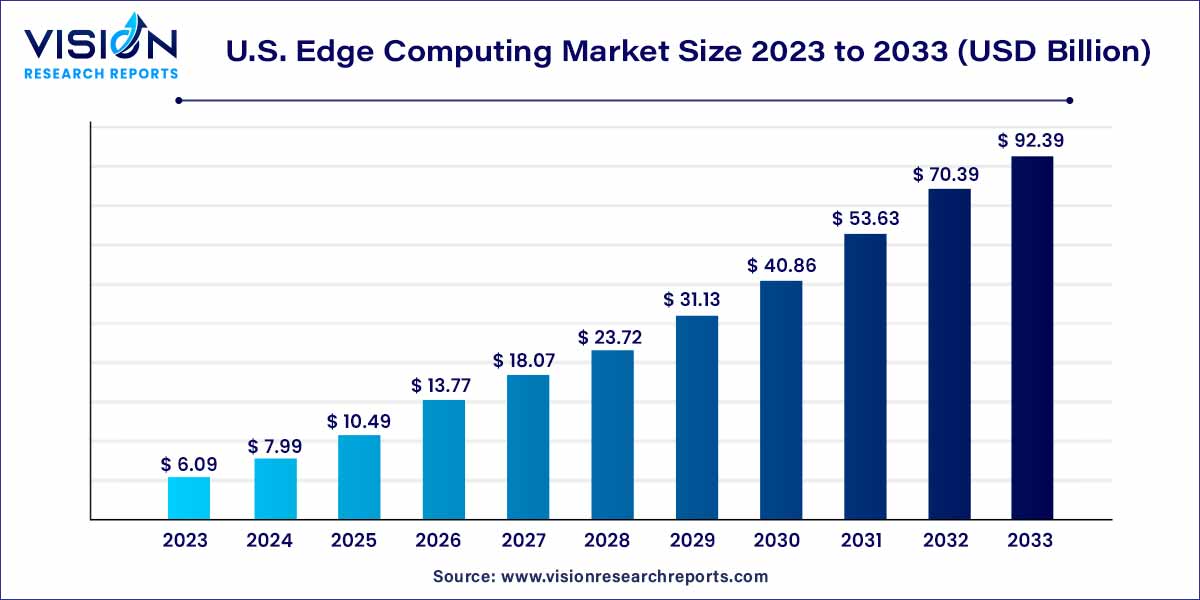

The U.S. edge computing market was estimated at USD 6.09 billion in 2023 and it is expected to surpass around USD 92.39 billion by 2033, poised to grow at a CAGR of 31.25% from 2024 to 2033. The U.S. edge computing market is driven by the demand for ultra-low latency, advent of 5g networks, decentralized computing power, and digital transformation across industries.

The U.S. Edge Computing market has emerged as a dynamic and pivotal force in the technology, redefining how data is processed and delivered. This overview aims to shed light on the key aspects shaping the landscape of edge computing, providing a comprehensive understanding of its current state and future potential.

The growth of the U.S. Edge Computing market is propelled by various factors contributing to its dynamic expansion. One key driver is the proliferation of Internet of Things (IoT) devices, which has surged in recent years. The increasing adoption of IoT across industries necessitates real-time data processing capabilities, a demand effectively met by edge computing. Additionally, the pursuit of ultra-low latency in critical applications, such as autonomous vehicles and augmented reality, further accelerates the market's growth. The advent of 5G networks is also a significant contributor, as it enhances the speed and connectivity required for seamless edge computing operations. Furthermore, the rising need for decentralized computing power, coupled with the ongoing digital transformation across sectors, positions edge computing as a strategic solution to optimize data processing, making it a key player in the technological landscape.

In 2023, the hardware segment dominated the market, holding a significant share of over 44%. This notable presence can be attributed to the increasing preference for hardware within the managed services industry. The surge in IoT and IIoT device applications has led to a substantial increase in data generation. Consequently, businesses are adopting hardware components, including edge computing gear, to alleviate the burden on cloud infrastructure and data centers.

Within the hardware segment, there are distinct categories, including Edge Nodes/Gateways (Servers), Sensors/Routers, and others. The escalating number of data centers is driving the demand for edge routers that establish connections between local and wide-area networks. To efficiently manage high incoming traffic while maintaining low latency, edge data centers require well-equipped and flexible edge routers. The growing need for secure and streamlined data processing at the network's edge is anticipated to propel the hardware segment's growth throughout the forecast period

In 2023, the industrial sector secured a substantial market share, driven by the significant impact of real-time monitoring on enhancing operational efficiency and productivity in manufacturing. Edge computing emerges as the optimal solution for remote sites experiencing unstable cloud connectivity, with remote oil fields widely embracing this technology.

Furthermore, in industries where data sensitivity and strict compliance regulations prevail, edge computing serves as an effective solution for data processing. The convergence of Industrial Internet of Things (IIoT) with edge computing is fostering the adoption of connected factories among U.S. manufacturers. This trend has given rise to several startups specializing in platforms for developing edge-enabled solutions, poised to contribute significantly to the regional industry's growth

In 2023, the market was dominated by the Industrial Internet of Things (IIoT) segment, underlining the pivotal role of edge computing in facilitating organizations' digital transformation of their facilities. The demand for edge infrastructure is expected to rise in tandem with increasing service intricacy and improved accessibility to infrastructure edges. Edge computing proves instrumental in aiding manufacturers in achieving the digitization of their facilities.

The Industry 4.0 initiative further provides a framework for modernizing manufacturing processes in response to industry disruptions, paving the way for widespread edge deployment. This initiative promotes operational agility by leveraging technologies that bring uniformity to both cyber and physical systems. Smart factories, as part of this initiative, can utilize edge platforms to transmit only processed data to their cloud servers, consequently fueling the market for AI edge computing. The edge serves as a conduit by locally analyzing data and sending condensed information to the cloud

By Component

By Application

By Industry Vertical

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Edge Computing Market

5.1. COVID-19 Landscape: U.S. Edge Computing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Edge Computing Market, By Component

8.1. U.S. Edge Computing Market, by Component, 2024-2033

8.1.1 Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Edge-Managed Platform

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Edge Computing Market, By Application

9.1. U.S. Edge Computing Market, by Application, 2024-2033

9.1.1. Industrial Internet of Things (IIoT)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Remote Monitoring

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Content Delivery

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Video Analytics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. AR/VR

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Connected Cars

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Smart Grids

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Critical Infrastructure Monitoring

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Traffic Management

9.1.9.1. Market Revenue and Forecast (2021-2033)

9.1.10. Assets Tracking

9.1.10.1. Market Revenue and Forecast (2021-2033)

9.1.11. Security & Surveillance

9.1.11.1. Market Revenue and Forecast (2021-2033)

9.1.12. Smart Cities

9.1.12.1. Market Revenue and Forecast (2021-2033)

9.1.13. Others

9.1.13.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Edge Computing Market, By Industry Vertical

10.1. U.S. Edge Computing Market, by Industry Vertical, 2024-2033

10.1.1. Industrial

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Energy & Utilities

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Healthcare

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Agriculture

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Transportation & Logistics

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Retail

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Data Centers

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Wearables

10.1.8.1. Market Revenue and Forecast (2021-2033)

10.1.9. Government & Public Sector

10.1.9.1. Market Revenue and Forecast (2021-2033)

10.1.10. Media & Entertainment

10.1.10.1. Market Revenue and Forecast (2021-2033)

10.1.11. Manufacturing

10.1.11.1. Market Revenue and Forecast (2021-2033)

10.1.12. Telecom & IT

10.1.12.1. Market Revenue and Forecast (2021-2033)

10.1.13. Others

10.1.13.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Edge Computing Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 12. Company Profiles

12.1. ABB Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Amazon Web Services (AWS), Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Atos SE.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Capgemini.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cisco Systems, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. General Electric Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Hewlett Packard Enterprise Development.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Honeywell International Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. IBM Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Intel Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others