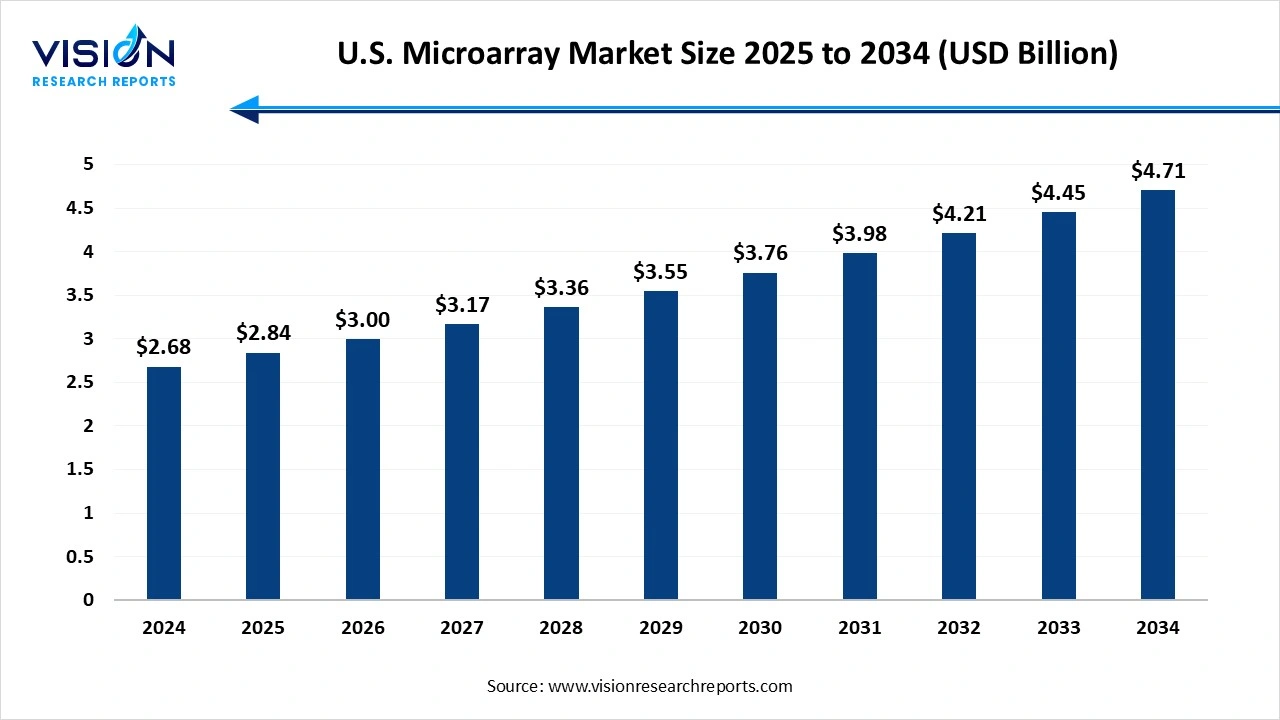

The U.S. microarray market size was reached at USD 2.68 billion in 2024 and it is projected to hit around USD 4.71

billion by 2034, growing at a CAGR of 5.8% from 2025 to 2034. The market growth is driven by increasing applications in genomics and proteomics, the U.S. Microarray Market is experiencing significant growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.68 billion |

| Revenue Forecast by 2034 | USD 4.71 billion |

| Growth rate from 2025 to 2034 | CAGR of 5.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered |

Thermo Fisher Scientific Inc (Applied Biosystems), Agilent Technologies, Inc., Illumina, Inc.; PerkinElmer, Merck KGaA, Schott (Applied Microarrays), Danaher Corporation, Arrayit Corporation, Bio-Rad Laboratories, Inc., Microarrays Inc. |

The U.S. microarray market is experiencing steady growth, driven by increasing demand for high-throughput genomic and proteomic research in both academic and commercial sectors. Microarray technology has become a cornerstone in fields such as gene expression profiling, disease diagnosis, drug discovery, and personalized medicine. As biotechnology and pharmaceutical companies intensify their focus on precision medicine, the need for efficient and accurate gene analysis tools like microarrays continues to rise. Additionally, advancements in microarray platforms such as higher sensitivity, improved automation, and integration with AI-based analytics are further propelling market expansion. The presence of major market players, robust healthcare infrastructure, and substantial investments in R&D are positioning the U.S. as a dominant force in the global microarray landscape.

The U.S. microarray market is primarily driven by the rising demand for personalized medicine and targeted therapies. As healthcare shifts toward individualized treatment plans, microarray technologies play a crucial role in genetic screening and biomarker identification. This growing reliance on molecular diagnostics particularly for cancer, genetic disorders, and infectious diseases is boosting the adoption of microarray tools. Additionally, the strong presence of pharmaceutical and biotech companies engaged in drug discovery and development further supports market growth, as these firms leverage microarrays for gene expression analysis and toxicogenomic studies.

Another key growth factor is the increasing funding and support from government and private organizations for genomics research. Institutions such as the National Institutes of Health (NIH) continue to allocate substantial resources toward genetic and genomic projects, encouraging innovation and wider application of microarray technologies. The integration of microarrays with cutting-edge technologies like artificial intelligence (AI), next-generation sequencing (NGS), and lab-on-a-chip platforms is also enhancing the efficiency and scalability of genetic analysis, making these solutions more accessible to clinical laboratories and research centers across the U.S.

One of the primary challenges in the U.S. microarray market is the growing competition from next-generation sequencing (NGS) technologies. While microarrays have long been used for gene expression analysis and genotyping, NGS offers greater depth, accuracy, and scalability for complex genomic studies. As NGS becomes more affordable and accessible, many research institutions and diagnostic laboratories are shifting away from microarrays, posing a threat to market growth. Additionally, microarrays are limited in detecting unknown mutations or rare variants, which restricts their applicability in certain areas of clinical genomics.

Another significant challenge lies in the standardization and reproducibility of microarray results. Variations in sample preparation, hybridization conditions, and data interpretation can lead to inconsistent outcomes across different labs and platforms. This issue is particularly critical in clinical diagnostics, where accuracy and reliability are paramount.

The consumables accounted for the largest share of the microarray market, representing 50% of the total market in 2024. Consumables such as microarray chips, reagents, labeling kits, and slides are critical for the successful execution of every assay, making them indispensable in both research and clinical diagnostics. The growing prevalence of chronic diseases, increased investment in personalized medicine, and widespread adoption of molecular diagnostic tests are fueling the consistent need for high-quality consumables.

The instruments are projected to register the fastest growth rate over the forecast period. These instruments such as scanners, hybridization stations, and analytical software are becoming increasingly sophisticated with the integration of automation and digital imaging technologies. As research institutions, academic centers, and diagnostic laboratories in the U.S. focus on improving throughput and minimizing human error, the demand for high-performance, user-friendly instruments continues to rise.

The DNA microarray segment held the largest revenue share of the microarray market in 2024. These arrays enable researchers and clinicians to simultaneously analyze thousands of genes, making them essential tools in both basic and applied research. In the U.S., the growing focus on precision medicine and the increasing prevalence of genetic disorders have driven demand for DNA microarray-based diagnostics.

The protein microarray segment is projected to witness the fastest growth during the forecast period. These microarrays are crucial for studying protein interactions, post-translational modifications, and disease-specific biomarkers. In recent years, the demand for protein microarrays has surged in fields such as immunology, oncology, and infectious disease research, reflecting a shift toward proteome-wide analysis in understanding disease mechanisms. The expansion of proteomics research, combined with the need for high-throughput and multiplexed analysis tools, has positioned protein microarrays as valuable assets in the U.S. biomedical and diagnostic landscape.

The research applications segment led the microarray market in 2024. Academic institutions, biotechnology companies, and pharmaceutical firms rely heavily on microarray platforms to conduct gene expression analysis, mutation detection, and drug discovery. The ability of microarrays to analyze thousands of genes or proteins simultaneously makes them indispensable for high-throughput screening and systems biology research. The U.S. benefits from a robust research infrastructure and significant funding from government bodies like the National Institutes of Health (NIH), which further propels the use of microarray technologies across diverse areas of life sciences and biomedical research.

The disease diagnostics segment is expected to register the fastest growth during the forecast period. Microarrays are increasingly used to identify genetic mutations, detect pathogens, and monitor disease progression, particularly in oncology, infectious diseases, and hereditary conditions. With the shift toward personalized medicine and early disease detection, healthcare providers are leveraging microarray-based diagnostic tests to improve patient outcomes. The technology’s ability to deliver precise, large-scale data within a short turnaround time makes it ideal for clinical laboratories and diagnostic centers.

The research and academic institutes held the largest revenue share of the microarray market in 2024. Research and academic institutes constitute a major end-user segment in the U.S. microarray market, fueled by extensive scientific research activities in genomics, molecular biology, and personalized medicine. These institutions utilize microarray technology for a wide range of applications, including gene expression profiling, genotyping, and biomarker discovery. The presence of leading universities and government-funded research centers in the U.S., combined with strong financial support from agencies such as the National Institutes of Health (NIH), has significantly contributed to the widespread adoption of microarrays.

The diagnostic laboratories segment is projected to record the highest CAGR during the forecast period. These laboratories use microarrays for detecting genetic mutations, identifying infectious agents, and performing comprehensive disease risk assessments. The growing demand for precise and rapid diagnostic tools, especially in areas like oncology, infectious diseases, and inherited disorders, has reinforced the role of microarrays in clinical diagnostics. With the push toward personalized healthcare and preventive medicine, diagnostic labs are integrating microarray-based assays into routine testing protocols.

By Product and Services

By Type

By Application

By End Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Microarray Market

5.1. COVID-19 Landscape: U.S. Microarray Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Microarray Market, By Product and Services

8.1. U.S. Microarray Market, by Product and Services

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast

8.1.2. Software and Services

8.1.2.1. Market Revenue and Forecast

8.1.3. Instruments

8.1.3.1. Market Revenue and Forecast

Chapter 9. U.S. Microarray Market, By Type

9.1. U.S. Microarray Market, by Type

9.1.1. DNA Microarrays

9.1.1.1. Market Revenue and Forecast

9.1.2. Protein Microarrays

9.1.2.1. Market Revenue and Forecast

9.1.3. Others

9.1.3.1. Market Revenue and Forecast

Chapter 10. U.S. Microarray Market, By Application

10.1. U.S. Microarray Market, by Application

10.1.1. Research Applications

10.1.1.1. Market Revenue and Forecast

10.1.2. Drug Discovery

10.1.2.1. Market Revenue and Forecast

10.1.3. Disease Diagnostics

10.1.3.1. Market Revenue and Forecast

10.1.4. Others

10.1.4.1. Market Revenue and Forecast

Chapter 11. U.S. Microarray Market, By End Use

11.1. U.S. Microarray Market, by End Use

11.1.1. Research & Academic Institutes

11.1.1.1. Market Revenue and Forecast

11.1.2. Pharmaceutical & Biotechnology Companies

11.1.2.1. Market Revenue and Forecast

11.1.3. Diagnostic Laboratories

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. U.S. Microarray Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product and Services

12.1.2. Market Revenue and Forecast, by Type

12.1.3. Market Revenue and Forecast, by Application

12.1.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc. (Applied Biosystems)

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Agilent Technologies, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Illumina, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. PerkinElmer

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Merck KGaA

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Schott (Applied Microarrays)

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Danaher Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Arrayit Corporation

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Bio-Rad Laboratories, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Microarrays Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others