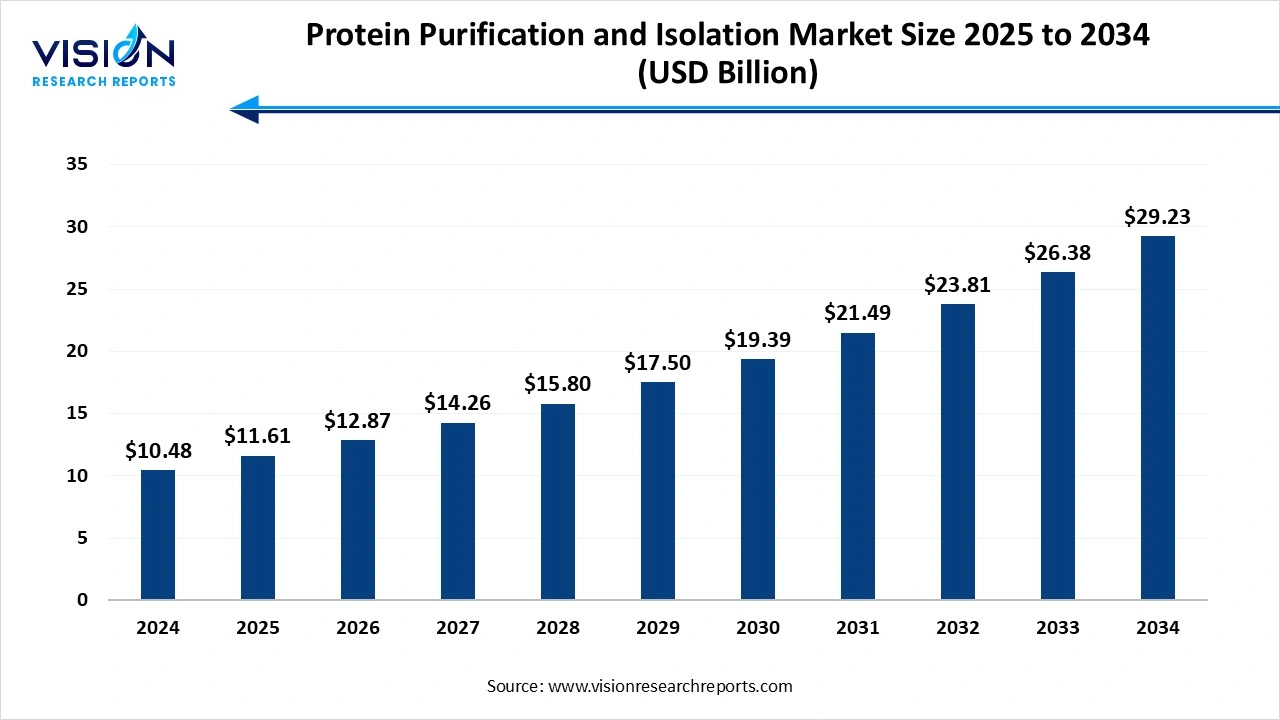

The global protein purification and isolation market size was valued at USD 10.48 billion in 2024 and is projected to reach USD YY billion in 2025 to around USD 29.23 billion by 2034, growing at a CAGR of 10.8% from 2025 to 2034. The rise in demand for protein-based therapies, the focus on precision medicine, and the advancement of technology drive the market growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 10.48 billion |

| Revenue Forecast by 2034 | USD 29.23 billion |

| Growth rate from 2025 to 2034 | CAGR of 10.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

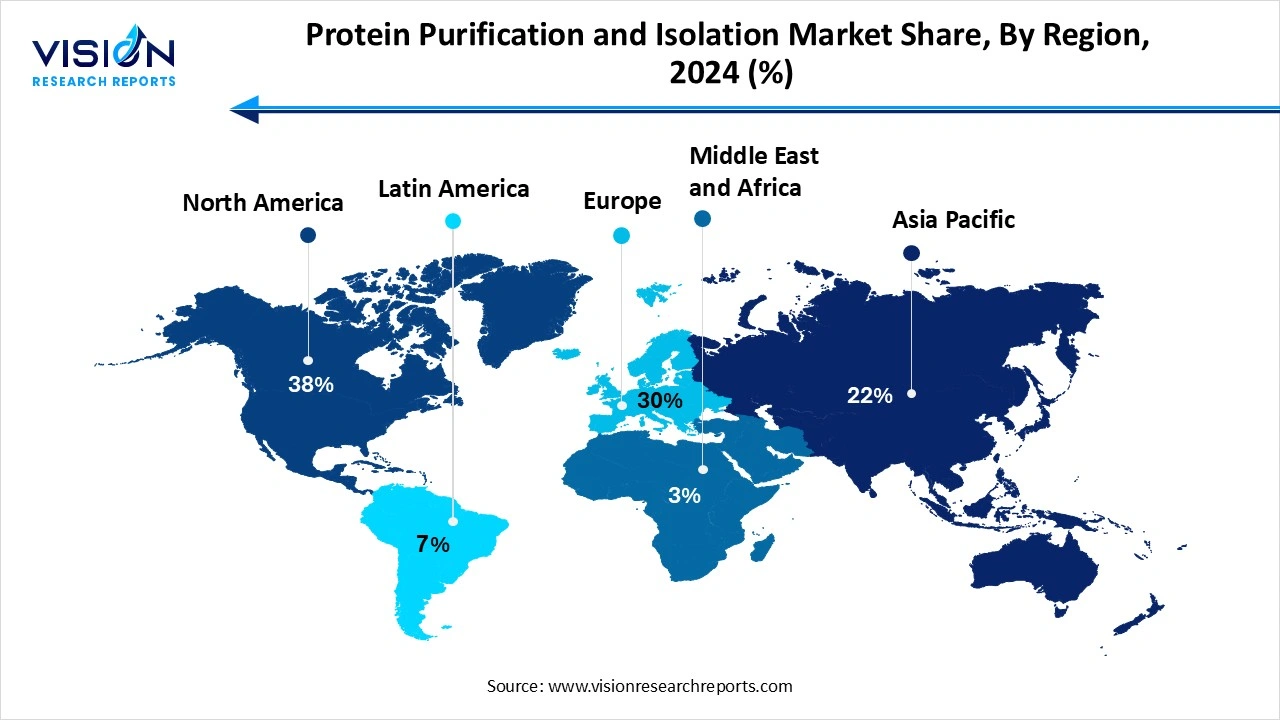

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, Inc., Qiagen N.V., Agilent Technologies, Inc., Sartorius AG, Promega Corporation, Takara Bio Inc., and Purolite Corporation. |

The protein purification and isolation market refers to a systematic process used to separate a specific protein from a complex of biological materials, such as a cell or tissue. The market growth is driven by the growing demand of consumers and the industrial demand for products or services. Innovation in areas such as chromatography, electrophoresis, and filtration systems is enhancing the efficiency, resolution, and scalability of protein isolation, making it easier to obtain the desired proteins for various applications. The increasing focus on research and development, rising investments in life science research, and drug discovery.

The increased funding from both governments and private entities for research in biotechnology, pharmaceuticals, and the life sciences fuels the adoption of protein purification and isolation technologies, advancing scientific knowledge and developing new therapies. Significantly higher R&D spending, enabled by investor capital, is accelerating drug discovery and pushing the boundaries of medical science.

The ongoing need for advancement in protein purification methods and technologies, including faster, more efficient, and scalable systems. Innovations in techniques, such as affinity chromatography, magnetic beads, and automated systems, are enhancing efficiency, specificity, and scalability. This addresses the demand for high-purity proteins in a cost-effective and streamlined manner.

The high-performance chromatography systems, automated workstations, and other advanced purification devices require significant upfront capital investment. Advanced techniques, particularly affinity chromatography, rely on specialized and expensive resins and reagents. High research and development expenses add to the financial burden for market players.

North America dominated the global market with highest share of 38% in 2024. The well-established pharmaceutical and biotechnology firms, with significant investment in research and development and the presence of major key players in the region, drive market growth. Moreover, advanced healthcare infrastructure, rising implementation of cutting-edge technologies in clinical research, accelerate market growth.

United States Protein Purification and Isolation Market Trends

The shift towards automated purification systems and the use of AI to enhance efficiency and reduce errors, enabling high-throughput screening essential for drug discovery and proteomics. The expanding pipeline of biologics and biosimilars requires high-purity proteins for safety and efficacy. Growth in proteomics and genomics research is a key driver, as large-scale protein studies help understand diseases and identify biomarkers.

Asia Pacific expects significant growth in the protein purification and isolation market during the forecast period. The rising investment in biopharmaceutical research, increasing government support for life science, and the expansion of healthcare infrastructure. The increasing contract research and manufacturing organizations in the region creates increased demand for protein purification and isolation technologies. Moreover, the region’s cost-effective manufacturing capabilities and increasing presence of global biotech firms are contributing to its rapid market expansion.

Why did the Consumables Segment Dominate the Protein Purification and Isolation Market?

The consumables segment dominated the Protein Purification and Isolation market in 2024. The rising demand for protein-based therapeutics, such as monoclonal antibodies, vaccine, and biologics, requires large quantities of high-purity proteins. Significant investment in life science research, genomic, and proteomics by both academic and industry players is fueling the need for efficient protein isolation tools and, by extension, consumables.

The instrument segment is the fastest-growing in the protein purification and isolation market during the forecast period. The growing demand in biologic development, particularly monoclonal antibodies, fuels the demand for robust purification processes and high-purity proteins needed for therapeutic applications. Technological innovation, increased research and development activities, and increasing demand for chromatography.

How the Chromatography Segment hold the Largest Share in the Protein Purification and Isolation Market?

The chromatography emerged as the leading technology in the protein purification and isolation market, accounting for a revenue share of 30% in 2024. Among the most widely used technologies are chromatography, ultrafiltration, precipitation, and electrophoresis. Chromatography, particularly affinity and ion exchange chromatography, dominates the market due to its precision in separating proteins based on charge, size, or binding affinity. Ultrafiltration and membrane-based techniques are also gaining momentum for their effectiveness in removing contaminants and concentrating proteins without affecting their structure. Precipitation techniques, although more traditional, continue to serve as cost-effective methods in primary purification steps.

The electrophoresis segment is projected to witness substantial growth with a notable CAGR in the protein purification and isolation market over the forecast period. It enables the separation of proteins based on their molecular weight and charge through an electric field, offering high resolution and accuracy. Techniques like SDS-PAGE and native PAGE are widely used in laboratories for protein profiling, purity checks, and molecular weight determination. Capillary electrophoresis, a more advanced variant, offers faster results and greater sensitivity, making it suitable for high-throughput and clinical applications. Although electrophoresis is more commonly associated with analysis, its role in isolating and identifying target proteins makes it an indispensable tool in the purification workflow.

How the Protein-Protein Interaction Segment hold the Largest Share in the Protein Purification and Isolation Market?

The protein-protein interaction studies led the market, contributing a revenue share of 33% in 2024. The critical role in understanding fundamental biological processes and disease mechanisms, various roles in drug discovery and development. The increasing focus on personalized medicine also emphasizes the need for tailored therapies based on individual patient molecular profiles, further driving demand for PPI studies and the high-quality purified proteins they require. Advancements in functional proteomics and technology, including innovative resins, automated systems, and magnetic bead technologies, further support the growing demand from PPI studies.

The drug screening application segment is experiencing the fastest growth in the market during the forecast period. Drug screening assays rely heavily on purified proteins to accurately assess potential drug candidates' interactions and effects. Focusing on developing highly specific therapies requires precise identification and isolation of targets for proteins for drug development, driving demand for efficient purification techniques.

How the Academic and Research Institute Segment hold the Largest Share in the Protein Purification and Isolation Market?

The academic and research institutes dominated the market, holding a revenue share of 41% in 2024. The extensive research activities and the need for high-purity proteins, intensive research generate a continuous demand for high-purity proteins, driving the adoption of advanced purification methods. Universities and research centers serve as vital training grounds, nurturing a pipeline of skilled operators and researchers proficient in protein purification techniques. Strong funding support, innovation, and early adoption of new technologies drive market growth.

The hospitals segment is experiencing the fastest growth in the market during the forecast period. The hospital labs use protein purification techniques to isolate and analyze critical protein biomarkers for disease diagnosis and monitoring. In addition, hospital-based research departments are increasingly developing protein-based therapies, such as monoclonal antibodies and vaccines, through translational research. By integrating advanced purification systems, hospitals can ensure the high-purity proteins needed for both diagnostic testing and therapeutic development.

In January 2025, Quantum-Si introduced Platinum Pro, a benchtop sequencer was introduced to enhance efficiency and versatility in proteomics research. (Source: Quantum-Si)

In March 2025, Momentum Biotechnologies acquired OmicScouts to enhance its proteomics-driven drug discovery efforts. The deal integrates OmicScouts' advanced mass spectrometry platforms, strengthening Momentum's target identification and biomarker discovery capabilities. (Source: Momentum Biotechnologies)

By Product

By Technology

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Protein Purification and Isolation Market

5.1. COVID-19 Landscape: Protein Purification and Isolation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Protein Purification and Isolation Market, By Product

8.1. Protein Purification and Isolation Market, by Product

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast

Chapter 9. Global Protein Purification and Isolation Market, By Technology

9.1. Protein Purification and Isolation Market, by Technology

9.1.1. Ultrafiltration

9.1.1.1. Market Revenue and Forecast

9.1.2. Precipitation

9.1.2.1. Market Revenue and Forecast

9.1.3. Chromatography

9.1.3.1. Market Revenue and Forecast

9.1.4. Electrophoresis

9.1.4.1. Market Revenue and Forecast

9.1.5. Western Blotting

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. Global Protein Purification and Isolation Market, By Application

10.1. Protein Purification and Isolation Market, by Application

10.1.1. Drug Screening

10.1.1.1. Market Revenue and Forecast

10.1.2. Biomarker Discovery

10.1.2.1. Market Revenue and Forecast

10.1.3. Protein-Protein Interaction Studies

10.1.3.1. Market Revenue and Forecast

10.1.4. Diagnostics

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Protein Purification and Isolation Market, By End Use

11.1. Protein Purification and Isolation Market, by End Use

11.1.1. Academic And Research Institutes

11.1.1.1. Market Revenue and Forecast

11.1.2. Hospitals

11.1.2.1. Market Revenue and Forecast

11.1.3. Pharmaceutical And Biotechnology Companies

11.1.3.1. Market Revenue and Forecast

11.1.4. CROs

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Protein Purification and Isolation Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Product

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Product

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Application

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Product

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Application

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Product

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Application

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Product

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Application

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Product

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Application

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Product

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Application

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Product

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Application

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Product

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Application

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Product

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Application

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Product

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Application

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Product

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Application

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Product

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Application

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Product

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Application

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Product

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Application

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Product

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Application

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Product

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Application

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Product

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Application

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Product

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Application

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Product

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Application

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Product

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Application

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Merck KGaA (MilliporeSigma)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Bio-Rad Laboratories, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Qiagen N.V.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Agilent Technologies, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Sartorius AG

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Promega Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Takara Bio Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Purolite Corporation

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others