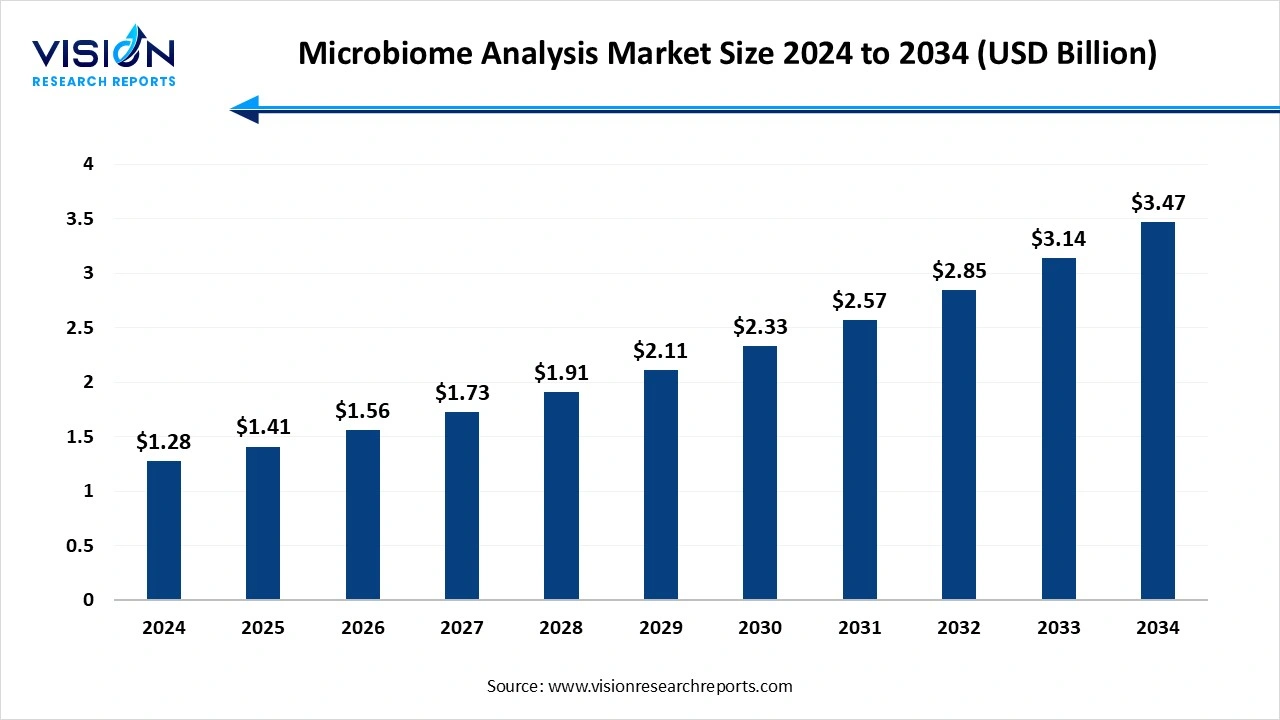

The global microbiome analysis market size stood at USD 1.28 billion in 2024 and is estimated to reach USD 1.41 billion in 2025. It is projected to surge past USD 3.47 billion by 2034, registering a robust CAGR of 10.5% from 2025 to 2034. The rise in the incidence of chronic diseases, trends towards personalized healthcare creating a strong demand for individual microbiome profiles to tailor treatments, technology innovation, and growing healthcare awareness drive the market growth.

A microbiome analysis is a study of the collective microorganisms and their genes within a special environment, such as the human body, soil, or water. The global microbiome analysis market growth is driven by progress in microbiome sequencing technologies, such as next-generation sequencing (NGS), and advanced analytical techniques, which are making microbiome analysis more efficient and cost-effective. The growing understanding of the crucial role the human microbiome plays in health and its connection to various chronic conditions like gastrointestinal disorders, obesity, diabetes, and even cancer. Growing demand in personalized medicine, rise in startups, and small/medium-sized startups fuel the market growth.

The progress in microbiome sequencing technologies, such as next-generation sequencing, and advanced analysis techniques, is making analysis more affordable. A newer technology, nanopore sequencing, provides cost-effective, high-throughput results and is particularly valuable for complex analyses like direct RNA sequencing. Artificial intelligence and machine learning are being used to analyze complex microbial data, identify disease-related patterns, and predict responses to therapies.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.28 billion |

| Revenue Forecast by 2034 | USD 3.47 billion |

| Growth rate from 2025 to 2034 | CAGR of 10.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

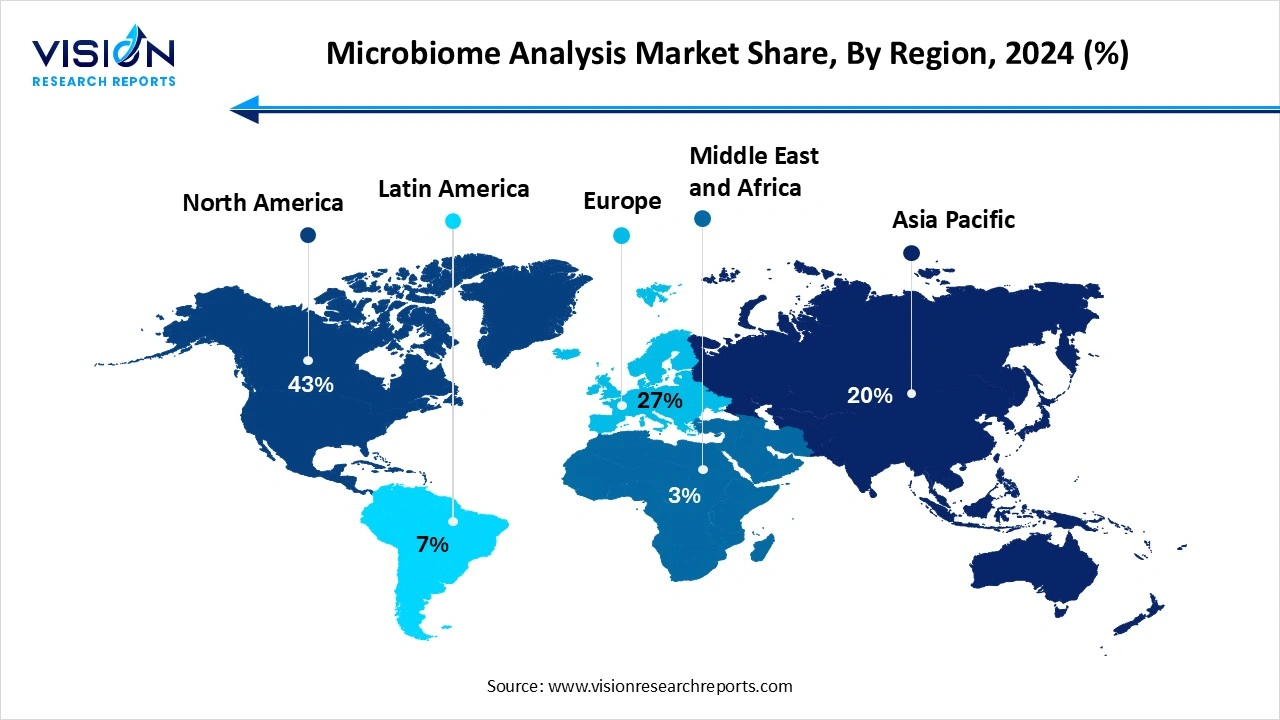

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Illumina, Inc.; QIAGEN N.V.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Zymo Research Corporation; Second Genome, Inc.; uBiome (defunct but historically notable); OraSure Technologies, Inc. (DNA Genotek); Diversigen, Inc.; Enterome Bioscience; Microba Life Sciences; CosmosID Inc.; Eagle Genomics Ltd.; Metabiomics Corporation. |

Microbiome analysis can offer tailored treatment strategies based on an individual's unique microbiome composition, addressing various conditions like gastrointestinal disorders, metabolic disorders, and even cancer. The expansion of DTC microbiome testing, driven by consumer interest in personalized feedback on gut health, is another growth driver.

The development and production of microbiome-based therapies and diagnostics involve complex, expensive processes. High research and development costs, including clinical trials and regulatory approvals, contribute to high prices for these products, limiting affordability and market expansion.

North America led the global microbiome analysis market, capturing the highest revenue share of 43% in 2024. The region's strong investment and funding in human microbiome projects are fostering research and development. The high investment in biotechnology and pharmaceutical industries, along with strong academic institutions, creates a fertile ground for microbial research and product development. Innovation in technology, next-generation sequencing, and sophisticated bioinformatics platforms are crucial for microbiome analysis. .

United States Microbiome Analysis Market Trends

The use of multi-omics approaches for a deeper understanding of the microbiome, the integration of AI and machine learning for data analysis and predictions, and the application of microbiome analysis for personalized nutrition. The market is also seeing growth in Direct-to-Consumer testing, the development of microbiome-based therapeutics, and an expansion of research into various disease areas beyond gastrointestinal disorders, fuel the market growth.

Asia Pacific expects significant growth in the Microbiome Analysis market during the forecast period. The growing health awareness and consumer demand, government supporting policies, and innovation in research and development. The rising incidence of chronic diseases, such as gastrointestinal disorders, metabolic diseases, and autoimmune conditions, is creating demand for novel microbiome-based therapies. The increasing demand for personalized medicine and preventive healthcare is propelling the market, as microbiome profiling becomes crucial for targeted treatments.

Why did the Consumables Segment Dominate the Microbiome Analysis Market?

The consumables segment which includes microbiome analysis kits, reagents, and associated laboratory supplies accounted for the largest revenue share at 47% in 2024. The microbiome analysis requires a constant supply of consumables such as kits and reagents, leading to recurring purchases by the end-user. The rising number of microbiome diagnostic tests and research initiatives worldwide contributes to the high demand for consumables. Advancements in sequencing technologies, like Next-Generation Sequencing (NGS), and other omics approaches necessitate specific and often disposable consumables for sample preparation and analysis. The rising awareness towards gut health fuels the market growth.

The services segment is the fastest-growing in the microbiome analysis market during the forecast period. The high cost and technical complexity of in-house research. This pushes academic and industry players to outsource, granting them access to advanced sequencing technologies and bioinformatics expertise. The services segment also capitalizes on the increasing demand for personalized medicine and diagnostics. This allows for tailored treatments based on individual microbial profiles and accelerates drug discovery.

How the 16S Ribosomal RNA (rRNA) Sequencing Segment hold the Largest Share in the Microbiome Analysis Market?

The 16S ribosomal RNA (rRNA) sequencing segment accounted for the highest revenue share, reaching 50% in 2024. The 16S sequencing is a more affordable technique compared to metagenomics, which allows for cost-sensitive diagnostics and large-scale studies. The 16S rRNA gene is a nearly universal and highly conserved component of all bacterial and archaeal genomes, containing both conserved and hypervariable regions. The wide application in research and industry, high-throughput capabilities, and rapid processing fuel the market growth.

The shotgun metagenomics separation segment is experiencing the fastest growth in the market during the forecast period. It's a comprehensive, unbiased analysis, unlike limited 16S rRNA sequencing. It provides deeper insights into species diversity and microbial functional potential, accelerating discoveries in diagnostics and drug development. Decreasing sequencing costs and advancing bioinformatics tools further expand its adoption across clinical, agricultural, and environmental applications. These benefits collectively position it as the fastest-growing segment in the microbiome analysis market.

How the Research Application Segment hold the Largest Share in the Microbiome Analysis Market?

The research application segment held the largest revenue share in the microbiome analysis market in 2024. Their large-scale presence in academic institutions and microbiome research is foundational for developing personalized medicine strategies, where treatments are tailored to an individual's unique microbial profile. This has spurred a surge in research to identify microbial patterns associated with specific diseases. The availability of advanced sequencing technologies, along with rising funding support for life sciences research, has significantly enhanced microbiome research globally.

The disease application segment is experiencing the fastest growth in the market during the forecast period. The mounting evidence linking microbiome imbalances to prevalent chronic illnesses, including autoimmune disorders, cancer, and infectious diseases. Advances in sequencing technology and bioinformatics make microbiome analysis more accessible and affordable for diagnostics and drug discovery. Significant investment from pharmaceutical companies and government funding further accelerates the development of novel, microbiome-based therapies and personalized medicine approaches. This focus on high-impact clinical solutions gives the disease segment a strong market advantage over other applications.

How the Academic and Research Institution Segment hold the Largest Share in the Microbiome Analysis Market?

The academic and research institution segment held the largest revenue share in the microbiome analysis market in 2024. There is a rise in funding for research and development activities worldwide. The collaboration between industries and academic institutions fosters the development of new microbiome-based diagnostic products and accelerates the pace of innovation. Technological innovation has advanced microbiome-based technologies, such as 16S rRNA sequencing and whole-genome sequencing, driving the market growth.

The contract research organization (CROs) segment is experiencing the fastest growth in the market during the forecast period. The CROs offer access to state-of-the art facilities that innovator companies might not have, including specialized infrastructure for anaerobic fermentation and GMP-compliant manufacturing of LBPs. CROs provide access to cutting-edge technologies like next-generation sequencing (NGS), advanced bioinformatics platforms, and AI-driven analytics, which can be prohibitively expensive for smaller companies to develop in-house. Their high research cost and resource demands, specialized expertise and technology, and addressing regulatory complexity drive the market growth.

By Product & Services

By Technology

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Microbiome Analysis Market

5.1. COVID-19 Landscape: Microbiome Analysis Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Microbiome Analysis Market, By Product & Services

8.1. Microbiome Analysis Market, by Product & Services

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Microbiome Analysis Market, By Technology

9.1. Microbiome Analysis Market, by Technology

9.1.1. 16S rRNA Sequencing

9.1.1.1. Market Revenue and Forecast

9.1.2. Shotgun Metagenomics

9.1.2.1. Market Revenue and Forecast

9.1.3. Metatranscriptomics

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Microbiome Analysis Market, By Application

10.1. Microbiome Analysis Market, by Application

10.1.1. Disease Application

10.1.1.1. Market Revenue and Forecast

10.1.2. Research Application

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Microbiome Analysis Market, By End Use

11.1. Microbiome Analysis Market, by End Use

11.1.1. Biopharmaceutical & Pharmaceutical Companies

11.1.1.1. Market Revenue and Forecast

11.1.2. CROs & CMOs

11.1.2.1. Market Revenue and Forecast

11.1.3. Academic & Research Institutes

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Microbiome Analysis Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product & Services

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product & Services

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product & Services

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product & Services

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product & Services

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product & Services

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product & Services

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product & Services

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product & Services

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product & Services

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product & Services

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product & Services

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product & Services

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product & Services

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product & Services

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product & Services

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product & Services

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product & Services

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product & Services

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product & Services

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product & Services

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Illumina, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. QIAGEN N.V.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Thermo Fisher Scientific Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Bio-Rad Laboratories, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Zymo Research Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Second Genome, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. uBiome (defunct but historically notable)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. OraSure Technologies, Inc. (DNA Genotek)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Diversigen, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Enterome Bioscience

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others