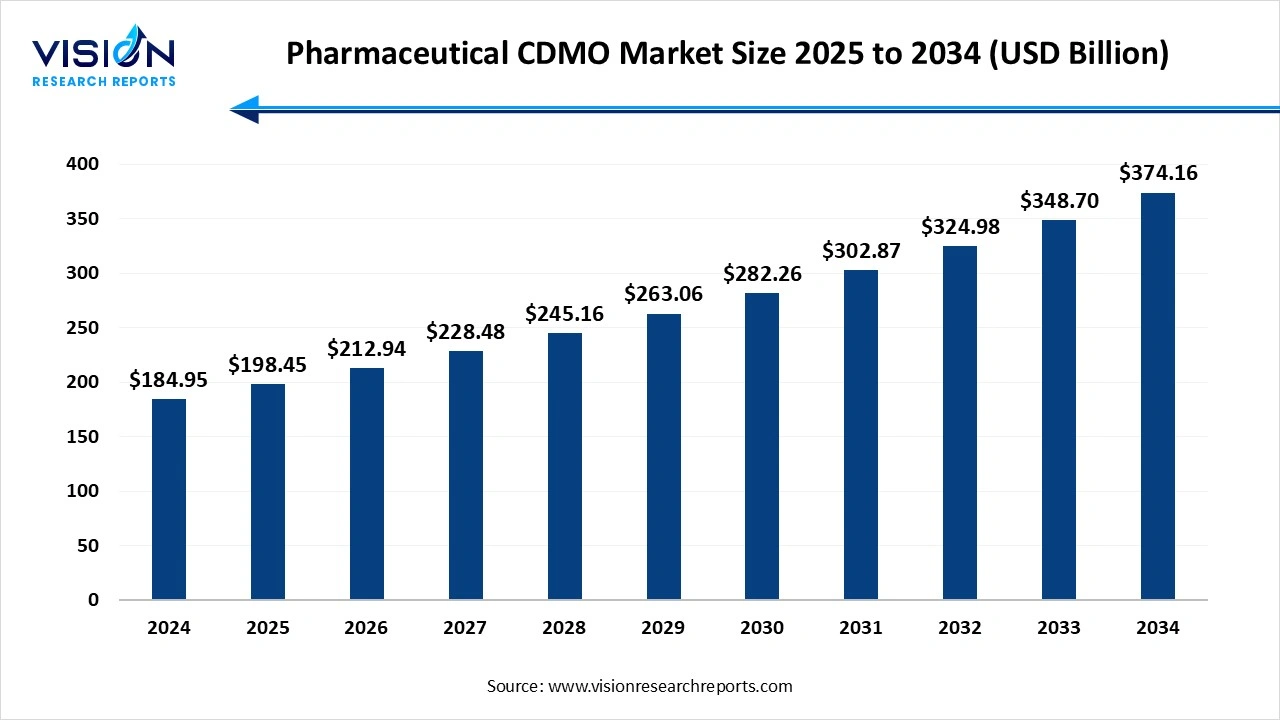

The global pharmaceutical CDMO market size was accounted at USD 184.95 billion in 2024 and it is projected to hit around USD 374.16 billion by 2034, growing at a CAGR of 7.3% from 2025 to 2034. The market growth is driven by the increasing demand for cost-effective drug development and manufacturing, the pharmaceutical CDMO market is experiencing significant growth.

| Report Coverage | Details |

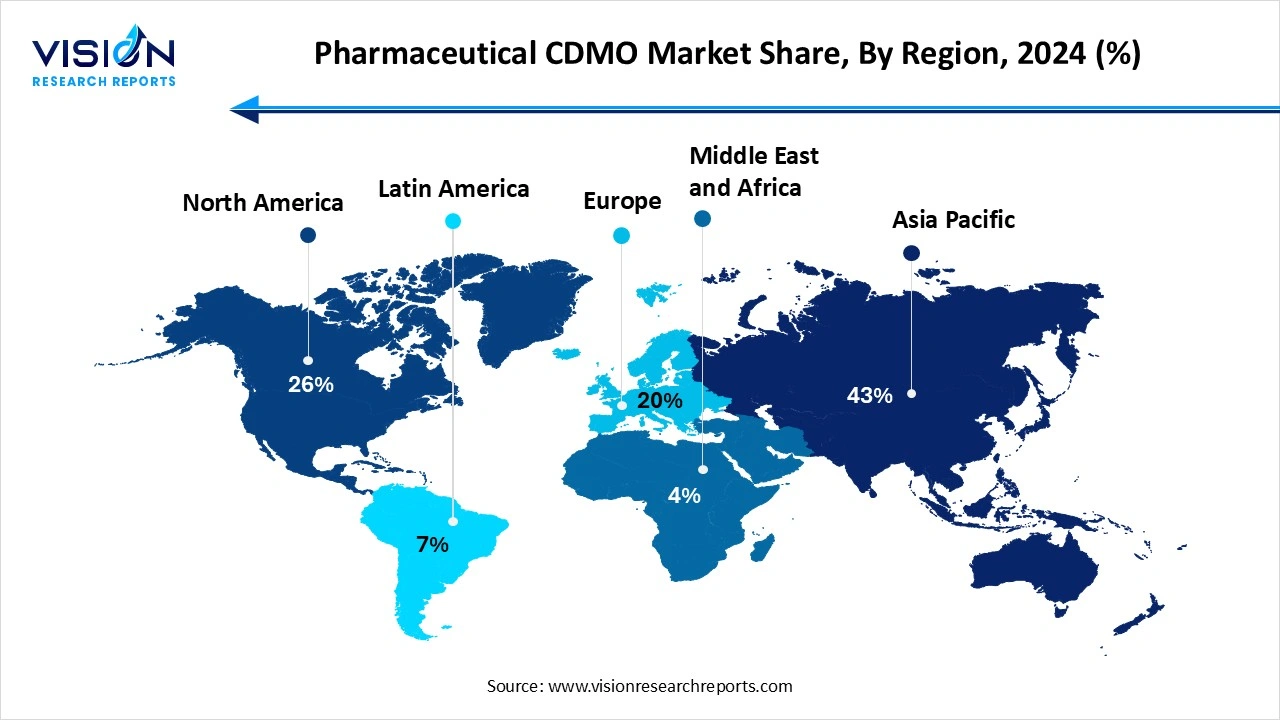

| Revenue Share of Asia Pacific in 2024 | 43% |

| Revenue Forecast by 2034 | USD 374.16 billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Bushu Pharmaceuticals Ltd.; Nipro Corporation; Thermo Fisher Scientific Inc; Samsung Biologics; Laboratory Corporation of America Holdings; Siegfried Holding Ag; Catalent, Inc; Lonza Group Ag; Recipharm Ab; Piramal Pharma Solutions; Cordenpharma International; Cambrex Corporation; Wuxi Apptec. |

The Pharmaceutical Contract Development and Manufacturing Organization (CDMO) market plays a critical role in supporting pharmaceutical companies by offering end-to-end services, including drug development, manufacturing, and packaging. As the demand for cost-effective and flexible production solutions grows, many pharmaceutical companies are outsourcing these operations to CDMOs to streamline processes, reduce time-to-market, and focus on core competencies such as R&D and marketing. The increasing complexity of drug molecules, the rise of biologics, and the growing demand for personalized medicine are further driving the need for specialized development and manufacturing expertise.

The Pharmaceutical CDMO market is being significantly driven by the increasing trend of outsourcing drug development and manufacturing processes. Pharmaceutical and biotechnology companies are increasingly relying on CDMOs to reduce operational costs, accelerate time-to-market, and access specialized capabilities without investing in large-scale infrastructure. This shift is particularly prominent among small and mid-sized firms that lack in-house manufacturing capabilities.

Regulatory pressures and stringent compliance requirements also fuel market growth, as CDMOs with proven regulatory track records become preferred partners. Furthermore, the expansion of the pharmaceutical industry in emerging markets, coupled with the growing prevalence of chronic diseases, is boosting global drug demand prompting companies to scale production quickly and efficiently through CDMOs. Innovation in manufacturing technologies, such as continuous manufacturing and single-use systems, further enhances the competitiveness of CDMOs, positioning them as vital contributors in the evolving pharmaceutical landscape.

One of the primary challenges in the pharmaceutical CDMO market is maintaining strict compliance with evolving global regulatory standards. CDMOs must navigate complex regulatory frameworks across different regions, including those set by the FDA, EMA, and other authorities. Failure to meet these standards can result in delays, product recalls, or loss of business. Moreover, securing necessary certifications and passing regulatory inspections require substantial investment in quality systems, staff training, and facility upgrades, which can strain the resources of smaller or mid-sized CDMOs.

Another significant challenge is capacity constraints and supply chain disruptions. With increasing demand for outsourcing, many CDMOs face bottlenecks in production capacity, especially for high-tech biologics and advanced therapies. In addition, global supply chain volatility exacerbated by geopolitical tensions, raw material shortages, and pandemic-related disruptions can hinder timely production and delivery. CDMOs are under pressure to balance flexibility with scalability while ensuring uninterrupted service to clients, which demands continuous investment in infrastructure, talent, and digital solutions.

Asia Pacific accounted for the largest revenue share of 43% in the market 2024. Countries such as China, India, South Korea, and Japan are playing an increasingly important role in global drug manufacturing, offering both cost efficiency and scalability. India and China, in particular, are home to numerous CDMOs with large-scale API and finished dosage manufacturing capabilities. As Western pharmaceutical companies seek to optimize production costs and access new patient populations, partnerships with Asia-Pacific CDMOs are on the rise.

North America is projected to witness the fastest growth in the pharmaceutical CDMO market, with a CAGR of 6.6% over the forecast period. The region’s high healthcare expenditure, strong focus on drug innovation, and demand for outsourcing complex manufacturing processes have accelerated the growth of CDMO services. Additionally, the rising development of biologics, biosimilars, and specialty drugs in the United States and Canada continues to create significant opportunities for CDMOs offering high-value, technically sophisticated solutions.

North America is projected to witness the fastest growth in the pharmaceutical CDMO market, with a CAGR of 6.6% over the forecast period. The region’s high healthcare expenditure, strong focus on drug innovation, and demand for outsourcing complex manufacturing processes have accelerated the growth of CDMO services. Additionally, the rising development of biologics, biosimilars, and specialty drugs in the United States and Canada continues to create significant opportunities for CDMOs offering high-value, technically sophisticated solutions.

The oncology segment dominated the market in 2024, capturing the largest revenue share of 22%. The rising global burden of cancer and the continuous development of targeted therapies, immunotherapies, and biologics have led to increased demand for specialized development and manufacturing capabilities. CDMOs play a vital role in supporting pharmaceutical and biotech companies in the production of complex oncology drugs, which often require high containment, precision, and regulatory compliance. These organizations provide scalable solutions, including formulation development, clinical trial material production, and commercial manufacturing, enabling faster time-to-market for cancer treatments.

The infectious diseases remain another major application area within the pharmaceutical CDMO market, especially in the wake of global health emergencies such as the COVID-19 pandemic. The urgent need for vaccines, antiviral drugs, and antibiotics has highlighted the importance of flexible and responsive manufacturing partners. CDMOs have played a pivotal role in accelerating the development and mass production of treatments and vaccines by offering rapid scale-up capabilities and global supply chain support. Their ability to handle complex biologics, mRNA-based products, and sterile formulations has made them essential collaborators in combating both emerging and re-emerging infectious diseases.

The active pharmaceutical ingredient (API) segment dominated the market with the highest revenue share of 82% in 2024. CDMOs engaged in this segment offer services that include synthesis, purification, and characterization of both active and inactive pharmaceutical ingredients. With increasing pressure on pharmaceutical companies to reduce in-house manufacturing costs, many are turning to CDMOs for the efficient and compliant production of high-quality pharmaceutical ingredients. This trend is further supported by the growing complexity of modern drug formulations, which require advanced chemical and biological capabilities.

The traditional APIs segment is expected to register a CAGR of 5.3% throughout the forecast period. APIs, or active pharmaceutical ingredients, are the biologically active components responsible for the therapeutic effects of drugs. CDMOs in this segment provide services ranging from process development and scale-up to commercial manufacturing of APIs under strict regulatory standards. The shift toward outsourcing API production is largely driven by the need for cost efficiency, quality assurance, and rapid access to global markets.

The commercial segment dominated the market, accounting for the highest revenue share of 88% in 2024. This stage involves not only the manufacture of active pharmaceutical ingredients and finished dosage forms but also services such as packaging, labeling, serialization, and global distribution. With pharmaceutical companies increasingly focusing on core competencies like R&D and marketing, CDMOs have become trusted partners in handling the technical and regulatory demands of commercial drug manufacturing. The need for reliable, high-capacity production lines, quality control, and global compliance has led to substantial investment in commercial-scale facilities by CDMOs.]

The clinical segment of the pharmaceutical CDMO market, contract development and manufacturing organizations play a pivotal role in supporting early-stage drug development and clinical trial material production. As pharmaceutical companies work to bring novel therapies through preclinical and clinical testing phases, CDMOs provide crucial services such as formulation development, analytical testing, small-batch manufacturing, and packaging for clinical trials. These services are essential for ensuring that investigational drugs meet regulatory requirements and are delivered efficiently to trial sites across global locations. The growing number of clinical trials and the increasing complexity of drug candidates have created a strong demand for flexible and highly compliant CDMO partners.

By Product

By Workflow

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Pharmaceutical CDMO Market

5.1. COVID-19 Landscape: Pharmaceutical CDMO Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Pharmaceutical CDMO Market, By Product

8.1. Pharmaceutical CDMO Market, by Product

8.1.1 API

8.1.1.1. Market Revenue and Forecast

8.1.2. Drug Product

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Pharmaceutical CDMO Market, By Workflow

9.1. Pharmaceutical CDMO Market, by Workflow

9.1.1. Clinical

9.1.1.1. Market Revenue and Forecast

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Pharmaceutical CDMO Market, By Application

10.1. Pharmaceutical CDMO Market, by Application

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast

10.1.2. Hormonal

10.1.2.1. Market Revenue and Forecast

10.1.3. Glaucoma

10.1.3.1. Market Revenue and Forecast

10.1.4. Cardiovascular Disease

10.1.4.1. Market Revenue and Forecast

10.1.5. Diabetes

10.1.5.1. Market Revenue and Forecast

10.1.6. Others

10.1.6.1. Market Revenue and Forecast

Chapter 11. Global Pharmaceutical CDMO Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Workflow

11.1.3. Market Revenue and Forecast, by Application

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Workflow

11.1.4.3. Market Revenue and Forecast, by Application

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Workflow

11.1.5.3. Market Revenue and Forecast, by Application

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Workflow

11.2.3. Market Revenue and Forecast, by Application

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Workflow

11.2.4.3. Market Revenue and Forecast, by Application

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Workflow

11.2.5.3. Market Revenue and Forecast, by Application

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Workflow

11.2.6.3. Market Revenue and Forecast, by Application

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Workflow

11.2.7.3. Market Revenue and Forecast, by Application

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Workflow

11.3.3. Market Revenue and Forecast, by Application

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Workflow

11.3.4.3. Market Revenue and Forecast, by Application

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Workflow

11.3.5.3. Market Revenue and Forecast, by Application

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Workflow

11.3.6.3. Market Revenue and Forecast, by Application

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Workflow

11.3.7.3. Market Revenue and Forecast, by Application

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Workflow

11.4.3. Market Revenue and Forecast, by Application

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Workflow

11.4.4.3. Market Revenue and Forecast, by Application

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Workflow

11.4.5.3. Market Revenue and Forecast, by Application

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Workflow

11.4.6.3. Market Revenue and Forecast, by Application

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Workflow

11.4.7.3. Market Revenue and Forecast, by Application

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Workflow

11.5.3. Market Revenue and Forecast, by Application

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Workflow

11.5.4.3. Market Revenue and Forecast, by Application

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Workflow

11.5.5.3. Market Revenue and Forecast, by Application

Chapter 12. Company Profiles

12.1. Thermo Fisher Scientific, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Lonza.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Recipharm AB.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Laboratory Corporation of America Holdings (LabCorp).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Catalent, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. WuXi AppTec, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Samsung Biologics.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Piramal Pharma Solutions

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Siegfried Holding AG.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. CordenPharma International

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others