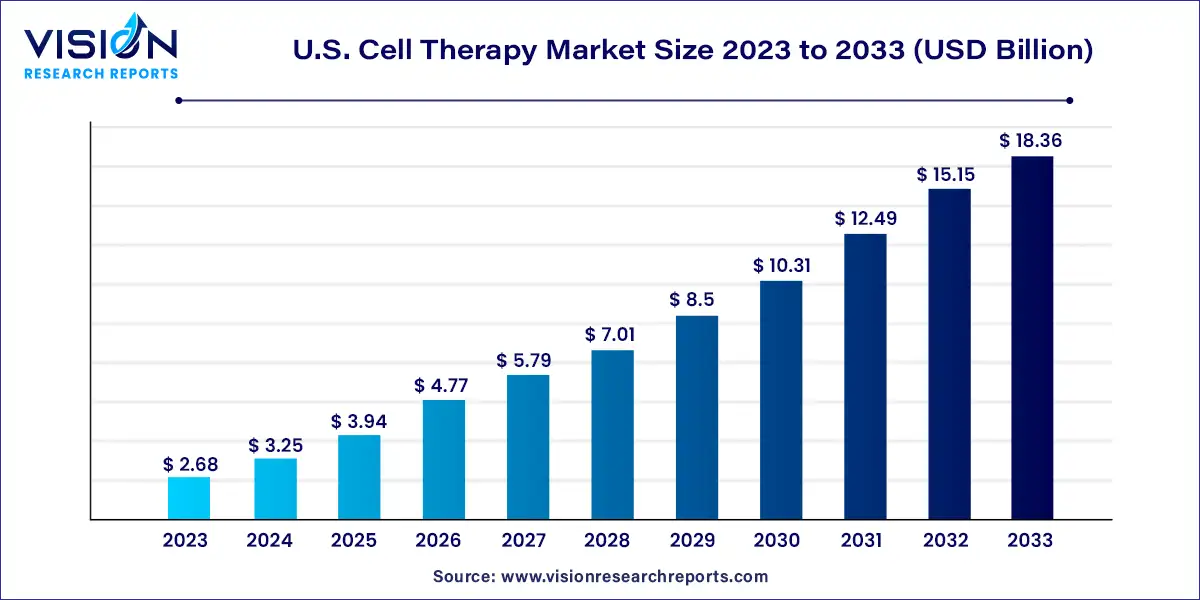

The U.S. Cell Therapy market was estimated at USD 2.68 billion in 2023 and it is expected to surpass around USD 18.36 billion by 2033, poised to grow at a CAGR of 21.22% from 2024 to 2033. The U.S. cell therapy market has witnessed significant growth driven by advancements in biotechnology, increasing investment in research and development, and rising demand for innovative medical treatments.

The growth of the U.S. cell therapy market is driven by an advancement in biotechnology and regenerative medicine have enabled the development of innovative cell-based therapies with the potential to address a wide range of diseases and disorders. Additionally, increasing investment in research and development, coupled with rising demand for effective medical treatments, drives continuous innovation and expansion within the market. Furthermore, favorable regulatory frameworks and reimbursement policies facilitate the commercialization and adoption of cell therapy products, encouraging investment and fostering market growth.

In 2023, the autologous therapies segment asserted its dominance in the market, commanding a substantial 92% share. This growth trajectory is primarily fueled by the personalized nature and broad applicability of these therapies, offering treatment solutions for a diverse array of conditions, including cancer, cardiovascular diseases, neurodegenerative diseases, and orthopedic injuries. Notably, companies are actively pursuing the development of cell therapies tailored for cardiovascular diseases. For instance, BIOCARDIA, INC. is advancing its CardiAMP Cell Therapy, specifically designed to address ischemic heart failure in individuals. This upward trend in autologous therapies is anticipated to sustain and propel demand throughout the forecast period.

Conversely, the allogeneic therapies segment is forecasted to witness the most substantial growth at a robust compound annual growth rate (CAGR) from 2024 to 2033. This surge is attributable to the widespread adoption of allogeneic cell therapies in pioneering innovative treatment approaches. Allogeneic therapies offer distinct advantages over their autologous counterparts, including immediate availability, scalability, and cost-effectiveness. Furthermore, major companies are actively expanding their production capacities for allogeneic cell therapies, a trend poised to further fuel market expansion.

In 2023, the oncology segment firmly held the market, commanding an impressive 93% share. The robust growth of this segment is primarily propelled by the extensive applications of cell therapy within the oncology sector. Various cell therapies, such as CAR T cell therapies, TCR-based therapies, and allogeneic cord blood-based therapies, are deployed in the treatment of diverse cancers, including blood cancer, melanoma, and multiple myeloma. Moreover, companies are intensifying their efforts to advance cell therapies specifically tailored for cancer treatment, further amplifying market expansion prospects.

Conversely, the dermatology segment is poised to experience notable growth at a significant compound annual growth rate (CAGR) from 2024 to 2033. This trajectory is attributed to the continuous advancements in cell therapies aimed at addressing skin disorders. Additionally, the growing emphasis of companies on developing dermatological therapeutics through cell therapy is anticipated to propel segmental growth. For example, in March 2024, SkinCure Oncology unveiled groundbreaking skin cancer treatment technology during the American Academy of Dermatology Annual Meeting in San Diego. This innovation presents a noninvasive treatment option for non-melanoma skin cancer, offering a targeted and efficacious approach with high cure rates.

By Therapy Type

By Therapeutic Area

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Cell Therapy Market

5.1. COVID-19 Landscape: U.S. Cell Therapy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Cell Therapy Market, By Therapy Type

8.1. U.S. Cell Therapy Market, by Therapy Type, 2024-2033

8.1.1. Allogeneic Therapies

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Autologous Therapies

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Cell Therapy Market, By Therapeutic Area

9.1. U.S. Cell Therapy Market, by Therapeutic Area, 2024-2033

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Dermatology

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Cell Therapy Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Therapy Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

Chapter 11. Company Profiles

11.1. Gilead Sciences, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Selecta Bioscience

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bristol-Myers Squibb Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. CARGO Therapeutics, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Johnson & Johnson

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Atara Biotherapeutics, Inc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nkarta, Inc

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Cellular Biomedicine Group, Inc

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Vertex Pharmaceuticals Incorporated

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Aurion Biotech

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others