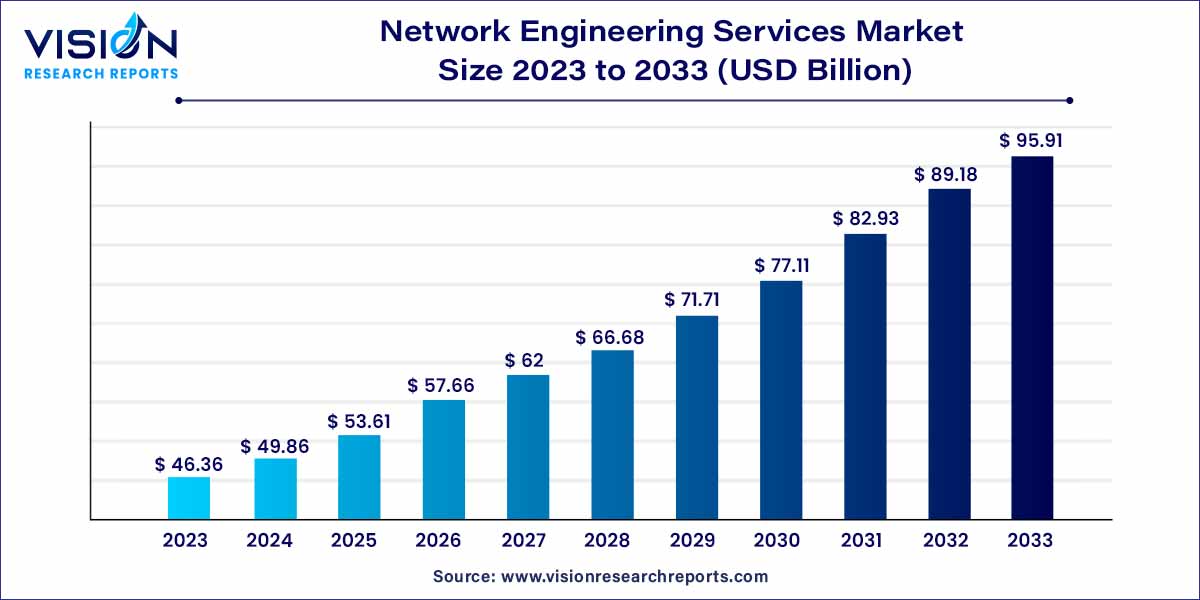

The global network engineering services market size was estimated at around USD 46.36 billion in 2023 and it is projected to hit around USD 95.91 billion by 2033, growing at a CAGR of 7.54% from 2024 to 2033. The network engineering services market is a dynamic and vital sector within the technology industry, playing a central role in shaping the digital landscape of businesses worldwide. Network engineering services encompass a wide array of specialized solutions focused on designing, implementing, managing, and securing complex network infrastructures. These services are crucial for organizations seeking seamless connectivity, efficient data transfer, and robust cybersecurity measures.

The growth of the network engineering services market is propelled by several key factors. Firstly, the rapid evolution of technology, including the advent of 5G networks, Internet of Things (IoT) devices, and cloud computing, creates a demand for sophisticated and scalable network solutions. Businesses are increasingly relying on these advanced technologies to enhance their operations, driving the need for expert network engineering services. Secondly, the rise of remote work and digitalization across industries has accentuated the significance of secure and high-performance networks. As companies expand their digital footprint, they seek reliable service providers to ensure seamless connectivity and data transfer. Additionally, the escalating concerns related to cybersecurity and data breaches have made businesses prioritize robust network security measures. Network engineering services providers play a crucial role in implementing advanced security protocols, meeting compliance requirements, and safeguarding sensitive information.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 95.91 billion |

| Growth Rate from 2024 to 2033 | CAGR of 7.54% |

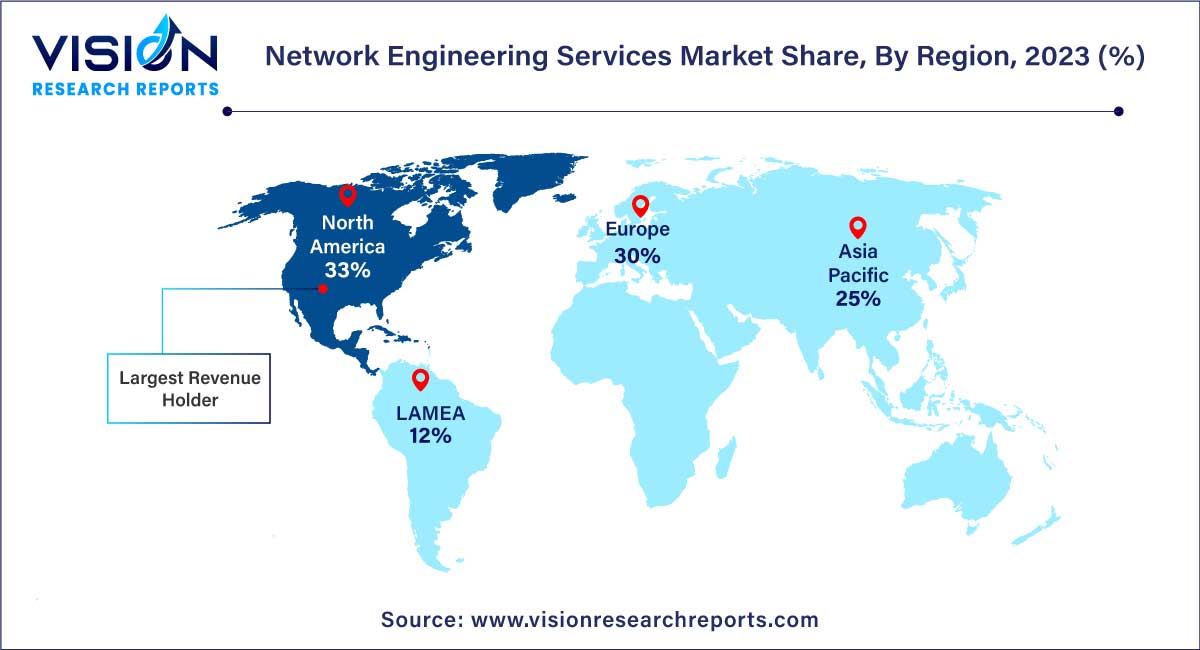

| Revenue Share of North America in 2023 | 32% |

| CAGR of Asia Pacific from 2024 to 2033 | 8.95% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The professional services segment dominated the global market with the largest market share of 62% in 2023. Professional services in network engineering encompass expert consultation, network design, implementation, and optimization. Skilled professionals work closely with clients to understand their specific requirements, crafting tailored solutions that align with the organization's goals. Network engineers, through their expertise, ensure seamless deployment of networking technologies, optimizing network performance, and enhancing overall efficiency.

The managed services segment is anticipated to grow at the fastest CAGR of 8.15% throughout the forecast period. Managed services, on the other hand, offer businesses the convenience of outsourcing their network management and maintenance tasks to specialized service providers. These services often include 24/7 monitoring, troubleshooting, regular updates, and security enhancements. Managed service providers (MSPs) take a proactive approach, identifying potential issues before they escalate, thereby minimizing downtime and ensuring uninterrupted network operations.

The wired segment contributed the largest market share of 58% in 2023. Wired connections, characterized by physical cables and infrastructure, have long been the foundation of reliable and high-speed networking. Ethernet cables, fiber optics, and other wired technologies provide stable and consistent data transmission, making them ideal for applications demanding low latency, high bandwidth, and secure connectivity. Wired networks are often preferred in environments where data integrity and speed are paramount, such as data centers, large enterprises, and critical infrastructure industries.

The wireless segment is expected to grow at the highest CAGR of 8.45% during the forecast period. Wireless connections have revolutionized the way businesses operate, offering unparalleled mobility and flexibility. Wireless technologies, such as Wi-Fi and cellular networks, eliminate the constraints of physical cables, enabling employees to connect to the network from virtually anywhere within the coverage area. This wireless freedom is particularly valuable in modern workplaces, promoting collaboration, enhancing productivity, and accommodating the growing trend of remote work.

The large enterprises segment generated the maximum market share of 68% in 2023. Large enterprises, characterized by their expansive operations and diverse infrastructure, require robust and scalable network solutions. These organizations often operate across multiple locations, demanding intricate network architectures that ensure seamless communication, data transfer, and collaboration. Network engineering services for large enterprises involve intricate planning, implementation, and ongoing optimization to handle the complexity of their extensive networks.

The small and medium-sized enterprises (SMEs) segment expected to grow at the notable CAGR of 8.15% over the forecast period. Small and medium-sized enterprises (SMEs) constitute a significant segment of the market, characterized by their agility, innovation, and resource efficiency. For SMEs, network engineering services play a crucial role in leveling the playing field with their larger counterparts. These businesses often require cost-effective, scalable, and secure networking solutions that enhance their competitiveness in the market.

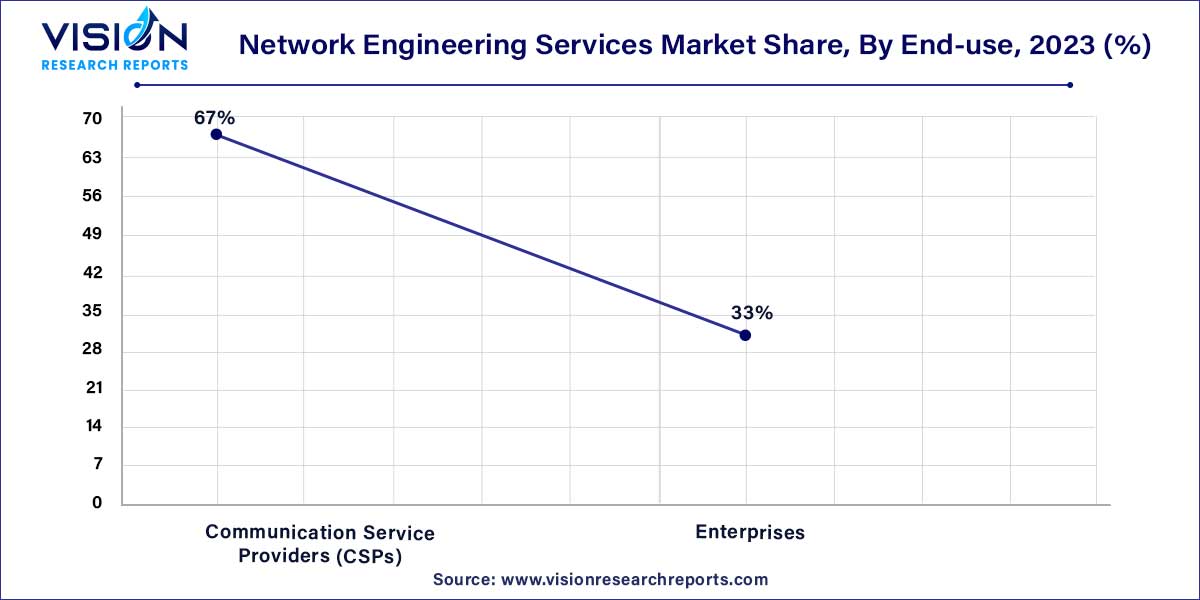

The communication service providers (CSPs) segment led the market with a revenue share of 67% in 2023 and is expected to grow at the fastest CAGR of 7.1% over the forecast period. Communication Service Providers, or CSPs, are pivotal entities in the telecommunications industry, responsible for delivering a wide array of communication services to consumers and businesses alike. These services encompass mobile and landline telephony, broadband internet, television broadcasting, and, in some cases, digital services like cloud computing and IoT connectivity. For CSPs, network engineering services are the backbone of their operations. Expert engineers design, deploy, and maintain the intricate networks that enable seamless communication services for millions of subscribers.

The enterprise segment is anticipated to grow at the fastest CAGR of 8.48% throughout the forecast period. Enterprises, on the other hand, represent a diverse range of businesses spanning various industries, including finance, healthcare, manufacturing, and retail. Network engineering services for enterprises are tailored to their specific requirements, ensuring that their networking infrastructure aligns with their operational goals. Enterprises rely on networks not only for internal communication but also for connecting with clients, partners, and suppliers globally. Network engineers work closely with enterprises to understand their unique needs, designing networks that facilitate secure data transfer, support bandwidth-intensive applications, and provide a robust platform for collaboration.

The North America region dominated the market with a revenue share of 33% in 2023. In North America, particularly in the United States and Canada, the market is characterized by a high demand for advanced network solutions driven by technological innovation. With a strong emphasis on digital transformation, businesses in this region heavily invest in network engineering services to optimize their operations, enhance cybersecurity measures, and facilitate seamless communication. The presence of numerous large enterprises and tech-driven industries further fuels the demand for specialized network services.

Asia Pacific is expected to grow at the fastest CAGR of 8.95% over the forecast period. Asia-Pacific, with its diverse economies and rapid digitalization, presents a fertile ground for the network engineering services market. Countries like China, India, Japan, and South Korea are witnessing substantial investments in telecommunications infrastructure, 5G networks, and smart technologies. The increasing number of businesses, coupled with a burgeoning middle class, drives the demand for efficient and reliable network services.

By Service Type

By Connection Type

By Organization Size

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Network Engineering Services Market

5.1. COVID-19 Landscape: Network Engineering Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Network Engineering Services Market, By Service Type

8.1. Network Engineering Services Market, by Service Type, 2024-2033

8.1.1. Professional Services

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Managed Services

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Network Engineering Services Market, By Connection Type

9.1. Network Engineering Services Market, by Connection Type, 2024-2033

9.1.1. Wired

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Wireless

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Network Engineering Services Market, By Organization Size

10.1. Network Engineering Services Market, by Organization Size, 2024-2033

10.1.1. Small and Medium Sized Enterprises (SMEs)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Large Size Enterprises

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Network Engineering Services Market, By End-use

11.1. Network Engineering Services Market, by End-use, 2024-2033

11.1.1. Communication Service Providers (CSPs)

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Enterprises

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Network Engineering Services Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.2.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.3.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.4.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Service Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Connection Type (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Sincera Technologies

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Juniper Networks, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Datavision, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cyient

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. HCL Technologies Limited

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Accenture

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Infosys Limited

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Advance Digital Systems, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Movate

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Hughes Systique Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others