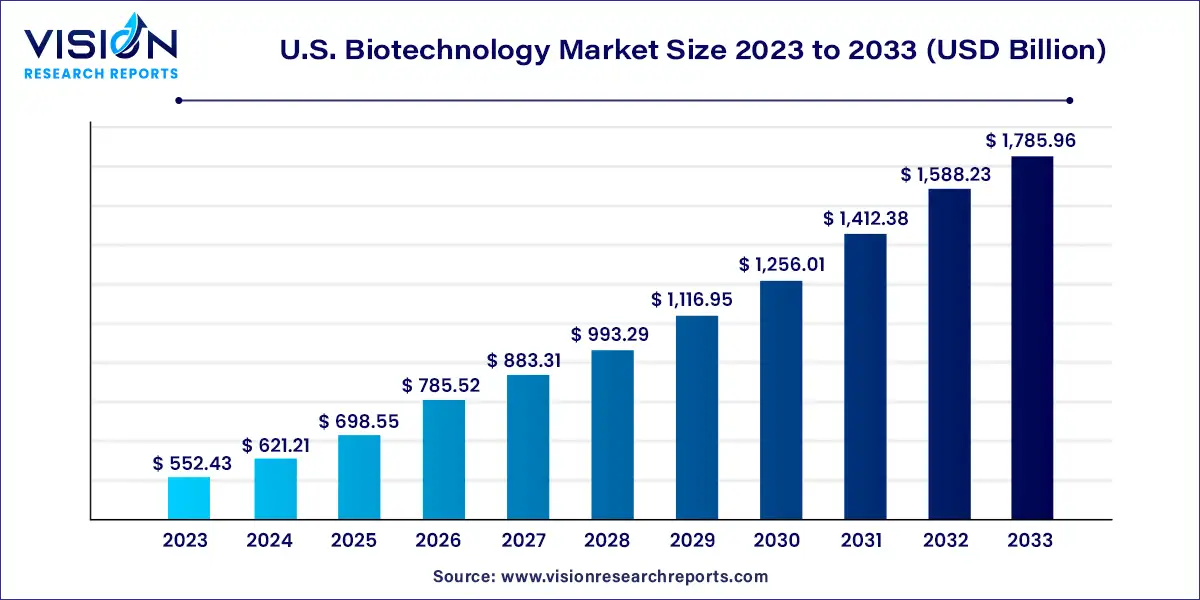

The U.S. biotechnology market size was valued at USD 552.43 billion in 2023 and is anticipated to reach around USD 1,785.96 billion by 2033, growing at a CAGR of 12.45% from 2024 to 2033.

The U.S. biotechnology market presents a dynamic landscape characterized by innovation, research, and commercialization of cutting-edge technologies. It encompasses a broad spectrum of industries, including pharmaceuticals, healthcare, agriculture, and environmental sciences, all driven by advancements in biology, genetics, and related disciplines.

One of the defining features of the U.S. biotechnology market is its robust ecosystem of biotech companies, research institutions, and academic centers. These entities collaborate to develop novel therapies, diagnostics, and solutions to address various challenges in human health, agriculture, and the environment

The growth of the U.S. biotechnology market is propelled by an advancements in molecular biology, genetics, and bioinformatics drive innovation and enable the development of novel therapies, diagnostics, and agricultural solutions. Secondly, increasing demand for personalized medicine and precision healthcare fosters investment in biopharmaceuticals and medical biotechnology. Thirdly, government initiatives, funding support, and regulatory frameworks encourage research and development activities, stimulating industry growth. Additionally, collaborations between academia, industry, and research institutions facilitate knowledge exchange and accelerate the translation of scientific discoveries into commercial products. Furthermore, growing awareness of environmental sustainability fuels investment in bioremediation, biofuels, and renewable resources, expanding the scope of biotechnology applications.

DNA sequencing dominated this market and held the highest revenue market share of 18% in 2023, which can be attributed to declining sequencing costs and rising penetration of advanced DNA sequencing techniques. This technology is key in creating personalized cancer treatments by pinpointing mutations. Widely embraced in research, DNA sequencing efficiently compares large DNA segments across species. Advancements in sequencing systems are enhancing speed and cost-effectiveness, offering substantial potential in healthcare applications. Government support, exemplified by grants like the USD 10.7 million NIH award in May 2021 for Alzheimer's disease research, is fueling the expansion of sequencing for disease insights.

The others’ segment is anticipated to grow at the fastest CAGR of 28.04% during the forecast period. This segment includes fermentation in food and environmental applications, driven by the rising use of microorganisms in the food industry and to address environmental challenges like climate change. Intechopen highlighted in February 2023 that employing microorganisms in food processing can boost efficiency, save time and energy, and establish a more consistent processing system commercially. With the modern lifestyle's demands, there is a growing reliance on processed foods, leading to an increased demand for such products. Fermentation in food processing leverages microorganisms' growth and metabolic activity to stabilize and transform food materials by converting organic acids or carbon dioxide and carbohydrates to alcohols under anaerobic conditions using bacteria, yeasts, or a combination of them. This is anticipated to fuel market growth.

The health segment dominated the market and accounted for the largest revenue market share of 45% in 2023. The use of biotechnology in healthcare is transforming the industry. Innovations in genomics, molecular biology, cellular and tissue engineering, bio-imaging, new drug discovery, and delivery methods offer promising possibilities for enhancing diagnostic capabilities and broadening treatment options. The segment's growth is expected to be driven by an increasing disease burden, the rising availability of agri-biotech and bio-services, and technological advancements in the bio-industrial sector. Furthermore, significant progress in Artificial Intelligence (AI), machine learning (ML), and big data is also fueling the segment's growth and boosting its adoption food and beverage industries.

Bioinformatics is expected to witness the fastest growth, with a CAGR of 17.13% during the forecast period. The bioinformatics industry has seen rapid global expansion, driven by various fields like physics, mathematics, and pharmaceuticals, and the emergence of new biotechnology fields like proteomics and genomics. The surge in data from increased biotechnology R&D has broadened bioinformatics’ scope. It’s now widely used for bioresource conservation & management, biology prospecting, product & process evaluation, and managing complex data for national programs. Cloud computing has become integral to bioinformatics, providing scalable computing & storage, data sharing, and on-demand resource access. The rise of biomedical cloud platforms catering to specific research community needs is a notable trend, expected to boost bioinformatics tool adoption in life sciences.

By Technology

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Biotechnology Market

5.1. COVID-19 Landscape: U.S. Biotechnology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Biotechnology Market, By Technology

8.1. U.S. Biotechnology Market, by Technology, 2024-2033

8.1.1. Nanobiotechnology

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Tissue Engineering and Regeneration

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. DNA Sequencing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Cell-based Assays

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Fermentation

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. PCR Technology

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Chromatography

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Biotechnology Market, By Application

9.1. U.S. Biotechnology Market, by Application, 2024-2033

9.1.1. Health

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food & Agriculture

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Natural Resources & Environment

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Industrial Processing

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Bioinformatics

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Biotechnology Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. AstraZeneca

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Gilead Sciences, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bristol-Myers Squibb

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sanofi

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Biogen

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Abbott Laboratories

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Pfizer, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Amgen Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Novo Nordisk A/S

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Merck KGaA

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others