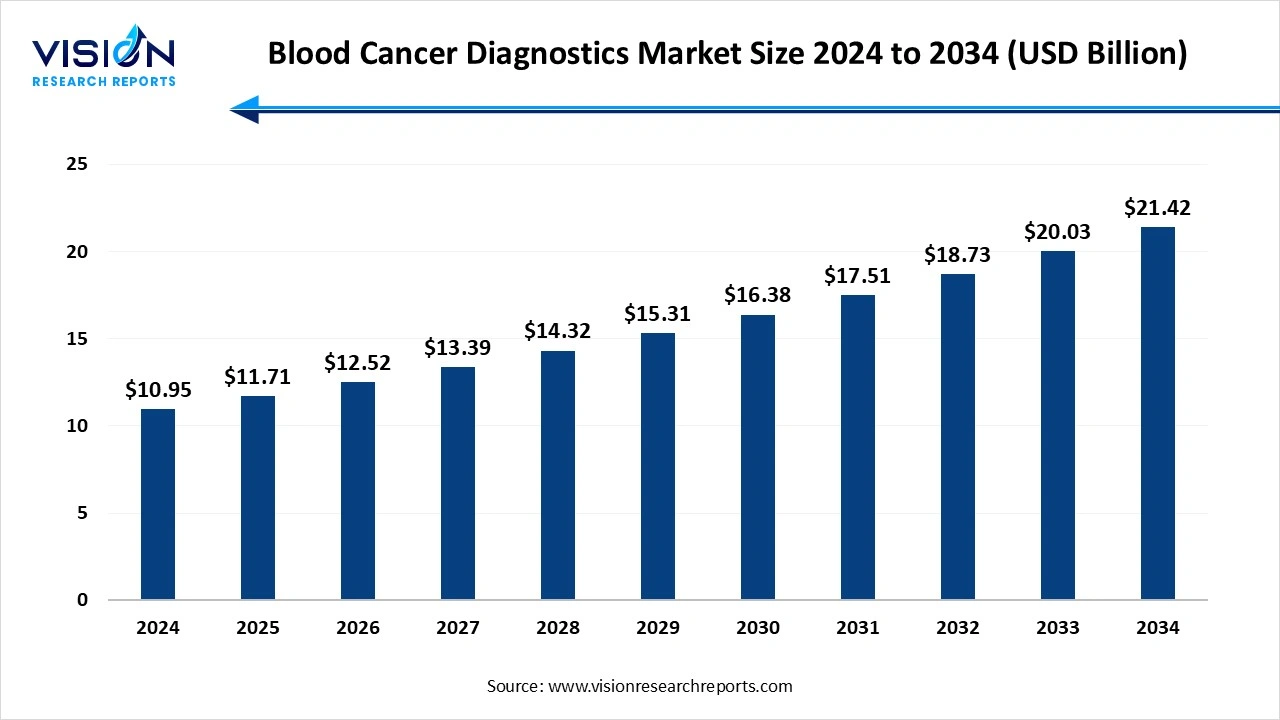

The global blood cancer diagnostics market size surpassed at USD 10.95 billion in 2024 and is estimated to reach USD 11.71 billion in 2025. It is projected to hit USD 21.42 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034. The market Growth is driven by the rising prevalence of leukemia and lymphoma, advancements in molecular diagnostics and NGS technologies, increasing focus on personalized medicine, and expanding access to advanced testing in emerging regions.

The blood cancer diagnostics market plays a crucial role in early disease detection and effective treatment planning for various hematologic malignancies, including leukemia, lymphoma, and myeloma. This market encompasses a wide range of diagnostic tools such as biopsy testing, flow cytometry, molecular diagnostics, immunohistochemistry, and next-generation sequencing (NGS). Rising global incidence of blood cancers, growing awareness regarding early diagnosis, and advancements in precision medicine are key drivers propelling market growth.

Additionally, continuous improvements in molecular profiling and biomarker discovery have enhanced diagnostic accuracy and personalized therapy selection. With increasing healthcare expenditure and expanding access to advanced testing in emerging economies, the blood cancer diagnostics market is expected to witness steady expansion over the coming years.

The blood cancer diagnostics market is experiencing robust growth driven by the rising global incidence of blood cancers such as leukemia, lymphoma, and myeloma is a primary catalyst, necessitating advanced diagnostic solutions for early detection and effective treatment. Technological advancements play a significant role, with innovations like next-generation sequencing (NGS), liquid biopsies, and artificial intelligence (AI)-driven tools enhancing diagnostic accuracy and efficiency. The increasing emphasis on personalized medicine further fuels market expansion, as tailored diagnostic approaches cater to individual genetic profiles, improving treatment outcomes.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.95 Billion |

| Revenue Forecast by 2034 | USD 21.42 Billion |

| Growth rate from 2025 to 2034 | CAGR of 6.94% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Quest Diagnostics, Illumina, InVivoScribe, Ipsogen (Qiagen), Asuragen (Bio-Techne), Danaher Corporation, Abbott, Sequenta (Adaptive Biotechnologies), SkylineDx, Bio-Rad Laboratories, Alercell, and Sophia Genetics. |

North America region led the global blood cancer diagnostics market with a 46% share in 2023. This dominance is driven by the presence of major global players such as Illumina, InVivoScribe, Danaher Corporation, and Abbott. Factors such as high prevalence rates, substantial R&D activities, and technological advancements in diagnostic methods contribute to market growth. Diagnostic tools and techniques like liquid biopsy, Positron Emission Tomography (PET), NGS testing solutions, and molecular testing are widely available.

Europe Blood Cancer Diagnostics Market Trends

Europe is a promising region for market growth, driven by increased awareness among healthcare professionals and patients. The European Cancer Information System (ECIS) reports around 467,733 new blood cancer cases annually, representing about 8.5% of all new cancer cases. In the UK, growth is expected due to rising cancer rates and supportive government initiatives. For instance, Thermo Fisher Scientific completed its acquisition of The Binding Site Group in January 2023, enhancing its portfolio of diagnostic reagents and kits for blood cancer detection.

Asia-Pacific Blood Cancer Diagnostics Market Trends

The Asia-Pacific region is anticipated to experience the fastest growth. Increased public awareness and research efforts are accelerating market expansion. Countries like China, Japan, and India are witnessing demographic shifts toward aging populations, driving demand for blood cancer diagnostics. Notable developments include Kura Oncology’s clinical trial for tipifarnib, targeting peripheral T-cell lymphoma. China’s booming medical tourism industry is also contributing to market growth by expanding oncological screening services.

In 2023, assay kits and reagents led the market, capturing a dominant 73% revenue share. This significant share is due to their role in detecting specific biomarkers, genetic mutations, and other indicators essential for effective diagnosis and treatment of blood cancers. The growing demand for precise and rapid diagnostic tests is driving the increased adoption of these products. Additionally, advancements in molecular diagnostics and emerging technologies, such as Next-Generation Sequencing (NGS), are expected to further propel market growth. The segment is forecasted to expand at the highest rate of 7.3% CAGR during the forecast period. Manufacturers are actively pursuing strategic initiatives like product approvals, expansions, and collaborations to enhance their offerings. For instance, Sysmex announced in December 2023 the launch of its HISCL β-Amyloid 1-42 and 1-40 assay kits in Europe, aimed at detecting Amyloid Beta accumulation in the brain.

Blood tests were the leading segment in 2023, holding a substantial 37% market share. The rising incidence of blood cancers and the need for early and accurate diagnosis are fueling the demand for blood tests. Complete Blood Count (CBC) tests are commonly used as initial diagnostic tools to detect irregularities in blood cell counts, which may indicate blood cancer. The advent of specialized blood tests, such as multicancer detection assays, has revolutionized the field. For example, the Galleri test by GRAIL, launched in 2021 and highlighted in a June 2023 NHS study, can identify over 50 types of cancer from a single blood sample with 51.5% sensitivity and 99.5% specificity.

The molecular tests segment is expected to grow at a robust 8.43% CAGR during the forecast period. Molecular diagnostics have transformed the management of blood cancers by detecting genetic abnormalities and molecular markers specific to various cancer types. Techniques such as PCR, Fluorescence in Situ Hybridization (FISH), and NGS are commonly used to identify genetic mutations and chromosomal abnormalities. In April 2024, OGT introduced the SureSeq Myeloid Fusion Panel, an RNA-based NGS technology designed to identify key fusion genes associated with Acute Myeloid Leukemia (AML), enhancing the precision of diagnosis and treatment.

Hospitals and clinics represented the largest market segment in 2023 with a 51% share. These facilities are preferred due to their comprehensive range of services under one roof. The National Cancer Institute reports approximately 3,000 new cases of Acute Lymphoblastic Leukemia (ALL) annually in the U.S., with a higher admission rate among children and young adults. Hospitals provide essential diagnostic tests even in emergencies, contributing to their dominant market position. The growing acceptance and integration of advanced cancer diagnostics within hospitals further drive their adoption. The development of on-site diagnostic laboratories and comprehensive diagnostic services, including blood tests, imaging, biopsy, and molecular testing, is crucial for enhancing diagnostic accuracy and prompt treatment.

By Product

By Test

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Blood Cancer Diagnostics Market

5.1. COVID-19 Landscape: Blood Cancer Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Blood Cancer Diagnostics Market, By Product

8.1. Blood Cancer Diagnostics Market, by Product,

8.1.1 Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Assay Kits and Reagents

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Blood Cancer Diagnostics Market, By Test

9.1. Blood Cancer Diagnostics Market, by Test,

9.1.1. Blood Tests

9.1.1.1. Market Revenue and Forecast

9.1.2. Imaging Tests

9.1.2.1. Market Revenue and Forecast

9.1.3. Biopsy

9.1.3.1. Market Revenue and Forecast

9.1.4. Molecular Test

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Blood Cancer Diagnostics Market, By End Use

10.1. Blood Cancer Diagnostics Market, by End Use,

10.1.1. Hospitals and Clinics

10.1.1.1. Market Revenue and Forecast

10.1.2. Diagnostic Labs

10.1.2.1. Market Revenue and Forecast

10.1.3. Research Institutes

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Blood Cancer Diagnostics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Test

11.1.3. Market Revenue and Forecast, by End Use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Test

11.1.4.3. Market Revenue and Forecast, by End Use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Test

11.1.5.3. Market Revenue and Forecast, by End Use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Test

11.2.3. Market Revenue and Forecast, by End Use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Test

11.2.4.3. Market Revenue and Forecast, by End Use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Test

11.2.5.3. Market Revenue and Forecast, by End Use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Test

11.2.6.3. Market Revenue and Forecast, by End Use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Test

11.2.7.3. Market Revenue and Forecast, by End Use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Test

11.3.3. Market Revenue and Forecast, by End Use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Test

11.3.4.3. Market Revenue and Forecast, by End Use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Test

11.3.5.3. Market Revenue and Forecast, by End Use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Test

11.3.6.3. Market Revenue and Forecast, by End Use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Test

11.3.7.3. Market Revenue and Forecast, by End Use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Test

11.4.3. Market Revenue and Forecast, by End Use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Test

11.4.4.3. Market Revenue and Forecast, by End Use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Test

11.4.5.3. Market Revenue and Forecast, by End Use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Test

11.4.6.3. Market Revenue and Forecast, by End Use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Test

11.4.7.3. Market Revenue and Forecast, by End Use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Test

11.5.3. Market Revenue and Forecast, by End Use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Test

11.5.4.3. Market Revenue and Forecast, by End Use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Test

11.5.5.3. Market Revenue and Forecast, by End Use

Chapter 12. Company Profiles

12.1. Quest Diagnostics.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Illumina.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. InVivoScribe.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ipsogen (Qiagen).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Asuragen(Bio-Techne).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Danaher Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Abbott.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sequenta (Adaptive biotechnologies)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. SkylineDx.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Bio-Rad Laboratories

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others