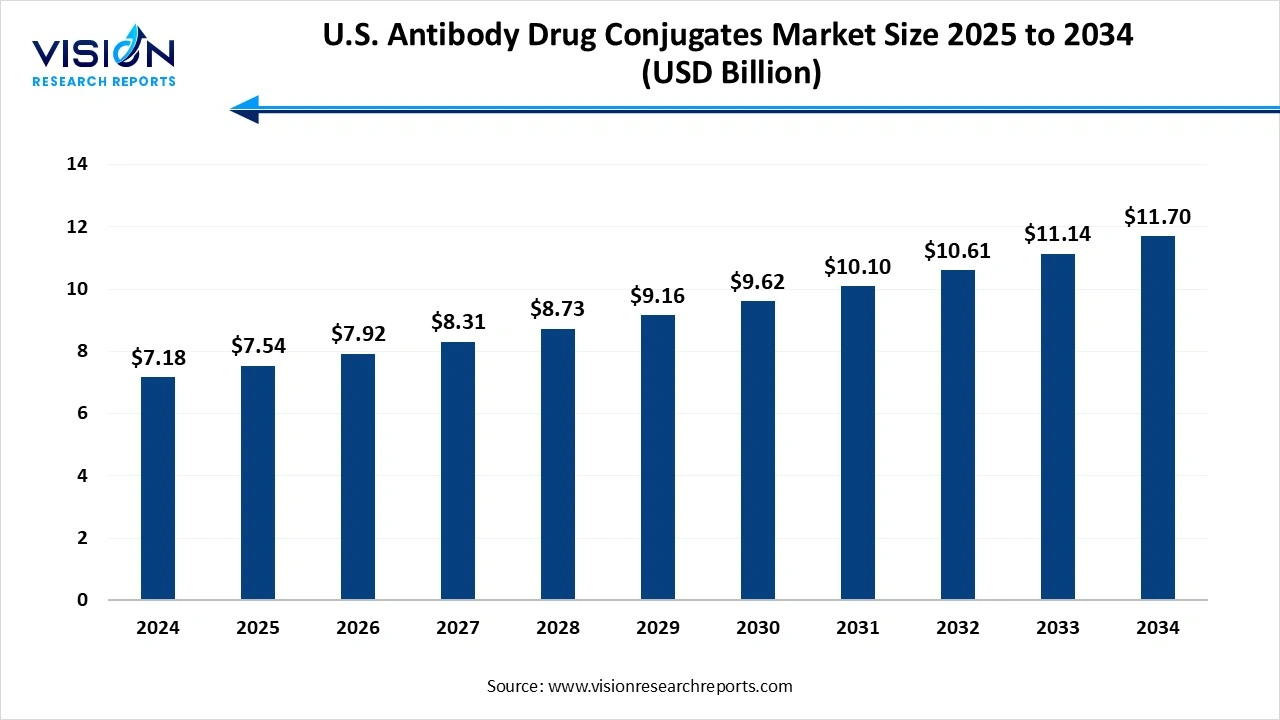

The U.S. antibody drug conjugates market size was worth USD 7.18 billion in 2024 and is estimated to reach USD 7.54 billion in 2025 to reach USD 11.70 billion by 2034, growing at a CAGR of 5% over the forecast period. The increasing prevalence of cancer and R&D activities in development. The increase in demand for targeted therapies, experiencing robust growth.

The U.S. antibody drug conjugates market comprises an investment in targeted cancer therapies and development in biopharmaceutical research. This component acts as a guidance system, a lab-made antibody designed to specifically bind to a unique protein found on the surface of cancer cells. Minimizing damage to healthy tissue, the increasing prevalence of cancer in the U.S., growing demand for precision medicine drive the adoption of antibody drug conjugates in oncology treatment protocols. The antibody drug conjugation can deliver to highly potent cytotoxic drug that might be too toxic to be administered systemically on its own, and it can treat various types of cancer.

In the U.S region, the increasing prevalence of cancer treatment, such as breast cancer, lymphoma, and leukemia, expansion of demand for innovative and targeted therapies, such as ADCs. The innovations in the antibody drug conjugates design, surrounding improved linkers, more potent payloads, and enhanced antibody engineering, lead to ADCs with better efficiency and reduced side effects, further fuelling their adoption. The significant innovations in research and development in pharmaceutical companies and research institutions are leading to the discovery and development of new ADC candidates, driving the market growth. The increased demand for targeted approach treatment, delivering potent cytotoxic drugs directly to cancer cells while minimizing harm to healthy tissues.

Promising Clinical Trial Results: Clinical trial successes, such as the demonstration of improved progression-free survival and overall survival for ADCs compared to standard care in various cancers, increase confidence in these therapies. For instance, Enhertu demonstrated a 72% reduction in tumor progression or death risk in the phase 3 DESTINY-Breast03 trial for HER2-positive metastatic breast cancer compared to standard of care.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.18 billion |

| Revenue Forecast by 2034 | USD 11.70 billion |

| Growth rate from 2025 to 2034 | CAGR of 5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered |

ADC Therapeutics SA, Takeda Pharmaceutical Company Ltd., Astellas Pharma, Inc., AstraZeneca Plc, GlaxoSmithKline Plc, F. Hoffmann-La Roche Ltd., Daiichi Sankyo Company Ltd., Pfizer, Inc., Gilead Sciences, Inc., Sutro Biopharma |

The rise in the number of cases in the U.S. region, according to the National Cancer Institute, with estimated to be 2,041,910 new cancer cases diagnosed in the US in 2025. The increasing number of cancer patients creates a substantial demand for more effective and targeted treatment options, especially for those who have failed or are refractory to traditional chemotherapy or other therapies. The ADC's ability to target cancer cells and protectively addresses this growing need. (Source: NIH National Cancer Institude)

High Development Cost and Drug Resistance, and Toxicity of the U.S. Antibody Drug Conjugates Market

The requirement of specialized manufacturing significantly increases development cost. This process involves conjugating a cytotoxic payload to an antibody using a linker that demands strict conditions and expertise. Managing large-scale production batches is a major challenge, leading to potential quality control and regulatory issues. The cancer cells can develop resistance to ADCs through mechanisms like diminished antigen expression, disrupted drug trafficking, dysfunctional lysosomal processing, and increased efflux pump activity. Common severe side effects include hematotoxicity, hepatotoxicity, gastrointestinal reactions, and interstitial lung disease (ILD), which can be dose-limiting and impact treatment adherence.

The U.S. is a major contributor to the U.S. antibody drug conjugates market. The FDA has approved a growing number of ADCs, signalling both their clinical value and the efficacy of these therapies. Clinical trials are expanding beyond established targets like HER2 to newer targets such as HER3, CD70, and TROP2, indicating a broadening scope of application. The robust investment in strategic collaboration, such as AstraZeneca and Daiichi Sankyo for Enhertu development and commercialization, and BioNTech's licensing deal with Duality Biologics, demonstrates the drive to accelerate innovation and market expansion.

The breast cancer segment led the market, accounting for a 49% share of the total revenue in 2024. Breast cancer is the most common cancer in this region, number of cases included and diagnosed annually. This high rate of incidence naturally leads to rising demand for effective treatment options, including ADCs. The widespread use of Kadcyla and Enhertu, specifically targeting HER2-positive breast cancer, has shown superior efficacy and tolerability compared to conventional chemotherapy. The increase in research and development infrastructure for ADCs, with numerous companies actively working on improving ADC technology and developing new therapies for different cancer types, drives the market growth.

The urothelial and bladder cancer U.S. antibody drug conjugates segment is the fastest-growing in the market during the forecast period. The increase in high unmet medical need for the standard treatments for advanced and metastatic urothelial carcinoma, such as chemotherapy and immune checkpoint inhibitors, offers long-term benefits and significant opportunities. The increasing prevalence of bladder cancer, particularly in the aging population and smokers, is increasing, leading to a larger patient pool requiring advanced treatment options.

The kadcyla segment held the largest revenue share in the U.S. antibody drug conjugates market in 2024. The Kadcyla's early FDA approval positioned it as a standard treatment option for HER2-positive metastatic breast cancer and, later, for early-stage breast cancer patients with residual disease after neoadjuvant therapy. The widespread adoption and proven clinical outcomes, and its major role as a preferred treatment option, especially for patients with residual disease following neoadjuvant therapy. The rising incidence of HER2-positive breast cancer, and uses a noclevable of linker that prevents premature drug release in the bloodstream, enhancing its stability and safety profile.

The enhertu segment is experiencing the fastest growth in the market during the forecast period. The Enhertu has shown promising results in treating HER2-low metastatic breast cancer and other solid tumors, offering a new treatment option for patients who have previously undergone other therapies. The increasing number of cancer cases in this region drives the market growth. The ADCs are rising in use in various cancer types, such as breast cancer, lung cancer, and bladder cancer. These applications expand the market growth. The innovations towards technology, the development of more efficient linkers and payload delivery systems, are fuelling the market growth.

The HER2 segment dominated the U.S. antibody drug conjugates market in 2024. The discovery of HER2's genetic link to breast cancer led to the development of targeted therapies such as trastuzumab, the first FDA-approved anti-HER2 monoclonal antibody, which drastically improved patient outcomes. The technological advancement in ADC design. Example, T-DXd's cleavable linker and membrane-permeable payload enable a bystander effect, allowing the payload to diffuse and kill nearby cancer cells regardless of their HER2 expression levels, addressing tumor heterogeneity and expanding treatment options for patients with HER2-low tumors.

The CD22 segment is the fastest-growing in the market during the forecast period. The increasing incidence of hematological cancers and the need for more precise, less toxic therapies are key drivers of CD22-targeting ADC development in the U.S. market. It's targeted approaches to cancer treatment and fever and less severe side effects compared to traditional chemotherapy, making them a more appealing treatment option. The increasing cancer evidence in these regions, such as leukemia, is raising the demand for effective and targeted therapies in ADCs.

The FDA approval of the CD22-targeted ADC, Inotuzumab ozogamicin, for relapsed or refractory B-cell acute lymphoblastic leukemia (B-ALL), further validates the clinical potential of this approach and drives market expansion. This approval was recently expanded to include pediatric patients aged 1 year and older.

For example, a study exploring the efficacy of an anti-CD22 ADC with a seco-CBI-dimer payload (thio-Hu anti–CD22-(LC: K149C)-SN36248) found that it was effective in xenograft models resistant to another anti-CD22 ADC (pinatuzumab vedotin), yielded a longer duration of response, and exhibited a different mechanism of resistance. This suggests the potential for developing even more effective CD22 ADCs with tailored payloads and linkers.

The leavable linker technology segment dominated the U.S. antibody drug conjugates market in 2024. The primary function of the linker is to maintain the stability of the ACD in the bloodstream. This stability minimizes systemic toxicity and damage to healthy cells, improving patient safety. The improvement in technology, resulting in more stable ADCs and efficient payload release, directly contributes to a wider therapeutic index. The evaluation of linker chemistry, including the development of cleavage and non-cleavable linkers, has been a driving force behind the advancement of ADCs, driving the market growth.

The payload technology segment is the fastest-growing in the market during the forecast period. The payload refers to the cytotoxic agent that is attached to the antibody via a linker and is responsible for killing the cancer cells once the ADC is taken into the targeted tumor cells. The advances in payload technology have expanded the range of options beyond microtubule inhibitors, introducing highly potent cytotoxins such as DNA-damaging agents and topoisomerase inhibitors. These newer payloads offer several benefits.

By Application

By Product

By Target

By Technology

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Antibody Drug Conjugates Market

5.1. COVID-19 Landscape: U.S. Antibody Drug Conjugates Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8.

U.S. Antibody Drug Conjugates Market, By Application

8.1. U.S. Antibody Drug Conjugates Market, by Application

8.1.1. Blood Cancer

8.1.1.1. Market Revenue and Forecast

8.1.2. Breast Cancer

8.1.2.1. Market Revenue and Forecast

8.1.3. Urothelial Cancer & Bladder Cancer

8.1.3.1. Market Revenue and Forecast

8.1.4. Other Cancer

8.1.4.1. Market Revenue and Forecast

Chapter 9. U.S. Antibody Drug Conjugates Market, By Product

9.1. U.S. Antibody Drug Conjugates Market, by Product

9.1.1. Kadcyla

9.1.1.1. Market Revenue and Forecast

9.1.2. Enhertu

9.1.2.1. Market Revenue and Forecast

9.1.3. Adcetris

9.1.3.1. Market Revenue and Forecast

9.1.4. Padcev

9.1.4.1. Market Revenue and Forecast

9.1.5. Polivy

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. U.S. Antibody Drug Conjugates Market, By Target

10.1. U.S. Antibody Drug Conjugates Market, by Target

10.1.1. HER2

10.1.1.1. Market Revenue and Forecast

10.1.2. CD22

10.1.2.1. Market Revenue and Forecast

10.1.3. CD30

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. U.S. Antibody Drug Conjugates Market, By Technology

11.1. U.S. Antibody Drug Conjugates Market, by Technology

11.1.1. Type

11.1.1.1. Market Revenue and Forecast

11.1.2. Linker Technology Type

11.1.2.1. Market Revenue and Forecast

11.1.3. Payload Technology

11.1.3.1. Market Revenue and Forecast

Chapter 12. U.S. Antibody Drug Conjugates Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Application

12.1.2. Market Revenue and Forecast, by Product

12.1.3. Market Revenue and Forecast, by Target

12.1.4. Market Revenue and Forecast, by Technology

Chapter 13. Company Profiles

13.1. Takeda Pharmaceutical Company Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AstraZeneca Plc

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. F. Hoffmann-La Roche Ltd.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Pfizer, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Gilead Sciences, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Daiichi Sankyo Company Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. GlaxoSmithKline Plc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Astellas Pharma, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. ADC Therapeutics SA

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others