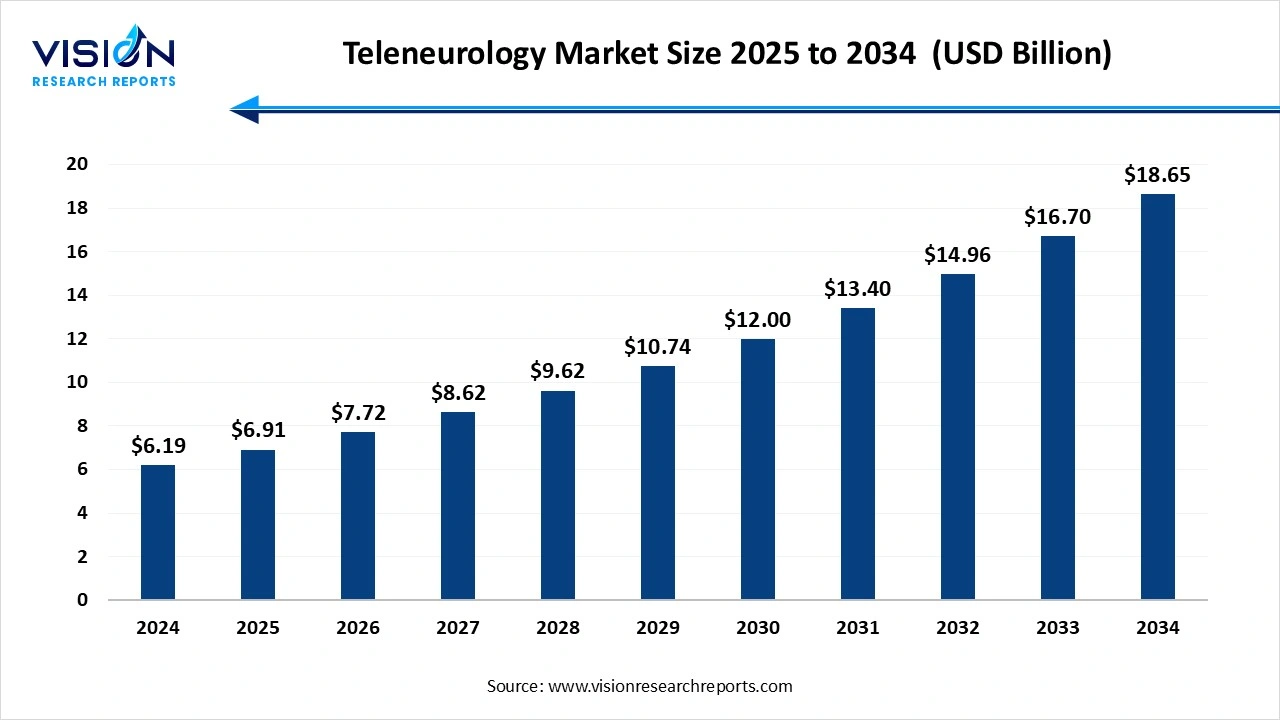

The global teleneurology market size was valued at USD 6.19 billion in 2024 and is expected to grow from USD 6.91 billion in 2025 to around USD 18.65 billion by 2034, expanding at a CAGR of 11.66% during the forecast period. The market growth is driven by the increasing prevalence of neurological disorders and the growing demand for remote healthcare services, the electric teleneurology market is witnessing robust growth.

The global teleneurology market has witnessed significant growth in recent years due to increasing demand for remote neurological consultations and the rising prevalence of neurological disorders such as stroke, epilepsy, multiple sclerosis and Parkinson’s disease. Teleneurology enables patients to access specialized neurological care regardless of geographic barriers, offering timely diagnosis, treatment and follow-up through telecommunication technologies. This model has proven especially effective in rural and under developed regions, where access to neurologists is often limited.

One of the primary growth factors driving the teleneurology market is the increasing prevalence of neurological disorders globally. Conditions such as stroke, dementia, epilepsy, and Parkinson’s disease are on the rise, creating a strong demand for accessible and timely neurological care. Teleneurology provides a practical solution by allowing specialists to consult with patients remotely, reducing the need for in-person visits, especially in rural or underserved areas.

Another key driver is the rapid advancement in digital health technologies and healthcare IT infrastructure. High-speed internet, secure video conferencing tools, electronic health records (EHRs), and mobile health apps have made virtual consultations more seamless and effective. Additionally, supportive government policies, reimbursement reforms, and growing awareness of telehealth benefits are encouraging healthcare providers to integrate teleneurology into their services.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.19 billion |

| Revenue Forecast by 2034 | USD 18.65 billion |

| Growth rate from 2025 to 2034 | CAGR of 11.66% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Amwell (American Well Corporation), Teladoc Health Inc., Koninklijke Philips N.V., Medtronic plc, Cerner Corporation, Neurovative Diagnostics, GlobalMed, and SOC Telemed (now part of Access TeleCare). |

Growing Prevalence of Neurological Disorders

The escalating global burden of neurological disorders is a primary driver for teleneurology market’s growth. This market encompasses conditions ranging from migraine and epilepsy to more complex disorders such as multiple sclerosis and neurodegenerative diseases. Stroke incidence particularly drives teleneurology adoption due to time-critical treatment requirements. It also enables rapid specialist consultation during acute stroke episodes, facilitating timely thrombolytic therapy decisions.

Government-led healthcare digitization programs worldwide also help create favorable conditions for market expansion. These investments support broadband connectivity improvements, electronic health record standardization and interoperability frameworks essential for teleneurology implementation, thus propelling the market forward.

Regulatory Framework and Limited Access

One of the major challenges faced by the teleneurology market is the lack of standardized regulatory frameworks and reimbursement policies across various regions. Despite the growing adoption of telehealth, there is still inconsistency regarding data privacy, licensing and cross-border consultations, this often creates barriers for providers. Many healthcare systems still lack clear guidelines regarding billing and compensation related to virtual neurology services, making it difficult for practitioners to sustainably offer remote care.

Another such challenge is the digital inadequacy that limits access to teleneurology services, especially in rural or under developed areas. Patients without reliable internet connections, appropriate digital devices or technical literacy struggle to participate in virtual consultations, which can impact diagnostic accuracy in complex cases. This in turn, slows down market growth and development.

Technological Advancements and Partnerships

Technological advancements are opening up new opportunities in the market, with artificial intelligence, machine learning and predictive analytics playing vital roles. AI algorithms and tools are now being developed to detect early signs of neurological deterioration, enabling proactive interventions. Wearable devices, remote monitoring systems and mobile applications are also gaining traction, allowing real-time tracking of critical patient health parameters such as brain activity, motor functions and sleep patterns. The growing emphasis on patient-centered care is further encouraging the development of customizable platforms that are able to cater to individual neurological conditions, treatment schedules and rehabilitation programs.

Strategic partnerships between technology providers, hospitals and research institutions are also boosting the market as well as fostering innovation in telehealth solutions. The market is also witnessing increased adoption of hybrid care models, combining in-person visits with remote monitoring and consultations, thus enhancing treatment continuity and patient engagement.

North America led the teleneurology market, capturing a revenue share of 34% in 2024. This dominance is primarily driven by advanced healthcare infrastructure, high adoption of digital health technologies and a well-established reimbursement framework. The United States, in particular, has seen rapid integration of telehealth services across both public and private healthcare sectors. The presence of leading telemedicine companies and continuous investment in healthcare IT has further supported the growth of teleneurology in this region.

Asia Pacific is experiencing the fastest growth as of this year, fueled by rising healthcare digitization, growing awareness of neurological health, and expanding internet penetration. Countries like China, India and Japan are investing heavily in telehealth infrastructure in order to bridge the gap in specialist care, especially in rural areas. Government initiatives promoting telemedicine adoption and the increasing number of smartphone users is enabling broader access to neurological services, pushing the market forward.

Which application dominated the market in 2024?

The stroke segment led the market, accounting for the highest revenue share of 30% in 2024. The teleneurology market offers a valuable solution for managing stroke cases, particularly in remote or underserved regions where access to neurologists may be limited. Through telestroke programs, emergency departments can connect with specialists in real time to assess patients, interpret brain imaging and make rapid treatment decisions such as the administration of thrombolytics.

The Epilepsy segment is expected to witness the fastest growth. This is because epilepsy affects approximately 50 million people globally according to recent WHO statistics. Remote monitoring capabilities allow neurologists to track seizure patterns, medication compliance and treatment efficacy without requiring frequent in-person visits. This proves particularly valuable for pediatric epilepsy patients, where consistent monitoring is crucial for developmental outcomes.

Which service led the market as of this year?

The tele-consulting segment held the largest share of the market by services, contributing 46% to the overall revenue in 2024. This service has become increasingly essential for both acute and chronic neurological conditions, offering timely access to expert opinions without the need for in-person visits. Patients suffering from disorders such as migraines, epilepsy, multiple sclerosis and Parkinson’s disease can receive regular consultations, medication adjustments and care recommendations from specialists through secure video platforms.

The tele-monitoring segment is expected to register the fastest growth during the forecast period. This service is particularly beneficial for managing chronic conditions, as it allows neurologists to track symptoms, medication adherence and disease progression in real time. Wearable technologies and mobile apps collect critical data such as motor function, sleep patterns or seizure activity, which can be later analyzed to optimize treatment plans.

Which end user held the largest market share in 2024?

The providers segment accounted for the largest market share, contributing 54% to the total revenue in 2024. Hospitals, specialty clinics and telehealth service organizations are increasingly adopting teleneurology platforms to enhance their clinical capabilities, particularly in neurology departments facing workforce shortages. Providers benefit from the ability to offer consultations, diagnostics and follow-up care to patients without geographic limitations, improving access to expert opinions and accelerating treatment decisions.

The patients segment is projected to experience the fastest growth rate throughout the forecast period. The increasing awareness and acceptance of virtual healthcare coupled with the its convenience has driven patient engagement in remote neurology services. Individuals dealing with chronic neurological disorders, mobility limitations or living in remote areas find this segment advantageous for regular follow-ups and symptom management. The use of mobile applications, wearable health devices and secure video platforms has further empowered patients to take a more active role in their neurological care, fostering better health outcomes and enhancing their overall experience with healthcare systems.

By Application

By Service

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Teleneurology Market

5.1. COVID-19 Landscape: Teleneurology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Teleneurology Market, By Application

8.1. Teleneurology Market, by Application

8.1.1 Stroke

8.1.1.1. Market Revenue and Forecast

8.1.2. Parkinson

8.1.2.1. Market Revenue and Forecast

8.1.3. Epilipesy

8.1.3.1. Market Revenue and Forecast

8.1.4. Headache

8.1.4.1. Market Revenue and Forecast

8.1.5. Multiple sclerosis

8.1.5.1. Market Revenue and Forecast

8.1.6 Dementia

8.1.6.1. Market Revenue and Forecast

8.1.7. Others

8.1.7.1. Market Revenue and Forecast

Chapter 9. Global Teleneurology Market, By Service

9.1. Teleneurology Market, by Service

9.1.1. Tele-Consulting

9.1.1.1. Market Revenue and Forecast

9.1.2. Tele-Monitoring

9.1.2.1. Market Revenue and Forecast

9.1.3. Tele-Education

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Teleneurology Market, By End Use

10.1. Teleneurology Market, by End Use

10.1.1. Patients

10.1.1.1. Market Revenue and Forecast

10.1.2. Providers

10.1.2.1. Market Revenue and Forecast

10.1.3. Payers

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Teleneurology Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Application

11.1.2. Market Revenue and Forecast, by Service

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Application

11.1.4.2. Market Revenue and Forecast, by Service

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Application

11.1.5.2. Market Revenue and Forecast, by Service

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Application

11.2.2. Market Revenue and Forecast, by Service

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Application

11.2.4.2. Market Revenue and Forecast, by Service

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Application

11.2.5.2. Market Revenue and Forecast, by Service

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Application

11.2.6.2. Market Revenue and Forecast, by Service

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Application

11.2.7.2. Market Revenue and Forecast, by Service

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Application

11.3.2. Market Revenue and Forecast, by Service

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Application

11.3.4.2. Market Revenue and Forecast, by Service

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Application

11.3.5.2. Market Revenue and Forecast, by Service

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Application

11.3.6.2. Market Revenue and Forecast, by Service

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Application

11.3.7.2. Market Revenue and Forecast, by Service

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Application

11.4.2. Market Revenue and Forecast, by Service

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Application

11.4.4.2. Market Revenue and Forecast, by Service

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Application

11.4.5.2. Market Revenue and Forecast, by Service

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Application

11.4.6.2. Market Revenue and Forecast, by Service

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Application

11.4.7.2. Market Revenue and Forecast, by Service

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Application

11.5.2. Market Revenue and Forecast, by Service

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Application

11.5.4.2. Market Revenue and Forecast, by Service

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Application

11.5.5.2. Market Revenue and Forecast, by Service

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1 Amwell (American Well Corporation)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Teladoc Health Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Koninklijke Philips N.V.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Medtronic plc

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cerner Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Neurovative Diagnostics

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. GlobalMed

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. SOC Telemed (now part of Access TeleCare)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others