits (ICs) dominated the market, capturing a 26% share. This prominence is due to the critical role connectivity plays in IoT applications. As the IoT ecosystem grows, there is an increasing need for efficient, reliable, and energy-conscious communication between devices. Connectivity ICs provide the necessary hardware for various wireless communication protocols, allowing devices to connect and exchange data seamlessly via technologies like Wi-Fi, Bluetooth, and cellular networks.

The sensors segment is projected to experience the fastest growth from 2024 to 2033. This rise is driven by the expanding use of IoT devices across industries such as healthcare, automotive, manufacturing, and smart homes. Sensors are vital for gathering real-time data, which enhances decision-making and operational efficiency. Technological advancements, including smaller sensor sizes, improved accuracy, and reduced power consumption, are further accelerating their adoption in IoT devices. Additionally, the increasing emphasis on robust connectivity and communication in IoT systems is heightening the demand for sensors that support effective data transfer and device interaction.

In 2023, the consumer electronics segment held the largest market share due to the widespread integration of IoT technology into smart devices. IoT functionalities are now integral to a range of consumer electronics, such as smartphones, smart speakers, home appliances, and wearables. These devices utilize IoT chips to enable features like remote control, data tracking, and interoperability, thereby enhancing user convenience and experience. The rising demand for smart, interconnected consumer electronics, combined with a tech-savvy consumer base, has fueled the adoption of IoT chips.

The aerospace and defense sector is expected to see the fastest growth from 2024 to 2033. The sector is increasingly incorporating IoT devices for applications such as monitoring aircraft engine performance, tracking military assets, and improving soldier safety. These devices depend on specialized IoT chips for data processing and communication. The growing need for such devices is likely to drive the IoT chip market in this sector. Additionally, advancements in IoT chip technology are contributing to this growth.

By Product

By End Use

By Region

IoT Chip Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on IoT Chip Market

5.1. COVID-19 Landscape: IoT Chip Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global IoT Chip Market, By Product

8.1. IoT Chip Market, by Product, 2024-2034

8.1.1. Connectivity Integrated Circuits (ICs)

8.1.1.1. Market Revenue and Forecast (2025-2034)

8.1.2. Logic Devices

8.1.2.1. Market Revenue and Forecast (2025-2034)

8.1.3. Memory Devices

8.1.3.1. Market Revenue and Forecast (2025-2034)

8.1.4. Processors

8.1.4.1. Market Revenue and Forecast (2025-2034)

8.1.5. Sensors

8.1.5.1. Market Revenue and Forecast (2025-2034)

Chapter 9. Global IoT Chip Market, By End Use

9.1. IoT Chip Market, by End Use, 2024-2034

9.1.1. Consumer Electronics

9.1.1.1. Market Revenue and Forecast (2025-2034)

9.1.2. Wearable Devices

9.1.2.1. Market Revenue and Forecast (2025-2034)

9.1.3. Automotive & Transportation

9.1.3.1. Market Revenue and Forecast (2025-2034)

9.1.4. BFSI

9.1.4.1. Market Revenue and Forecast (2025-2034)

9.1.5. Healthcare

9.1.5.1. Market Revenue and Forecast (2025-2034)

9.1.6. Retail

9.1.6.1. Market Revenue and Forecast (2025-2034)

9.1.7. Building Automation

9.1.7.1. Market Revenue and Forecast (2025-2034)

9.1.8. Oil & Gas

9.1.8.1. Market Revenue and Forecast (2025-2034)

9.1.9. Agriculture

9.1.9.1. Market Revenue and Forecast (2025-2034)

9.1.10. Aerospace & Defense

9.1.10.1. Market Revenue and Forecast (2025-2034)

9.1.11. Others

9.1.11.1. Market Revenue and Forecast (2025-2034

Chapter 10. Global IoT Chip Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. Qualcomm Technologies Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Intel Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. STMicroelectronics N.V.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Texas Instruments Incorporated

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. NXP Semiconductors N.V.

11.5. Intermountain Life Sciences

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Samsung Electronics Co. Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Analog Devices Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. MediaTek Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Microchip Technology Inc.

11.9. Evoqua Water Technologies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Infineon Technologies AG

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others