U.S. Biobanks Market Size, Growth, Trends, Report 2025-2034

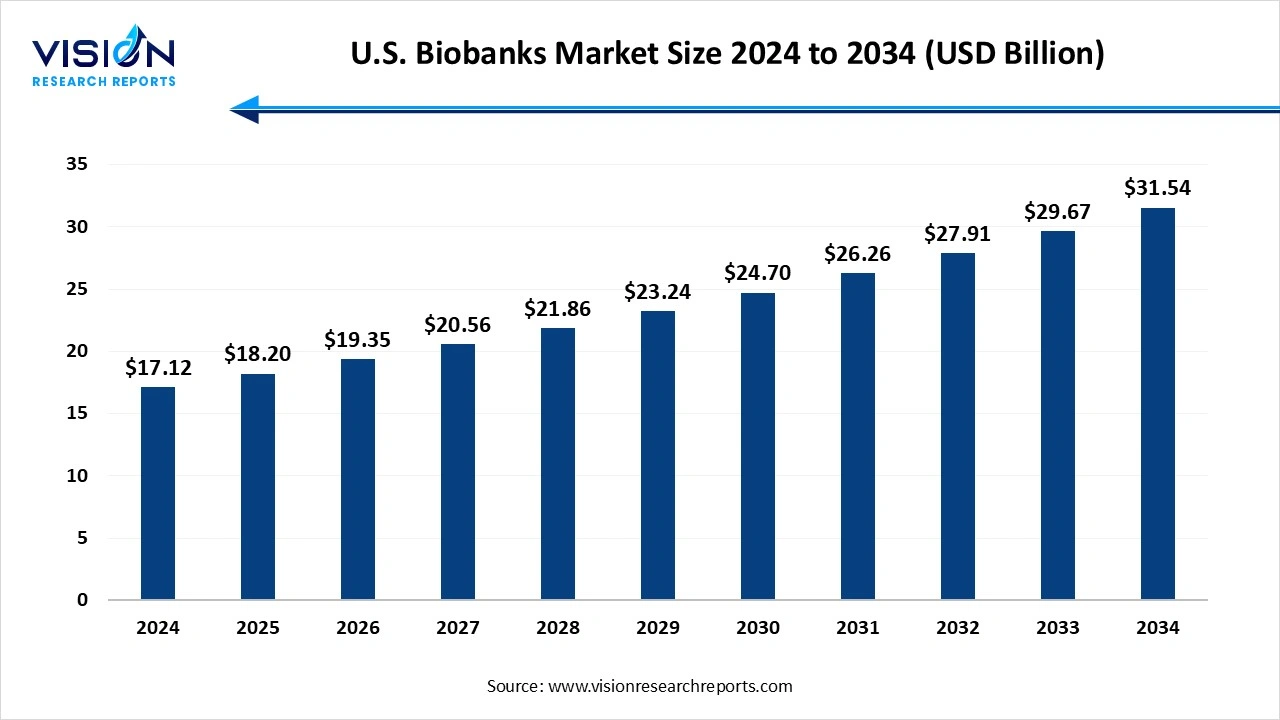

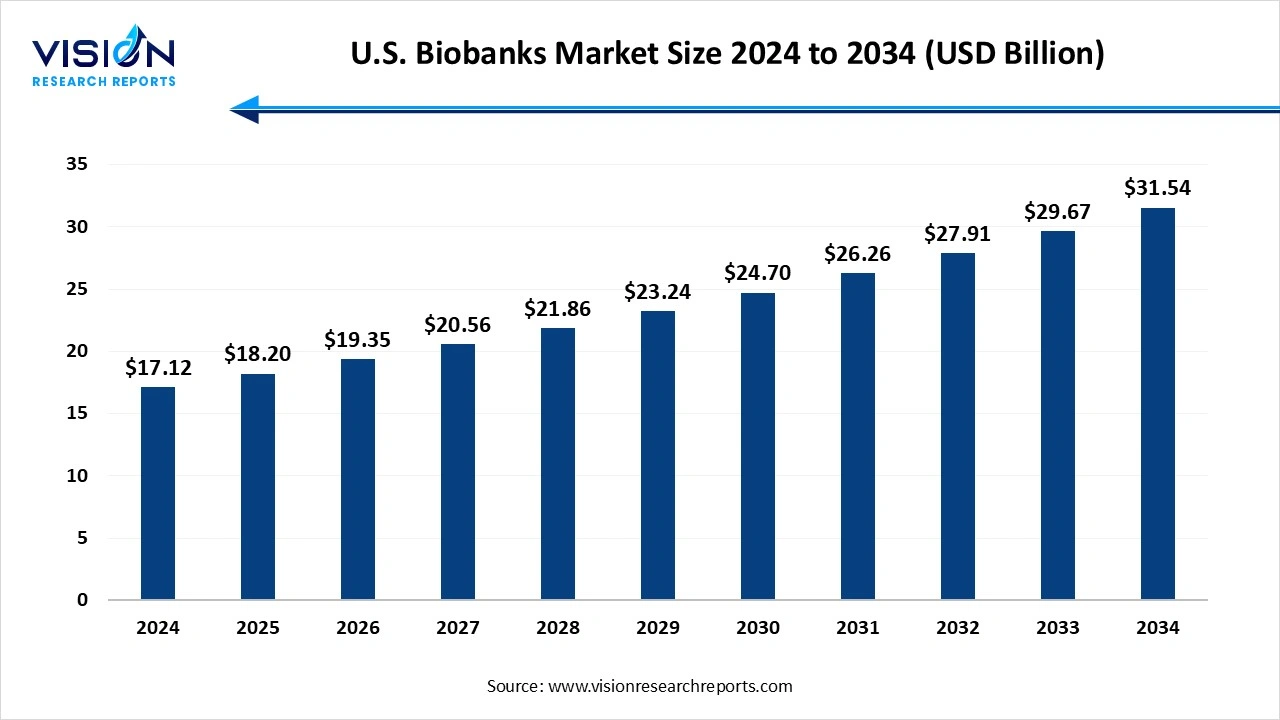

The U.S. biobanks market size stood at USD 17.12 billion in 2024 and is estimated to reach USD 18.20 billion in 2025. It is projected to hit USD 31.54 billion by 2034, growing at a CAGR of 7.9% from 2025 to 2034. The U.S. biobanks market is growing due to rising demand for precision medicine, increasing use of genomics in drug discovery and diagnostics, and rapid adoption of advanced technologies like cryopreservation, automated storage, and digital data management. Expanding collaborations, strong public and private funding, and the growing need for high-quality tissues and stem cells for research further support market growth.

Key Pointers

- By product & service, the services segment contributed the largest market share in 2024

- By product & service, the products segment estimated to expand the fastest CAGR during the forecast period.

- By biospecimen, the human tissues segment registered the maximum market share of 37% in 2024.

- By biospecimen, the stem cells segment is projected to experience the highest CAGR during the forecast period.

- By type, the Physical/real biobanks segment registered the maximum market share in 2024

- By application, the therapeutics segment generated the maximum market share in 2024

U.S. Biobanks Market Overview

The U.S. biobanks market has experienced significant growth over the past decade, driven primarily by advancements in biotechnology, genomics, and personalized medicine. Biobanks, which collect, store, and manage biological samples such as blood, tissues, and DNA, play a critical role in supporting research and development in healthcare and pharmaceutical industries. Technological innovations in sample preservation, data management, and bioinformatics have enhanced the efficiency and reliability of biobanking processes. Government initiatives and funding, alongside collaborations between academic institutions, hospitals, and private organizations, have contributed to the expansion and diversification of biobank services.

What are the Growth Factors of U.S. Biobanks Market?

The growth of the U.S. biobanks market is primarily fueled by the increasing emphasis on precision medicine and personalized healthcare. As medical research shifts towards tailored treatments based on individual genetic profiles, the demand for high-quality, well-annotated biological samples has surged. This has prompted extensive collection and storage efforts by biobanks to support large-scale genomics studies, biomarker discovery, and drug development.

Technological advancements also play a crucial role in driving market growth. Innovations in cryopreservation techniques, automated sample handling, and digital data management systems have improved the efficiency, accuracy, and scalability of biobank operations. Increased funding from both public and private sectors, including government grants and partnerships with pharmaceutical companies, has strengthened the financial backbone of the market.

Report Scope of the U.S. Biobanks Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 17.12 Billion |

| Revenue Forecast by 2034 |

USD 31.54 Billion |

| Growth rate from 2025 to 2034 |

CAGR of 7.9% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Companies Covered |

Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), BioStorage Technologies, Stemcell Technologies Inc., Leica Biosystems, SeraCare Life Sciences, Inc., Brooks Life Sciences, Fisher Bioservices, Coriell Institute for Medical Research, and Cytiva (formerly GE Healthcare Life Sciences). |

What are the Trends in U.S. Biobanks Market?

- Integration of AI and Big Data Analytics: Biobanks are increasingly leveraging artificial intelligence and machine learning to analyze vast datasets, enabling more precise identification of disease markers and accelerating research outcomes.

- Growth of Disease-Specific Biobanks: There is a rising focus on establishing biobanks dedicated to specific diseases such as cancer, Alzheimer’s, and rare genetic disorders, which facilitates targeted research and personalized treatment development.

- Expansion of Population-Based Biobanks: Large-scale population biobanks that collect samples from diverse demographic groups are gaining prominence, supporting epidemiological studies and improving understanding of genetic variations across populations.

What are the Key Challenges Faced by U.S. Biobanks Market?

- High Operational and Maintenance Costs: Maintaining biobank facilities, including advanced storage systems and quality control, requires substantial financial investment, which can limit scalability and accessibility for smaller organizations.

- Regulatory and Ethical Complexities: Navigating diverse and evolving regulations related to consent, privacy, and data sharing presents ongoing challenges, requiring biobanks to implement robust compliance frameworks to avoid legal risks.

- Data Management and Integration Issues: Handling vast amounts of biological and clinical data in a standardized, interoperable manner remains difficult, often hindering seamless data sharing and collaborative research efforts.

Segmental Analysis

Product & Service Analysis

The services segment led the U.S. biobanks market in 2024, driven by the growing dependence of pharmaceutical companies, research institutions, and clinical laboratories on outsourced biobanking capabilities. External biobanks now handle critical functions such as biospecimen collection, processing, quality validation, long-term cryogenic preservation, and secure transport. These operations demand advanced infrastructure, strict regulatory compliance, and constant monitoring capabilities that many smaller organizations find too costly and complex to manage in-house.

The products segment is expected to record the fastest growth as demand rises for advanced storage and processing technologies that support next-generation scientific research. The rapid progress of precision medicine, multi-omics analysis, and personalized therapies has increased the need for high-performance cryogenic freezers, automated storage units, barcode-based tracking systems, and AI-driven LIMS platforms. These innovations play a crucial role in preserving sample integrity, minimizing manual errors, and enabling smooth data connectivity across research workflows.

Biospecimen Analysis

The human tissues accounted for the largest share of revenue, representing 37% of the total market in 2024. Human tissues, including organs, tumor samples, and normal tissue biopsies, are extensively collected and preserved in biobanks to support various research initiatives such as cancer studies, regenerative medicine, and drug discovery. These tissue samples provide invaluable insights into disease mechanisms, genetic variations, and treatment responses, enabling researchers to develop more targeted and effective therapies.

The stem cells segment is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. Biobanks that specialize in stem cell preservation cater to a growing demand for stem cell-based research and clinical applications, including tissue engineering and transplantation. The collection and storage of stem cells require stringent protocols to maintain cell viability and functionality, which has driven technological advancements in cryopreservation and quality control.

Type Analysis

The physical biobanks held the dominant market share in 2024 due to their critical role in storing real biological specimens under tightly controlled conditions that safeguard molecular and cellular integrity. These facilities enable direct analytical testing across genomics, proteomics, metabolomics, and advanced tissue imaging. Physical repositories are fundamental for population-based studies, long-term monitoring, and clinical intervention research, offering vital resources for examining disease patterns, genetic risk factors, and environmental influences. Their capacity to house a wide range of biospecimens including blood, tissues, DNA, and cell lines makes them indispensable to large-scale biomedical programs. With continued momentum in evidence-based medicine and precision healthcare, physical biobanks remain the core foundation of global biomedical research infrastructure.

The virtual biobanks are projected to witness significant growth as digital transformation accelerates across healthcare and scientific research. These platforms integrate data from multiple physical biobanks into centralized digital repositories, enabling researchers to search, compare, and request samples remotely. Virtual systems enhance collaboration across institutions, increase visibility of available samples, and minimize redundant collections, ultimately improving efficiency in biospecimen utilization.

Application Analysis

The therapeutics segment dominated the market in 2024, driven by the growing application of biobanked samples in drug discovery, biomarker validation, target identification, and disease modeling. Biobanks allow researchers to analyze genetic and molecular variations across diverse populations, enabling the identification of patient subgroups that respond differently to specific treatment approaches. The increasing adoption of multi-omics technologies including genomics, transcriptomics, and proteomics has further elevated the strategic value of biospecimens in advancing precision therapies for cancers, cardiovascular diseases, metabolic disorders, and neurological conditions. Pharmaceutical companies continue to depend heavily on biobank-enabled insights to accelerate both preclinical and clinical research, reinforcing the therapeutics segment as the leading area of application.

The clinical diagnostics segment is expected to witness rapid growth, fueled by rising demand for biomarker-driven testing, early disease detection, and personalized risk assessment. Biobanks provide the high-quality, standardized biospecimens essential for validating diagnostic assays and developing advanced technologies such as liquid biopsies, molecular pathology tests, and genomic screening platforms. With healthcare increasingly embracing precision medicine, the need for reliable and clinically validated diagnostic biomarkers is surging. By supplying consistent sample quality and ensuring reproducibility across research studies, biobanks play a pivotal role in large-scale diagnostic innovation. Their contribution to identifying molecular signatures for conditions such as cancer, Alzheimer’s disease, and autoimmune disorders is accelerating the expansion of this segment.

Top Companies in U.S. Biobanks Market

U.S. Biobanks Market Segmentation

By Product & Service

- Products

- Biobanking Equipment

- Temperature Control Systems

- Freezers & Refrigerators

- Cryogenic Storage Systems

- Thawing Equipment

- Incubators & Centrifuges

- Alarms & Monitoring Systems

- Accessories & Other Equipment

- Biobanking Consumables

- Laboratory Information Management Systems

- Services

- Biobanking & Repository

- Lab processing

- Qualification/ Validation

- Cold Chain Logistics

- Other Services

By Biospecimen

- Human Tissues

- Organs

- Stem Cells

- Adult Stem Cells

- Embryonic Stem Cells

- IPS Cells

- Other Stem Cells

- Other Biospecimens

By Type

- Physical/Real Biobanks

- Tissue Biobanks

- Population Based Biobanks

- Genetic (DNA/RNA)

- Disease Based Biobanks

- Virtual Biobanks

By Application

- Therapeutics

- Drug Discovery & Clinical Research

- Clinical Diagnostics

- Other Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Biobanks Market

5.1. COVID-19 Landscape: U.S. Biobanks Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Biobanks Market, By By Product & Service

8.1. U.S. Biobanks Market, by By Product & Service

8.1.1. Products

8.1.1.1. Market Revenue and Forecast

8.1.2. Services

8.1.2.1. Market Revenue and Forecast

Chapter 9. U.S. Biobanks Market, By Biospecimen

9.1. U.S. Biobanks Market, by Biospecimen

9.1.1. Human Tissues

9.1.1.1. Market Revenue and Forecast

9.1.2. Organs

9.1.2.1. Market Revenue and Forecast

9.1.3. Stem Cells

9.1.3.1. Market Revenue and Forecast

Chapter 10. U.S. Biobanks Market, By Type

10.1. U.S. Biobanks Market, by Type

10.1.1. Physical/Real Biobanks

10.1.1.1. Market Revenue and Forecast

10.1.2. Virtual Biobanks

10.1.2.1. Market Revenue and Forecast

Chapter 11. U.S. Biobanks Market, By Application

11.1. U.S. Biobanks Market, by Application

11.1.1. Therapeutics

11.1.1.1. Market Revenue and Forecast

11.1.2. Drug Discovery & Clinical Research

11.1.2.1. Market Revenue and Forecast

11.1.3. Clinical Diagnostics

11.1.3.1. Market Revenue and Forecast

11.1.4. Other Application

11.1.4.1. Market Revenue and Forecast

Chapter 12. U.S. Biobanks Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by By Product & Service

12.1.2. Market Revenue and Forecast, by Biospecimen

12.1.3. Market Revenue and Forecast, by Type

12.1.4. Market Revenue and Forecast, by Application

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by By Product & Service

12.1.5.2. Market Revenue and Forecast, by Biospecimen

12.1.5.3. Market Revenue and Forecast, by Type

12.1.5.4. Market Revenue and Forecast, by Application

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by By Product & Service

12.1.6.2. Market Revenue and Forecast, by Biospecimen

12.1.6.3. Market Revenue and Forecast, by Type

12.1.6.4. Market Revenue and Forecast, by Application

12.2. Europe

12.2.1. Market Revenue and Forecast, by By Product & Service

12.2.2. Market Revenue and Forecast, by Biospecimen

12.2.3. Market Revenue and Forecast, by Type

12.2.4. Market Revenue and Forecast, by Application

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by By Product & Service

12.2.5.2. Market Revenue and Forecast, by Biospecimen

12.2.5.3. Market Revenue and Forecast, by Type

12.2.5.4. Market Revenue and Forecast, by Application

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by By Product & Service

12.2.6.2. Market Revenue and Forecast, by Biospecimen

12.2.6.3. Market Revenue and Forecast, by Type

12.2.6.4. Market Revenue and Forecast, by Application

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by By Product & Service

12.2.7.2. Market Revenue and Forecast, by Biospecimen

12.2.7.3. Market Revenue and Forecast, by Type

12.2.7.4. Market Revenue and Forecast, by Application

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by By Product & Service

12.2.8.2. Market Revenue and Forecast, by Biospecimen

12.2.8.3. Market Revenue and Forecast, by Type

12.2.8.4. Market Revenue and Forecast, by Application

12.3. APAC

12.3.1. Market Revenue and Forecast, by By Product & Service

12.3.2. Market Revenue and Forecast, by Biospecimen

12.3.3. Market Revenue and Forecast, by Type

12.3.4. Market Revenue and Forecast, by Application

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by By Product & Service

12.3.5.2. Market Revenue and Forecast, by Biospecimen

12.3.5.3. Market Revenue and Forecast, by Type

12.3.5.4. Market Revenue and Forecast, by Application

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by By Product & Service

12.3.6.2. Market Revenue and Forecast, by Biospecimen

12.3.6.3. Market Revenue and Forecast, by Type

12.3.6.4. Market Revenue and Forecast, by Application

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by By Product & Service

12.3.7.2. Market Revenue and Forecast, by Biospecimen

12.3.7.3. Market Revenue and Forecast, by Type

12.3.7.4. Market Revenue and Forecast, by Application

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by By Product & Service

12.3.8.2. Market Revenue and Forecast, by Biospecimen

12.3.8.3. Market Revenue and Forecast, by Type

12.3.8.4. Market Revenue and Forecast, by Application

12.4. MEA

12.4.1. Market Revenue and Forecast, by By Product & Service

12.4.2. Market Revenue and Forecast, by Biospecimen

12.4.3. Market Revenue and Forecast, by Type

12.4.4. Market Revenue and Forecast, by Application

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by By Product & Service

12.4.5.2. Market Revenue and Forecast, by Biospecimen

12.4.5.3. Market Revenue and Forecast, by Type

12.4.5.4. Market Revenue and Forecast, by Application

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by By Product & Service

12.4.6.2. Market Revenue and Forecast, by Biospecimen

12.4.6.3. Market Revenue and Forecast, by Type

12.4.6.4. Market Revenue and Forecast, by Application

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by By Product & Service

12.4.7.2. Market Revenue and Forecast, by Biospecimen

12.4.7.3. Market Revenue and Forecast, by Type

12.4.7.4. Market Revenue and Forecast, by Application

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by By Product & Service

12.4.8.2. Market Revenue and Forecast, by Biospecimen

12.4.8.3. Market Revenue and Forecast, by Type

12.4.8.4. Market Revenue and Forecast, by Application

12.5. Latin America

12.5.1. Market Revenue and Forecast, by By Product & Service

12.5.2. Market Revenue and Forecast, by Biospecimen

12.5.3. Market Revenue and Forecast, by Type

12.5.4. Market Revenue and Forecast, by Application

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by By Product & Service

12.5.5.2. Market Revenue and Forecast, by Biospecimen

12.5.5.3. Market Revenue and Forecast, by Type

12.5.5.4. Market Revenue and Forecast, by Application

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by By Product & Service

12.5.6.2. Market Revenue and Forecast, by Biospecimen

12.5.6.3. Market Revenue and Forecast, by Type

12.5.6.4. Market Revenue and Forecast, by Application

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Becton, Dickinson and Company (BD)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. BioStorage Technologies

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Stemcell Technologies Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Leica Biosystems

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. SeraCare Life Sciences, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Brooks Life Sciences

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Fisher Bioservices

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Coriell Institute for Medical Research

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Cytiva (formerly GE Healthcare Life Sciences)

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments