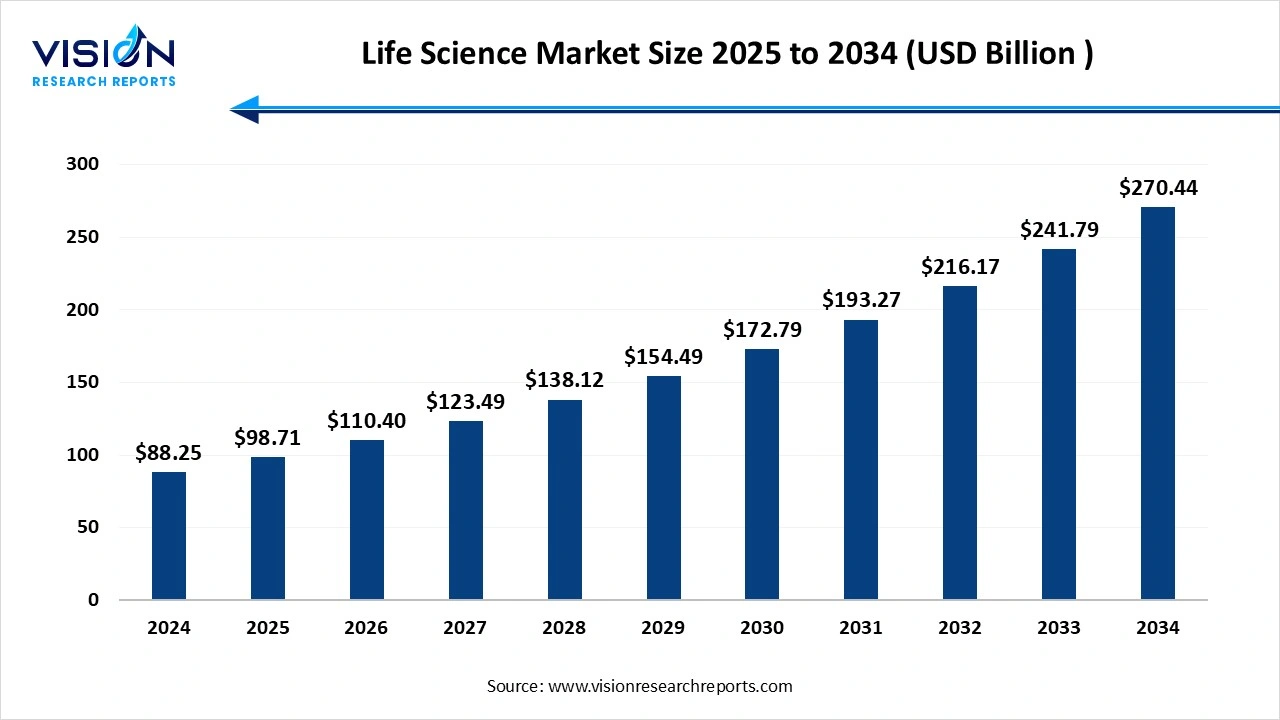

The global life science market size was estimated at USD 88.25 billion in 2024 and is expected to grow to USD 98.71 billion in 2025, ultimately reaching USD 270.44 billion by 2034, reflecting a remarkable CAGR of 11.85%. The trends towards healthcare, increasing aging global population, increasing prevalence of chronic disease, and focus on personalized and precision medicine. The technological advancement and innovation in R&D drive market growth.

The life science market encompasses products, technologies, and services that support biological research, healthcare innovation, and biopharmaceutical development. It includes laboratory equipment, consumables, reagents, software, and analytical tools used in genomics, proteomics, cell biology, molecular biology, microbiology, and related fields. The market also spans contract research and manufacturing services, diagnostics, and data-driven solutions enabling the discovery, development, and commercialization of therapeutics and diagnostics.

The market growth is driven by the significant innovation in R&D spending, mostly in the pharmaceutical and biotechnological divisions are essential to life science market growth. The rising applications of genomic technologies, innovations in artificial intelligence, and digital health technologies.

The increasing worldwide incidence of diseases is driving the demand for new diagnostic tools and therapies. The increasing need for advanced treatment is driving the growth in the biopharmaceutical and genomics market. The increasing aging population requires significant investment from both public and private sectors, fueling innovation across the life science industry.

| Report Coverage | Details |

| Market Size in 2024 | USD 88.25 billion |

| Revenue Forecast by 2034 | USD 270.44 billion |

| Growth rate from 2025 to 2034 | CAGR of 11.85% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

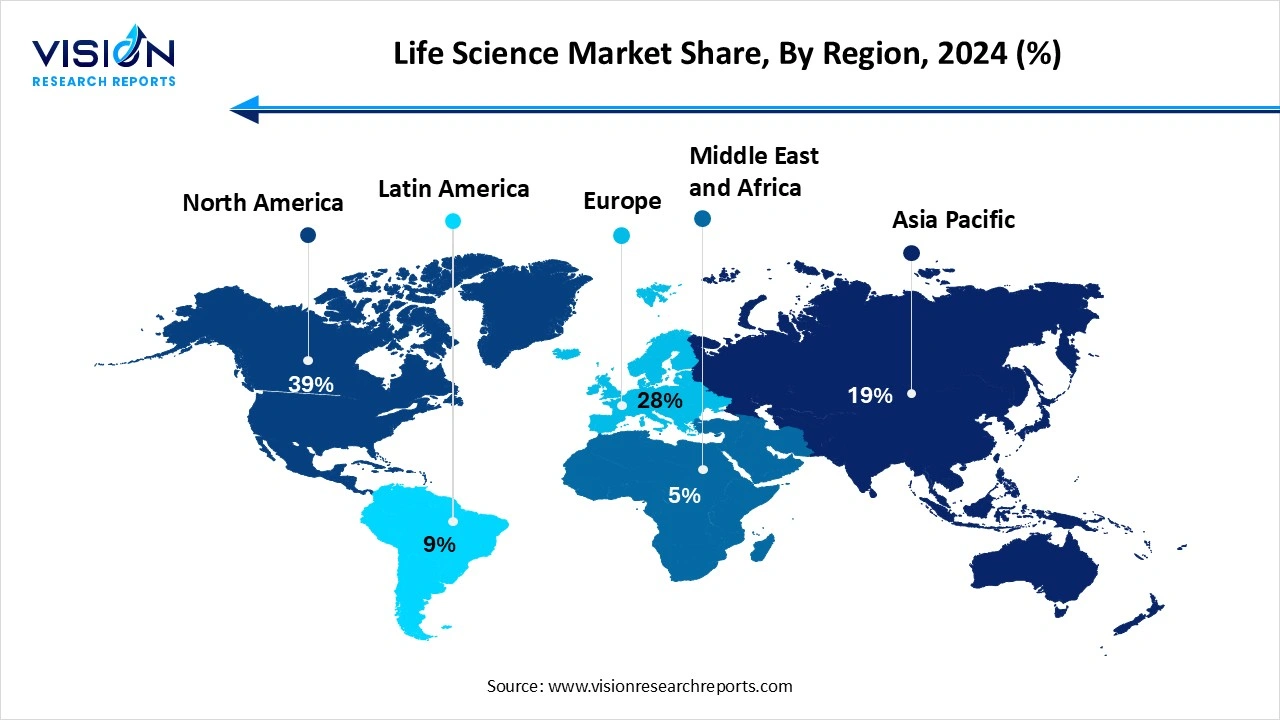

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific, Danaher Corporation, Agilent Technologies, Merck KGaA (MilliporeSigma), Bio-Rad Laboratories, PerkinElmer (Revvity), Illumina, QIAGEN, Bruker Corporation, Waters Corporation, Sartorius AG, Charles River Laboratories, Lonza Group, Becton, Dickinson and Company (BD), Cytiva (Danaher), Eppendorf AG, Shimadzu Corporation, Corning Incorporated (Life Sciences), Promega Corporation, Tecan Group. |

Advanced Diagnostics and Therapeutics for the Life Science Market

The leveraging of genomics and multi-omics data to create treatments tailored to an individual's unique genetic profile is a rapidly expanding field. Cell and gene therapy offers new treatment options for conditions previously considered untreatable, such as rare genetic diseases and certain cancers. Liquid biopsies for non-invasive blood tests for early-stage cancer detection are gaining traction and promise a shift towards proactive diagnostics.

High Implementation Costs in the Life Science Market

The advanced technologies, such as artificial intelligence (AI), analytics, and new life science software, require substantial upfront investments in hardware, software, and infrastructure. This can create a significant barrier for smaller firms and delay the broader adoption of these solutions. Life science research and technology development are expensive undertakings, but budgets are often limited.

Which Region Dominated the Life Science Market?

North America dominated the life science market in 2024, and the region is expected to sustain the position during the forecast period. The region in which significant R&D investment in research and development, particularly in the biotechnology and pharmaceutical sectors. The advancement in healthcare infrastructure, a sophisticated healthcare system that supports the development and adoption of cutting-edge technologies and advanced analytical solutions. The region's high technology adoption expands the market growth.

United States Life Science Market Trends

The region's strong infrastructure well well-funded healthcare system provide a fertile ground for life science innovations. The private and public sectors in the U.S. provide substantial investment in biomedical research and development, fuelling market growth. The government supports favorable policies and high adoption of technology.

Why is Asia Pacific Significantly Growing in the Life Science Market?

Asia Pacific expects significant growth in the life science market during the forecast period. The growing demand for advanced diagnostic and therapeutic solutions, increasing prevalence of chronic and infectious diseases. The growing emphasis on personalized medicine and the increasing adoption of innovative technologies. The expanding healthcare infrastructure investment in hospitals, clinics, and manufacturing facilities increases demand for medical devices and services.

Why did the Reagents & Consumables Segment Dominate the Life Science Market?

The reagents & consumables segment dominated the Life Science market in 2024. The expansion of diagnostics, booming R&D investments, and the growth of personalized medicine. The innovation in life science techniques has spurred demand for new and more advanced reagents. Many pharmaceutical and biotech firms outsource their research and manufacturing to Contract Research Organizations and Contract Manufacturing Organizations. These organizations rely on life science reagents and consumables to streamline drug development and production.

The software & informatics segment is the fastest-growing in the Life Science market during the forecast period. Artificial Intelligence and Machine Learning are accelerating drug discovery, improving clinical trial efficiency, and enabling more accurate diagnostics. The rising demand for precision medicine and software helps to streamline complex processes in drug development, clinical trials, and lab operations, reducing cost and bringing new drugs to market faster. The digitalization of workflow and increasing healthcare spending boost the market growth.

How the Genomics & NGS Segment hold the Largest Share in the Life Science Market?

The Genomics & NGS segment held the largest revenue share in the life science market in 2024. The rising demand for personalized medicine and tailored treatments, an increased focus on understanding and treating diseases at the genomic level, and strong government and institutional support fuel the dominance of the genomics and NGS segment in the life sciences market.

The synthetic biology segment is experiencing the fastest growth in the market during the forecast period. The rapid progress in gene editing technologies, such as CRISPR/Cas9 and synthetic genomics, allows scientists to precisely modify and create new biological systems with greater efficiency and lower cost. The rising investment and research initiatives, growing demand for sustainable solutions, and impactful applications drive market growth.

How the Drug Discovery & Development Segment Held the Dominant Share in the Life Science Market?

The drug discovery & development segment dominated the Life Science market in 2024. Their high demand for novel treatments and increasing prevalence of chronic and complex diseases create a significant market for new and effective therapies, compelling companies to invest heavily in drug discovery. The adoption of advanced technologies, strategic collaboration expansion of the market growth. The rising focus on personalized medicine and small-molecule drug dominance boosts the market growth.

The personalized & precision medicine segment is the fastest-growing in the market during the forecast period. The rising prevalence of chronic diseases necessitates more effective and targeted treatments than traditional approaches. The rising research and development investment and funding, and the shift towards personalized healthcare and patient-centric care. Personalized medicine allows for more informed decision-making by both doctors and patients, leading to greater patient empowerment and satisfaction, fueling the market growth.

How Pharmaceutical & Biotechnology Companies Segment Held the Dominant Share in the Life Science Market?

The pharmaceutical & biotechnology companies segment dominated the Life Science market in 2024. The high research and development investment, companies heavily invest in discovering and developing new drugs, therapies, and innovative solutions to address unmet medical needs. The rising demand for novel therapies, advancement in biotechnology focused towards genomics, proteomics, cell biology, and AI-driven analytics, accelerates drug discovery, clinical trials, and diagnostics. The strong regulatory framework and streamlining efforts and trends in personalized medicine and advanced therapies.

The CROs & CDMOs segment is the fastest-growing in the market during the forecast period. The increasing need for specialized expertise, cost-effectiveness, advanced technologies, and the rise of complex therapies and emerging markets. This trend is expected to continue as pharmaceutical and biotechnology companies increasingly recognize the value of outsourcing to accelerate drug development and bring innovative treatments to patients more efficiently.

By Product Type

By Technology

By Application

By End User

By Industry Vertical

By Region

Life Science Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Life Science Market

5.1. COVID-19 Landscape: Life Science Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market TrIndustry Verticals and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and TrIndustry Verticals

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. VIndustry Verticalor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Life Science Market, By Product Type

8.1. Life Science Market, by Product Type

8.1.1. Instruments & Equipment

8.1.1.1. Market Revenue and Forecast

8.1.2. Reagents & Consumables

8.1.2.1. Market Revenue and Forecast

8.1.3 Software & Informatics

8.1.3.1. Market Revenue and Forecast

8.1.4. Services

8.1.4.1. Market Revenue and Forecast

8.1.5. Others

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Life Science Market, By Technology

9.1. Life Science Market, by Technology

9.1.1 Genomics & Next-Generation Sequencing (NGS)

9.1.1.1. Market Revenue and Forecast

9.1.2. Proteomics & Protein Engineering

9.1.2.1. Market Revenue and Forecast

9.1.3. Cell Biology & Cell-based Assays

9.1.3.1. Market Revenue and Forecast

9.1.4. Molecular Biology (PCR, cloning, gene editing)

9.1.4.1. Market Revenue and Forecast

9.1.5. Structural Biology & Imaging

9.1.5.1. Market Revenue and Forecast

9.1.6. Microbiology & Virology

9.1.6.1. Market Revenue and Forecast

9.1.7 Synthetic Biology

9.1.7.1. Market Revenue and Forecast

9.1.8. Stem Cell Research

9.1.8.1. Market Revenue and Forecast

9.1.9. Systems Biology

9.1.9.1. Market Revenue and Forecast

9.1.10. Stem Cell Research

9.1.10.1. Market Revenue and Forecast

9.1.11. Stem Cell Research

9.1.11.1. Market Revenue and Forecast

Chapter 10. Global Life Science Market, By Application

10.1 Life Science Market, by Application

10.1.1. Drug Discovery & Development

10.1.1.1. Market Revenue and Forecast

10.1.2. Clinical Diagnostics

10.1.2.1. Market Revenue and Forecast

10.1.3. Personalized & Precision Medicine

10.1.3.1. Market Revenue and Forecast

10.1.4. Genetic Testing & Screening

10.1.4.1. Market Revenue and Forecast

10.1.5. Forensics

10.1.5.1. Market Revenue and Forecast

10.1.6. Agricultural & Environmental Research

10.1.6.1. Market Revenue and Forecast

10.1.7. Industrial Biotechnology

10.1.7.1. Market Revenue and Forecast

10.1.8. Stem Cell & Regenerative Medicine

10.1.8.1. Market Revenue and Forecast

10.1.9. Academic & Basic Research

10.1.9.1. Market Revenue and Forecast

10.1.10. Others

10.1.10.1. Market Revenue and Forecast

Chapter 11. Global Life Science Market, By End User

11.1. Life Science Market, by End User

11.1.1. Academic & Research Institutes

11.1.1.1. Market Revenue and Forecast

11.1.2 Pharmaceutical & Biotechnology Companies

11.1.2.1. Market Revenue and Forecast

11.1.3 Hospitals & Diagnostic Laboratories

11.3.1. Market Revenue and Forecast

11.1.4 Contract Research Organizations (CROs)

11.1.4.1. Market Revenue and Forecast

11.1.5 Contract Manufacturing & Development Organizations (CDMOs)

11.1.5.1. Market Revenue and Forecast

11.1.6 Government & Regulatory Bodies

11.1.6.1. Market Revenue and Forecast

11.1.7 Others

11.1.7.1. Market Revenue and Forecast

Chapter 12. Global Life Science Market, By Industry Vertical

12.1. Life Science Market, by Industry Vertical

12.1.1. Pharmaceuticals

12.1.1.1. Market Revenue and Forecast

12.1.2. Biotechnology

12.1.2.1. Market Revenue and Forecast

12.1.3. Diagnostics & Healthcare

12.1.3.1. Market Revenue and Forecast

12.1.4. Agriculture & Food Science

12.1.4.1. Market Revenue and Forecast

12.1.5 Environmental Science

12.1.5.1. Market Revenue and Forecast

12.1.5. Industrial Bioprocessing

12.1.5.1. Market Revenue and Forecast

12.1.5. Forensics & Security

12.1.5.1. Market Revenue and Forecast

12.1.5. Others

12.1.5.1. Market Revenue and Forecast

Chapter 13. Global Life Science Market, Regional Estimates and Industry Vertical Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product Type

13.1.2. Market Revenue and Forecast, by Technology

13.1.3. Market Revenue and Forecast, by Application Mode

13.1.4. Market Revenue and Forecast, by End User Size

13.1.5. Market Revenue and Forecast, by Industry Vertical Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product Type

13.1.6.2. Market Revenue and Forecast, by Technology

13.1.6.3. Market Revenue and Forecast, by Application Mode

13.1.6.4. Market Revenue and Forecast, by End User Size

13.1.7. Market Revenue and Forecast, by Industry Vertical Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product Type

13.1.8.2. Market Revenue and Forecast, by Technology

13.1.8.3. Market Revenue and Forecast, by Application

13.1.8.4. Market Revenue and Forecast, by End User

13.1.8.5. Market Revenue and Forecast, by Industry Vertical

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product Type

13.2.2. Market Revenue and Forecast, by Technology

13.2.3. Market Revenue and Forecast, by Application

13.2.4. Market Revenue and Forecast, by End User

13.2.5. Market Revenue and Forecast, by Industry Vertical

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product Type

13.2.6.2. Market Revenue and Forecast, by Technology

13.2.6.3. Market Revenue and Forecast, by Application

13.2.7. Market Revenue and Forecast, by End User

13.2.8. Market Revenue and Forecast, by Industry Vertical

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product Type

13.2.9.2. Market Revenue and Forecast, by Technology

13.2.9.3. Market Revenue and Forecast, by Application

13.2.10. Market Revenue and Forecast, by End User

13.2.11. Market Revenue and Forecast, by Industry Vertical

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product Type

13.2.12.2. Market Revenue and Forecast, by Technology

13.2.12.3. Market Revenue and Forecast, by Application

13.2.12.4. Market Revenue and Forecast, by End User

13.2.13. Market Revenue and Forecast, by Industry Vertical

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product Type

13.2.14.2. Market Revenue and Forecast, by Technology

13.2.14.3. Market Revenue and Forecast, by Application

13.2.14.4. Market Revenue and Forecast, by End User

13.2.15. Market Revenue and Forecast, by Industry Vertical

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product Type

13.3.2. Market Revenue and Forecast, by Technology

13.3.3. Market Revenue and Forecast, by Application

13.3.4. Market Revenue and Forecast, by End User

13.3.5. Market Revenue and Forecast, by Industry Vertical

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product Type

13.3.6.2. Market Revenue and Forecast, by Technology

13.3.6.3. Market Revenue and Forecast, by Application

13.3.6.4. Market Revenue and Forecast, by End User

13.3.7. Market Revenue and Forecast, by Industry Vertical

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product Type

13.3.8.2. Market Revenue and Forecast, by Technology

13.3.8.3. Market Revenue and Forecast, by Application

13.3.8.4. Market Revenue and Forecast, by End User

13.3.9. Market Revenue and Forecast, by Industry Vertical

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product Type

13.3.10.2. Market Revenue and Forecast, by Technology

13.3.10.3. Market Revenue and Forecast, by Application

13.3.10.4. Market Revenue and Forecast, by End User

13.3.10.5. Market Revenue and Forecast, by Industry Vertical

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product Type

13.3.11.2. Market Revenue and Forecast, by Technology

13.3.11.3. Market Revenue and Forecast, by Application

13.3.11.4. Market Revenue and Forecast, by End User

13.3.11.5. Market Revenue and Forecast, by Industry Vertical

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product Type

13.4.2. Market Revenue and Forecast, by Technology

13.4.3. Market Revenue and Forecast, by Application

13.4.4. Market Revenue and Forecast, by End User

13.4.5. Market Revenue and Forecast, by Industry Vertical

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product Type

13.4.6.2. Market Revenue and Forecast, by Technology

13.4.6.3. Market Revenue and Forecast, by Application

13.4.6.4. Market Revenue and Forecast, by End User

13.4.7. Market Revenue and Forecast, by Industry Vertical

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product Type

13.4.8.2. Market Revenue and Forecast, by Technology

13.4.8.3. Market Revenue and Forecast, by Application

13.4.8.4. Market Revenue and Forecast, by End User

13.4.9. Market Revenue and Forecast, by Industry Vertical

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product Type

13.4.10.2. Market Revenue and Forecast, by Technology

13.4.10.3. Market Revenue and Forecast, by Application

13.4.10.4. Market Revenue and Forecast, by End User

13.4.10.5. Market Revenue and Forecast, by Industry Vertical

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product Type

13.4.11.2. Market Revenue and Forecast, by Technology

13.4.11.3. Market Revenue and Forecast, by Application

13.4.11.4. Market Revenue and Forecast, by End User

13.4.11.5. Market Revenue and Forecast, by Industry Vertical

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product Type

13.5.2. Market Revenue and Forecast, by Technology

13.5.3. Market Revenue and Forecast, by Application

13.5.4. Market Revenue and Forecast, by End User

13.5.5. Market Revenue and Forecast, by Industry Vertical

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product Type

13.5.6.2. Market Revenue and Forecast, by Technology

13.5.6.3. Market Revenue and Forecast, by Application

13.5.6.4. Market Revenue and Forecast, by End User

13.5.7. Market Revenue and Forecast, by Industry Vertical

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product Type

13.5.8.2. Market Revenue and Forecast, by Technology

13.5.8.3. Market Revenue and Forecast, by Application

13.5.8.4. Market Revenue and Forecast, by End User

13.5.8.5. Market Revenue and Forecast, by Industry Vertical

Chapter 14. Company Profiles

14.1. Thermo Fisher Scientific

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Danaher Corporation

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Agilent Technologies

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Merck KGaA (MilliporeSigma)

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Bio-Rad Laboratories

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. PerkinElmer (Revvity)

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Illumina

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. QIAGEN

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Bruker Corporation

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Waters Corporation

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. AppIndustry Verticalix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others