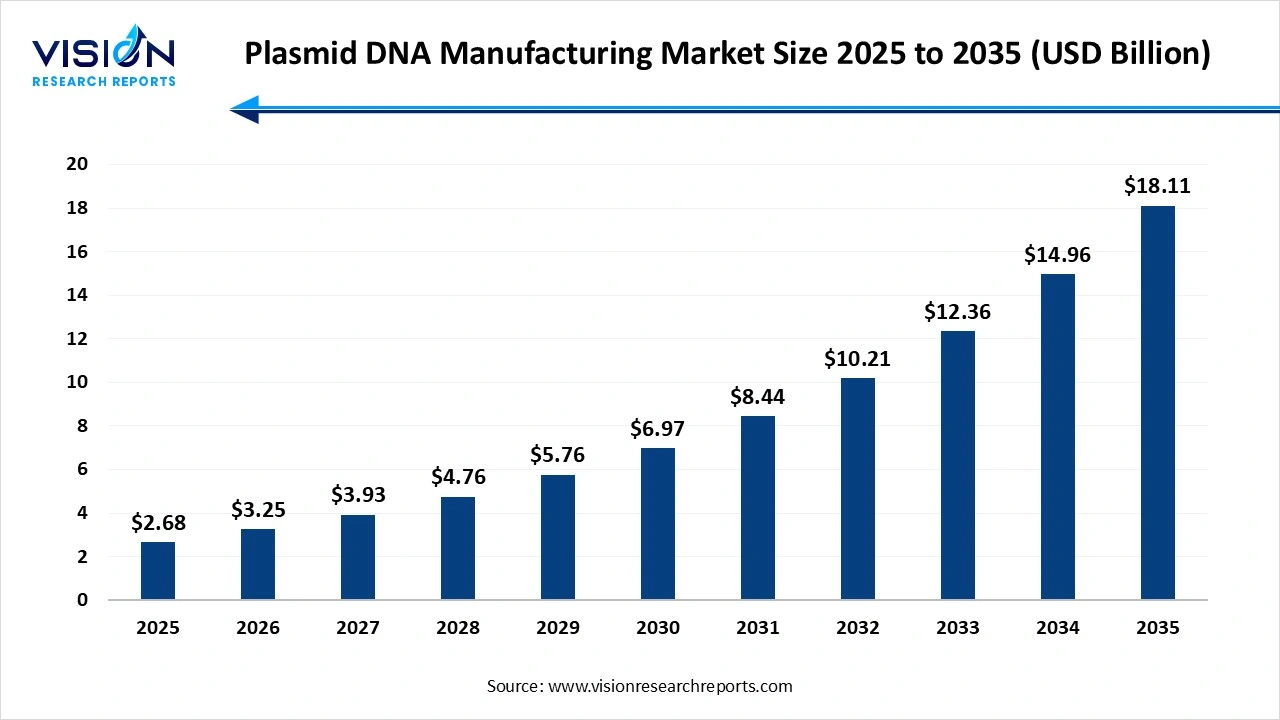

The global plasmid DNA manufacturing market size stood at USD 2.68 billion in 2025 and is estimated to reach USD 3.25 billion in 2026 It is projected to hit USD 18.11 billion by 2035, registering a robust CAGR of 21.05% from 2026 to 2035. The plasmid DNA manufacturing market is growing rapidly due to the increasing adoption of gene and cell therapies, rising demand for DNA and mRNA vaccines, and expanding biopharmaceutical R&D pipelines targeting cancer and genetic disorders. Advancements in bioprocessing technologies, automation, and GMP-compliant production are improving scalability and quality, while government funding and regulatory support for next-generation biologics continue to accelerate market expansion.

The plasmid DNA manufacturing market is witnessing strong growth driven by the rising demand for advanced therapies, including gene therapy, DNA vaccines, cell therapy, and mRNA-based drug development. Plasmid DNA plays a crucial role as a foundational component for delivering genetic material, boosting both therapeutic innovation and vaccine production pipelines. Increasing investments in biopharmaceutical R&D, expansion of clinical trials targeting genetic disorders and cancers, and the rapid adoption of viral vector and non-viral delivery systems are further propelling market expansion. Additionally, advancements in bioprocessing technologies, automation, and scalable upstream and downstream manufacturing are improving plasmid yield, purity, and cost-efficiency. With growing interest in personalized medicine and government support for biologics manufacturing, the plasmid DNA manufacturing market is expected to continue its upward trajectory in the foreseeable future.

The Plasmid DNA Manufacturing market is experiencing robust growth, propelled by several key factors. Firstly, the surge in biopharmaceutical research has significantly increased the demand for plasmid DNA, a pivotal component in the development of biopharmaceutical products. Additionally, the rapid advancements in gene therapy have played a crucial role, fostering a heightened demand for plasmid DNA due to its integral role in delivering therapeutic genes. The continuous evolution of manufacturing technologies has further augmented market growth, as novel techniques enhance efficiency and scalability while reducing production costs. Furthermore, the global emphasis on vaccine development, particularly DNA vaccines, has fueled the demand for plasmid DNA manufacturing, underscoring its versatility and importance in the pharmaceutical industry. Collectively, these growth factors underscore the promising trajectory of the Plasmid DNA Manufacturing market.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.68 Billion |

| Revenue Forecast by 2034 | USD 18.11 Billion |

| Growth rate from 2025 to 2034 | CAGR of 21.05% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Charles River Laboratories, VGXI, Inc., Danaher (Aldevron), Kaneka Corp., Nature Technology, Cell and Gene Therapy Catapult, Eurofins Genomics, Lonza, Luminous BioSciences, LLC, and Akron Biotech. |

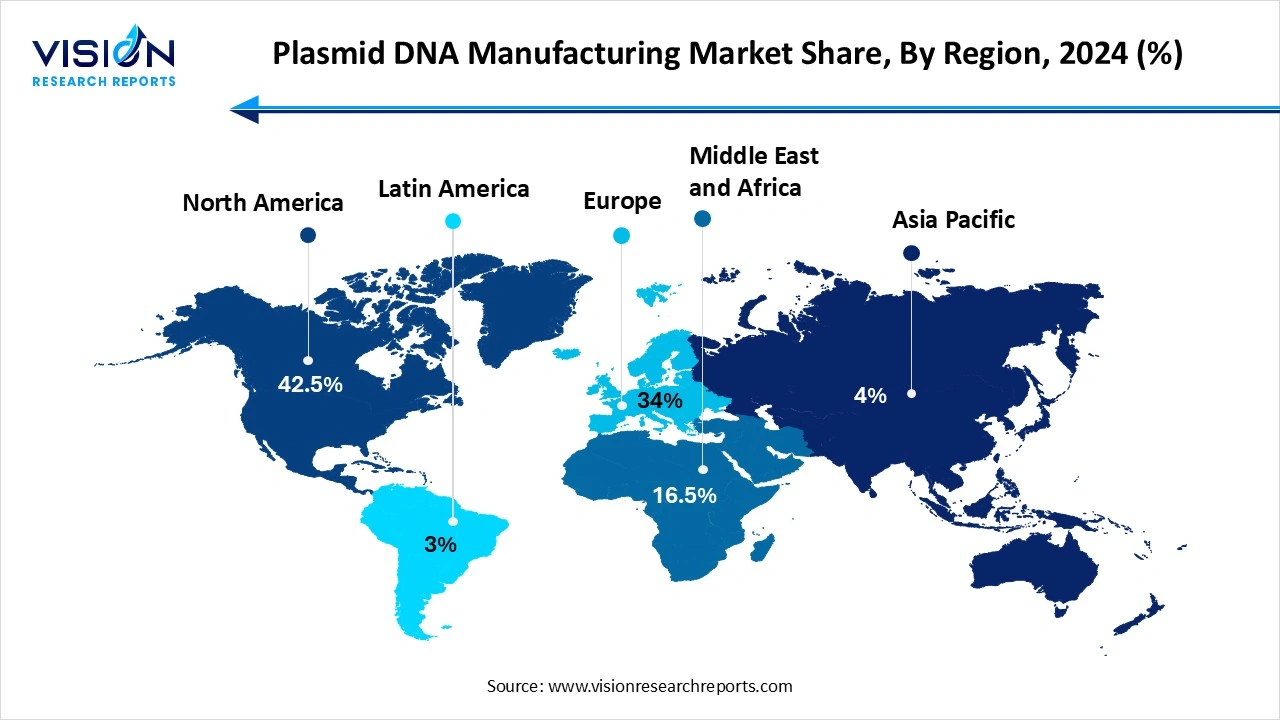

In 2025, North America claimed the largest market share at 42.5% globally. The region's substantial share can be attributed to the presence of numerous research and development centers dedicated to advanced therapies. Additionally, the establishment of the Recombinant DNA Advisory Committee by the National Institutes of Health (NIH), tasked with overseeing scientific, ethical, and legal aspects related to the use of recombinant DNA techniques, has significantly influenced the adoption of these technologies. Notably, the committee plays a crucial role in evaluating research involving human gene transfer

Asia-Pacific is emerging as the fastest-growing region, driven by major markets such as India, China, Japan, and South Korea. The region’s rapid growth is fueled by expanding biotechnology research, supportive government programs for biomanufacturing, and rising production of DNA-based vaccines, collectively accelerating market momentum. Furthermore, the region offers cost-effective operating and manufacturing units for research purposes. Japan leads the Asian market, serving as a prominent hub for regenerative medicine research. The Japanese government recognizes regenerative medicine and cell therapy as vital contributors to the country's economic growth, aiming to establish global leadership in stem cell development and marketing, thereby driving market growth in the Asia Pacific region.

In 2025, the clinical therapeutics segment dominated the market, holding the largest share at 55%. Plasmid DNA's significance is on the rise, particularly in clinical research applications for genetic vaccination and gene therapy. Notably, plasmid DNA gene therapy is being employed for cardiovascular disorders, allowing the transfer of plasmid DNA to skeletal or cardiac muscle. Clinical angiogenic gene therapy using plasmid DNA gene transfer has been administered to patients with peripheral artery disease, thereby driving growth in this segment.

The pre-clinical therapeutics segment is predicted to rise at the fastest rate. The pre-clinical plasmid DNA manufacturing serves heavy purity, This growth is fueled by factors such as an upsurge in clinical trials demonstrating promising results, a higher incidence of chronic diseases, and intensified efforts in gene therapy development. The progression of gene therapy's clinical transformation and industrialization is particularly noteworthy across Asian countries. As an illustration, in June 2021, Aldevron and Aruvant Sciences revealed their collaboration, with Aldevron contributing to the development of ARU-1801 an investigational gene therapy for sickle cell disease (SCD), along with ARU-2801, a gene therapy for hypophosphatasia (HPP). Furthermore, in support of Aruvant's planned pivotal study for ARU-1801, Aldevron will supply a plasmid adhering to good manufacturing practice (GMP) standards

In 2025, the cell & gene therapy segment dominated the market, holding a substantial share of 55%. This significant share is attributable to the widespread application of gene therapy in treating various inherited and genetic diseases. The continuous advancements in technology aimed at developing safe and reliable treatments for diverse disorders further contribute to the growth of this segment.

The DNA vaccines segment is expected to rise at the fastest rate in the plasmid DNA manufacturing market. The surge in chronic diseases and the global impact of the COVID-19 pandemic have spurred increased research and development activities for novel therapies and vaccine. This heightened demand fuels the need for plasmid DNA manufacturing solutions for research purposes. For example, in May 2020, Takara Bio enlisted AGC Biologics to produce an intermediate COVID-19 DNA vaccine a circular DNA (plasmid DNA) containing the target pathogen's protein. Developed through collaborative efforts by Osaka University and AnGes Inc., this vaccination is poised to elevate the revenue share of DNA vaccines in the plasmid DNA manufacturing industry.

In 2025, the cancer segment commanded the largest market share at 41%, and it is poised to exhibit the most rapid Compound Annual Growth Rate (CAGR) from 2026 to 2035. The predominant use of DNA plasmids in developing cancer treatment therapies is a key driver propelling the expansion of this segment. The increasing application of various gene therapy strategies for cancer, including genetic manipulation of apoptotic pathways, immune modulation through gene therapy, and oncolytic virotherapy, is escalating the demand for plasmid DNA and fostering substantial growth in this sector.

The rising prevalence of cancer is anticipated to have a positive impact on the regional market dynamics throughout the forecast period. Additionally, with the expansion of vaccine production and technological advancements, there is an expected surge in the demand for plasmid DNA manufacturing. According to estimates from the American Cancer Society, the projected number of new cancer cases in 2023 is approximately 1,958,310, with 609,820 expected cancer-related deaths in the U.S. This data further substantiates the market growth, highlighting the crucial role of plasmid DNA in addressing the challenges posed by cancer.

In 2025, the GMP grade segment dominated the market with a substantial share of 87%. This segment's prominence can be attributed to its extensive applications in preclinical studies, particularly in animal testing for drug safety and metabolism. Additionally, GMP-grade plasmid DNA finds utility in various applications, including direct injection as vaccines and ex-vivo applications like cell and gene therapy. Notably, plasmid DNA meeting Good Manufacturing Practice (GMP) standards is imperative for safe and effective gene transfer into humans.

This process aligns with crucial GMP requirements, ensuring a consistent production method and maintaining comparable quality standards. Moreover, many therapeutic manufacturers prefer GMP-grade plasmid DNA to meet both the volume and quality demands necessary for therapeutic applications. Recognizing the pivotal role of plasmids in influencing the quality and safety of the final product, the adoption of GMP-compliant plasmids is strongly recommended, particularly during the development of clinical batches, starting from phase 1.

By Grade

By Development Phase

By Application

By Disease

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Plasmid DNA Manufacturing Market

5.1. COVID-19 Landscape: Plasmid DNA Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Plasmid DNA Manufacturing Market, By Grade

8.1. Plasmid DNA Manufacturing Market, by Grade Scope,

8.1.1. R&D Grade

8.1.1.1. Market Revenue and Forecast

8.1.2. GMP Grade

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Plasmid DNA Manufacturing Market, By Development Phase

9.1. Plasmid DNA Manufacturing Market, by Development Phase Scope,

9.1.1. Pre-clinical Therapeutics

9.1.1.1. Market Revenue and Forecast

9.1.2. Clinical Therapeutics

9.1.2.1. Market Revenue and Forecast

9.1.3. Marketed Therapeutics

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Plasmid DNA Manufacturing Market, By Application

10.1. Plasmid DNA Manufacturing Market, by Application Scope,

10.1.1. DNA Vaccines

10.1.1.1. Market Revenue and Forecast

10.1.2. Cell & Gene Therapy

10.1.2.1. Market Revenue and Forecast

10.1.3. Immunotherapy

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Plasmid DNA Manufacturing Market, By Disease

11.1. Plasmid DNA Manufacturing Market, by Disease Scope,

11.1.1. Infectious Disease

11.1.1.1. Market Revenue and Forecast

11.1.2. Cancer

11.1.2.1. Market Revenue and Forecast

11.1.3. Genetic Disorder

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Plasmid DNA Manufacturing Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Grade Scope

12.1.2. Market Revenue and Forecast, by Development Phase Scope

12.1.3. Market Revenue and Forecast, by Application Scope

12.1.4. Market Revenue and Forecast, by Disease Scope

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Grade Scope

12.1.5.2. Market Revenue and Forecast, by Development Phase Scope

12.1.5.3. Market Revenue and Forecast, by Application Scope

12.1.5.4. Market Revenue and Forecast, by Disease Scope

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Grade Scope

12.1.6.2. Market Revenue and Forecast, by Development Phase Scope

12.1.6.3. Market Revenue and Forecast, by Application Scope

12.1.6.4. Market Revenue and Forecast, by Disease Scope

12.2. Europe

12.2.1. Market Revenue and Forecast, by Grade Scope

12.2.2. Market Revenue and Forecast, by Development Phase Scope

12.2.3. Market Revenue and Forecast, by Application Scope

12.2.4. Market Revenue and Forecast, by Disease Scope

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Grade Scope

12.2.5.2. Market Revenue and Forecast, by Development Phase Scope

12.2.5.3. Market Revenue and Forecast, by Application Scope

12.2.5.4. Market Revenue and Forecast, by Disease Scope

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Grade Scope

12.2.6.2. Market Revenue and Forecast, by Development Phase Scope

12.2.6.3. Market Revenue and Forecast, by Application Scope

12.2.6.4. Market Revenue and Forecast, by Disease Scope

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Grade Scope

12.2.7.2. Market Revenue and Forecast, by Development Phase Scope

12.2.7.3. Market Revenue and Forecast, by Application Scope

12.2.7.4. Market Revenue and Forecast, by Disease Scope

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Grade Scope

12.2.8.2. Market Revenue and Forecast, by Development Phase Scope

12.2.8.3. Market Revenue and Forecast, by Application Scope

12.2.8.4. Market Revenue and Forecast, by Disease Scope

12.3. APAC

12.3.1. Market Revenue and Forecast, by Grade Scope

12.3.2. Market Revenue and Forecast, by Development Phase Scope

12.3.3. Market Revenue and Forecast, by Application Scope

12.3.4. Market Revenue and Forecast, by Disease Scope

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Grade Scope

12.3.5.2. Market Revenue and Forecast, by Development Phase Scope

12.3.5.3. Market Revenue and Forecast, by Application Scope

12.3.5.4. Market Revenue and Forecast, by Disease Scope

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Grade Scope

12.3.6.2. Market Revenue and Forecast, by Development Phase Scope

12.3.6.3. Market Revenue and Forecast, by Application Scope

12.3.6.4. Market Revenue and Forecast, by Disease Scope

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Grade Scope

12.3.7.2. Market Revenue and Forecast, by Development Phase Scope

12.3.7.3. Market Revenue and Forecast, by Application Scope

12.3.7.4. Market Revenue and Forecast, by Disease Scope

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Grade Scope

12.3.8.2. Market Revenue and Forecast, by Development Phase Scope

12.3.8.3. Market Revenue and Forecast, by Application Scope

12.3.8.4. Market Revenue and Forecast, by Disease Scope

12.4. MEA

12.4.1. Market Revenue and Forecast, by Grade Scope

12.4.2. Market Revenue and Forecast, by Development Phase Scope

12.4.3. Market Revenue and Forecast, by Application Scope

12.4.4. Market Revenue and Forecast, by Disease Scope

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Grade Scope

12.4.5.2. Market Revenue and Forecast, by Development Phase Scope

12.4.5.3. Market Revenue and Forecast, by Application Scope

12.4.5.4. Market Revenue and Forecast, by Disease Scope

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Grade Scope

12.4.6.2. Market Revenue and Forecast, by Development Phase Scope

12.4.6.3. Market Revenue and Forecast, by Application Scope

12.4.6.4. Market Revenue and Forecast, by Disease Scope

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Grade Scope

12.4.7.2. Market Revenue and Forecast, by Development Phase Scope

12.4.7.3. Market Revenue and Forecast, by Application Scope

12.4.7.4. Market Revenue and Forecast, by Disease Scope

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Grade Scope

12.4.8.2. Market Revenue and Forecast, by Development Phase Scope

12.4.8.3. Market Revenue and Forecast, by Application Scope

12.4.8.4. Market Revenue and Forecast, by Disease Scope

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Grade Scope

12.5.2. Market Revenue and Forecast, by Development Phase Scope

12.5.3. Market Revenue and Forecast, by Application Scope

12.5.4. Market Revenue and Forecast, by Disease Scope

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Grade Scope

12.5.5.2. Market Revenue and Forecast, by Development Phase Scope

12.5.5.3. Market Revenue and Forecast, by Application Scope

12.5.5.4. Market Revenue and Forecast, by Disease Scope

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Grade Scope

12.5.6.2. Market Revenue and Forecast, by Development Phase Scope

12.5.6.3. Market Revenue and Forecast, by Application Scope

12.5.6.4. Market Revenue and Forecast, by Disease Scope

Chapter 13. Company Profiles

13.1. Charles River Laboratories

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. VGXI, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Aldevron

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Kaneka Corp.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Nature Technology

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Cell and Gene Therapy Catapult

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Eurofins Genomics

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Lonza

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Luminous BioSciences, LLC

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Akron Biotech

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others