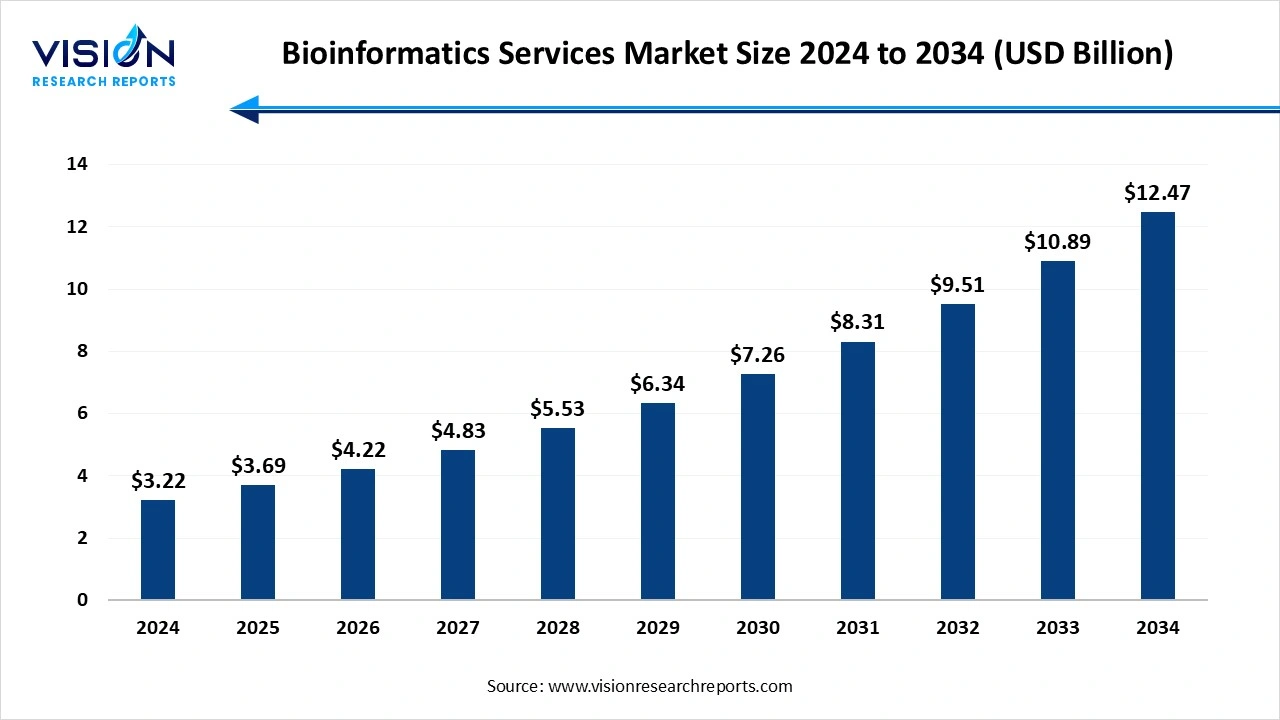

The global bioinformatics services market size was worth USD 3.22 billion in 2024 and is projected to grow to USD 3.69 billion in 2025, reaching USD 12.47 billion by 2034, with a CAGR of 14.5%. The rising pharmaceutical and biotechnology firms are using bioinformatics services to drive drug discovery and development.

Bioinformatics services use computational and statistical methods to analyze and interpret large, complex biological datasets, such as those generated by next-generation sequencing (NGS). These services leverage expertise in biology, computer science, and data science to provide actionable insights for various research, medical, and agricultural applications. These services combine biology, computer science, and statistics to help researchers, clinicians, and pharmaceutical companies understand complex biological processes, identify genetic variations, and accelerate discoveries in drug development and personalized medicine.

There is an increasing demand for healthcare solutions tailored to an individual's genetic makeup. Bioinformatics services are essential for analyzing genomic data to identify biomarkers, predict disease risk, and optimize treatment plans. Regulatory bodies are increasingly adopting real-world evidence to accelerate drug approval pathways. Bioinformatics services, particularly through federated data platforms, are critical for analyzing large, diverse datasets while protecting patient privacy to generate this evidence.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.22 billion |

| Revenue Forecast by 2034 | USD 12.47 billion |

| Growth rate from 2025 to 2034 | CAGR of 14.5% |

| Forecast Period | 2025 to 2034 |

| Base Year | 2024 |

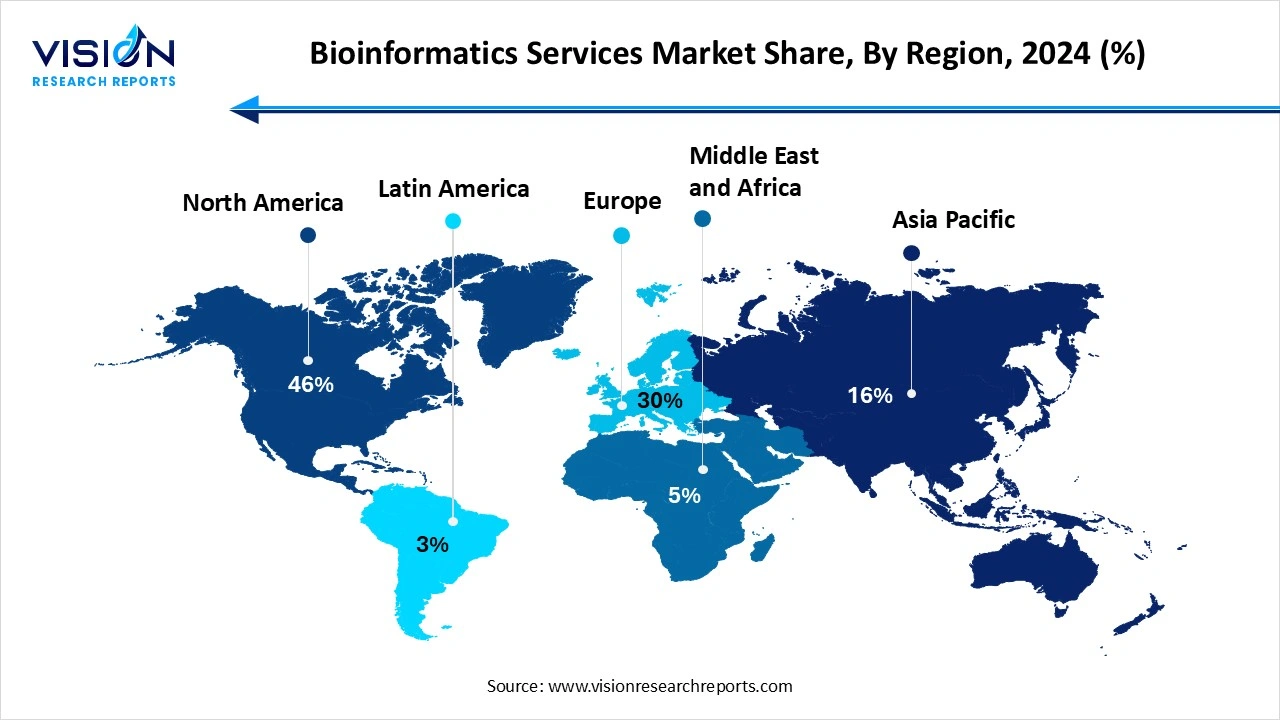

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific Inc., QIAGEN N.V., Agilent Technologies, Inc., PerkinElmer, Inc., Bina Technologies (acquired by Roche), DNAnexus, Inc., SOPHiA GENETICS, Genedata AG, Seven Bridges Genomics, Inc., Bioinformatics Solutions Inc., Invitae Corporation, Exscientia Ltd., WuXi NextCODE, BGI Group. |

Bioinformatics can be used to study plant-pathogen interactions at a molecular level, helping researchers understand disease genetics and identify new ways to combat plant diseases. In pharmaceutical and academic research, bioinformatics is finding applications in areas like agriculture and veterinary science, creating new opportunities for innovation.

Acquiring, implementing, and maintaining advanced bioinformatics platforms, including software licenses, cloud infrastructure, and high-performance computing systems, can be costly. These high costs can be prohibitive for small and medium-sized organizations.

North America led the bioinformatics services market, capturing a dominant share of 46% in 2024. The region is home to major pharmaceutical, biotechnology, and technology companies that are at the forefront of innovations in genomics and proteomics. North America leads in innovations related to next-generation sequencing (NGS), AI, and machine learning, which are vital components of bioinformatics. These technologies help analyze massive datasets generated in genomics and proteomics, driving the demand for specialized services. High adoption of advanced healthcare applications and a robust research and development ecosystem drive the market growth.

United States Bioinformatics Services Market Trends

The rising demand for personalized medicine and advancements in genomics research. A shortage of skilled bioinformaticians and complex data integration remain key challenges. The market is rapidly evolving through the integration of AI/ML, the increasing adoption of cloud-based services, and strategic industry collaborations. This trend is reshaping drug discovery and diagnostics, positioning the sector for continued expansion.

Asia Pacific expects significant growth in the bioinformatics services market during the forecast period. The rising demand for customized treatments that require advanced computational tools to analyse genomic data is a core function of bioinformatics services. The regions' rapidly developing life science sectors are experiencing increased genomic research and a rise in the adoption of bioinformatic solutions for managing biological datasets. Expanding healthcare infrastructure and increased investment in healthcare IT solutions in emerging economies within the region contribute significantly to the adoption of bioinformatics services.

Why did the NGS Segment Dominate the Bioinformatics Services Market?

The NGS segment held the largest market revenue share at 35% in 2024 and is projected to record the highest compound annual growth rate (CAGR) throughout the forecast period. It's massive data output and cost reductions. This flood of genomic information requires sophisticated bioinformatics tools for processing, analysis, and interpretation. Expanding applications in precision medicine, drug discovery, and clinical diagnostics further solidify its central role in the market. The resulting surge in demand for specialized software and services cements NGS as the primary growth driver for the bioinformatics industry.

The scientific software testing segment is the fastest-growing in the bioinformatics services market during the forecast period. The bioinformatics software and tools are becoming increasingly complex, integrating advanced algorithms and handling massive datasets from areas like genomics, proteomics, and transcriptomics. A strong emphasis on validating bioinformatics software and ensuring its accuracy and robustness. This translates into a higher demand for scientific software testing services to ensure the quality and integrity of bioinformatics solutions. With the increasing use in clinical diagnostics, drug discovery, and personalized medicine, the reliability and regulatory compliance of these tools become paramount.

How the Drug Discovery Application Segment hold the Largest Share in the Bioinformatics Services Market?

The drug discovery application segment held the highest market revenue share, accounting for 25% in 2024. The process of discovering new drugs is becoming increasingly intricate, requiring advanced tools and techniques to analyze vast amounts of data. Bioinformatics services offer the necessary computational power and expertise to handle this complexity effectively. Need for efficiency and cost reduction, rising demand for personalized medicine, and advanced technology drive the market growth.

The proteomics segment is experiencing the fastest growth in the market during the forecast period. The crucial insights into the molecular mechanisms of diseases help identify potential biomarkers for early detection, prognosis, and treatment monitoring. Technological advancements like mass spectrometry and the integration of AI/ML have significantly improved the speed and accuracy of protein analysis. This capability is highly valued in drug development, where identifying new protein targets can lead to more effective therapies. Thus, the focus on applying proteomics data to address clinical and therapeutic needs is driving its strong market growth.

How the Academic Segment hold the Largest Share in the Bioinformatics Services Market?

The academic segment held the largest revenue share in the bioinformatics services market in 2024. Academic institutions are at the forefront of fundamental research in genomics, proteomics, and other biological sciences. This research generates massive amounts of complex data requiring specialized bioinformatics tools and expertise for analysis and interpretation. Universities and research centers are key providers of bioinformatics education and training, equipping students and researchers with the necessary skills to utilize and develop bioinformatics solutions.

The animal sector segment is experiencing the fastest growth in the market during the forecast period. The advancements in genetics and breeding programs, increasing demand for personalized animal medicine, and a heightened focus on sustainable animal agriculture and welfare. Improved sequencing technologies and sophisticated bioinformatics tools further contribute to this expansion. This growth facilitates enhanced disease diagnosis, targeted therapies, efficient livestock breeding, and overall improved animal health and productivity.

By Type

By Application

By Sector

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioinformatics Services Market

5.1. COVID-19 Landscape: Bioinformatics Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioinformatics Services Market, By Type

8.1. Bioinformatics Services Market, by Type

8.1.1 NGS

8.1.1.1. Market Revenue and Forecast

8.1.2. Chemoinformatics

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Bioinformatics Services Market, By Application

9.1. Bioinformatics Services Market, by Application

9.1.1. Genomics

9.1.1.1. Market Revenue and Forecast

9.1.2. Transcriptomics

9.1.2.1. Market Revenue and Forecast

9.1.3. Proteomics

9.1.3.1. Market Revenue and Forecast

9.1.4. Metabolomics

9.1.4.1. Market Revenue and Forecast

9.1.5. Drug Discovery

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Global Bioinformatics Services Market, By Sector

10.1. Bioinformatics Services Market, by Sector

10.1.1. Medical

10.1.1.1. Market Revenue and Forecast

10.1.2. Animal

10.1.2.1. Market Revenue and Forecast

10.1.3. Agricultural

10.1.3.1. Market Revenue and Forecast

10.1.4. Academics

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Bioinformatics Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by Sector

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by Sector

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by Sector

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by Sector

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by Sector

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by Sector

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by Sector

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by Sector

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by Sector

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by Sector

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by Sector

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by Sector

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by Sector

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by Sector

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by Sector

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by Sector

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by Sector

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by Sector

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by Sector

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by Sector

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by Sector

Chapter 12. Company Profiles

12.1. Illumina, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Thermo Fisher Scientific Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. QIAGEN N.V.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Agilent Technologies, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. PerkinElmer, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Bina Technologies (acquired by Roche)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. SOPHiA GENETICS.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Genedata AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Seven Bridges Genomics, Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Bioinformatics Solutions Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others