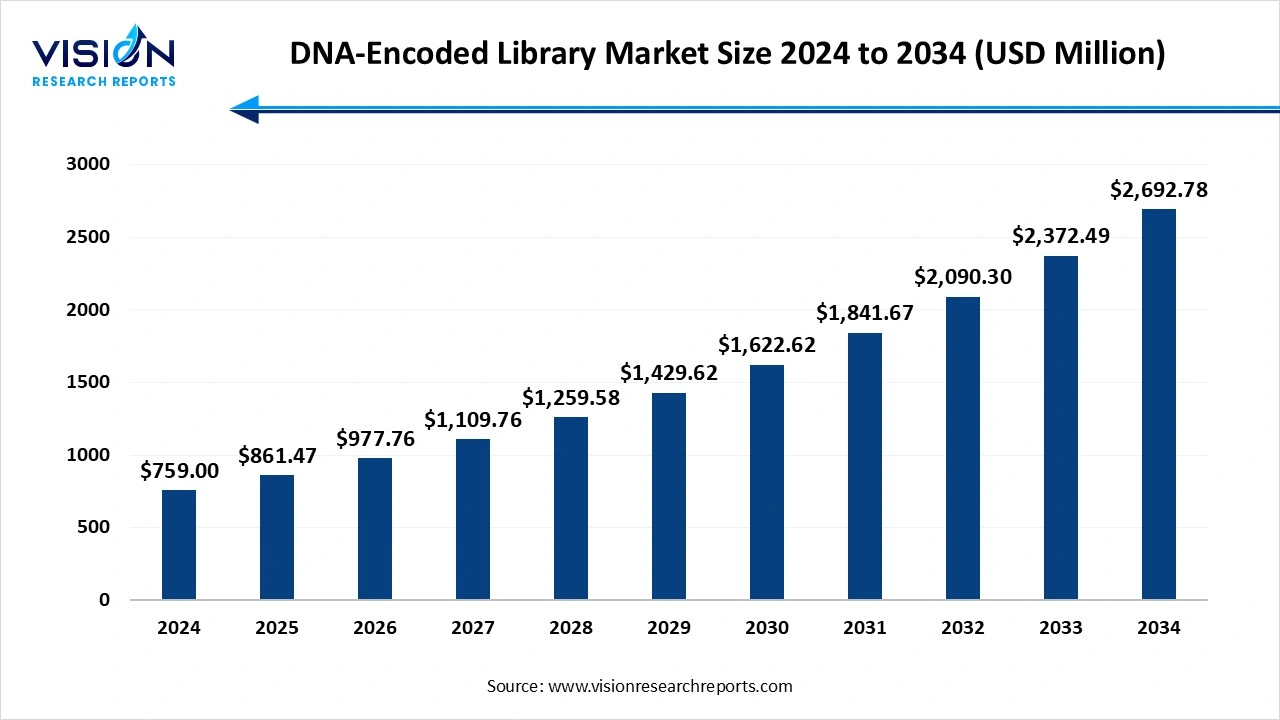

The global DNA-encoded library market size valued at USD 759 million in 2024, is projected to reach around USD 861.47 million in 2025, and is expected to surpass USD 2.6 billion by 2034, healthy grow at a CAGR of 13.5% from 2025 to 2034. This strong growth trajectory reflects rising investments in advanced materials, rapid technology upgrades, and increasing demand for high-performance energy solutions that collectively act as major growth accelerators in the market.

Key Takeaways

The DNA-encoded library (DEL) market is revolutionizing drug discovery domain by offering a new highly efficient, scalable, and cost-effective method that is able to screen billions of small molecules in one single experiment. Pharmaceutical giants, contract research organizations (CROs) and biotech firms are seen rapidly adopting this method to enrich and enhance their early-stage pipelines. Academic institutions all over the world are also showing increased interest due to its potential in targeting previously undruggable proteins. With the growing demand for innovative therapies and an increase in research and development investments, the DNA-encoded library market is poised for robust growth all throughout the forecast period.

A DNA-Encoded Library (DEL) is a collection of small molecules, which is specifically identified by a DNA barcode. This technique is used to synthesize and screen a large number of compounds efficiently in the discovery of the drug. DNA-Encoded Library takes advantage of the power of DNA amplification and sequencing in order to connect chemical diversity with biological activity.

| Report Coverage | Details |

| Market Size in 2024 | USD 759 Million |

| Revenue Forecast by 2034 | USD 2.6 Billion |

| Growth rate from 2025 to 2034 | CAGR of 13.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Merck KGaA, GenScript, Pharmaron, WuXi Biology, Aurigene Pharmaceutical Services, BOC Sciences, LGC Bioresearch Technologies, SPT Labtech Ltd, Life Chemicals, Charles River Laboratories. |

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in the DNA encoded library (DEL) market is bringing revolutionary changes, thus boosting market growth and development. These tools and systems help in improving the efficiency and accuracy of the compound identity. AI and ML technologies enable the rapid analysis of large, complex datasets that are generated during del screening, which helps researchers highlight patterns and correlations that can be difficult to detect using traditional methods. This leads to a quick identity of lead compounds and streamlining the drug development timeline by reducing the research cost. Since pharmaceutical and biotechnology companies rapidly identify the value of the AI enhanced DEL system, these technologies and tools are expected to increase, leading to a rise in market potential.

Rise in Precision Medicine and Partnerships

The rising focus on precision medicine and personalized therapeutics is a key driver fueling the demand for DNA-encoded library technology. Researchers worldwide are seen leveraging DEL platforms to identify highly selective as well as potent compounds that are able to target specific disease pathways. Additionally, the ability to design and screen vast chemical libraries with high accuracy improves drug discovery efficiency. New advancements in technology and research are also optimizing data analysis and accelerating hit identification.

Increased strategic collaborations and partnerships between biotech firms and Contract Research Organizations (CROs) are another key driver, expanding the reach of DNA-encoded library technology. Companies are seen actively outsourcing drug discovery services to specialized CROs that can offer expertise in DEL-based screening. This trend is helping in reducing operational costs and also increasing access to diverse chemical libraries. Increased investments in research infrastructure and expansion of laboratory capabilities are also strengthening the market’s landscape.

Complexity of Sequencing Data

Despite various growth prospects, the market does have its fair share of challenges. One of the major challenges faced by the DEL market is the sheer complexity of sequencing data that is generated during high-throughput screening. Identifying relevant hits from millions of potential binders necessitates sophisticated bioinformatics tools and skilled data analysts. Interpretation of screening results must also consider chemical structure-activity relationships, background noise and potential off-target effects. These complex challenges can hinder small scale firms and academic institutions from entering the market, as they lack the necessary computational infrastructure and bioinformatics expertise. This in turn, slows down market growth and development.

Technological Advancements

Continuous improvements in DNA barcoding, sequencing technologies, and chemical synthesis are bringing in new opportunities in the market by enhancing the efficiency and accuracy of DNA-encoded library screening. The increased adoption of Artificial Intelligence and Machine Learning has further revolutionized the analysis of large chemical libraries by improving hit validation and lead optimization. AI-driven DNA-encoded library platforms help in the rapid identification of potential drug candidates by predicting molecular interactions with high precision. These advancements also help to overcome traditional challenges such as high attrition rates and false positives. As technology continues to evolve, more and more companies are seen leveraging AI-driven DNA-encoded library solutions in order to accelerate their drug discovery pipelines.

This technological prowess is particularly evident or useful in fields like oncology, rare genetic disorders, and immunology, where standard treatments often fail. Patient-derived cell lines or disease-specific proteins can be screened against custom-built DELs to uncover unique therapeutic candidates. As the field of precision medicine continues to expand, DEL is showing immense potential to become a cornerstone in the development of highly tailored treatment regimens.

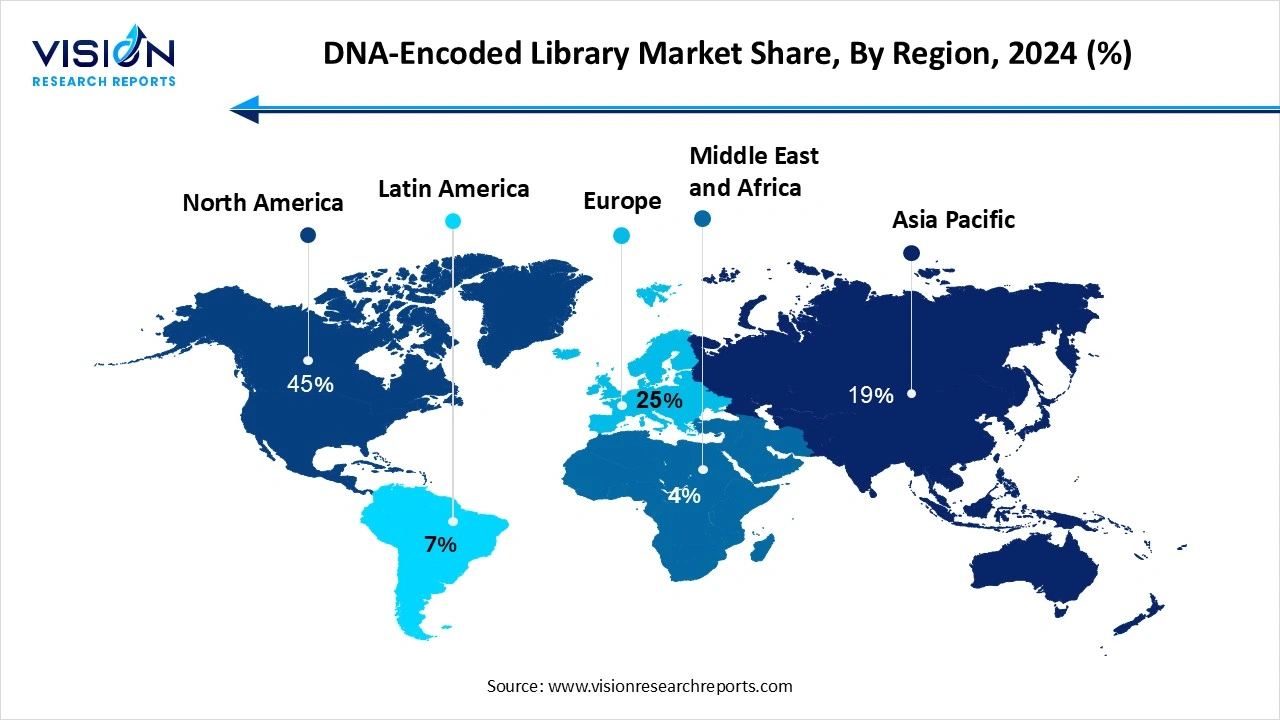

North America dominated the market in 2024. This dominance is because the region is home to key industry players that are actively investing in innovative drug discovery technologies. The region also benefits from a well-established research infrastructure that supports extensive research and development activities, facilitating the adoption of DNA-encoded library platforms. Collaborations between academic institutions and pharmaceutical companies and advanced technological capabilities further accelerate the development, positioning North America as a global competitor and leader.

Asia Pacific is expected to showcase the fastest growth rate during the forecast period. This growth is driven by increasing investments in pharmaceutical research. Emerging economies in countries like India, Japan and China are enhancing the regions biotech capabilities, leading to higher adoption of DNA-encoded library technologies. The region also has a large patient population that necessitates the development of new therapeutics. Collaborations with international pharmaceutical companies is bringing advanced technologies to the region, leading to market expansion.

Which product and service segment dominated the market in 2024?

The services segment dominated the market in 2024, driven by the increasing outsourcing of drug discovery research. Pharmaceutical companies are seen partnering up with service providers to access advanced screening technologies without significant infrastructure investments. The rising complexity of drug discovery has further fueled the demand for specialized expertise. The growing need for cost-effective and time-efficient screening solutions have boosted this segment.

The products segment is expected to grow at the fastest rate over the forecast period. This growth is due to the rising demand for novel drug discovery tools. Pharmaceutical and biotechnology companies are increasingly adopting DNA-encoded library technologies in order to enhance screening efficiency and reduce development costs.

Which therapeutic area led the market as of this year?

The oncology segment led the market as of this year in 2024. This is due to the high demand for targeted cancer therapies. This technology has rapidly identified potential small-molecule inhibitors for oncogenic targets. The increasing prevalence of cancer worldwide has further intensified research efforts in this field. The need for innovative and cost-effective drug discovery methods has further driven DNA-encoded library adoption in oncology.

The neurological diseases segment is expected to grow at the fastest rate throughout the forecast period. This growth is fueled by the rising demand for effective treatments against neurodegenerative disorders. The complexity of central nervous system drug discovery has further increased the reliance on DNA-encoded library-based screening. Efforts for the analysis of Alzheimer’s, Parkinson’s, and other neurological diseases has expanded this segment even more.

Which application dominated the market as of this year?

Hit Generation / Identification dominated the market as of this year. DEL’s primary value proposition lies in its ability to generate high-confidence hits rapidly and accurately. The vast chemical space encoded within DNA libraries allows for the exploration of novel scaffolds and binding motifs that traditional HTS may overlook. DEL screening can also be performed in various aqueous environments, making it suitable for a variety of protein targets including GPCRs, kinases, and enzymes.

Hit Validation / Optimization is projected to grow at the fastest rate during the forecast years. Following the identification of initial hits, validating and optimizing those candidates to improve potency, selectivity, and pharmacokinetic properties is critical. Recent advances in structure-guided design, artificial intelligence and SAR analysis are being combined with DEL outputs to streamline this process. Moreover, hybrid workflows integrating DEL with cryo-EM and X-ray crystallography are further boosting this segment.

Which end user held the largest market share in 2024?

Pharmaceutical and Biotechnology Companies held the largest market share in 2024. This is because these types of organizations are the primary drivers of DEL adoption, due to their emphasis on pipeline expansion and innovation. Companies all over the world are integrating DEL into their lead discovery platforms in order to improve efficiency and tackle undruggable targets. Large pharma firms are also seen investing in proprietary library creation and building in-house capabilities to gain long-term strategic advantages.

Contract Research Organizations (CROs) are witnessing the fastest growth rate throughout the forecast period. This growth is due to the increasing demand for cost-effective and flexible drug discovery solutions. They cater to small scale and medium scale biotech firms and academic institutions that lack the infrastructure for large-scale DEL implementation. The increased number of partnerships and licensing deals between CROs and pharma clients is set to push the momentum in this segment even more.

By Product & Service

By Therapeutic Area

By Application

By End Use

By Region

DNA-Encoded Library Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on DNA-Encoded Library Market

5.1. COVID-19 Landscape: DNA-Encoded Library Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global DNA-Encoded Library Market, By Product & Service

8.1. DNA-Encoded Library Market, by Product & Service

8.1.1. Products

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global DNA-Encoded Library Market, By Oncology

9.1. DNA-Encoded Library Market, by Therapeutic Area

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast

9.1.2. Infectious Diseases

9.1.2.1. Market Revenue and Forecast

9.1.3. Cardiovascular Diseases

9.1.3.1. Market Revenue and Forecast

9.1.4. Neurological Diseases

9.1.4.1. Market Revenue and Forecast

9.1.5. Autoimmune Diseases

9.1.5.1. Market Revenue and Forecast

9.1.6. Metabolic Diseases

9.1.6.1. Market Revenue and Forecast

9.1.7. Others

9.1.7.1. Market Revenue and Forecast

Chapter 10. Global DNA-Encoded Library Market, By Application

10.1. DNA-Encoded Library Market, by Application

10.1.1. Hit Generation / Identification

10.1.1.1. Market Revenue and Forecast

10.1.2. Hit to Lead

10.1.2.1. Market Revenue and Forecast

10.1.3. Hit Validation / Optimization

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global DNA-Encoded Library Market, By End Use

11.1. DNA-Encoded Library Market, by End Use

11.1.1. Academic & Research Institutes

11.1.1.1. Market Revenue and Forecast

11.1.2. Pharmaceutical & Biotechnology Companies

11.1.2.1. Market Revenue and Forecast

11.1.3. Contract Research Organizations

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global DNA-Encoded Library Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product & Service

12.1.2. Market Revenue and Forecast, by Therapeutic Area

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product & Service

12.1.5.2. Market Revenue and Forecast, by Therapeutic Area

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product & Service

12.1.6.2. Market Revenue and Forecast, by Therapeutic Area

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product & Service

12.2.2. Market Revenue and Forecast, by Therapeutic Area

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product & Service

12.2.5.2. Market Revenue and Forecast, by Therapeutic Area

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product & Service

12.2.6.2. Market Revenue and Forecast, by Therapeutic Area

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product & Service

12.2.7.2. Market Revenue and Forecast, by Therapeutic Area

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product & Service

12.2.8.2. Market Revenue and Forecast, by Therapeutic Area

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product & Service

12.3.2. Market Revenue and Forecast, by Therapeutic Area

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product & Service

12.3.5.2. Market Revenue and Forecast, by Therapeutic Area

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product & Service

12.3.6.2. Market Revenue and Forecast, by Therapeutic Area

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product & Service

12.3.7.2. Market Revenue and Forecast, by Therapeutic Area

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product & Service

12.3.8.2. Market Revenue and Forecast, by Therapeutic Area

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product & Service

12.4.2. Market Revenue and Forecast, by Therapeutic Area

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product & Service

12.4.5.2. Market Revenue and Forecast, by Therapeutic Area

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product & Service

12.4.6.2. Market Revenue and Forecast, by Therapeutic Area

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product & Service

12.4.7.2. Market Revenue and Forecast, by Therapeutic Area

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product & Service

12.4.8.2. Market Revenue and Forecast, by Therapeutic Area

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product & Service

12.5.2. Market Revenue and Forecast, by Therapeutic Area

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product & Service

12.5.5.2. Market Revenue and Forecast, by Therapeutic Area

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product & Service

12.5.6.2. Market Revenue and Forecast, by Therapeutic Area

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Merck KGaA

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. GenScript

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Pharmaron

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. WuXi Biology

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Aurigene Pharmaceutical Services

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. BOC Sciences

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. LGC Bioresearch Technologies

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SPT Labtech Ltd

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Life Chemicals

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Charles River Laboratories

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others