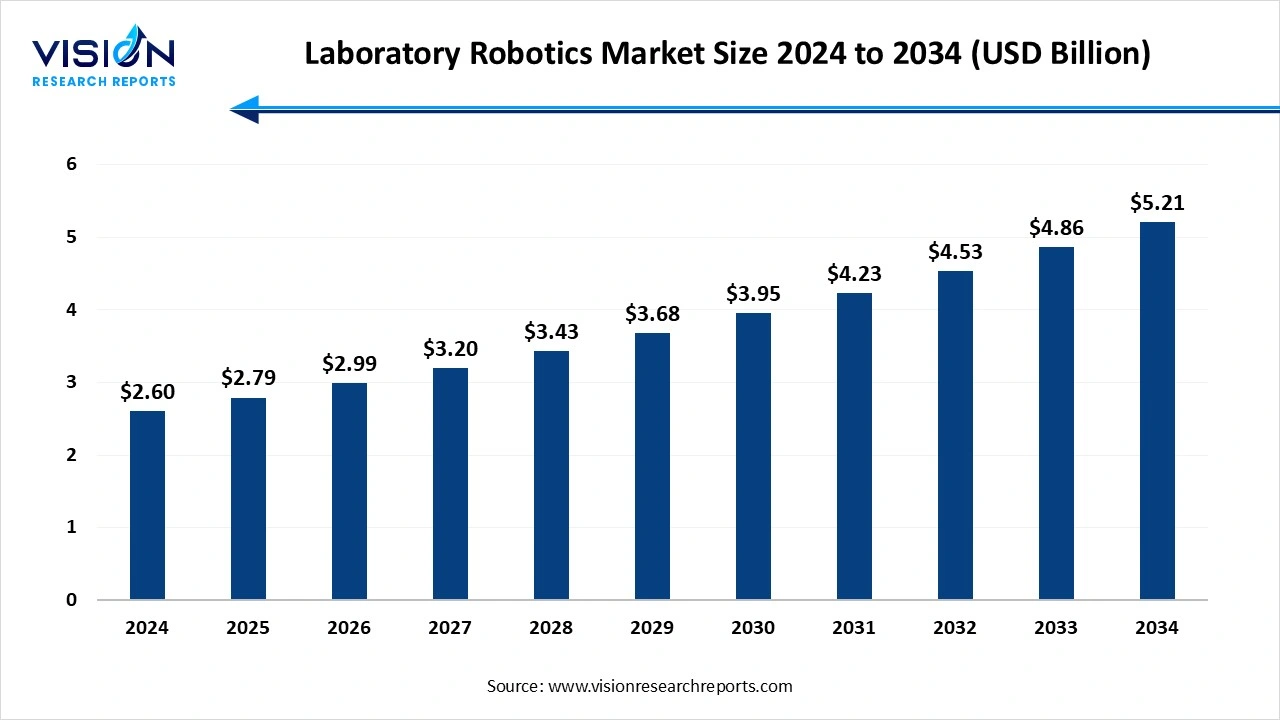

The global laboratory robotics market size was valued at USD 2.60 billion in 2024 and is projected to hit USD 2.79 billion in 2025 to around USD 5.21 billion by 2034, growing at a CAGR of 7.2% from 2025 to 2034. The market growth is driven by technological advancements in AI and machine learning, rising demand for automation in pharmaceutical, clinical, and research laboratories, and increasing adoption of compact, modular, and collaborative robotic systems that enhance precision, efficiency, and throughput while reducing human error.

The laboratory robotics market is experiencing significant growth as technological advancements and increasing demand for automation drive innovation in laboratory processes. Laboratory robots are becoming indispensable in various sectors, including pharmaceuticals, biotechnology, clinical laboratories, and academic research institutions.These automated systems enhance precision, efficiency, and repeatability, leading to higher throughput and reduced human error.

The growth of the laboratory robotics market is propelled by the technological advancements, particularly in artificial intelligence and machine learning, are enhancing the capabilities and efficiency of robotic systems. These innovations enable more precise, reliable, and faster laboratory processes. Additionally, the increasing demand for automation across various industries, including pharmaceuticals, biotechnology, and clinical diagnostics, drives market expansion. Automation improves productivity, reduces human error, and lowers operational costs. Furthermore, the trend toward miniaturization and portability of robotic systems makes them more accessible and practical for laboratories with limited space. Collectively, these factors contribute to the robust growth of the laboratory robotics market.

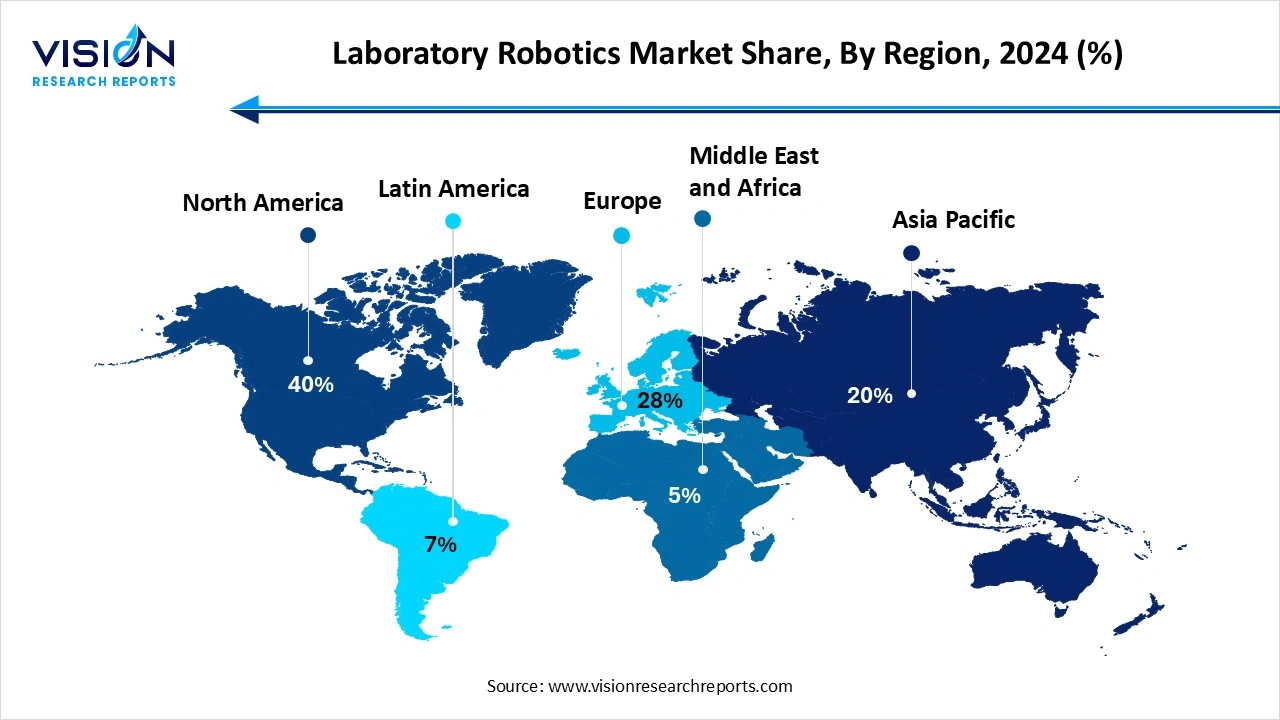

The North American laboratory robotics market dominated the global market, accounting for a 41% revenue share in 2023, driven by technological advancements and increasing demand for automation in laboratories. Strategic partnerships between key players are further fueling this expansion. Collaborations between technology developers and research institutions enhance innovation, streamline workflows, and improve efficiency in laboratory processes.

The Asia-Pacific laboratory robotics market is experiencing substantial growth, fueled by increased funding and investment in innovative technologies. Key players in the region are receiving significant financial backing to develop advanced robotic solutions for laboratory automation. This investment is driving the adoption of cutting-edge robotics technology, enhancing efficiency, and expanding the market presence of laboratory robotics in various industries.

The lab automation workstations segment captured the largest market share of 38% in 2023. This growth is driven by the increasing demand for streamlined laboratory processes, which require higher throughput and efficiency. Additionally, advancements in robotics technology, such as improved precision and flexibility, are enhancing the capabilities of automated workstations, further propelling market growth. The rising adoption of lab automation solutions also contributes to the expanding market size. Furthermore, strategic initiatives by market players are accelerating growth. For example, in 2022, XtalPi, an AI technology company, acquired over 100 GoFa cobots to establish automated laboratory workstations at its testing center in China.

The automated plate handlers segment is expected to grow the fastest in the coming years, largely due to technological advancements. These advancements have led to the development of highly efficient and versatile plate handling systems capable of handling various types of plates with precision and speed. In February 2023, Automata introduced the LINQ platform, designed to fully automate workflows, including automated plate handlers and the movement of labware across all laboratory environments. The integration of advanced features such as robotic arms, vision systems, and sophisticated software has significantly improved the throughput and accuracy of plate handling operations. As laboratories increasingly seek to automate and streamline their processes, the demand for automated plate handlers continues to rise, further driving market growth.

The drug discovery segment held the largest share, 29%, of the market in 2023 due to several key factors. The increasing demand for innovative drugs to address various diseases drives extensive research and development efforts in pharmaceutical and biotechnology companies. For instance, in August 2021, Exscientia established a new 26,000 square foot robotic laboratory at Milton Park, Oxfordshire. The lab focuses on automating chemistry and biology processes to speed up drug discovery, enabling the company to develop drugs using AI and manufacture them using robots. Additionally, advancements in technology, such as artificial intelligence and machine learning, are revolutionizing drug discovery by enabling predictive modeling and virtual screening, further boosting the adoption of laboratory robotics.

The clinical diagnosis segment is projected to show significant growth during the forecast period. With an increasing emphasis on precision medicine and personalized healthcare, there is a growing demand for accurate and efficient diagnostic solutions. Laboratory robotics play a crucial role in automating various diagnostic processes, including sample handling, testing, and analysis, leading to faster turnaround times and improved accuracy. Furthermore, the rising prevalence of chronic diseases and the growing aging population are escalating the need for robust diagnostic capabilities. Chronic diseases such as diabetes, cancer, and cardiovascular conditions require ongoing monitoring and frequent diagnostic testing, thereby fostering market growth.

The clinical laboratory segment accounted for the largest market share of 56% in 2023, driven by advancements in clinical research and strong government support. Increased funding for healthcare infrastructure and research initiatives is propelling the adoption of laboratory robotic systems. These systems automate repetitive tasks, enhance precision, and improve workflow efficiency in clinical laboratories. For instance, in June 2023, United Robotics Group collaborated with Siemens and HUS Diagnostic Center to address the lab staff shortage crisis by unveiling umobileLAB. Developed in partnership with Siemens and HUS Diagnostic Center, uMobileLAB is designed to perform laboratory tasks. Additionally, the rising prevalence of chronic diseases and the demand for large-scale diagnostic testing underscore the need for advanced automation. This combination of clinical research advancements and government backing is accelerating the growth of laboratory robotics in clinical settings.

The research laboratory segment is expected to grow the fastest during the forecast period, driven by increased investments and technological advancements. Research laboratories are heavily investing in automation to enhance productivity, accuracy, and throughput of experimental processes. The adoption of laboratory robotics streamlines complex workflows, reduces human error, and accelerates data collection and analysis. For instance, in March 2024, Abbott launched its innovative GLP Systems Track automation solutions, designed to support laboratories' high-volume needs. This new offering aims to provide greater flexibility, enabling laboratories to optimize performance and efficiency to meet increasing demand. Furthermore, the rising demand for high-throughput screening and reproducibility in experiments is pushing laboratories to incorporate advanced robotic systems. These factors enhance the capabilities of research laboratories, driving innovation and enabling researchers to address complex scientific challenges with increased efficiency and effectiveness.

By Product

By Application

By End-use

By Region

Laboratory Robotics Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Laboratory Robotics Market

5.1. COVID-19 Landscape: Laboratory Robotics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Laboratory Robotics Market, By Product

8.1. Laboratory Robotics Market, by Product

8.1.1 Automated Liquid Handling Robots

8.1.1.1. Market Revenue and Forecast

8.1.2. Automated Plate Handlers

8.1.2.1. Market Revenue and Forecast

8.1.3. Robotic Arms

8.1.3.1. Market Revenue and Forecast

8.1.4. Lab Automation Workstations

8.1.4.1. Market Revenue and Forecast

8.1.5. Microplate Readers and Washers

8.1.5.1. Market Revenue and Forecast

8.1.6. Others

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global Laboratory Robotics Market, By Application

9.1. Laboratory Robotics Market, by Application

9.1.1. Drug Discovery

9.1.1.1. Market Revenue and Forecast

9.1.2. Clinical Diagnosis

9.1.2.1. Market Revenue and Forecast

9.1.3. Microbiology Solutions

9.1.3.1. Market Revenue and Forecast

9.1.4. Genomics Solutions

9.1.4.1. Market Revenue and Forecast

9.1.5. Proteomics Solutions

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Laboratory Robotics Market, By End-use

10.1. Laboratory Robotics Market, by End-use

10.1.1. Clinical Laboratory

10.1.1.1. Market Revenue and Forecast

10.1.2. Research Laboratory

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Laboratory Robotics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by End-use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by End-use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by End-use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by End-use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by End-use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by End-use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by End-use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by End-use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by End-use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by End-use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by End-use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by End-use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by End-use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by End-use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by End-use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by End-use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by End-use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by End-use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by End-use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by End-use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by End-use

Chapter 12. Company Profiles

12.1. Sezzle.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sezzle.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Sezzle.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Sezzle.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Sezzle.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sezzle

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Sezzle.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sezzle

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Sezzle.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Sezzle

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others