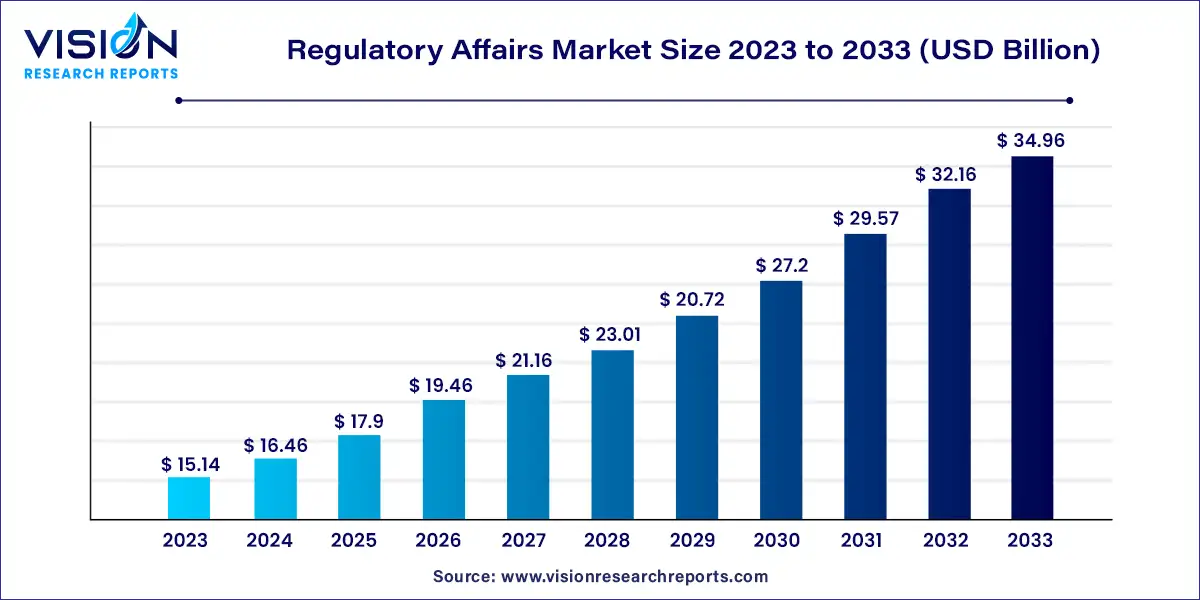

The global regulatory affairs market size was estimated at around USD 15.14 billion in 2023 and it is projected to hit around USD 34.96 billion by 2033, growing at a CAGR of 8.73% from 2024 to 2033.

The growth of the regulatory affairs market is driven by an increasing complexity of healthcare products and technologies necessitates robust regulatory oversight to ensure safety and efficacy. This complexity arises from advancements in areas such as biopharmaceuticals, medical devices, and personalized medicine, driving the need for sophisticated regulatory strategies. Secondly, globalization has expanded the reach of healthcare markets, leading companies to navigate diverse regulatory regimes across multiple jurisdictions. Efforts towards harmonization and mutual recognition agreements aim to streamline these processes.

Based on services, the regulatory writing & publishing segment dominated the market and accounted for the largest revenue share of 37% in 2023. The global market for regulatory affairs can be categorized into regulatory consulting, legal representation, regulatory writing & publishing, product registration & clinical trial applications, and other services. The main drivers of the regulatory writing & publishing segment are increased outsourcing of these services by large- and mid-size biopharmaceutical and medical device companies. Big pharma and medical device companies outsource part of regulatory affairs functions such as regulatory writing and publishing service, which helps them to focus on their core competencies and efficiently manage their internal resources.

The legal representation segment is expected to rise with the fastest CAGR of 9.53% during the forecast period. This is due to the increase in the complexity of regulations in healthcare and the increase in healthcare reforms, especially in emerging regions like the Asia Pacific and MIDDLE EAST & AFRICA.

Based on Categories, the medical device segment dominated the global market and accounted for the maximum share of 41% of the overall revenue in 2023. The segment can be broadly categorized into drugs, biologics, and medical devices. High shares of the medical device segment can be attributed to the increasing outsourcing activities of medical devices by pharmaceutical companies so they can focus on their core competencies. Increasing demand for wearable medical devices, rapid advancements in material sciences, and complexities of drug-device combinations are among factors anticipated to propel the growth of this segment.

The biologics segment is anticipated to witness a stable growth rate of 8.05% during the analysis timeframe. In the biotechnology industry, the product manufacturing process is very critical, as even a slight change in environmental conditions can adversely alter the structure and cells of a biological product. Furthermore, the manufacturing process, facility, and equipment are designed to prevent microbial contamination throughout the process, as a contaminated product can be potentially life-threatening for patients.

The clinical studies product stage segment dominated the global market in 2023 and accounted for the maximum revenue share of 47% of the global revenue. The emergence of new diseases and the rising prevalence of chronic diseases are the key factors that are anticipated to increase the number of clinical trials conducted to meet healthcare needs. These regulations make sure that the clinical studies are carried out transparently and guided so that the trials are authentic and are adequately exposed to humans, and show credible data.

The preclinical product stage segment is expected to register the fastest growth rate of 9.44% during the forecast period. The fastest growth of this segment can be attributed to the increasing demand for novel disease treatments, such as COVID-19, Zika virus, and Ebola, as well as the increasing prevalence of various existing diseases, such as Cardiovascular Diseases (CVDs), cancer, and neurological diseases.

The oncology segment accounted for the maximum revenue share of 33% in 2023. This can be attributed to the high prevalence of cancer, prompting a need for safe and effective treatment options. Furthermore, oncology is one of the most profitable markets for pharmaceutical & biotechnology companies, thereby increasing the R&D projects undertaken by these players. For instance, Merck is focused on improving and expanding its oncology segment. This is reflected in its clinical development initiative involving 700 clinical trials for Keytruda as monotherapy and more than 400 trials with various Keytruda combinations. Hence, growth in anti-cancer therapeutics has simultaneously boosted demand for its quality regulatory services, thus supporting the segment’s growth.

The immunology segment is expected to register the fastest CAGR of 10.36% during the forecast period. The segment's high growth is attributed to its potential to facilitate the treatment of various cardiovascular, neurological, oncological, and inflammatory diseases. This can be attributed to the presence of immune cells throughout the body, as well as the presence of tissue-specific immune cells in organs. The robust immunology pipeline of pharmaceutical and biopharmaceutical companies is anticipated to boost segment growth further.

The in-house segment accounted for a revenue share of 43% in 2023. In-house regulatory affairs function has declined in the past few years and is anticipated to continue declining over the forecast period. Key reasons for the decline include increasing number of small- and medium-scale pharma/biotech/medical device companies, which lack funds and infrastructure to support an in-house regulatory affairs department. Furthermore, these firms find it difficult to hire experienced and technically sound full-time employees as they are emerging companies and have budget constraints. Hence, in-house regulatory affairs department is not preferred by small-scale companies, and they outsource nearly 90% of their regulatory solutions.

The outsourcing segment is expected to register the fastest CAGR of 10.33% during the forecast period. This can be attributed to increasing popularity of these services as outsourcing enables healthcare companies to reduce costs, prioritize strategic projects, reduce staff training time, and improve overall efficiency as well as provides greater flexibility. Availability of various outsourcing models suitable for different company sizes is also anticipated to boost the outsourcing market. For instance, Functional Service Provider (FSP) model is suitable for large biotechnology & pharmaceutical companies, while the hybrid model is generally suitable for medium-sized companies and end-to-end service model is suitable for small-sized companies.

The pharmaceutical companies segment dominated the market in 2023 and accounted for the maximum share of more than 39% of the global revenue. Based on end-uses, the global market for regulatory affairs has been further subdivided into medical device companies, biotechnology companies, and pharmaceutical companies. The pharmaceutical companies segment is also projected to register the fastest growth rate from 2024 to 2033. High growth can be attributed to the increase in the number of approved pharmaceutical products. For instance, as per the U.S. Food and Drug Administration, the year 2021 witnessed the launch of 50 novel drugs. Thus, a rise in the commercialization of new drugs in the U.S. is anticipated to increase the demand for product approval, registration, licensing, and related regulatory services.

Biotechnology companies are estimated to be the second-fastest-growing end-use segment during the forecast period witnessing a stable CAGR of 8.67% from 2024 to 2033. This is due to the high demand for biologics, the rise in investment in manufacturing of biologics, and improvements in infrastructure, which are anticipated to boost the demand for regulatory services, such as audit & validation, quality & assurance, GMP practices, BLA filings, and patent filings.

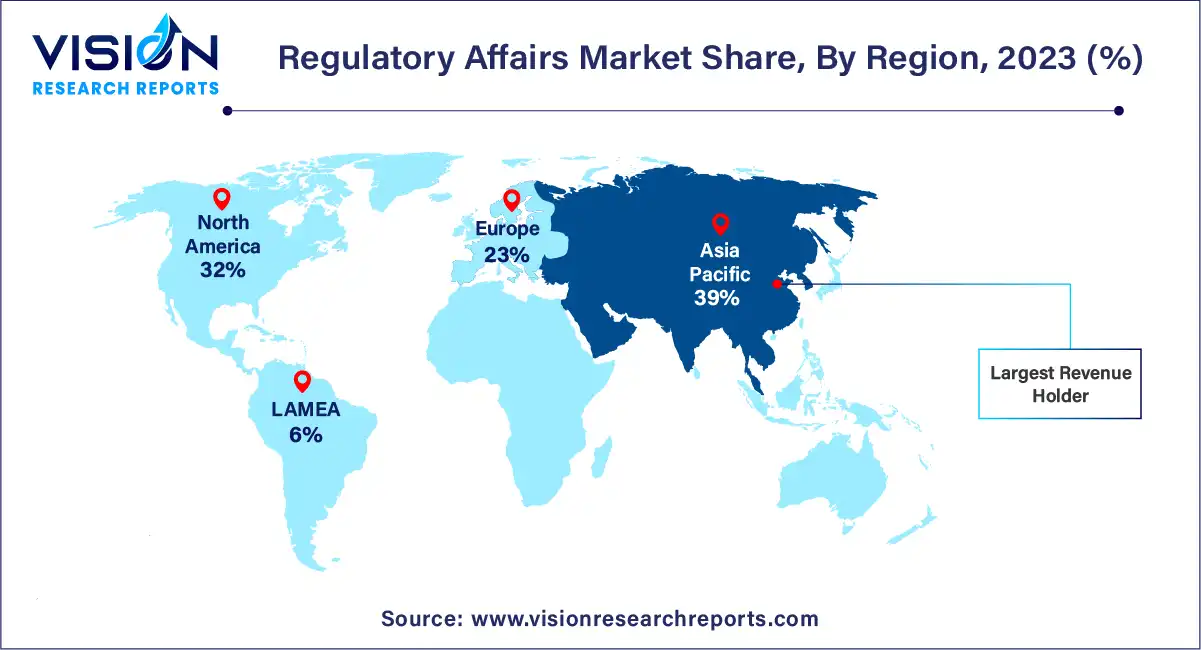

The Asia Pacific dominated the market & accounted for the largest revenue share of more than 39% in 2023. The region is anticipated to expand further at the fastest CAGR from 2024 to 2033 owing to the improved regulatory landscape, cost savings, growing number of clinical trials conducted in the region, and an increasing number of biopharmaceutical companies venturing into the region. Furthermore, the availability of a skilled workforce within the region at a lower cost compared to the U.S. is another factor expected to propel market growth. Rising demand for biosimilars and medical devices is also expected to contribute to the growth of the biopharmaceutical and medical devices market within the region.

North America is projected to witness a considerable CAGR of 8.83% from 2024 to 2033. This region has the most outstanding regulatory system in the world. The main driving factors for this market are a rise in biologics approvals; an increase in outsourcing of regulatory affairs services by large biopharmaceuticals; and growing R&D expenditure. North America is known to have one of the most stringent regulatory systems in the world. There has been a tremendous increase in the approval of biologics, which accounted for 39.0% of total new drug approvals in 2021, and this indicates the growing pipeline of biotechnology products.

By Services

By Categories

By Indication

By Product Stage

By Service Provider

By Company Size

By End-use

By Region

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Regulatory Affairs Market, By Service

7.1. Regulatory Affairs Market, by Service, 2024-2033

7.1.1. Regulatory consulting

7.1.1.1. Market Revenue and Forecast (2021-2033)

7.1.2. Legal representation

7.1.2.1. Market Revenue and Forecast (2021-2033)

7.1.3. Regulatory writing & publishing

7.1.3.1. Market Revenue and Forecast (2021-2033)

7.1.4. Product registration & clinical trial applications

7.1.4.1. Market Revenue and Forecast (2021-2033)

7.1.5. Other services

7.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 8. Global Regulatory Affairs Market, By Categories

8.1. Regulatory Affairs Market, by Categories, 2024-2033

8.1.1. Drugs

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Biologics

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Medical devices

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Regulatory Affairs Market, By Indication

9.1. Regulatory Affairs Market, by Indication, 2024-2033

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Neurology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cardiology

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Immunology

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Regulatory Affairs Market, By Product Stage

10.1. Regulatory Affairs Market, by Product Stage, 2024-2033

10.1.1. Preclinical

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Clinical

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. PMA

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Regulatory Affairs Market, By End-use

11.1. Regulatory Affairs Market, by End-use, 2024-2033

11.1.1. Medical Device Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. BioService Provider Companies

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Pharmaceutical Companies

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Regulatory Affairs Market, By Service Provider

12.1. Regulatory Affairs Market, by Service Provider, 2024-2033

12.1.1. In-house

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Outsourced

12.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Regulatory Affairs Market, By Company Size

13.1. Regulatory Affairs Market, by Company Size, 2024-2033

13.1.1. Small

13.1.1.1. Market Revenue and Forecast (2021-2033)

13.1.2. Medium

13.1.2.1. Market Revenue and Forecast (2021-2033)

13.1.3. Large

13.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 14. Global Regulatory Affairs Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Service (2021-2033)

14.1.2. Market Revenue and Forecast, by Categories (2021-2033)

14.1.3. Market Revenue and Forecast, by Indication (2021-2033)

14.1.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.1.5. Market Revenue and Forecast, by End-use (2021-2033)

14.1.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.1.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.1.8. U.S.

14.1.8.1. Market Revenue and Forecast, by Service (2021-2033)

14.1.8.2. Market Revenue and Forecast, by Categories (2021-2033)

14.1.8.3. Market Revenue and Forecast, by Indication (2021-2033)

14.1.8.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.1.8.5. Market Revenue and Forecast, by End-use (2021-2033)

14.1.8.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.1.8.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Service (2021-2033)

14.1.9.2. Market Revenue and Forecast, by Categories (2021-2033)

14.1.9.3. Market Revenue and Forecast, by Indication (2021-2033)

14.1.9.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.1.9.5. Market Revenue and Forecast, by End-use (2021-2033)

14.1.9.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.1.9.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.2. Europe

14.2.1. Market Revenue and Forecast, by Service (2021-2033)

14.2.2. Market Revenue and Forecast, by Categories (2021-2033)

14.2.3. Market Revenue and Forecast, by Indication (2021-2033)

14.2.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.2.5. Market Revenue and Forecast, by End-use (2021-2033)

14.2.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.2.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Service (2021-2033)

14.2.8.2. Market Revenue and Forecast, by Categories (2021-2033)

14.2.8.3. Market Revenue and Forecast, by Indication (2021-2033)

14.2.8.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.2.8.5. Market Revenue and Forecast, by End-use (2021-2033)

14.2.8.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.2.8.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.2.9. Germany

14.2.9.1. Market Revenue and Forecast, by Service (2021-2033)

14.2.9.2. Market Revenue and Forecast, by Categories (2021-2033)

14.2.9.3. Market Revenue and Forecast, by Indication (2021-2033)

14.2.9.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.2.9.5. Market Revenue and Forecast, by End-use (2021-2033)

14.2.9.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.2.9.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.2.10. France

14.2.10.1. Market Revenue and Forecast, by Service (2021-2033)

14.2.10.2. Market Revenue and Forecast, by Categories (2021-2033)

14.2.10.3. Market Revenue and Forecast, by Indication (2021-2033)

14.2.10.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.2.10.5. Market Revenue and Forecast, by End-use (2021-2033)

14.2.10.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.2.10.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.2.11. Rest of Europe

14.2.11.1. Market Revenue and Forecast, by Service (2021-2033)

14.2.11.2. Market Revenue and Forecast, by Categories (2021-2033)

14.2.11.3. Market Revenue and Forecast, by Indication (2021-2033)

14.2.11.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.2.11.5. Market Revenue and Forecast, by End-use (2021-2033)

14.2.11.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.2.11.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.3. APAC

14.3.1. Market Revenue and Forecast, by Service (2021-2033)

14.3.2. Market Revenue and Forecast, by Categories (2021-2033)

14.3.3. Market Revenue and Forecast, by Indication (2021-2033)

14.3.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.3.5. Market Revenue and Forecast, by End-use (2021-2033)

14.3.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.3.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.3.8. India

14.3.8.1. Market Revenue and Forecast, by Service (2021-2033)

14.3.8.2. Market Revenue and Forecast, by Categories (2021-2033)

14.3.8.3. Market Revenue and Forecast, by Indication (2021-2033)

14.3.8.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.3.8.5. Market Revenue and Forecast, by End-use (2021-2033)

14.3.8.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.3.8.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.3.9. China

14.3.9.1. Market Revenue and Forecast, by Service (2021-2033)

14.3.9.2. Market Revenue and Forecast, by Categories (2021-2033)

14.3.9.3. Market Revenue and Forecast, by Indication (2021-2033)

14.3.9.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.3.9.5. Market Revenue and Forecast, by End-use (2021-2033)

14.3.9.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.3.9.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.3.10. Japan

14.3.10.1. Market Revenue and Forecast, by Service (2021-2033)

14.3.10.2. Market Revenue and Forecast, by Categories (2021-2033)

14.3.10.3. Market Revenue and Forecast, by Indication (2021-2033)

14.3.10.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.3.10.5. Market Revenue and Forecast, by End-use (2021-2033)

14.3.10.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.3.10.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.3.11. Rest of APAC

14.3.11.1. Market Revenue and Forecast, by Service (2021-2033)

14.3.11.2. Market Revenue and Forecast, by Categories (2021-2033)

14.3.11.3. Market Revenue and Forecast, by Indication (2021-2033)

14.3.11.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.3.11.5. Market Revenue and Forecast, by End-use (2021-2033)

14.3.11.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.3.11.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.4. MEA

14.4.1. Market Revenue and Forecast, by Service (2021-2033)

14.4.2. Market Revenue and Forecast, by Categories (2021-2033)

14.4.3. Market Revenue and Forecast, by Indication (2021-2033)

14.4.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.4.5. Market Revenue and Forecast, by End-use (2021-2033)

14.4.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.4.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.4.8. GCC

14.4.8.1. Market Revenue and Forecast, by Service (2021-2033)

14.4.8.2. Market Revenue and Forecast, by Categories (2021-2033)

14.4.8.3. Market Revenue and Forecast, by Indication (2021-2033)

14.4.8.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.4.8.5. Market Revenue and Forecast, by End-use (2021-2033)

14.4.8.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.4.8.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.4.9. North Africa

14.4.9.1. Market Revenue and Forecast, by Service (2021-2033)

14.4.9.2. Market Revenue and Forecast, by Categories (2021-2033)

14.4.9.3. Market Revenue and Forecast, by Indication (2021-2033)

14.4.9.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.4.9.5. Market Revenue and Forecast, by End-use (2021-2033)

14.4.9.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.4.9.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.4.10. South Africa

14.4.10.1. Market Revenue and Forecast, by Service (2021-2033)

14.4.10.2. Market Revenue and Forecast, by Categories (2021-2033)

14.4.10.3. Market Revenue and Forecast, by Indication (2021-2033)

14.4.10.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.4.10.5. Market Revenue and Forecast, by End-use (2021-2033)

14.4.10.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.4.10.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.4.11. Rest of MEA

14.4.11.1. Market Revenue and Forecast, by Service (2021-2033)

14.4.11.2. Market Revenue and Forecast, by Categories (2021-2033)

14.4.11.3. Market Revenue and Forecast, by Indication (2021-2033)

14.4.11.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.4.11.5. Market Revenue and Forecast, by End-use (2021-2033)

14.4.11.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.4.11.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Service (2021-2033)

14.5.2. Market Revenue and Forecast, by Categories (2021-2033)

14.5.3. Market Revenue and Forecast, by Indication (2021-2033)

14.5.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.5.5. Market Revenue and Forecast, by End-use (2021-2033)

14.5.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.5.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.5.8. Brazil

14.5.8.1. Market Revenue and Forecast, by Service (2021-2033)

14.5.8.2. Market Revenue and Forecast, by Categories (2021-2033)

14.5.8.3. Market Revenue and Forecast, by Indication (2021-2033)

14.5.8.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.5.8.5. Market Revenue and Forecast, by End-use (2021-2033)

14.5.8.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.5.8.7. Market Revenue and Forecast, by Service Provider (2021-2033)

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Service (2021-2033)

14.5.9.2. Market Revenue and Forecast, by Categories (2021-2033)

14.5.9.3. Market Revenue and Forecast, by Indication (2021-2033)

14.5.9.4. Market Revenue and Forecast, by Product Stage (2021-2033)

14.5.9.5. Market Revenue and Forecast, by End-use (2021-2033)

14.5.9.6. Market Revenue and Forecast, by Company Size (2021-2033)

14.5.9.7. Market Revenue and Forecast, by Service Provider (2021-2033)

Chapter 15. Company Profiles

15.1. Accell Clinical Research, LLC.

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. GenPact Ltd.

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. Criterium, Inc.

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. PRA Health Sciences

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Promedica International

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. WuXiAppTec, Inc.

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Medpace

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Pharmaceutical Product Development, LLC (PPD)

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Charles River Laboratories International, Inc.

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. ICON plc

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

15.11. Covance

15.11.1. Company Overview

15.11.2. Product Offerings

15.11.3. Financial Performance

15.11.4. Recent Initiatives

15.12. Parexel International Corporation, Inc.

15.12.1. Company Overview

15.12.2. Product Offerings

15.12.3. Financial Performance

15.12.4. Recent Initiatives

15.13. Freyr

15.13.1. Company Overview

15.13.2. Product Offerings

15.13.3. Financial Performance

15.13.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others