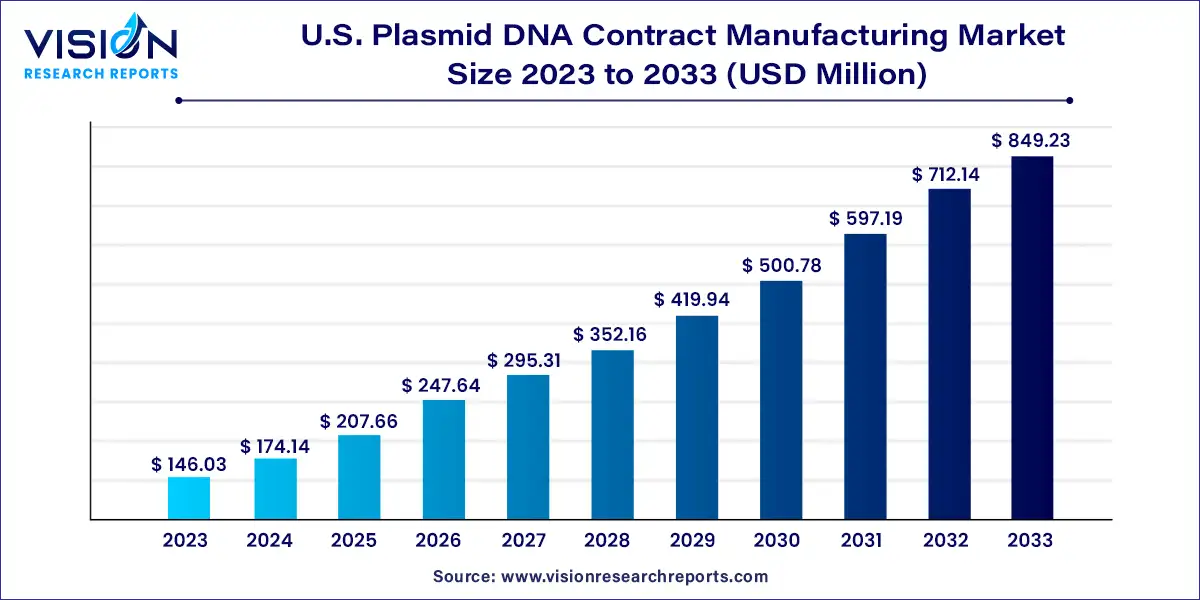

The U.S. plasmid DNA contract manufacturing market size was estimated at USD 146.03 million in 2023 and it is expected to surpass around USD 849.23 million by 2033, poised to grow at a CAGR of 19.25% from 2024 to 2033. The U.S. plasmid DNA contract manufacturing market is driven by the increasing demand for plasmid DNA in various biotechnological applications.

The U.S. plasmid DNA contract manufacturing market has witnessed significant growth in recent years, driven by the increasing demand for plasmid DNA in various biotechnological applications. This overview delves into the key factors shaping the market landscape, exploring market trends, major players, and future prospects.

The growth of the U.S. plasmid DNA contract manufacturing market can be attributed to several key factors. Firstly, the increasing demand for plasmid DNA in the biopharmaceutical industry for the production of therapeutic proteins and vaccines plays a pivotal role. The expanding applications of gene therapies and personalized medicine further fuel the demand for plasmid DNA manufacturing services. Additionally, advancements in genetic engineering technologies and the rise of innovative therapeutic modalities contribute to market growth. Collaborations between pharmaceutical companies and contract manufacturers also foster the market, allowing for cost-effective and efficient production processes. Furthermore, the growing investment in research and development activities within the biotechnology sector amplifies the need for outsourced plasmid DNA manufacturing services, driving sustained market expansion.

In 2023, the cell and gene therapy segment secured the largest market share at 61%, establishing its dominance and poised for continued growth. This trend is primarily fueled by a surge in clinical trials and subsequent drug approvals within the field. The market's expansion is underpinned by the increasing trust, efficiency, and safety of gene treatments, addressing a spectrum of chronic and genetic disorders.

The involvement of Contract Development and Manufacturing Organizations (CDMOs) in the development of new plasmid DNA significantly contributes to market growth. A notable example is the collaboration between Ray Therapeutics and Forge Biologics, a CDMO. Their extended partnership in October 2022 focuses on manufacturing clinical-stage plasmid DNA to support Ray Therapeutics' lead optogenetics gene therapy program.

Looking ahead, the immunotherapy segment is anticipated to experience substantial growth from 2024 to 2033. This growth is propelled by heightened research and development activities in the realm of immunotherapy. Given the high prevalence of cancer, the adoption rates for novel immunotherapies have soared. A JAMA Oncology report from 2023 reveals adoption rates of approximately 11% and 27% in rural and urban clinical practices in the U.S., respectively. This prevalence is expected to drive the growth of the immunotherapy segment in the forecast years.

In 2023, the cancer segment emerged as the dominant force in this market, claiming a substantial 40% share. This growth is primarily fueled by the escalating prevalence of cancer and the intensified focus of key industry players on cancer therapeutics. The increasing adoption of cell and gene therapy for cancer treatment is a key driver propelling the expansion of the U.S. plasmid DNA contract manufacturing market. A noteworthy example is Charles River's collaboration with Rznomics, announced in October 2023, to manufacture viral vectors for gene therapy targeting patients with liver cancer.

Anticipated to exhibit the fastest growth rate from 2024 to 2033, the infectious segment is propelled by the growing commercialization of plasmid DNA therapeutics for treating infectious diseases. For instance, the collaboration between GeneScript ProBio and RVAC in February 2023 aimed to manufacture a COVID-19 Vaccine plasmid DNA. This partnership seeks to accelerate the clinical manufacturing of RVM-V001 and future mRNA-based vaccines addressing infectious diseases such as Clostridioides difficile infection (CDI) and Respiratory Syncytial Virus (RSV).

In 2023, the pharmaceutical and biotechnology companies held a commanding share of 60%, asserting their dominance in the market. This growth is attributed to the escalating production of plasmid DNA-based therapeutics throughout the U.S. Key market players are actively engaging in strategic initiatives to enhance plasmid DNA production, contributing significantly to the segment's expansion. A notable example is Charles River Laboratories International, Inc., which, in January 2023, announced the launch of the eXpDNA™ plasmid platform. This innovative platform aims to streamline plasmid manufacturing and production timelines, particularly in the context of gene therapy.

The research institutes segment is poised for the fastest growth from 2024 to 2033, fueled by increasing funding for cell and gene therapy-based research. Research institutes play a crucial role in advancing the research and development of cell and gene therapies, responding to the growing demand for plasmid DNA. The combination of augmented funding and the rising demand for plasmid DNA-based therapeutics is set to propel robust growth in this segment within the plasmid DNA contract manufacturing market. As an example, in September 2019, the National Institutes of Health (NIH) disclosed the allocation of 24 grants to researchers across the United States through the Somatic Cell Genome Editing (SCGE) Program. Funded by the NIH Common Fund, this program aims to enhance genome-editing techniques and the manufacturing of genome-editing therapies.

By Application

By Therapeutic Area

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Application Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Plasmid DNA Contract Manufacturing Market

5.1. COVID-19 Landscape: U.S. Plasmid DNA Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Plasmid DNA Contract Manufacturing Market, By Application

8.1. U.S. Plasmid DNA Contract Manufacturing Market, by Application, 2024-2033

8.1.1 Cell & gene therapy

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Immunotherapy

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Other application

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Plasmid DNA Contract Manufacturing Market, By Therapeutic Area

9.1. U.S. Plasmid DNA Contract Manufacturing Market, by Therapeutic Area, 2024-2033

9.1.1. Cancer

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Infectious Diseases

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Autoimmune Diseases

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Cardiovascular Diseases

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Plasmid DNA Contract Manufacturing Market, By End-use

10.1. U.S. Plasmid DNA Contract Manufacturing Market, by End-use, 2024-2033

10.1.1. Pharmaceutical and Biotechnology Companies

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Research Institutes

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Plasmid DNA Contract Manufacturing Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Application (2021-2033)

11.1.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Aldevron.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Charles River Laboratories.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Akron Biotech.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. VGXI, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Catalent, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. DH Life Sciences, LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Recipharm AB.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. TriLink BioTechnologies

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. AGC Biologics.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Thermo Fisher Scientific Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others