Lung Cancer Liquid Biopsy Market Size, Share, Report 2025-2034

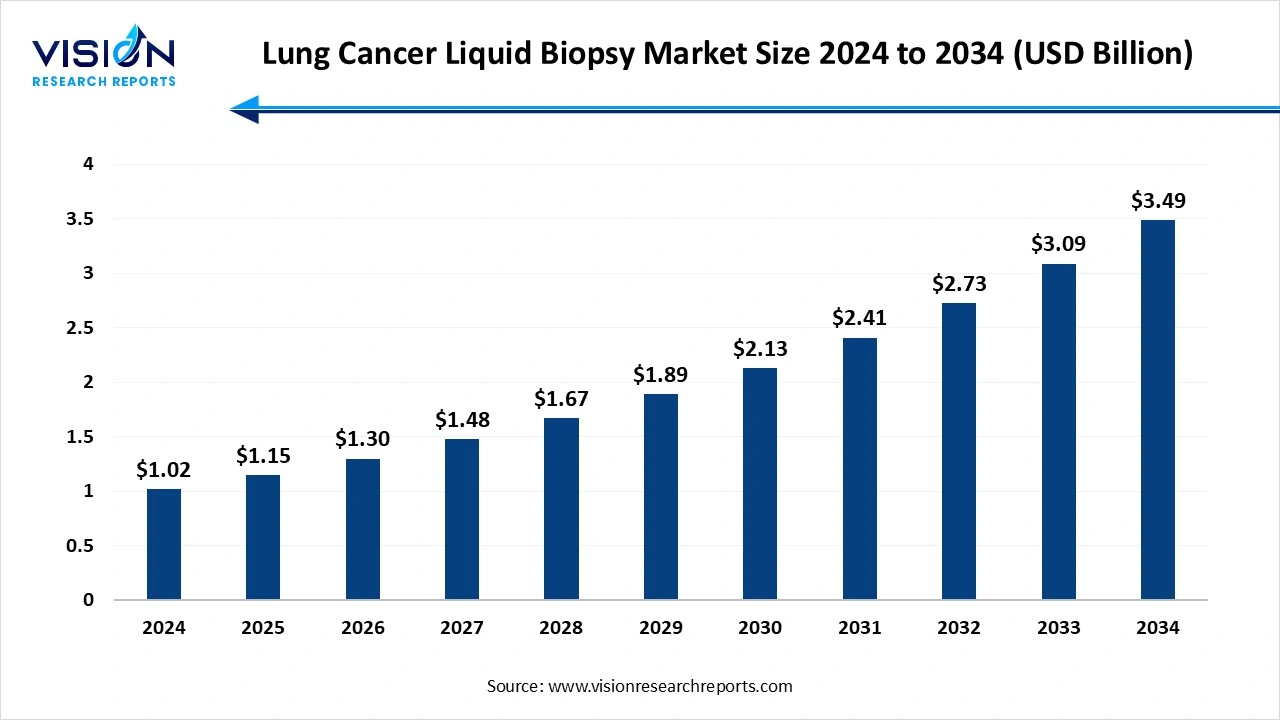

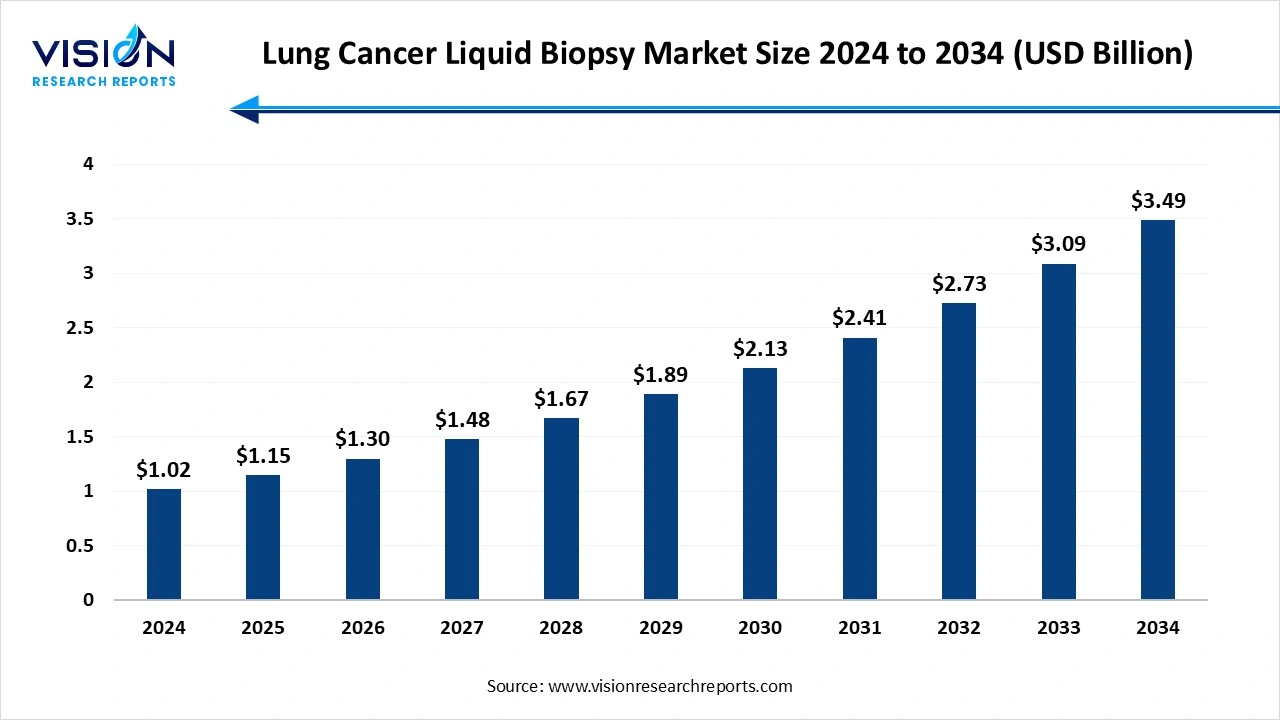

The global lung cancer liquid biopsy market size stood at USD 1.02 billion in 2024 and is estimated to reach USD 1.15 billion in 2025. It is projected to hit USD 3.49 billion by 2034, registering a robust CAGR of 13.1% from 2025 to 2034. The market growth is fueled by rising lung cancer incidence, increasing adoption of non-invasive diagnostic tools, rapid advancements in NGS and digital PCR technologies, and the expanding role of personalized medicine in oncology.

Key Pointers

Key Pointers

- By region, North America dominated with the highest market share in 2024.

- By end-use, the hospitals and laboratories segment generated the maximum market share in 2024.

- By end-use, the specialty clinics segment is projected to register the fastest CAGR from 2025 to 2034.

- By biomarker, the circulating nucleic acids segment contributed the largest market share in 2024.

- By technology, the multi-gene parallel analysis (NGS) segment held the largest revenue share in 2024 and is projected to grow at the fastest CAGR from 2025 to 2034.

- By clinical application, the therapy selection segment captured the maximum market share in 2024.

- By product, the instruments segment held the largest revenue share in 2024 and is projected to achieve the fastest CAGR during the forecast period

Lung Cancer Liquid Biopsy Market Overview

The lung cancer liquid biopsy market is experiencing significant growth and transformation, driven by advances in technology, rising incidences of lung cancer, and an increasing demand for non-invasive diagnostic methods. Liquid biopsy, a less invasive alternative to traditional tissue biopsy, uses a simple blood sample to detect cancer-related biomarkers, providing a promising approach for early diagnosis, monitoring, and treatment of lung cancer.

Lung Cancer Liquid Biopsy Market Growth Factors

The growth of the lung cancer liquid biopsy market is driven by the technological advancements in molecular diagnostics, such as next-generation sequencing (NGS) and digital PCR, have significantly improved the accuracy and efficiency of liquid biopsy tests, making them more reliable for detecting cancer biomarkers. Additionally, the rising incidence of lung cancer globally has increased the demand for early and minimally invasive diagnostic methods. Liquid biopsy offers a non-invasive alternative to traditional tissue biopsies, which are often risky and uncomfortable for patients. Moreover, the trend towards personalized medicine, where treatments are tailored based on individual genetic profiles, is also driving market growth. Liquid biopsy enables precise monitoring of tumor mutations and treatment responses, thereby enhancing the effectiveness of targeted therapies. These factors collectively contribute to the expanding adoption and development of liquid biopsy technologies in the lung cancer diagnostics market.

Report Scope of the Lung Cancer Liquid Biopsy Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.02 Billion |

| Revenue Forecast by 2034 |

USD 3.49 Billion |

| Growth rate from 2025 to 2034 |

CAGR of 13.1% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Regions |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered |

Eurofins Scientific, MDxHealth, CareDx, Immucor, Thermo Fisher Scientific Inc., Menarini Silicon Biosystems, Qiagen, Guardant Health, Exact Sciences Corporation, Myriad Genetics Inc., LungLife AI Inc., Bio-Rad Laboratories, and Agilent Technologies. |

Lung Cancer Liquid Biopsy Market Trends:

- Advancements in Technology: Continuous improvements in genomic technologies such as next-generation sequencing (NGS) and digital PCR are enhancing the accuracy and sensitivity of liquid biopsies, making them more effective in detecting and analyzing cancer biomarkers.

- Increased Adoption of Non-Invasive Diagnostics: There is a growing preference for non-invasive diagnostic methods among patients and healthcare providers. Liquid biopsies offer a safer and less painful alternative to traditional tissue biopsies, facilitating more frequent monitoring of disease progression and treatment response.

- Rising Incidence of Lung Cancer: The increasing prevalence of lung cancer globally is driving the demand for early and accurate diagnostic methods. Liquid biopsies provide a means for early detection, which is crucial for improving patient outcomes.

- Growth of Personalized Medicine: Liquid biopsies are integral to the development of personalized treatment plans. By analyzing specific genetic mutations in tumors, these tests enable the customization of therapies to better target individual cancers, enhancing treatment efficacy and reducing side effects.

Lung Cancer Liquid Biopsy Market Dynamics

Market Opportunity for the Lung Cancer Liquid Biopsy Market

The lung cancer liquid biopsy market is witnessing strong growth due to rapid advancements in diagnostic technologies and the shift toward targeted therapies. Innovations in treatment, especially for non-small cell lung cancer (NSCLC) the most prevalent lung cancer type have improved outcomes by reducing side effects and increasing therapeutic precision. Targeted therapies such as tyrosine kinase inhibitors (TKIs) specifically address genetic mutations like EGFR and ALK, creating a substantial need for reliable, non-invasive diagnostic tools that can detect and monitor these mutations. This growing emphasis on personalized medicine continues to expand opportunities for liquid biopsy solutions.

Key Challenges in the Lung Cancer Liquid Biopsy Market

Despite its benefits, liquid biopsy faces several limitations. Detecting early-stage lung cancer remains difficult due to the low concentration of circulating tumor DNA (ctDNA) or circulating tumor cells (CTCs) in blood during initial disease stages. This can lead to missed diagnoses, which is why tissue biopsy continues to be the gold standard for confirming malignancy. Additional challenges include pre-analytical and analytical variability, as well as the complexity of distinguishing tumor-derived signals from normal biological background noise.

Technological Advancements Driving Market Growth

Artificial intelligence (AI) and machine learning (ML) are transforming lung cancer diagnostics and research. These technologies can analyze large datasets from genomics, imaging, and electronic health records to provide deeper diagnostic insights. AI-powered tools can detect subtle patterns in CT scans indicative of early-stage cancer, helping reduce false positives and false negatives.

Furthermore, AI-driven platforms support personalized treatment planning by identifying patient-specific genetic mutations and biomarkers. This enables clinicians to select the most effective therapies, ultimately improving clinical outcomes and enhancing the role of liquid biopsy in lung cancer management.

Regional Analysis

Which Region Dominated the Lung Cancer Liquid Biopsy Market?

North America emerged as the dominant market, capturing approximately the revenue share in 2024. The region contends with a higher prevalence of smoking compared to others, a major risk factor for lung cancer, consequently leading to a greater incidence of the disease. With its advanced medical infrastructure, including specialized equipment and well-trained professionals, North America is well-equipped to conduct lung cancer biopsies. Moreover, the region generally boasts better access to healthcare services, including lung cancer screening and diagnostic procedures such as biopsies, potentially resulting in increased detection of lung cancer cases. These factors collectively contribute to a heightened demand for lung cancer biopsies in North America compared to other regions.

Asia Pacific is poised to witness significant growth from 2025 to 2034. Lung cancer ranks among the most common cancers in this region, with notably high incidence rates in countries like China, India, and Japan. This increased prevalence naturally translates into a greater demand for diagnostic procedures such as biopsies. Tobacco use, particularly smoking, amplifies the risk of lung cancer, necessitating more biopsies for diagnosis and treatment. Additionally, air pollution poses a significant concern in the region, with elevated levels of particulate matter and other pollutants contributing to respiratory issues and lung cancer risk. Consequently, there is a heightened need for lung cancer screening and biopsies to address these challenges.

Segmental Analysis

Sample Type Analysis

The blood sample-based segment led the market in 2024, capturing a revenue share of over 71%. This dominance is due to its non-invasive nature, repeatability, real-time monitoring capabilities, early detection, and cost-effectiveness. Blood sample-based biopsy tests can be conducted multiple times during a patient’s treatment without causing additional harm or discomfort. Additionally, liquid biopsies offer real-time updates on the patient’s condition, as they can be performed at any stage of the disease and throughout the treatment process.

End-use Analysis

The hospitals and laboratories segment captured the largest revenue share in 2024. These institutions employ specialized medical professionals, including oncologists, pathologists, and radiologists, who possess the expertise necessary to accurately perform and interpret biopsies. Additionally, hospitals and laboratories have access to advanced equipment and technologies essential for biopsy procedures and subsequent analyses. These facilities adhere to stringent quality control measures and safety protocols to ensure precise and reliable results. They also follow well-established protocols for handling biological samples, minimizing contamination risks, and maintaining sample integrity.

The specialty clinics segment is projected to register the fastest CAGR from 2025 to 2034. Specialty clinics focus on specific diseases or medical conditions, such as lung cancer, enabling them to develop a comprehensive understanding of the disease, its diagnosis, and treatment options. These clinics prioritize patient needs and preferences, offering personalized care and support tailored to each individual. This patient-centric approach can lead to increased patient satisfaction and improved adherence to treatment plans, thereby contributing to the growth of specialty clinics.

Biomarker Analysis

The circulating nucleic acids segment accounted for the largest revenue share in 2024. Circulating nucleic acids, especially circulating tumor DNA (ctDNA), can be detected at very low concentrations in blood samples, even in the early stages of cancer. Early detection of lung cancer significantly increases the chances of successful treatment and improves patient survival rates. By analyzing these circulating nucleic acids, healthcare providers can make informed decisions about treatment adjustments and more effectively monitor the patient’s response to therapy. Additionally, ctDNA carries valuable genetic and molecular information about the cancer, which can be used to identify specific mutations and biomarkers associated with lung cancer. This information helps healthcare professionals develop personalized treatment strategies and targeted therapies.

The exosomes/microvesicles segment is expected to register the fastest CAGR from 2025 to 2034. Exosomes and microvesicles can be isolated from a simple blood sample, making them ideal for liquid biopsy applications. These biomarkers reflect changes in the tumor microenvironment and cancer progression. Monitoring the levels of these vesicles in blood samples helps healthcare providers track disease progression and response to treatment, enabling timely adjustments to treatment plans.

Technology Analysis

The multi-gene parallel analysis (NGS) segment dominated the market in 2024 and is projected to grow at the fastest CAGR from 2024 to 2033. This growth is driven by NGS's ability to comprehensively analyze multiple genes, detect various mutations, identify actionable targets for personalized treatment, enable early detection, and monitor disease progression and treatment response. NGS allows for the simultaneous analysis of numerous genes, providing a deeper understanding of the genetic and molecular alterations involved in lung cancer. It can detect a wide range of genetic alterations, including single nucleotide variations, insertions, deletions, and copy number variations.

The single gene analysis (PCR microarrays) segment is anticipated to witness growth during the forecast period. The increasing use of PCR microarrays in lung cancer screening is expected to drive the growth of this segment. PCR microarrays are cost-effective compared to other genetic analysis methods, such as Sanger sequencing or next-generation sequencing (NGS), making them more accessible to patients and healthcare systems.

Clinical Application Analysis

The therapy selection segment held the largest revenue share in 2024. Different therapies carry varying levels of risk and potential side effects. Healthcare professionals can mitigate the risks associated with biopsy procedures by selecting the most appropriate treatment for each patient. Therapy selection in lung cancer biopsy screening is essential for ensuring accurate diagnosis, minimizing risks, delivering personalized treatment, optimizing resource allocation, and prioritizing patient comfort.

The early cancer screening segment is projected to achieve the fastest CAGR from 2025 to 2034. Detecting lung cancer at an early stage significantly improves the likelihood of successful treatment and higher survival rates. Early-stage lung cancer is often more treatable, with a wider range of treatment options available to patients

Product Analysis

The instruments segment held the largest revenue share in 2024 and is projected to achieve the fastest CAGR during the forecast period. Instruments like biopsy needles and bronchoscopes facilitate precise targeting of suspicious lesions within the lung, enhancing the likelihood of obtaining representative tissue samples for diagnosis. These instruments provide a safer approach by minimizing the risk of damaging surrounding healthy lung tissue and other vital organs. Additionally, instrument-based biopsies are typically more cost-effective than open surgical biopsies, making them a more economical option for lung cancer screening.

Lung Cancer Liquid Biopsy Market Key Companies

Lung Cancer Liquid Biopsy Market Segmentation:

By Sample Type

- Blood Sample Based

- Others

By Biomarker

- Circulating Nucleic Acids

- CTC

- Exosomes/Microvesicles

- Circulating Proteins

By Technology

- Multi-gene-parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

By End-use

- Hospitals & Laboratories

- Specialty Clinics

- Academic & Research Centers

- Others

By Clinical Application

- Therapy Selection

- Treatment Monitoring

- Early Cancer Screening

- Recurrence Monitoring

- Others

By Product

- Instruments

- Consumables Kits and Reagents

- Software and Services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Frequently Asked Questions

The global lung cancer liquid biopsy market size was reached at USD 1.02 billion in 2024 and it is projected to hit around USD 3.49 billion by 2034.

The global lung cancer liquid biopsy market is growing at a compound annual growth rate (CAGR) of 13.35% from 2025 to 2034.

The North America region has accounted for the largest lung cancer liquid biopsy market share in 2024.

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Product Procurement Analysis

4.3.2. Sales and Distribution Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Lung Cancer Liquid Biopsy Market

5.1. COVID-19 Landscape: Lung Cancer Liquid Biopsy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Lung Cancer Liquid Biopsy Market, By Sample Type

8.1. Lung Cancer Liquid Biopsy Market, by Sample Type,

8.1.1. Blood Sample Based

8.1.1.1. Market Revenue and Forecast

8.1.2. Others

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Lung Cancer Liquid Biopsy Market, By Biomarker

9.1. Lung Cancer Liquid Biopsy Market, by Biomarker,

9.1.1. Circulating Nucleic Acids

9.1.1.1. Market Revenue and Forecast

9.1.2. CTC

9.1.2.1. Market Revenue and Forecast

9.1.3. Exosomes/Microvesicles

9.1.3.1. Market Revenue and Forecast

9.1.4. Circulating Proteins

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Lung Cancer Liquid Biopsy Market, By Technology

10.1. Lung Cancer Liquid Biopsy Market, by Technology,

10.1.1. Multi-gene-parallel Analysis (NGS)

10.1.1.1. Market Revenue and Forecast

10.1.2. Single Gene Analysis (PCR Microarrays)

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Lung Cancer Liquid Biopsy Market, By End-use

11.1. Lung Cancer Liquid Biopsy Market, by End-use,

11.1.1. Hospitals & Laboratories

11.1.1.1. Market Revenue and Forecast

11.1.2. Specialty Clinics

11.1.2.1. Market Revenue and Forecast

11.1.3. Academic & Research Centers

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Lung Cancer Liquid Biopsy Market, By Clinical Application

12.1. Lung Cancer Liquid Biopsy Market, by Clinical Application,

12.1.1. Therapy Selection

12.1.1.1. Market Revenue and Forecast

12.1.2. Treatment Monitoring

12.1.2.1. Market Revenue and Forecast

12.1.3. Early Cancer Screening

12.1.3.1. Market Revenue and Forecast

12.1.4. Recurrence Monitoring

12.1.4.1. Market Revenue and Forecast

12.1.5. Others

12.1.5.1. Market Revenue and Forecast

Chapter 13. Global Lung Cancer Liquid Biopsy Market, By Product

13.1. Lung Cancer Liquid Biopsy Market, by Product,

13.1.1. Instruments

13.1.1.1. Market Revenue and Forecast

13.1.2. Consumables Kits and Reagents

13.1.2.1. Market Revenue and Forecast

13.1.3. Software and Services

13.1.3.1. Market Revenue and Forecast

Chapter 14. Global Lung Cancer Liquid Biopsy Market, Regional Estimates and Trend Forecast

14.1. North America

14.1.1. Market Revenue and Forecast, by Sample Type

14.1.2. Market Revenue and Forecast, by Biomarker

14.1.3. Market Revenue and Forecast, by Technology

14.1.4. Market Revenue and Forecast, by End-use

14.1.5. Market Revenue and Forecast, by Clinical Application

14.1.6. Market Revenue and Forecast, by Product

14.1.7. U.S.

14.1.7.1. Market Revenue and Forecast, by Sample Type

14.1.7.2. Market Revenue and Forecast, by Biomarker

14.1.7.3. Market Revenue and Forecast, by Technology

14.1.7.4. Market Revenue and Forecast, by End-use

14.1.8. Market Revenue and Forecast, by Clinical Application

14.1.8.1. Market Revenue and Forecast, by Product

14.1.9. Rest of North America

14.1.9.1. Market Revenue and Forecast, by Sample Type

14.1.9.2. Market Revenue and Forecast, by Biomarker

14.1.9.3. Market Revenue and Forecast, by Technology

14.1.9.4. Market Revenue and Forecast, by End-use

14.1.10. Market Revenue and Forecast, by Clinical Application

14.1.11. Market Revenue and Forecast, by Product

14.1.11.1.

14.2. Europe

14.2.1. Market Revenue and Forecast, by Sample Type

14.2.2. Market Revenue and Forecast, by Biomarker

14.2.3. Market Revenue and Forecast, by Technology

14.2.4. Market Revenue and Forecast, by End-use

14.2.5. Market Revenue and Forecast, by Clinical Application

14.2.6. Market Revenue and Forecast, by Product

14.2.7.

14.2.8. UK

14.2.8.1. Market Revenue and Forecast, by Sample Type

14.2.8.2. Market Revenue and Forecast, by Biomarker

14.2.8.3. Market Revenue and Forecast, by Technology

14.2.9. Market Revenue and Forecast, by End-use

14.2.10. Market Revenue and Forecast, by Clinical Application

14.2.10.1. Market Revenue and Forecast, by Product

14.2.11. Germany

14.2.11.1. Market Revenue and Forecast, by Sample Type

14.2.11.2. Market Revenue and Forecast, by Biomarker

14.2.11.3. Market Revenue and Forecast, by Technology

14.2.12. Market Revenue and Forecast, by End-use

14.2.13. Market Revenue and Forecast, by Clinical Application

14.2.14. Market Revenue and Forecast, by Product

14.2.14.1.

14.2.15. France

14.2.15.1. Market Revenue and Forecast, by Sample Type

14.2.15.2. Market Revenue and Forecast, by Biomarker

14.2.15.3. Market Revenue and Forecast, by Technology

14.2.15.4. Market Revenue and Forecast, by End-use

14.2.16. Market Revenue and Forecast, by Clinical Application

14.2.16.1. Market Revenue and Forecast, by Product

14.2.17. Rest of Europe

14.2.17.1. Market Revenue and Forecast, by Sample Type

14.2.17.2. Market Revenue and Forecast, by Biomarker

14.2.17.3. Market Revenue and Forecast, by Technology

14.2.17.4. Market Revenue and Forecast, by End-use

14.2.18. Market Revenue and Forecast, by Clinical Application

14.2.18.1. Market Revenue and Forecast, by Product

14.3. APAC

14.3.1. Market Revenue and Forecast, by Sample Type

14.3.2. Market Revenue and Forecast, by Biomarker

14.3.3. Market Revenue and Forecast, by Technology

14.3.4. Market Revenue and Forecast, by End-use

14.3.5. Market Revenue and Forecast, by Clinical Application

14.3.6. Market Revenue and Forecast, by Product

14.3.7. India

14.3.7.1. Market Revenue and Forecast, by Sample Type

14.3.7.2. Market Revenue and Forecast, by Biomarker

14.3.7.3. Market Revenue and Forecast, by Technology

14.3.7.4. Market Revenue and Forecast, by End-use

14.3.8. Market Revenue and Forecast, by Clinical Application

14.3.9. Market Revenue and Forecast, by Product

14.3.10. China

14.3.10.1. Market Revenue and Forecast, by Sample Type

14.3.10.2. Market Revenue and Forecast, by Biomarker

14.3.10.3. Market Revenue and Forecast, by Technology

14.3.10.4. Market Revenue and Forecast, by End-use

14.3.11. Market Revenue and Forecast, by Clinical Application

14.3.11.1. Market Revenue and Forecast, by Product

14.3.12. Japan

14.3.12.1. Market Revenue and Forecast, by Sample Type

14.3.12.2. Market Revenue and Forecast, by Biomarker

14.3.12.3. Market Revenue and Forecast, by Technology

14.3.12.4. Market Revenue and Forecast, by End-use

14.3.12.5. Market Revenue and Forecast, by Clinical Application

14.3.12.6. Market Revenue and Forecast, by Product

14.3.13. Rest of APAC

14.3.13.1. Market Revenue and Forecast, by Sample Type

14.3.13.2. Market Revenue and Forecast, by Biomarker

14.3.13.3. Market Revenue and Forecast, by Technology

14.3.13.4. Market Revenue and Forecast, by End-use

14.3.13.5. Market Revenue and Forecast, by Clinical Application

14.3.13.6. Market Revenue and Forecast, by Product

14.4. MEA

14.4.1. Market Revenue and Forecast, by Sample Type

14.4.2. Market Revenue and Forecast, by Biomarker

14.4.3. Market Revenue and Forecast, by Technology

14.4.4. Market Revenue and Forecast, by End-use

14.4.5. Market Revenue and Forecast, by Clinical Application

14.4.6. Market Revenue and Forecast, by Product

14.4.7. GCC

14.4.7.1. Market Revenue and Forecast, by Sample Type

14.4.7.2. Market Revenue and Forecast, by Biomarker

14.4.7.3. Market Revenue and Forecast, by Technology

14.4.7.4. Market Revenue and Forecast, by End-use

14.4.8. Market Revenue and Forecast, by Clinical Application

14.4.9. Market Revenue and Forecast, by Product

14.4.10. North Africa

14.4.10.1. Market Revenue and Forecast, by Sample Type

14.4.10.2. Market Revenue and Forecast, by Biomarker

14.4.10.3. Market Revenue and Forecast, by Technology

14.4.10.4. Market Revenue and Forecast, by End-use

14.4.11. Market Revenue and Forecast, by Clinical Application

14.4.12. Market Revenue and Forecast, by Product

14.4.13. South Africa

14.4.13.1. Market Revenue and Forecast, by Sample Type

14.4.13.2. Market Revenue and Forecast, by Biomarker

14.4.13.3. Market Revenue and Forecast, by Technology

14.4.13.4. Market Revenue and Forecast, by End-use

14.4.13.5. Market Revenue and Forecast, by Clinical Application

14.4.13.6. Market Revenue and Forecast, by Product

14.4.14. Rest of MEA

14.4.14.1. Market Revenue and Forecast, by Sample Type

14.4.14.2. Market Revenue and Forecast, by Biomarker

14.4.14.3. Market Revenue and Forecast, by Technology

14.4.14.4. Market Revenue and Forecast, by End-use

14.4.14.5. Market Revenue and Forecast, by Clinical Application

14.4.14.6. Market Revenue and Forecast, by Product

14.5. Latin America

14.5.1. Market Revenue and Forecast, by Sample Type

14.5.2. Market Revenue and Forecast, by Biomarker

14.5.3. Market Revenue and Forecast, by Technology

14.5.4. Market Revenue and Forecast, by End-use

14.5.5. Market Revenue and Forecast, by Clinical Application

14.5.6. Market Revenue and Forecast, by Product

14.5.7. Brazil

14.5.7.1. Market Revenue and Forecast, by Sample Type

14.5.7.2. Market Revenue and Forecast, by Biomarker

14.5.7.3. Market Revenue and Forecast, by Technology

14.5.7.4. Market Revenue and Forecast, by End-use

14.5.8. Market Revenue and Forecast, by Clinical Application

14.5.8.1. Market Revenue and Forecast, by Product

14.5.9. Rest of LATAM

14.5.9.1. Market Revenue and Forecast, by Sample Type

14.5.9.2. Market Revenue and Forecast, by Biomarker

14.5.9.3. Market Revenue and Forecast, by Technology

14.5.9.4. Market Revenue and Forecast, by End-use

14.5.9.5. Market Revenue and Forecast, by Clinical Application

14.5.9.6. Market Revenue and Forecast, by Product

Chapter 15. Company Profiles

15.1. Eurofins Scientific

15.1.1. Company Overview

15.1.2. Product Offerings

15.1.3. Financial Performance

15.1.4. Recent Initiatives

15.2. MDxHealth

15.2.1. Company Overview

15.2.2. Product Offerings

15.2.3. Financial Performance

15.2.4. Recent Initiatives

15.3. CareDx

15.3.1. Company Overview

15.3.2. Product Offerings

15.3.3. Financial Performance

15.3.4. Recent Initiatives

15.4. Immucor

15.4.1. Company Overview

15.4.2. Product Offerings

15.4.3. Financial Performance

15.4.4. Recent Initiatives

15.5. Thermo Fisher Scientific Inc.

15.5.1. Company Overview

15.5.2. Product Offerings

15.5.3. Financial Performance

15.5.4. Recent Initiatives

15.6. Menarini Silicon Biosystems

15.6.1. Company Overview

15.6.2. Product Offerings

15.6.3. Financial Performance

15.6.4. Recent Initiatives

15.7. Qiagen

15.7.1. Company Overview

15.7.2. Product Offerings

15.7.3. Financial Performance

15.7.4. Recent Initiatives

15.8. Guardant Health

15.8.1. Company Overview

15.8.2. Product Offerings

15.8.3. Financial Performance

15.8.4. Recent Initiatives

15.9. Exact Sciences Corporation

15.9.1. Company Overview

15.9.2. Product Offerings

15.9.3. Financial Performance

15.9.4. Recent Initiatives

15.10. Myriad Genetics, Inc.

15.10.1. Company Overview

15.10.2. Product Offerings

15.10.3. Financial Performance

15.10.4. Recent Initiatives

Chapter 16. Research Methodology

16.1. Primary Research

16.2. Secondary Research

16.3. Assumptions

Chapter 17. Appendix

17.1. About Us

17.2. Glossary of Terms

Key Pointers

Key Pointers Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments