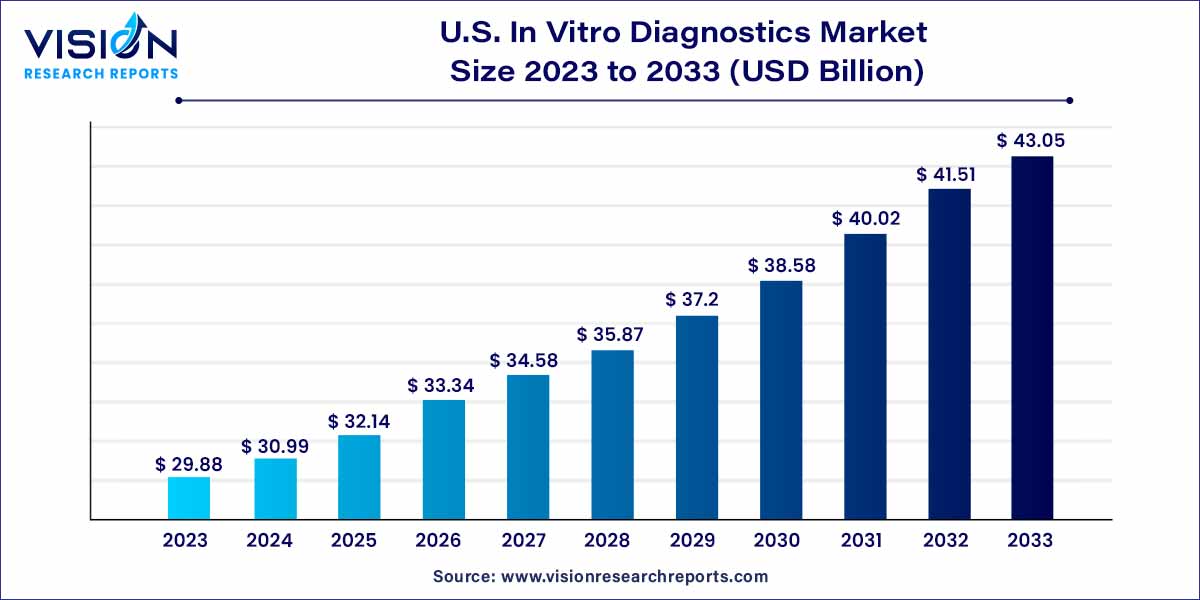

The U.S. in vitro diagnostics market size was estimated at USD 29.88 billion in 2023 and it is expected to surpass around USD 43.05 billion by 2033, poised to grow at a CAGR of 3.72% from 2024 to 2033.

The U.S. in vitro diagnostics (IVD) market stands at the forefront of healthcare innovation, playing a pivotal role in disease diagnosis and patient management. In this comprehensive overview, we delve into the key aspects that define and drive the U.S. IVD market, shedding light on its current landscape and future prospects.

The growth of the U.S. in vitro diagnostics (IVD) market is propelled by a confluence of factors that collectively contribute to its robust expansion. Technological advancements in diagnostic tools and methodologies have been a primary driver, enhancing the precision and efficiency of diagnostic processes. The increasing prevalence of chronic diseases across diverse demographic segments further fuels the demand for advanced diagnostic solutions, fostering market growth. Moreover, a rising emphasis on personalized medicine, where diagnostics play a pivotal role in tailoring treatment plans to individual patient needs, has significantly contributed to the market's upward trajectory. This sector's resilience is also attributed to a proactive regulatory environment, ensuring the safety and efficacy of diagnostic devices. The integration of artificial intelligence and continuous research into novel biomarkers are fostering a climate of innovation, positioning the U.S. IVD market as a cornerstone of healthcare advancement.

In 2023, the reagent segment emerged as the dominant force in the market, securing a substantial revenue share of 66%. This dominance can be attributed to major market players investing significantly in extensive research and development initiatives, focusing on the creation of innovative biomarker kits. The market's growth is further propelled by the continuous introduction and commercialization of new reagents. A noteworthy example is the October 2022 launch by Thermo Fisher Scientific of the TaqPath enteric bacterial select panel test, designed for the rapid detection of gastrointestinal bacterial infections within a two-hour timeframe.

In the same year, the instruments segment secured the second-largest share of the market's revenue. The growth of this segment is propelled by ongoing technological advancements, with the introduction of portable instruments like the cobas 4800 developed by GeneXpert (Cepheid and Roche Diagnostics) anticipated to boost market expansion. Key players in the industry are actively engaged in developing new technologies characterized by higher efficiency and accuracy. An example is the Ortho Vitros XT 7600 integrated system, utilizing digital chemistry technology to perform two separate laboratory tests simultaneously.

In 2023, molecular diagnostics claimed the largest share, driven by the growing adoption of rapid testing and point-of-care diagnostics. The demand for molecular diagnostics is further bolstered by the introduction of initiatives and programs. An example is the Molecular Characterization Initiative launched by the National Cancer Institute in March 2022, specifically designed to provide molecular characterization for childhood cancer. Major industry players are actively pursuing new product developments and partnerships to expand their presence in the U.S. market. For instance, in February 2023, Thermo Fisher Scientific, Inc. unveiled the QuantStudio, Applied Biosystems, Absolute Q AutoRun dPCR Suite, a cutting-edge digital PCR research tool. Notably, these PCR tools are the market's sole digital PCR solutions enabling lab automation, reducing administrative costs, and ensuring consistency, flexibility, and usability.

The hematology segment is projected to be the fastest-growing over the forecast period. This growth is fueled by the increasing awareness of the significance of regular health checkups, with hematology tests playing a crucial role in health monitoring. In July 2022, Sysmex introduced the XN-Series of automated hematology analyzers, including the XN-9100 automated hematology analyzer. Furthermore, in March 2022, Mindray launched the BC-700 series of hematology analyzers, incorporating complete blood count and erythrocyte sedimentation rate tests. This approval is expected to reduce waiting times for obtaining complete blood count (CBC) results, facilitating faster decision-making in critical cases.

In 2023, the infectious diseases segment secured the highest revenue share and is anticipated to maintain its dominance throughout the projection period. Key market players are actively involved in commercializing precise testing solutions specifically designed for infectious diseases. For example, in December 2021, Roche introduced new tests for infectious diseases on the Cobas 5800 system in countries that accept CE marking. This strategic launch significantly expanded the company's molecular diagnostics portfolio. Moreover, alarming statistics reveal that 57% of patients were found to be colonized with multidrug-resistant (MDR) bacteria during post-acute care admission.

The oncology segment is poised to witness the fastest compound annual growth rate (CAGR) over the forecast period. Cancer stands as the second most common cause of death in the U.S., emphasizing the critical need for effective diagnostic solutions. Genomic and genetic variation molecular tests have become integral in managing breast cancer, aiding in the prediction of this condition, especially in patients with a family history. Furthermore, technological advancements in cancer diagnostics and the increasing integration of artificial intelligence (AI) in cancer diagnosis are facilitating the expansion of this segment.

In 2023, the hospitals segment emerged as the dominant force in the U.S. in vitro diagnostics market. This dominance is attributed to the increasing rates of hospitalization, where physicians heavily rely on diagnostic interpretations to make informed treatment decisions. Diagnostic centers frequently collaborate with hospitals that already possess their diagnostic setups. The ongoing development of healthcare infrastructure is expected to enhance existing hospital facilities, thereby driving the demand for in vitro diagnostic tests within the hospital setting. Hospitals, being major consumers, purchase and utilize in vitro diagnostic devices in significant volumes. In 2022, the U.S. hosted over 6,093 hospitals, highlighting the widespread dependence on in vitro diagnostic tests for prompt and precise decision-making due to their ability to deliver fast and accurate results.

The home care segment is anticipated to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. This projection is fueled by the increasing geriatric population and a growing demand for home care in vitro diagnostic devices. The surge in demand for molecular diagnosis has underscored the need for molecular diagnostics platforms that enable patients to conduct self-tests.

By Product

By Technology

By Application

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others